2,3-Butanediol Market Outlook:

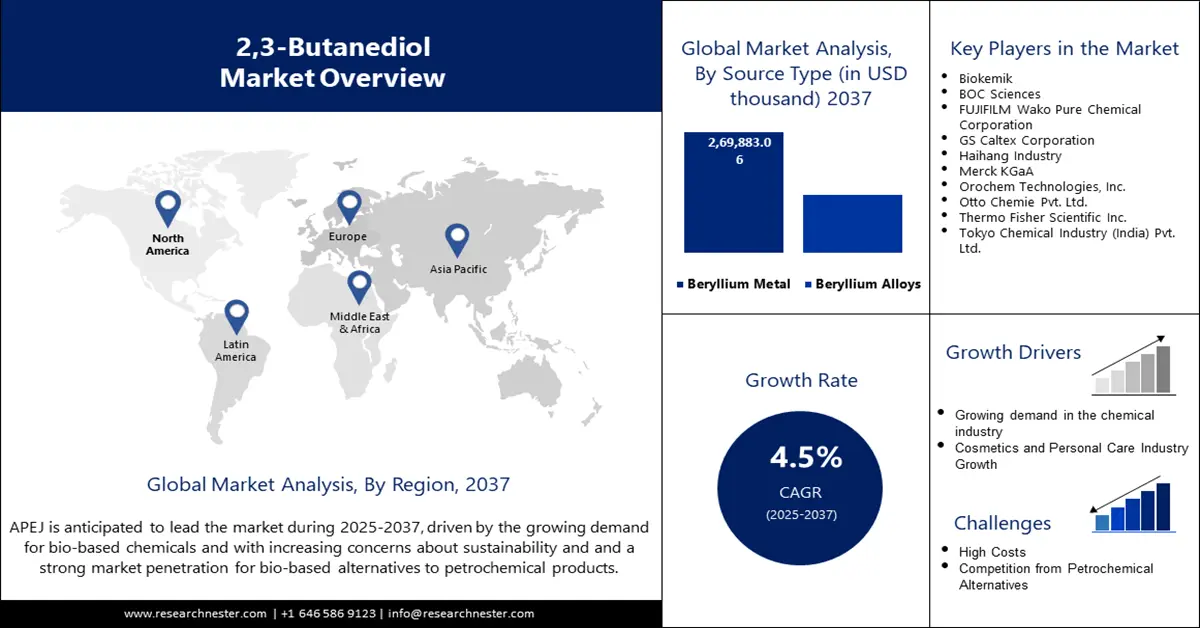

2,3-Butanediol Market size was valued at USD 226,051.9 thousand in 2024 and is projected to reach a valuation of USD 401,075.1 thousand by the end of 2037, rising at a CAGR of 4.5% during the forecast period, i.e., 2025-2037. In 2025, the industry size of 2,3-butanediol is estimated at USD 234,471.2 thousand.

The 2,3-butanediol market is on an upward trend as demand increases in pharmaceuticals, cosmetics, and sustainable materials. In June 2024, GS Caltex partnered with Summit Cosmetics for the global supply of GreenDiol, which is a bio-based 2,3-Butanediol produced from sugarcane and cassava. This partnership is an excellent example of how natural fermentation processes are being applied to the development of more sustainable formulations. At the same time, the European Green Deal and the DOE-backed R&D programs are driving the shift from petroleum chemicals to bio-based products. These changes also contribute to environmental goals while providing business opportunities for companies involved in bio-innovation. With the advancement of precision fermentation and biotechnology, the applications of 2,3-BDO in product development are expected to expand even further in such areas as bioplastics, fuel, and personal care products.

With industries moving towards net-zero carbon emissions, chemicals derived from biomass such as 2,3-Butanediol are proving to be pivotal. The Biotech Open Platform, initiated in June 2024 by Danone and Michelin in collaboration with DMC Biotechnologies, illustrates how precision fermentation can scale up 2,3-BDO production. The Japan Ministry of Economy, Trade, and Industry (METI), the China government, and the European Union remain committed to supporting sustainable chemical development. As microbial engineering advances, yield efficiency is also predicted to increase, which will help the market to reach price and performance equivalence to that of fossil-derived products. Also, the rising interest in green chemistry startups demonstrates that the commercialization process is gaining pace. This integration with AgriTech, energy, and pharma also strengthens its cross-sector compatibility and growth.

2,3-Butanediol Market - Growth Drivers and Challenges

Growth Drivers

- Expansion in sustainable cosmetics and personal care: The increasing consumer consciousness towards green beauty products is a reason to see a rise in the use of natural solvents and humectants such as 2,3-butanediol. In July 2024, Sumitomo and GS Caltex signed a supply contract with Japan’s Summit Cosmetics to incorporate GreenDiol in its sustainable products. This variant is derived from biomass fermentation and boasts non-GMO, non-toxic characteristics attractive to global brands. The rising trends in skincare that embrace minimalism and safety also support this adoption. There is a growing trend of using bio-based products instead of synthetic glycols, which have similar properties but are less detrimental to the environment. Cosmetic manufacturers are incorporating these solutions to satisfy legal requirements and the expectations of their customers.

- Biotech innovation and microbial engineering advancements: There has been considerable advancement in strain engineering that enhances the production of 2,3-BDO significantly. In August 2024, the newly engineered formolase (FLS) enzyme yielded a conversion of 92.7% in the synthesis of ethanol to BDO. This advancement enhances the catalytic activity and process selectivity of the catalysts in the reaction process. These developments enhance the feasibility of 2,3-BDO in synthetic rubber, pharmaceuticals, and biofuels, among others. New biotechnologies are revolutionizing the commercial downstream processing and the scalability of the reactor systems. This also aligns with endeavors to make the chemical industry less reliant on carbon in its manufacturing processes. Such enhanced microbial systems complement the circular bioeconomic ambitions that are being developed around the world.

- Government policies supporting bio-based transitions: National initiatives are critical for the advancement of 2,3-BDO market growth. METI’s Green Growth Strategy in Japan, revised in 2024, focuses on reducing emissions by shifting to bio-based chemical production. Similarly, the DOE extends its support to options that reduce the reliance on fossil fuels in the U.S. industry. These frameworks do not only support R&D but also encourage pilot-scale manufacturing and commercial readiness. In the EU, the Circular Economy Action Plan promotes green precursors, including 2,3-BDO produced through fermentation. Such policies have been instrumental in fostering fresh supply chains and public-private partnerships. They also assist in achieving global carbon-neutrality goals as well as other climate change mitigation objectives.

Challenges

- Product standardization and purity assurance: The quality of 2,3-BDO depends on its purity grades and isomer compositions, which makes it difficult to provide a uniform input for various applications. Sustaining batch-to-batch consistency at scale is challenging. Pharmaceutical and cosmetic industries have strict standards for purity, hence the need for proper quality assurance measures. These challenges raise the level of production and regulatory difficulties. Sustainability in the manufacturing of products across the globe is still another area that needs more research and development and coordination.

- Commercial scale-up and infrastructure gaps: Despite advancements, full-scale bio-based BDO manufacturing still faces limitations in fermentation infrastructure and downstream processing. Linking lab results with industrial yields is a process that involves a lot of capital and time. Most regions are not able to produce high-grade fermentation inputs locally. Also, the integration of the provided petrochemical products to existing distribution networks is also restricted. These logistical and investment challenges remain critical hindrances to achieving the required scale and affordable pricing.

2 3-Butanediol Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Period |

2025-2037 |

|

CAGR |

4.5% |

|

Base Year Market Size (2024) |

USD 226,051.9 thousand |

|

Forecast Year Market Size (2037) |

USD 401,075.1 thousand |

|

Regional Scope |

|

2,3-Butanediol Market Segmentation:

Source Type Segment Analysis

Fossil fuel-derived 2,3-butanediol is projected to maintain the largest market share of 64.1% throughout the forecast period attributed to well-developed supply chains and lower costs. It remains the most popular choice in large-scale production of chemicals, especially where cost is an important factor. However, the increasing awareness of the environment is forcing manufacturers to integrate both fossil and bio-based feedstocks. The chemical industry in China, which is one of the major consumers of petroleum-derived products, recorded a growth rate of 4.0% in 2023 due to the demand. Long-term transition indicates that green chemistry will dominate the chemical industry in the long run. However, the short-term volume is likely to be dominated by fossil-based variants. To reduce their carbon emissions, measures are being taken, but they are still in the experimental stage.

Purity Level Segment Analysis

The >97% purity segment is expected to dominate the market with a share of 43.6% through to 2037 due to its application in pharmaceuticals, electronics, and cosmetics. These applications demand high-purity compounds to ensure that they meet safety and functional standards. In March 2023, Biokemik’s process based on CECT strains allowed the company to achieve efficient and low-cost isolation of 2,3-BDO with high purity for its sensitive applications. Fermentation-based inputs are likely to witness a rise in demand as industries such as biotech and advanced materials emerge in the future. This segment’s strength is in the high-quality markets where safety, efficacy, and reproducibility of drugs are more important than the size of the production.

Our in-depth analysis of the 2,3-butanediol market includes the following segments:

|

Segment |

Subsegments |

|

Test Type |

|

|

Deployment |

|

|

Organization Size |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

2,3-Butanediol Market - Regional Analysis

Asia Pacific Market Insights

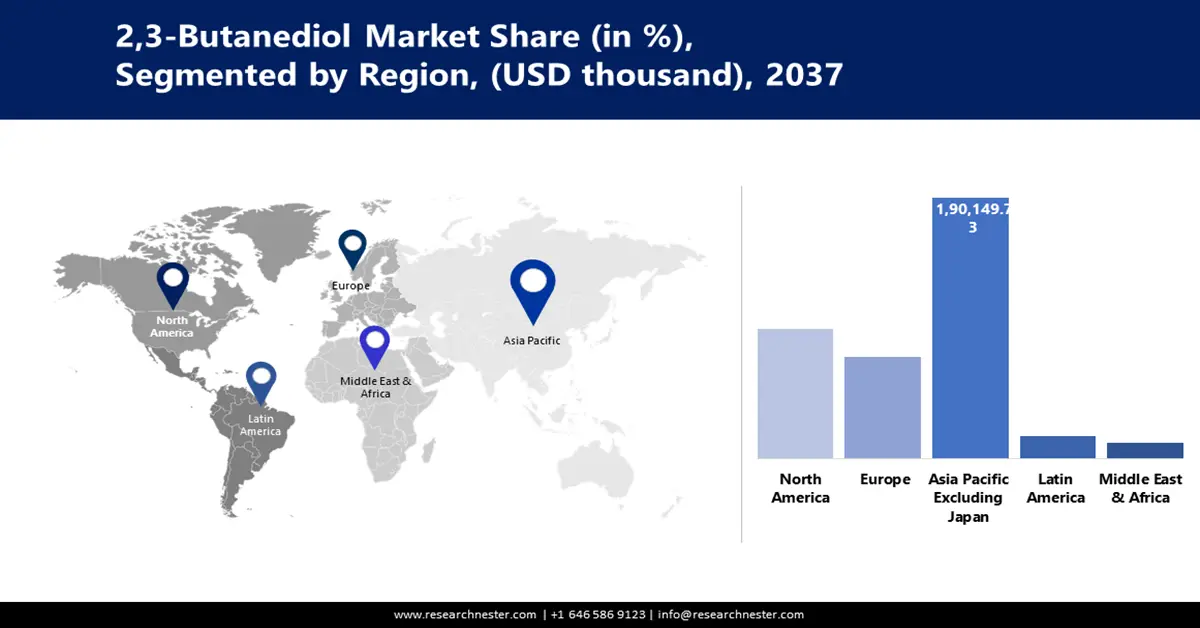

Asia Pacific excluding Japan is anticipated to dominate the market with 47.4% share through 2037 owing to a strong manufacturing base, the development of biotech facilities, and governmental support. In the same regard, UNIDO stated that APEJ was the region with the highest manufacturing growth rate of 1.7% in Q2 2024. China, South Korea, and India are among the countries that are promoting green chemistry through funding and policy support. In June 2024, China’s 14th Five-Year Plan laid out the development plan for the biochemical industry and the focus on fermentation-based chemicals such as 2,3-BDO. With infrastructure growing, the region is poised to be at the fore of global supply, backed by cost advantage and domestic demand.

China is steadily increasing the production of bio-based chemicals in addition to conventional petrochemicals. In 2024, the manufacturing output in the country increased by 6.7% y-o-y and reinforced its position as the world’s largest chemical producer. Government policies promote feedstock diversification and circular manufacturing, which provide a favorable environment for the growth of 2,3-BDO. The leading producers are using 2,3-BDO in synthetic rubber and agrochemicals applications. With the new government standards for emissions on the rise, consumers are looking for environmentally friendly products. There are also growing production and export relationships with Japan and Korea for high purity and green 2,3-BDO grades.

India market is growing with Make in India and ONDC, which is helping in digitalization in rural areas and opening doors for bio-based chemical distribution. In November 2024, the Department of Agriculture began to roll out educational programs to support organic inputs, thus supporting the demand for fermentation-derived chemicals such as 2,3-BDO. The cosmetics and pharma industries are increasingly using bio-based solvents to accommodate the increasing export quality requirements. Venture capital funding from around the world is also supporting startups in scaling up these processes to industrial levels. India’s 2,3-BDO sector has a promising outlook due to the sector’s AgriTech connection and supportive policies.

North America Market Insights

North America is anticipated to rise at a CAGR of 4.9% during the forecast period due to innovation, pharma demand, and favorable policies. As stated by the European Federation of Pharmaceutical Industries and Associations (EFPIA), the region encompassed over 53% of total global pharmaceutical sales in 2023, which underlines the leadership of the region in the formulation of medicines. Government agencies such as the EPA and the DOE are directing investments toward bio-based manufacturing. In September 2024, PCI Pharma Services launched a USD 365 million facility expansion in the U.S. and EU due to a rise in the use of biologically derived excipients. Public and private funding, educational scholarships, and private equity are all directing their resources toward synthetic biology and 2,3-BDO.

The U.S. remains one of the most attractive markets for synthetic biology investment due to its carbon reduction objectives and sustainable drug delivery advancements. In February 2025, the DOE continued funding for green chemical transitions through the Bioenergy Technologies Office, which includes 2,3-BDO from fermentation platforms. Also, its application in the production of biodegradable plastics and fuels is increasing regional demand for the material. The growing interest in pharma-grade inputs and crop-based solvents makes the U.S. a viable market for the commercialization of 2,3-BDO. A strong patent regime also provides market access and safeguards for investments in research and development.

Canada position in the 2,3-BDO market is on the rise due to investment in sustainable manufacturing. The country’s chemical industry is receiving policy support in line with its net-zero plans. In 2024, the Canada government continued its support for synthetic chemical manufacturers using biomass feedstock exports. As the biotech sector in Canada becomes more established in Ontario and Quebec, the country is now attracting outside players in fermentation. Increased compliance with US standards makes cross-border trade and distribution easier. High adoption of agro-based biofuels and advanced cosmetics are also diversifying product applications within the country.

Key 2 3-Butanediol Market Players:

- Biokemik

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BOC Sciences

- FUJIFILM Wako Pure Chemical Corporation

- GS Caltex Corporation

- Haihang Industry

- Merck KGaA

- Orochem Technologies, Inc.

- Otto Chemie Pvt. Ltd.

- Thermo Fisher Scientific Inc.

- Tokyo Chemical Industry (India) Pvt. Ltd.

The 2,3-butanediol market is fragmented with companies involved in the different fields of the industry, such as bio-based platform, fermentation management, and niche uses. Key players in the market include Biokemik, GS Caltex, BOC Sciences, FUJIFILM Wako Pure Chemical Corporation, Merck KGaA, Haihang Industry, Orochem Technologies, Otto Chemie Pvt. Ltd., Thermo Fisher Scientific Inc., and Tokyo Chemical Industry (India) Pvt. Ltd. These companies compete actively in aspects such as price, product purity, scale of production, and sustainability.

Biokemik, for instance, has made significant strides in the industry with its innovative approach. In March 2023, the company launched a microbial process using CECT strains to improve the downstream separation of several bio-based chemicals, particularly 2,3-BDO. This innovation has greatly enhanced Biokemik’s supply capacity and has expanded the company’s capacity to address different applications in the pharmaceutical and industrial industries.

Here are some leading companies in the 2,3-Butanediol market:

Recent Developments

- In February 2025, MOA Foodtech secured USD 15.4 million in funding from the European Innovation Council to scale its AI-driven fermentation platform. This breakthrough enhances the microbial production of bio-based chemicals, including 2,3-Butanediol, by optimizing yield and efficiency. The funding strengthens Europe’s position in sustainable biochemical manufacturing. MOA’s innovation signals a leap forward in AI-assisted fermentation technologies.

- In December 2024, Denmark's BioSolutions initiative, supported by USD 146.56 million from the Novo Nordisk Foundation, launched a robust program to accelerate bio-based production. The initiative focuses on advancing fermentation and enzymatic engineering for applications such as biofuels, synthetic rubber, and biopharma. It holds strong implications for 2,3-butanediol as a renewable intermediate. The program promotes commercial scalability and green innovation in biomanufacturing.

- In May 2024, Haihang Industry announced a strategic business shift by transferring operations to its newly formed subsidiary, GetChem Co., Ltd., based in Shanghai. The move aims to enhance global service capabilities, leveraging Shanghai’s logistics and economic advantages. This restructuring is expected to streamline supply chains for specialty chemicals, including 2,3-butanediol. The transition underscores Haihang’s intent to improve customer responsiveness and international reach.

- Report ID: 7540

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

2,3-Butanediol Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert