1-Octanol Market Outlook:

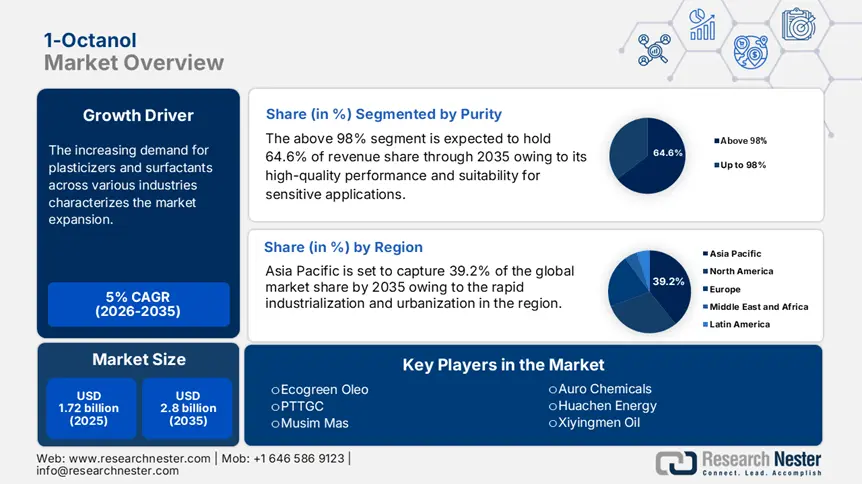

1-Octanol Market size was valued at USD 1.72 billion in 2025 and is set to exceed USD 2.8 billion by 2035, expanding at over 5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of 1-octanol is estimated at USD 1.8 billion.

The increasing demand for plasticizers and surfactants across various industries characterizes the 1-octanol market expansion. 1-Octanol is a key intermediate in producing esters used as plasticizers, especially in PVC products used in construction, automotive, and consumer goods. It is also widely used in the synthesis of non-ionic surfactants, essential in personal care products, industrial cleaners, and pharmaceuticals. Moreover, 1-octanol is used to manufacture nonionic surfactants for detergents, personal care, and industrial applications. Growth in hygiene awareness and personal care spending, especially in emerging markets, is a major driver.

Key 1-Octanol Market Insights Summary:

Regional Highlights:

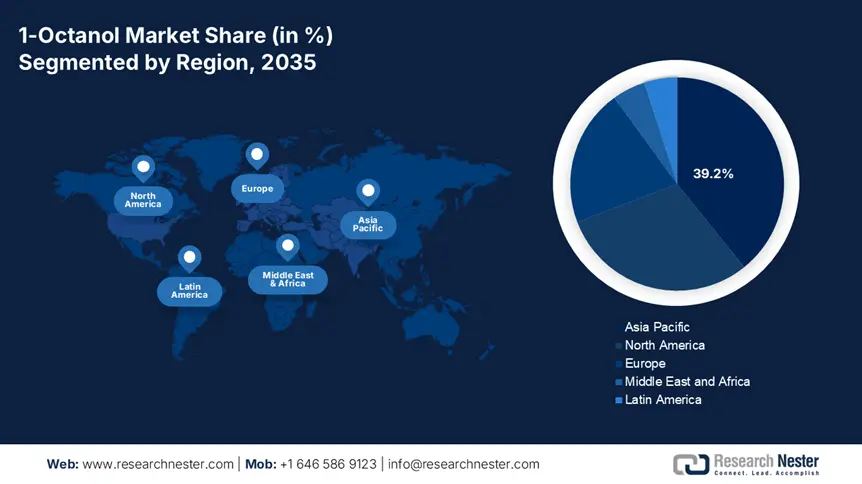

- Asia Pacific dominates the 1-Octanol Market with a 39.2% share, propelled by diverse applications and a shift toward sustainable and eco-friendly products, supporting strong growth through 2035.

- North America's 1-Octanol Market is expected to achieve significant growth through 2035, driven by sustainable practices and technological advancements in chemical manufacturing.

Segment Insights:

- The Above 98% Purity segment is anticipated to capture a 64.6% share by 2035, fueled by its high-purity performance critical for pharmaceuticals, cosmetics, and personal care applications.

- The Flavors and Fragrances segment is expected to gain significant market share from 2026 to 2035, driven by rising demand for mild and natural fragrances in cosmetics, food, and beverages.

Key Growth Trends:

- Growth in the cosmetics and personal care industry

- Rising pharmaceutical applications

Major Challenges:

- Limited awareness in developing regions and availability of substitutes

- Health and safety concerns and environmental regulations

- Key Players: Ecogreen Oleo, PTTGC, Musim Mas, Sasol, KLK Oleo, Emery, P&G Chem, VVF, Axxence.

Global 1-Octanol Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.72 billion

- 2026 Market Size: USD 1.8 billion

- Projected Market Size: USD 2.8 billion by 2035

- Growth Forecasts: 5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (39.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 12 August, 2025

1-Octanol Market Growth Drivers and Challenges:

Growth Drivers

-

Growth in the cosmetics and personal care industry: 1-Octanol is used as a fragrance ingredient due to its pleasant odor and fixative properties. It is also an emollient, helping to soften and smooth skin, making it useful in lotions, creams, and moisturizers. Many personal care products like shampoos, body washes, and cleansers contain nonionic surfactants derived from 1-octanol. As demand for milder and more skin-friendly formulations grows, so does the need for alcohol-based surfactants.

Increasing consumer spending on premium and organic personal care items boosts the demand for functional ingredients like 1-octanol. The expanding middle class in Asia Pacific, Latin America, and Africa is fueling long-term growth. Moreover, growth in customized and innovative formulations such as serums, anti-aging products often relies on specialty chemicals, where 1-octanol is a building block. - Rising pharmaceutical applications: 1-Octanol is used to produce esters and ethers that serve as intermediates in the synthesis of active pharmaceutical ingredients (APIs). Its role in creating complex molecules makes it valuable for producing certain medications. Due to its hydrophobic nature, 1-octanol is used in drug delivery systems to enhance the solubility and permeability of poorly soluble drugs.

In pharmacokinetics, 1-octanol is used to measure the octanol-water partition coefficient (log P), which helps predict how drugs behave in the body. Moreover, the global rise in chronic diseases, aging population, and increased healthcare spending has led to higher pharmaceutical production, boosting demand for intermediates like 1-octanol.

Challenges

-

Limited awareness in developing regions and availability of substitutes: In less developed markets, lower industrial usage and lack of awareness about 1-octanol’s applications can restrain 1-octanol market penetration. Further, alternative alcohols or synthetic chemicals can replace 1-octanol in certain applications, reducing demand in competitive sectors.

- Health and safety concerns and environmental regulations: 1-Octanol can be toxic of inhaled or ingested in large quantities. Strict safety handling protocols and labelling require increased operational costs. Moreover, as a volatile organic compound (VOC), its production and disposal are regulated to minimize environmental impact. Compliance with REACH, EPA, and other environmental norms can limit production flexibility.

1-Octanol Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5% |

|

Base Year Market Size (2025) |

USD 1.72 billion |

|

Forecast Year Market Size (2035) |

USD 2.8 billion |

|

Regional Scope |

|

1-Octanol Market Segmentation:

Purity (Up to 98%, Above 98%)

The above 98% segment is projected to gain a 64.6% 1-octanol market share by 2035, driven primarily by its high-quality performance and suitability for sensitive applications. Industries like pharmaceuticals, cosmetics, and personal care require high-purity 1-octanol to ensure product safety, stability, and effectiveness. High-purity grade offers more predictable chemical behavior, which is crucial for formulations and synthesis processes, especially in API production and fine chemicals.

Products for pharma and personal care must meet strict quality and purity standards like USP EP. Purity above 98% helps meet these regulatory requirements. Above 98% purity enhances application scope, regulatory alignment, and product performance, driving segment growth in value-added and high-margin industries.

Application (Plasticizer, Flavors and Fragrances, Pharmaceuticals, Chemicals, Paints and Coatings)

The flavors and fragrances segment in 1-octanol market is anticipated to garner a significant share during the assessed period. 1-Octanol has a mild, fatty, floral odor. This makes it valuable in fragrance formulations to create certain scents or modify the scent profile of products like perfumes, lotions, shampoos, and air fresheners. Though used sparingly, eaters of 1-octanol, like octyl acetate, are important in producing flavors, especially fruity ones used in foods, beverages, and sometimes pharmaceuticals.

1-Octanol is also a chemical intermediate for making other compounds that are directly used in flavors and fragrances. As the demand for natural and mild fragrance/flavor products grows in cosmetics, personal care, and food industries, the demand for 1-octanol rises.

Our in-depth analysis of the global market includes the following segments:

|

Purity |

|

|

Grade |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

1-Octanol Market Regional Analysis:

APAC Market Statistics

Asia Pacific 1-octanol market is predicted to garner a share of 39.2% by 2035, bolstered by its diverse applications across industries, supportive government policies, and a shift towards sustainable and eco-friendly products. Continued investments in industrial infrastructure and technological innovations are expected to further enhance the region’s market position.

In India, the 1-octanol market is driven by the chemical industry’s utilization of 1-octanol in producing plasticizers, surfactants, and flavors. Companies like Sasol India Pvt. Ltd. and Gujarat Alkalies and Chemicals Ltd. are key players. Further, in Australia, the cosmetics segment is the fastest-growing application area for 1-octanol, driven by consumer demand for natural ingredients. Also, in Singapore, post-pandemic recovery in chemical production and increased demand for sanitizers and cleaning products have revitalized the market.

North America Market Analysis

North America 1-octanol market is expected to grow at a significant rate during the projected period, supported by its diverse applications and the region’s focus on sustainable practices. Ongoing technological advancements and regulatory support for eco-friendly chemical manufacturing are expected to further enhance market prospects. The U.S. is a major consumer of 1-octanol, driven by robust chemical and cosmetics industries. Stringent regulations on plasticizer use influence market dynamics. Further, in Canada, the 1-octanol market is influenced by the chemical industry’s utilization of 1-octanol in producing plasticizers, surfactants, and flavors.

Key 1-Octanol Market Players:

- Kao Chem

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ecogreen Oleo

- PTTGC

- Musim Mas

- Sasol

- Basf

- KLK Oleo

- Emery

- P&G Chem

- VVF

- Axxence

- Auro Chemicals

- Huachen Energy

- Xiyingmen Oil

- YouYang Ind

- Liaoning Huaxing

Key players drive the 1-octanol market by expanding production, innovating for premium applications, pursuing global reach, and aligning with sustainable trends, ensuring consistent growth and competitiveness in a diverse range of industries.

Here are some of the key players

Recent Developments

- In October 2024, the production capacities of Evonik Oxeno for the INA-based plasticizers ELATUR CH (DINCH) and ELATUR DINCD are being further increased. Both of these compounds, which were released in recent years, have now become the new standard plasticizers among clients of Evonik Oxeno.

- In August 2023, Mesamoll, a plasticizer made by the specialty chemicals company LANXESS, now has a more sustainable option thanks to the Polymer Additives (PLA) business unit. A variety of polymers, including PVC, PUR, and rubber, can be treated with this phthalate-free, well-gelling, and remarkably saponification-resistant plasticizer.

- Report ID: 7653

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

1-Octanol Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.