1-Decene Market Outlook:

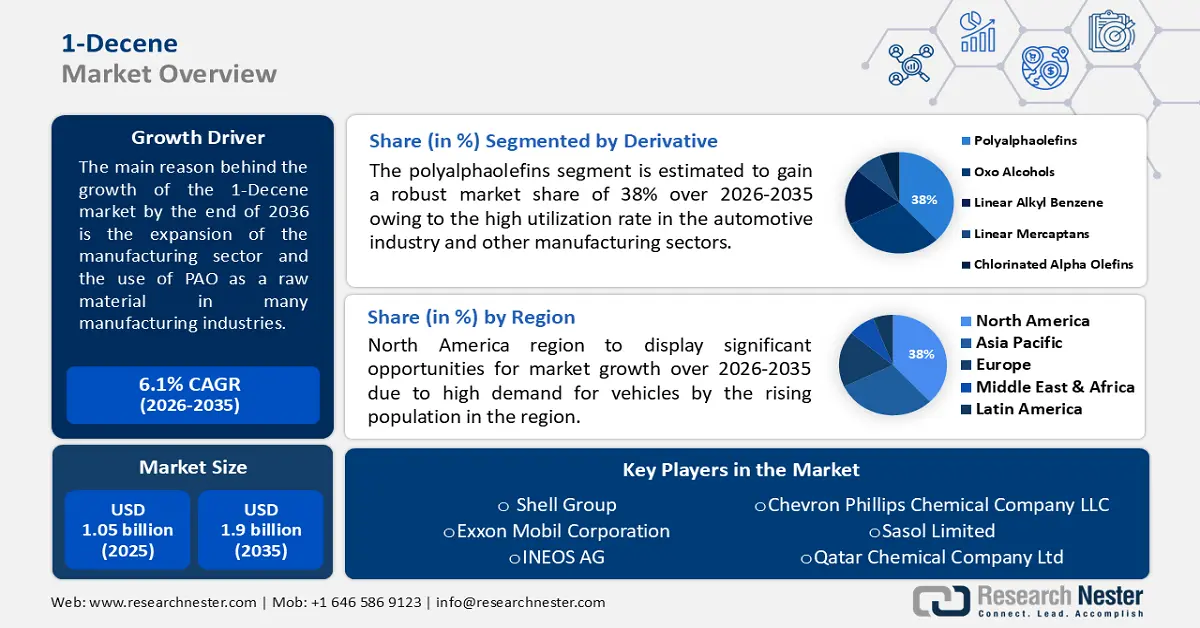

1-Decene Market size was valued at USD 1.05 billion in 2025 and is set to exceed USD 1.9 billion by 2035, expanding at over 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of 1-decene is estimated at USD 1.11 billion.

The primary factor that is attributed to creating lucrative growth opportunities in the market is the expansion of the manufacturing sector and the use of PAO as a raw material in many manufacturing industries as a transmission, compressor, lubricator, and gear oil. As per the reported data, the revenue generated by the manufacturing industry of the U.S. is projected to be approximately USD 9 trillion as of 2022.

Apart from the aforementioned factors, the increased utilization rate of 1-decene in the food and beverage industry as food additives, glazing, and polishing agents, is anticipated to be a positive contributing factor to the market growth in the forecast period. Moreover, it is being utilized as a non-stick coating in utensils, as a lubricant in dough-dividing machines, as an anti-dusting and anti-foaming agent, and as a plasticizer in the food and beverage industry. In addition, the advantages of 1-decene have also made it a preferable chemical intermediate in the manufacture of detergents, their derivatives, and industrial surfactants. As, a result of its characteristics, 1-decene is being highly utilized in end-use industries including automotive, petrochemical, and oil & gas, which subsequently is expected to bring profitable opportunities for the market. Furthermore, the rising economies as well as the rising spending capacities of consumers, along with the decrease in the prices of raw materials, are other anticipated growth drivers to fuel the market in the upcoming years.

Key 1-Decene Market Insights Summary:

Regional Highlights:

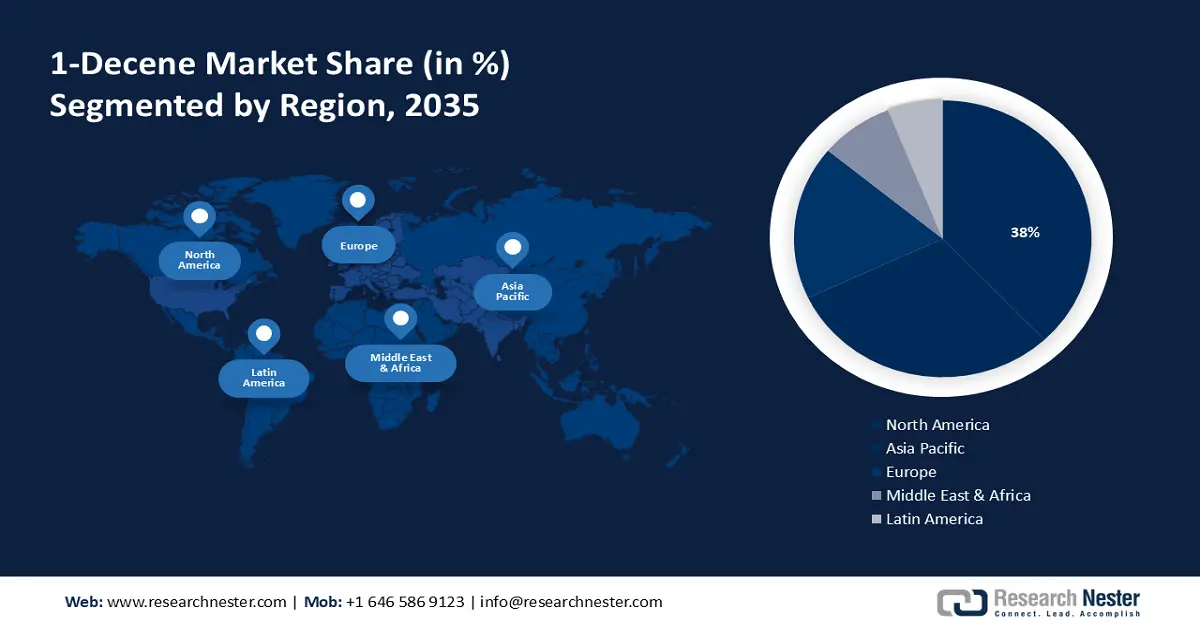

- North America 1-decene market is predicted to capture 38% share by 2035, driven by rapid automobile industry expansion and high demand for vehicles.

Segment Insights:

- The food & beverage segment is expected to achieve the highest market share by 2035, driven by rising global food consumption and use of 1-decene in food additives.

- The polyalphaolefins segment in the 1-decene market is anticipated to capture the highest market share by 2035, driven by its high demand in automotive and corrosion-resistant applications.

Key Growth Trends:

- High Consumption of Packaged Food

- High Investments by Companies in R&D Activities

Major Challenges:

- Highly Toxic in Nature

- Fluctuation in Costs of Raw Materials

Key Players: Shell Group, Exxon Mobil Corporation, INEOS AG, Chevron Phillips Chemical Company LLC, Sasol Limited, Qatar Chemical Company Ltd, Idemitsu Kosan Co., Ltd., Saudi Basic Industries Corporation, Alfa Aesar (Thermo Fisher Scientific), Gelest, Inc.

Global 1-Decene Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.05 billion

- 2026 Market Size: USD 1.11 billion

- Projected Market Size: USD 1.9 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, Saudi Arabia

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 10 September, 2025

1-Decene Market Growth Drivers and Challenges:

Growth Drivers

-

Growth in Automotive Industry - 1-decene is being highly adopted in the automotive and manufacturing industries as a high-quality lubricant, anti-corrosive, and high resistance power. This trend is projected to increase demand for 1-decene in the assessment period. Recent statistics reveal that the global automotive industry is expected to reach approximately USD 9 trillion by 2030.

-

High Consumption of Packaged Food – Hydrogenated poly-1-decene, originating from 1-decene is heavily used as a substitute for white mineral oil in glazing and polishing packaged food items such as dry fruits and sugar confectionery. Thus, an increase in demand for packaged food is forecasted to bring growth opportunities for the market growth in the future. The latest report showed that the global sales of packaged food rose to around USD 3 trillion in 2019 from USD 2 trillion in 2016.

-

High Investments by Companies in R&D Activities – World Bank showed the data on Research and Development expenditure to be 2.63% of total GDP in 2020, up from 2.13% of total GDP in 2017 across the globe.

-

Recent Advances in Chemical Industry – The focus of government and expenditure made the chemical industry grow. This has propelled the Indian chemical industry to grow with a revenue of USD 300 billion by 2025.

Challenges

-

Highly Toxic in Nature – 1-decene carries an odor that is toxic and also has CNS depressant properties. Its improper use can irritate the eyes, and respiratory tract, and also cardiovascular problems. The ingestion of 1-decene may lead to aspiration, causing lung damage. Additionally, it is toxic to aquatic life with long-lasting effects. Thus, the harmful nature of 1-decene is attributed to pose a challenge to market growth.

-

Fluctuation in Costs of Raw Materials

-

Rising Concern for Stringent Governmental Rules

1-Decene Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 1.05 billion |

|

Forecast Year Market Size (2035) |

USD 1.9 billion |

|

Regional Scope |

|

1-Decene Market Segmentation:

End-user Segment Analysis

The global 1-decene market is segmented and analyzed for demand and supply by end-use industry into food & beverage, pharmaceutical, paints & dyes, and others. Out of these, the food & beverage segment is expected to garner the highest market share by 2035. The factors contributing to segment growth are the high consumption of food and beverage products by the burgeoning population along with the rising use of 1-decene as a food additive. In 2021, food manufacturing sales reached almost USD 120 billion around the world and are projected to increase at a steady rate. Also, the benefits of 1-decene to be an effective glazing and polishing agent for food products and its help in producing synthetic fatty acids as an alpha-olefin is anticipated to create a positive outlook for the segment’s growth in the assessment period.

Derivative Segment Analysis

The global 1-decene market is also segmented and analyzed for demand and supply by derivative into polyalphaolefins, oxo alcohols, linear alkyl benzene, linear mercaptans, chlorinated alpha olefins, and others. Out of these, the polyalphaolefins segment is attributed to garner the highest market share by the end of 2035 on the back of its high utilization rate in the automotive industry as well as other manufacturing sectors. Moreover, it is in high demand from the constructing spectrum owing to its anti-corrosive properties against metals, steel, and alloys.

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

1-Decene Market Regional Analysis:

North American Market Insights

The North American 1-decene market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035. The major factors that are estimated to drive market’s growth in the forecast period are the rapid expansion of the automobile industry along with the high demand for vehicles by the rising population in the region. Moreover, 1-decene is an excellent option to work as a lubricant, gear oil, transmission, and compressor in automobiles. As per the International Organization of Motor Vehicle Manufacturers (OICA), the sales of all types of vehicles in the American region grew from 20,814,832 in 2020 to 22,001,152 in 2021, whereas the production of the same region was 16,151,639 vehicles in 2021. Furthermore, the continuous expansion of the petrochemical infrastructure and the oil & gas sector in the U.S., Canada, and Mexico is expected to increase the utilization of 1-decene in the following years. Noteworthy growth in the packaging industry, along with the chemical industry, is also expected to bring lucrative opportunities for the expansion of market size. Recent reports calculated that the chemical industry in the United States region amounted to almost USD 550 billion in 2019.

APAC Market Insights

Moreover, the market in the Asia Pacific region is also expected to show a notable success rate. The rapid technological advancement, along with the surge in demand for polyethylene from various industries is expected to impetus the market growth in the region.

1-Decene Market Players:

- Shell Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Exxon Mobil Corporation

- INEOS AG

- Chevron Phillips Chemical Company LLC

- Sasol Limited

- Qatar Chemical Company Ltd

- Idemitsu Kosan Co., Ltd.

- Saudi Basic Industries Corporation

- Alfa Aesar (Thermo Fisher Scientific)

- Gelest, Inc.

Recent Developments

-

Shell group is all set to start the production of the fourth alpha olefins (AO) unit at its Geismar, Louisiana, USA chemical manufacturing site.

-

Exxon Mobil Corporation has decided to invest USD 2 billion to expand its Baytown, Texas chemical plant.

- Report ID: 4591

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

1-Decene Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.