Womens Health Diagnostics Market Outlook:

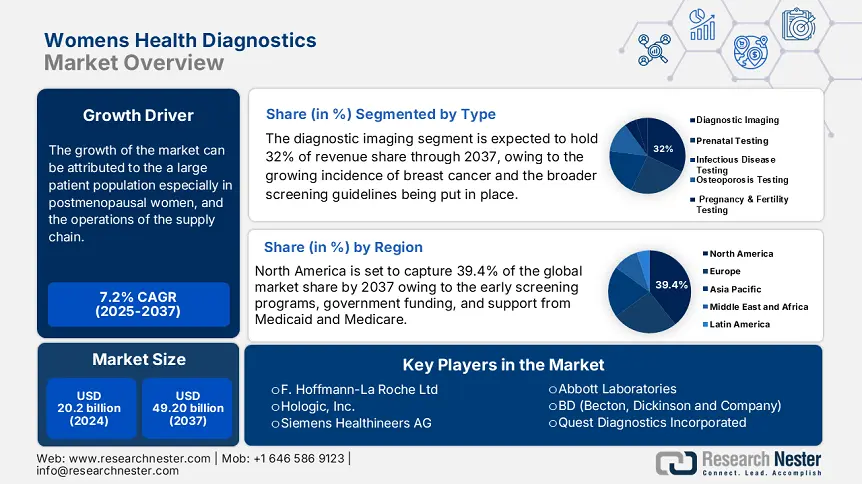

Womens Health Diagnostics Market size was valued at USD 20.2 billion in 2024 and is likely to reach USD 49.20 billion by the end of 2037, expanding at around 7.2% CAGR during the forecast period i.e., between 2025-2037. In 2025, the industry size of womens health diagnostics is evaluated at USD 22 billion.

The global market for womens health diagnostics is growing. Factors contributing to growth include a large patient population, especially in postmenopausal women, and the operations of the supply chain. The Foundation for Innovative New Diagnostics (FIND), a global health not-for-profit, is part of the supply chain space. FIND collaborates with over 140 partners in support of the development and provision of diagnostic tests for diseases that are typically seen in low- and middle-income countries. FIND implements a suite of initiatives, including the management of specimen banks, negotiating prices for products. These activities are educational and contribute to owning or accessing diagnostic tools.

In terms of economic indicators, there are no specific Producer Price Index (PPI) and Consumer Price Index (CPI) data for womens health diagnostics. This growth can be attributed to an increased commitment of research funding on both the public and private sides. Trade and logistics are also very important to the market. The distribution of diagnostic equipment and the distribution of diagnostic equipment raw materials require efficient importing and exporting. Organizations such as FIND have played a major role in providing equitable distributions of diagnostic tools.

Womens Health Diagnostics Market - Growth Drivers and Challenges

Growth Drivers

- Government investment in advanced diagnostics: Medicare Part B spending on genetic tests, including those related to womens health diagnostics, increased by over 27% in 2023. This increase reflects a 40% growth in test volumes, demonstrating that there is a growing focus on precision medicine and early detection approaches in women's health.

- Emphasis on preventative services: Medicare covers a variety of preventative services important to women's health, including screenings for breast and cervical cancers and sexually transmitted infections. These services are, in many cases, provided at low or no out-of-pocket costs for beneficiaries, which encourages early detection and intervention.

- Increase in demand for reproductive health services: More than one million women of reproductive age (20 to 49 years of age) have access to Medicare. These women are often of minority backgrounds and have lower incomes. This highlights the need for better diagnostic access to reproductive health. Although Medicare covers many preventive services, it lacks in certain areas, such as contraceptive coverage.

- Move toward value-based care: Medicare is changing its payment model from fee-for-service to value-based care models. It aligns facilities with diagnosing low-cost interventions that can demonstrate better patient outcomes and decreased utilization of healthcare services. Organizations such as the Foundation for Innovative New Diagnostics (FIND), which partner with a variety of organizations the world over to develop and implement diagnostic tools, specifically in low- and middle-income countries. Collaborations address global health disparities for access to necessary diagnostics.

Historical Patient Trends: A Catalyst For Global Womens Health Diagnostics Expansion

Throughout 2010 to 2020, the global market experienced significant changes as a result of increased disease burden, demographic shifts, mandatory screening programs, and access to preventive healthcare services.

Specifically, the U.S. addressed screening with an extension of programs to ensure coverage under the Affordable Care Act. Similarly, European countries, such as Germany and France, expanded national screening programs for breast and cervical cancer coverage. In the Asia-Pacific region, Japan billed more than 55% of its population through its obligatory health insurance and had improved prenatal care.

This past growth phase in the care continuum has set in place the capacity for strong market scalability. Now, the diagnostic manufacturers also have the opportunity to put forth AI-enhancing diagnostics, home testing kits, and integrated drugs with devices. The patient path from 2010–2020 will be considered as a major input in revenue prediction models, as personalized medicine and digital health platforms provide equal access to patients in the rural and semi-urban categories of Asia and Latin America. Given the continued growth, manufacturers of all sizes, from corporates to start-ups, have to structure their products and support along special access methods.

Historical Patient Growth Data (Womens Health Diagnostics Users, 2010–2020)

|

Country |

2010 Users (millions) |

2020 Users (millions) |

% Growth (2010–2020) |

|

USA |

51.9 |

69 |

34% |

|

Germany |

11.9 |

15.6 |

31% |

|

France |

10.7 |

13.8 |

31% |

|

Spain |

7.7 |

9.6 |

36.7% |

|

Australia |

4.4 |

6.4 |

41.9% |

|

Japan |

18.6 |

24.6 |

31.8% |

|

India |

38.4 |

54.7 |

42.9% |

|

China |

48 |

71.0 |

49.7% |

Revenue Feasibility Models Shaping the Future of the Market

Manufacturers operating in the womens health diagnostics (WHD) space utilized a variety of regional expansion strategies from 2020 to 2024, including various levels of regional partnerships, working with government agencies, and developing value-based innovations. For instance, distributors operating in India were able to apply a decentralized distribution model by utilizing public-private partnerships that strengthened rural access to diagnostics. In China, diagnostic procurement spikes have been seen as a result of government-funded programs that improve maternal health.

Feasibility Expansion Models – Statistical Summary (2022–2024)

|

Country |

Feasibility Model |

Revenue Change (2022–2024) |

|

India |

Local partnerships with primary care providers |

+11% |

|

USA |

Expanded Medicare screening reimbursements |

+9.2% |

|

China |

National maternal health procurement expansion |

+14% |

|

Germany |

Centralized insurance funding for WH diagnostics |

+8.0% |

|

Australia |

Mobile diagnostics funding in rural areas |

+6.3% |

Challenges

- High costs of diagnostics and their impact on Medicaid coverage: In the USA, in 2023, costs of advanced diagnostics for breast and cervical cancer exceeded USD 1,100 per patient. Medicaid's coverage is limited to 47% of eligible women based on the budget restrictions placed on the coverage. Consequently, as a result, this was an affordability gap across low-income populations.

- Regulatory slowdowns in Japan: Japan's 2022 update to the Pharmaceuticals and Medical Devices Law (PMDL) accelerated the amount of diagnostic innovation. This resulted in the average approval period extending 7-8 months, affecting the overseas manufacturer go to market period.

Womens Health Diagnostics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

7.2% |

|

Base Year Market Size (2024) |

USD 20.2 billion |

|

Forecast Year Market Size (2037) |

USD 49.20 billion |

|

Regional Scope |

|

Womens Health Diagnostics Market Segmentation:

Type Segment Analysis

The diagnostic imaging segment is projected to hold a dominant 32% revenue share by the end of 2037. The growth is driven by the growing incidence of breast cancer and the broader screening guidelines being put in place. According to the U.S. Preventive Services Task Force (USPSTF), it’s now standard for women aged 40 to 74 to get mammograms every two years. This has led to a significant boost in screening rates. Additionally, the use of digital breast tomosynthesis is on the rise around the world.

Technology Segment Analysis

The molecular diagnostics segment is poised to account for 23% revenue share in the market due to the growing need for precision medicine. The use of molecular diagnostics (PCR, NGS, microarrays) provides highly accurate detection and identification of genetic disorders, human papillomavirus (HPV), and prenatal conditions, supporting personalized health care practices. Those molecular tests are considered the gold standard of detection for high-risk HPV strains associated with cervical cancer. Next-generation sequencing (NGS) and CRISPR-based diagnostic testing can increase the speed and affordability of testing.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Technology |

|

|

Application |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Womens Health Diagnostics Market - Regional Analysis

North America Market Insights

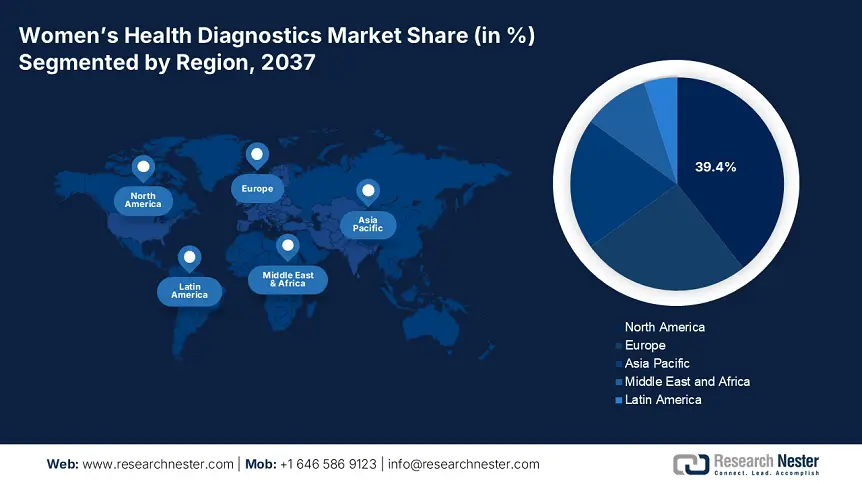

The North America market is projected to account for a leading share of 39.4% by the end of 2037. The growth is led by the early screening programs, government funding, and support from Medicaid and Medicare. In 2024, the CMS boosted Medicaid coverage for diagnostics by over 6%, setting aside around USD 1 billion for related treatments.

Over in Canada, Health Canada and CIHI noted over 7% federal healthcare allocation for this area in 2023. These financial commitments are enhancing access to mammograms, Pap smears, and genetic screenings. This, in turn, is leading to higher diagnosis rates and earlier interventions. Canada’s womens health diagnostics market is thriving. Provinces like Ontario and British Columbia have made significant improvements to their diagnostic infrastructure. Moreover, BioteCanada and Innovative Medicines Canada are supporting research and development partnerships with public hospitals to test next-generation genetic diagnostics.

Europe Market Insights

Europe is poised to hold a revenue share of 25% throughout the forecast period due to the growing awareness of public health, national screening programs, and funding initiatives. There's a strong focus on the early detection of breast, cervical, and ovarian cancers, which has prompted policy and budget alignment among member states. With aging populations, rising rates of female-specific health issues, and a commitment to health equity, countries are ramping up their investments.

Germany is at the forefront of the womens health diagnostics market in Europe. This impressive growth can be attributed to the increased availability of reimbursement options for digital diagnostics. Germany has launched a federal initiative focused on early diagnosis for underserved migrant and elderly communities. France’s womens health diagnostics market is set to represent over 17% of the European market by 2037. A significant development is the introduction of performance-based reimbursements for regional hospitals that offer women-specific diagnostics. Digital screening tools approved by HAS are currently being tested in regional health centers.

Key Womens Health Diagnostics Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global market for womens health diagnostics is a vibrant mix of companies using a variety of strategies to solidify their positions. Major players are forming strategic partnerships and expanding into new regions to meet the rising demand for womens health diagnostics. For instance, Roche and Hologic have rolled out cutting-edge diagnostic tests for issues like breast and cervical cancer. Moreover, acquisitions such as Hologic's buyout of Endomag and Gynesonics have broadened their product offerings. This is allowing them to provide more comprehensive solutions in womens health diagnostics. Furthermore, the competitive landscape is ever-evolving, with companies constantly pushing to innovate and extend their influence in the womens health diagnostics arena.

Here is a list of key players operating in the global market:

|

Company Name |

Country of Origin |

Estimated (%) |

|

F. Hoffmann-La Roche Ltd |

Switzerland |

15% |

|

Hologic, Inc. |

USA |

12.6% |

|

Siemens Healthineers AG |

Germany |

10% |

|

Abbott Laboratories |

USA |

9.9% |

|

BD (Becton, Dickinson and Company) |

USA |

8.9% |

|

Quest Diagnostics Incorporated |

USA |

xx% |

|

GE Healthcare |

USA |

xx% |

|

Koninklijke Philips N.V. |

Netherlands |

xx% |

|

Thermo Fisher Scientific Inc. |

USA |

xx% |

|

PerkinElmer Inc. |

USA |

xx% |

|

bioMérieux SA |

France |

xx% |

|

Cardinal Health Inc. |

USA |

xx% |

|

Cook Group Incorporated |

USA |

xx% |

|

Fujifilm Holdings Corporation |

Japan |

xx% |

|

Sysmex Corporation |

Japan |

xx% |

|

Shimadzu Corporation |

Japan |

xx% |

|

Canon Inc. |

Japan |

xx% |

|

Mylab Discovery Solutions |

India |

xx% |

|

Medtronic PLC |

Ireland/USA |

xx% |

|

Mindray Bio-Medical Electronics Co., Ltd. |

China |

xx% |

Below are the areas covered for each company in the womens health diagnostics market:

Recent Developments

- In March 2024, Hologic, Inc. introduced the Panther Fusion HPV Assay for high-throughput cervical cancer screening. This assay improved testing efficiency by over 20%. Moreover, it also contributed to around 9% increase in Hologic's molecular diagnostics market share in Q1 2024. The assay’s enhanced sensitivity supports earlier detection and better patient outcomes.

- In June 2024, Abbott Laboratories introduced the Alinity m STI Panel, a multiplex molecular test that detects sexually transmitted infections including HPV, Chlamydia, and Gonorrhea. Early adoption led to over 12% revenue growth in Abbott’s diagnostics segment during H1 2024.

- Report ID: 3844

- Published Date: Jul 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Women Health Diagnostics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert