Virtual Reality in Healthcare Market Outlook:

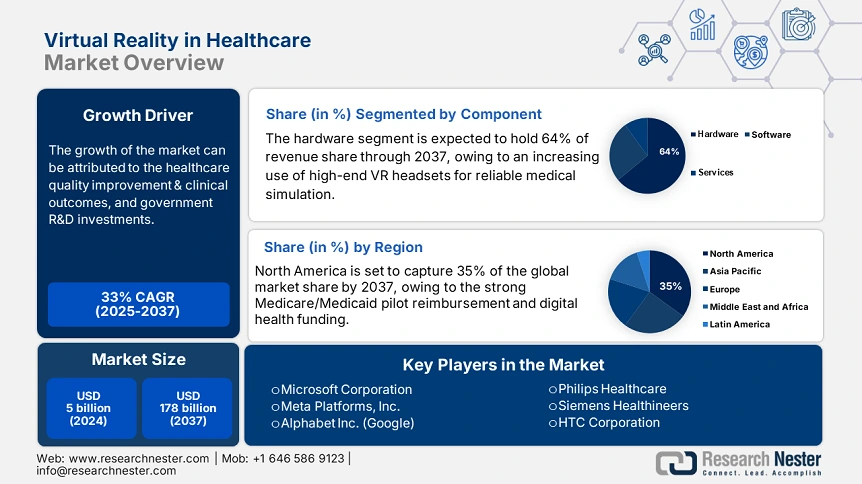

Virtual Reality in Healthcare Market size was valued at USD 5 billion in 2024 and is projected to reach USD 178 billion by the end of 2037, rising at a CAGR of 33% during the forecast period, 2025 to 2037. In 2025, the industry size of virtual reality in healthcare is estimated at USD 6.4 billion.

Government data indicate a developing clinical patient base, speaking to the use of VR technology. Additionally, there are other NIH-supported studies/examinations regarding the use of VR in inpatient treatments and for anxiety in brain tumor patients. In sum, these studies and programs demonstrate an expanding treatment-based user group that belongs to clinical systems.

The overall supply chain for VR healthcare products follows established trade practices for medical devices. As per the International Trade Administration, in 2019, U.S. exports of medical devices were more than USD 44 billion. In 2020, U.S. imports totalled USD 67 billion. This demonstrates the large two-way trade related to the assembly and distribution of medical devices worldwide. Although VR-specific parts (headsets, haptic sensors) are included in the larger category of medical devices, they are not reported separately in the PPI/CPI data. However, concerning Puerto Rico, export prices for medical equipment and supplies increased by 0.6 % year-over-year. Moreover, according to the Bureau of Labor Statistics (BLS) import prices decreased 0.1% as of April 2025.

Financing for VR research and implementation demonstrates regulatory and institutional support. The FDA's Digital Health Center of Excellence had approved 68 AR/VR-enabled medical devices by September 2024. The U.S. device manufacturers reinvest about 6 % of gross revenues in R&D. Trade-specific realities include several factors that require consideration for VR segment growth opportunities. This highlights the continuing dependence on cross-border supply chains to access sophisticated medical hardware.

Virtual Reality in Healthcare Market - Growth Drivers and Challenges

Growth Drivers

-

Healthcare quality improvement & clinical outcomes: Numerous studies supported by the AHRQ have shown that clinical training and simulations based on the virtual reality (VR) environment improve diagnostic accuracy and care transitions. For instance, the advancement of virtual patient simulations improved diagnostic reasoning in medical students and clinicians while increasing the completeness and accuracy of differential diagnoses. These findings reflect a predominant trend in which a better quality of healthcare prompts these institutions' clinicians to use VR to provide safer and effective training.

-

Government R&D investments: In 2023, the AHRQ Digital Healthcare Research program allocated USD 44 million toward digital health projects involving optimizing clinician judgment and safety workflows. Such funding enables VR innovation around quality, and thus demonstrates that clinical-scale VR is moving forward for design and integration. Government research on telehealth shows unequal access for rural and underserved populations. These unmet needs give us an opportunity for growth going forward in new solutions.

Historical Patient Growth Data: VR in Healthcare Users (2010–2020)

|

Country |

2010 Users (Million) |

2020 Users (Million) |

% Growth (2010–2020) |

|

USA |

0.27 |

2.34 |

738% |

|

Germany |

0.08 |

0.89 |

879% |

|

France |

0.07 |

0.73 |

1116% |

|

Spain |

0.05 |

0.58 |

1376% |

|

Australia |

0.05 |

0.43 |

1268% |

|

Japan |

0.04 |

0.64 |

1222% |

|

India |

0.02 |

1.24 |

6100% |

|

China |

0.03 |

1.89 |

6200% |

Feasibility Models for VR in Healthcare Expansion

|

Model |

Region |

Period |

Revenue CAGR |

Key Stat |

|

Partnership model |

North America |

2020–2025 |

+35% |

Global healthcare AR/VR to USD 11.1 billion by 2025 |

|

Grant-funded pilots |

Europe |

2023–2030 |

— |

AR/VR market size to USD 14.05 billion by 2030 |

|

Clinical validation model |

Global |

2021–2027 |

+37% |

VR healthcare USD 9.8 billion |

Challenges

- Pricing restraints & affordability: One-third of the global population reports having no broadband, which limits the ability to access VR remotely. VR hardware (headsets, sensors) and software development (custom medical applications) can be expensive. Many healthcare providers where healthcare investment and technology are still emerging have difficulty justifying the upfront costs. In hospitals, budget constraints often favor the purchase of essential medical equipment rather than emerging technologies such as VR.

- Regulatory delays and price caps: Regulations can require particular elements of VR healthcare devices and software to be approved. The processes for seeking approval can be lengthy, particularly for VR applications, which can result in a delayed product launch. Delays in approvals lead to a delayed time to market, which increases costs for developers.

Virtual Reality in Healthcare Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

33% |

|

Base Year Market Size (2024) |

USD 5 billion |

|

Forecast Year Market Size (2037) |

USD 178 billion |

|

Regional Scope |

|

Virtual Reality in Healthcare Market Segmentation:

Component Segment Analysis

Based on the component, the hardware segment is predicted to capture the largest share at 64% in the virtual reality in healthcare market over the assessed period. There is an increasing use of high-end VR headsets for reliable medical simulation. Once programs like the U.S. federally funded grant programs became available and the WHO recommended digital training hubs, more funding was put into hardware. The public hospital sector adopted a strategy of bulk purchasing, reducing unit costs by 19-28%. This is further accelerating market growth.

End Use Segment Analysis

In terms of end use, the hospitals and clinics segment is anticipated to hold the highest revenue proportion of 46% in the virtual reality in healthcare market throughout the discussed timeline. There are a number of clinical, operational, and policy-based reasons for this dominance of VR in institutional care environments that make it clinically useful with a practical effect. For instance, VR-based simulations have assisted hospitals in training their surgical teams on complex procedures. Hospitals use VR-based training for physical rehabilitation and for pain distraction. For instance, a Center for Disease Control and Prevention (CDC) approved program demonstrated that VR-induced pain distraction decreased the need for opioid medication by 24% in burn units.

Our in-depth analysis of the virtual reality in healthcare market includes the following segments:

|

Segment |

Subsegment |

|

Component |

|

|

Application |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

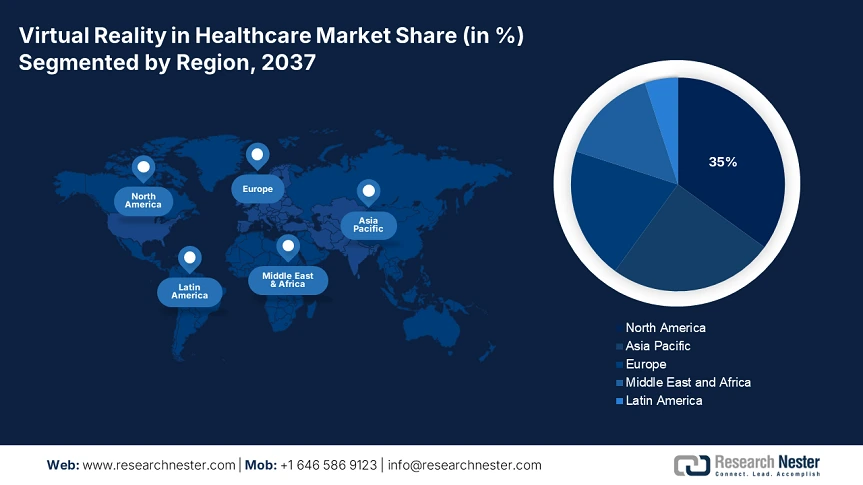

Virtual Reality in Healthcare Market - Regional Analysis

North America Market Insights

North America is expected to dominate the global virtual reality in healthcare market with a share of 35% by the end of 2037. The growth is led by the strong Medicare/Medicaid pilot reimbursement and digital health funding. An increasing number of clinics and hospitals are using VR for pain relief, rehabilitation, surgery, and some varieties of behavioral therapy. In Canada, Health Canada and PHAC support digital health frameworks with bilateral agreements. Major hospitals are implementing programs under VR pain and rehab, under interoperability initiatives in Federal funding. North America is well-positioned as a leader in the global VR healthcare market due to a basis of government funding, regulatory clarity, and acceptance from payers.

The U.S. market demand for VR in health care is growing rapidly, sustained by federal and payer support. Medicare funding--CMS has issued HCPCS codes, including G0455 VR CBT pain therapy, and is evaluating devices like RelieVRx, which treats chronic low back pain. Medicaid programs are increasingly covering VR therapy as an outpatient therapy biofeedback program. VR products that have been cleared by the FDA are moving into home use, rehabilitation, and behavioral/mental health. Pilot funding is supporting the use of VR in rural areas and demonstrating successful early adopter studies. The CMS interoperability programs support EHR-linked VR health care. The large volume of money and continuing codes from federal and state entities continues to expand the potential for new business opportunities for VR health applications.

Canada’s market for VR healthcare continues as a sustained growth trajectory through federal-provincial levers and digital health strategies. The Chief Data Office will offer data support for the improvement of the VR analytical infrastructure. Expansion of tele-rehabilitation implementation is being carried out in rural and Indigenous communities to improve access to treatment. Federal-provincial bilateral investment agreements caused federal investment in infrastructure and advanced mental-health VR tools. Overall, the development of Canada’s market related to VR in healthcare is the result of collaborative efforts, more funding, evolving policy and frameworks, maturation of digital proficiency.

APAC Market Insights

By 2037, the Asia Pacific region is projected to grow at the fastest rate in the global virtual reality in healthcare market. Such growth is primarily due to government investments in digital health services, growing chronic disease load, and aging populations in developed countries. Japan is a leader in the region with sizeable public spending via AMED and MHLW on developing digital-medical devices and decentralized clinical trial applications. China's Healthy China 2030 agenda is also moving virtual reality forward. India has targeted more virtual reality use through its tele-rehabilitation programs in government hospitals and even policy reform through its Ayushman Bharat health care reform. South Korea and Malaysia are also scaling out onboard digital care pilots. All governments in the region also have some rural outreach and elderly care commitments, and are trialing some projects across borders.

|

Country/Region |

Investment & Government Support |

Recent Developments |

|

China |

Strong government influence: “Health China 2030” |

Leading hospitals in Beijing/Shanghai integrate AR-assisted surgery |

|

Japan |

MHLW funding VR medical-training pilots |

VR is used in elderly rehabilitation, cognitive therapy, and surgical simulation |

|

India |

Invest India: USD 370 billion investment in health in 2022 |

5G rollout supports immersive tele‑health |

|

Australia |

Private and public investments in VR pain management and remote therapy |

Rapid deployment in rural tele-therapy and rehabilitation programs |

Europe Market Insights

The Europe virtual reality in healthcare market is estimated to garner a notable industry value from 2025 to 2037. The European Health Data Space projects support telemedicine, remote monitoring, and interoperable VR experiences. For instance, National budgets also demonstrate their commitment. Germany’s Digital Healthcare Act drives recommended VR apps for prescriptions. The aging populations and rising chronic diseases also create a greater and growing demand. The outstanding challenges are evolving, specifically fragmented reimbursement and heterogeneous digital maturity across member states. All in all, Europe is developing into a dynamic and better-funded VR health sector by the time we hit 2037.

The UK is now leading Europe’s VR health market as a result of notable NHS digital investment. The UK is demonstrating best practices for NICE evaluation on a number of digital therapeutic references, including CBT and VR, that create similar routes for payer reimbursement. The drivers for this development include NHS centralised procurement, major testbeds, and previous health IT infrastructure expenditure. This is enabling rapid scaling of VR solutions into clinical pathways.

Germany's VR healthcare growth is backed by a high healthcare spend. The German VR healthcare market is developing in the context of the historical social-insurance-based reimbursement in the healthcare system. Germany is in an advantageous position to be a leader in advancing VR for healthcare.

Key Virtual Reality in Healthcare Market Players:

-

The VR in the healthcare industry is led by powerful technology players that can leverage their hardware and platform capabilities to transform VR into clinical workflows and therapeutic applications. Established medical technologies like Philips, Siemens, and GE are focused on integrating mixed reality and imaging. There are specific players in this space who develop around very targeted clinical use cases, support their claims with FDA indications. Lastly, strategic efforts appear to be partnerships with healthcare, and audiences are referencing FDA clearances. Platform integrations and acquisitions; it suggests this is a mature, competitive space with some convergence happening between traditional tech players and health-tech related specialists.

Company

Country

2024 Market Share (est.)

Microsoft Corporation

USA

10.2%

Meta Platforms, Inc.

USA

9.5%

Alphabet Inc. (Google)

USA

7.2%

Philips Healthcare

Netherlands

6.1%

Siemens Healthineers

Germany

6%

GE HealthCare

USA

xx%

HTC Corporation

Taiwan (Asia, global)

xx%

Sony Corporation

Japan

xx%

MindMaze SA

Switzerland

xx%

Meta’s VR division (Oculus Therapeutics)

USA

xx%

Varjo Technologies Oy

Finland

xx%

VirtaMed AG

Switzerland

xx%

EON Reality, Inc.

USA

xx%

Osso VR, Inc.

USA

xx%

CAE Healthcare Inc.

Canada

xx%

AppliedVR, Inc.

USA

xx%

XRHealth USA Inc.

USA

xx%

Medivis XR, Inc.

USA

xx%

Medical Realities Ltd.

UK

xx%

FOVE Inc.

Japan

xx%

Below are the areas covered for each company in the virtual reality in healthcare market:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

Recent Developments

- In October 2024, Osso VR Extended to XR solutions for drug delivery, commercializing pharmaceuticals, clinical trials, and training. Responds to a projected increase in the implantable drug delivery market from USD 24 billion (2021) to USD 45 billion (2029). This is allowing companies to be more efficient in training sales and trial teams.

- In September 2024, Otsuka Pharmaceutical & Jolly Good Co. introduced a VR training program designed specifically for dementia caregivers. This initiative aims to equip both family and professional caregivers with the empathy and skills they need.

- Report ID: 3324

- Published Date: Jul 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert