Diode Bridge Rectifier Market Outlook:

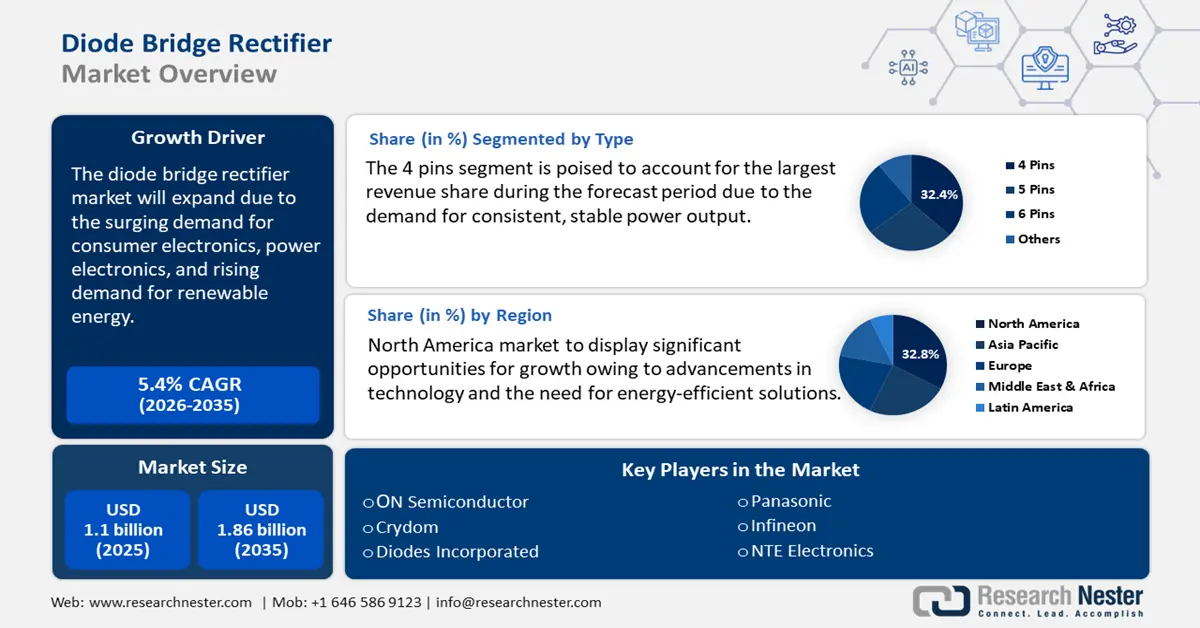

Diode Bridge Rectifier Market size was valued at USD 1.1 billion in 2025 and is set to exceed USD 1.86 billion by 2035, expanding at over 5.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of diode bridge rectifier is estimated at USD 1.15 billion.

The increasing use of consumer electronic products such as power supplies for phones, laptops, and home appliances has increased the demand for efficient power management solutions, including diode bridge rectifiers. With the increased usage of electronic devices and systems, there is a high need for reliable and efficient AC to DC-power rectification. These are widely used in electronic circuits and power supplies to enhance energy efficiency and device performance. In March 2023, Alpha and Omega Semiconductor launched AlphaZBL AC-DC Active Bridge Rectifier Solutions with high-power 100W and above adaptors for high-end premium laptops and televisions and provide power supplies for desktops, game consoles, servers, and telecom connections.

The advancements in the automobile sector particularly the electric vehicle segment drive the need for the diode bridge rectifiers. The energy management system and EV charging depend on these diodes which has led to a rise in demand for these rectifiers. The EV market has undergone a remarkable shift moving from a niche sector to a mainstream choice for most people and the demand for new EVs has significantly increased over the past five years. This growth can be attributed to the availability of various choices, better access to charging infrastructure, increased consumer awareness of environmental issues, supportive government policies, and financial incentives like rebates and tax credits.

Key Diode Bridge Rectifier Market Insights Summary:

Regional Highlights:

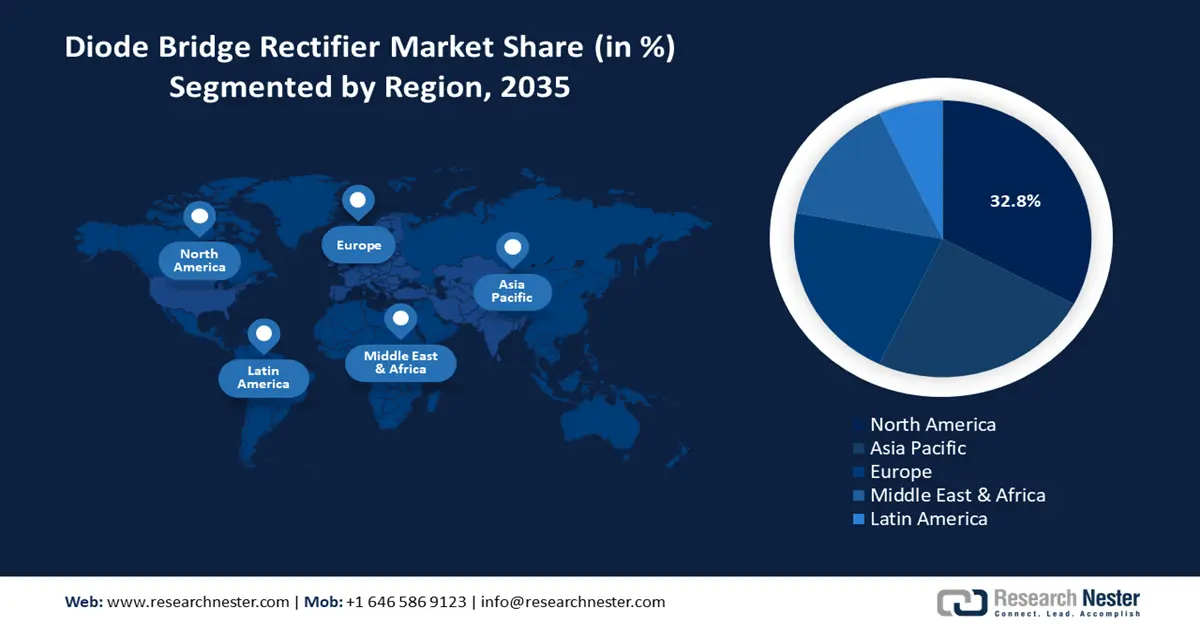

- North America holds a 32.8% share in the Diode Bridge Rectifier Market, propelled by advancements in technology and growing need for energy-efficient solutions, ensuring leadership through 2026–2035.

- Asia Pacific's diode bridge rectifier market is set for rapid growth by 2035, attributed to a strong manufacturing base and rising use of electronics and automotive products.

Segment Insights:

- The 4 Pins segment is projected to capture over 32.4% share in the Diode Bridge Rectifier Market by 2035, fueled by its simple configuration and widespread use in electronic appliances.

- The Consumer Electronics segment of the Diode Bridge Rectifier Market is projected to hold a significant share by 2035, driven by increasing demand for reliable power supply solutions in electronics.

Key Growth Trends:

- Growing demand for power electronics

- Rising demand for renewable energy

Major Challenges:

- High competition among manufacturers

- Rising raw material and production costs

- Key Players: ON Semiconductor, Panasonic, Crydom, Diodes Incorporated, Infineon, IXYS, NTE Electronics.

Global Diode Bridge Rectifier Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.1 billion

- 2026 Market Size: USD 1.15 billion

- Projected Market Size: USD 1.86 billion by 2035

- Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.8% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: China, Japan, South Korea, Taiwan, India

Last updated on : 13 August, 2025

Diode Bridge Rectifier Market Growth Drivers and Challenges:

Growth Drivers

-

Growing demand for power electronics: With increasing awareness about energy efficiency and stricter regulations, manufacturers are adding high-performance rectifiers to their products. Power electronics help manage and convert energy efficiently using high voltages and currents, powering many devices. These include integrated circuits, power diodes, transistors, and other electrical components. The rise of intelligent power modules has broadened their use in everything from consumer electronics to industrial systems, electric vehicles, and battery management. Power electronics have become even more important as electric vehicles, smart grids, and renewable energy systems expand.

According to a report by the International Energy Agency (IEA), it is expected that about 80% of all electricity worldwide will rely on power electronics for generation and usage by 2030. - Rising demand for renewable energy: The adoption of efficient electric and hybrid vehicles increases the need for rectifiers in charging systems, power inverters, and alternators. As the demand for energy-efficient technologies is increasing, manufacturers are focusing on developing better designs. To reduce Co2 emissions and air pollution, a rapid shift towards low-carbon sources of energy such as nuclear and renewable technologies is highly needed. The rising demand for renewable energy witnessed a shift in the purchasing pattern of electric vehicles. According to the IEA, nearly one in five cars sold in 2023 was electric. Further, electric car sales reached a total of 14 million in 2023.

Challenges

-

High competition among manufacturers: Intense competition among manufacturers leads to price pressures, reducing profit margins. Companies must constantly innovate to stay competitive. Further, rapid advancements in semiconductor technology mean older rectifier designs can quickly become obsolete, requiring manufacturers to invest heavily in research and development. Additionally, ensuring the long-term reliability of diode bridge rectifiers in industrial or automotive applications remains a challenge, requiring advanced designs and testing. The alternatives such as synchronous rectifiers can offer higher efficiency and reduce power loss, potentially limiting the market share for traditional diode rectifiers. Thus, the presence of these alternatives is a major threat to the diode bridge rectifier market.

-

Rising raw material and production costs: Fluctuating prices of raw materials such as silicon, gallium, and other semiconductor components increase production costs, affecting pricing and profitability. Top manufacturing companies may face challenges in maintaining competitive pricing while ensuring product quality and performance hampering market growth.

Diode Bridge Rectifier Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 1.1 billion |

|

Forecast Year Market Size (2035) |

USD 1.86 billion |

|

Regional Scope |

|

Diode Bridge Rectifier Market Segmentation:

Type (4 Pins, 5 Pins, 6 Pins, and Other)

The 4 pins segment is likely to dominate diode bridge rectifier market share of over 32.4% by 2035. The growth can be attributed to its easy accessibility, less complex configuration, and compact use. It is one of the most commonly used and easy-to-find types of bridge rectifier circuits and is used in many electronic devices, and home appliances such as chargers for laptops, phones, refrigerators, washing machines, air conditioners, and other gadgets.

Application (Consumer Electronics, Automotive, Industrial, Telecommunications, others)

By application, the consumer electronics segment is expected to register a significant diode bridge rectifier market share by the end of 2035. This segment accounts for a large portion of the market since diode bridges are essential components in power supply units used in many electronic devices and systems. The growing demand for efficient and reliable power solutions in both consumer and industrial settings drives growth in this segment. With the increasing use of gadgets and smart devices, there is a growing demand for stable power management solutions. Innovations and the constant introduction of electronic products continue to support growth in this segment.

Our in-depth analysis of the global diode bridge rectifier market includes the following segments:

|

Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Diode Bridge Rectifier Market Regional Analysis:

North America Market Analysis

North America in diode bridge rectifier market is poised to capture over 32.8% revenue share by 2035. The market is driven by advancements in technology and the growing need for energy-efficient solutions. The presence of leading semiconductor companies and the increasing adoption of electric vehicles (EVs) and renewable energy sources drive the demand for diode bridge rectifiers in this region. The implementation of strict regulations on energy efficiency and government initiatives to promote sustainable energy solutions are expected to boost the market growth in this region.

The diode bridge rectifier market in the U.S. is characterized by the increased demand for efficient use of energy and rising concerns about the environment. Thus, there has been a shift towards purchasing electronic vehicles rather than petroleum vehicles. The transformation also depends on advanced technologies and infrastructure in the U.S. According to the US EIA, the sales of electric and hybrid vehicles in the U.S. have increased in the second quarter of 2024.

The diode bridge rectifier market in Canada is experiencing steady growth, supported by various factors including increased adoption of advanced technologies and ongoing investments in EV charging and infrastructure. The Government of Canada is investing in electric vehicle charging infrastructure which increases demand for cutting-edge rectifier systems. For instance, Canada is committed to its initiative of decarbonizing the transportation sector and becoming a global leader in zero-emission vehicles (ZEVs). Canada aims to shift towards a low-carbon economy by 2050 and is projected to create around 60,000 new job openings in the electricity sector from 2023 to 2050.

Asia Pacific Market Analysis

Asia Pacific is expected to register rapid revenue growth during the forecast period due to its strong manufacturing base and the rising use of consumer electronics and automotive products. Countries such as China, Japan, and South Korea are the primary areas for any kind of technological advancement and industrial growth, which drive the demand for diode bridge rectifiers. Additionally, supportive government policies and investments in infrastructure development are further boosting the diode bridge rectifier market growth in this region.

New technologies such as the use of silicon carbide and gallium nitride have made the diode bridge rectifier market vast. Thus, companies are working towards advancing the silicon carbide ecosystem in China. For instance, in June 2023, STMicroelectronics and Sanan Optoelectronics started a joint venture for manufacturing high-volume 200mm silicon carbide devices that can be used for car electrification and industrial power and energy applications.

The diode bridge rectifier market in India is poised for substantial growth, driven by increasing demand in the automotive, electronics, and industrial sectors, rising adoption of electronic devices, and supportive government initiatives. Moreover, the rising middle-class population, increase in disposable income, and declining manufacturing costs have led to an increase in the sales of electronic devices. Manufacturers are focused on developing advanced, efficient, and cost-effective solutions for use in different industries. For instance, Comchip Technology Co introduced the HBS502-HF rectifiers featuring small packaging, surface mount design, and high forward current capability upto 5A.

Key Diode Bridge Rectifier Market Players:

- ON Semiconducto

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Panasonic

- Crydom

- Diodes Incorporated

- Infineon

- IXYS

- MCC

- NTE Electronics

- Semikron

- SOLID STATE

- TSMC

- Vishay Intertechnology, Inc.

- Littelfuse

Key players are driving growth through a combination of technological innovation, strategic partnerships, rising consumer demand, and expanding product offerings. The top companies play a crucial role in shaping the diode bridge rectifier market by driving innovation, enduring product quality, and diverse industry needs. These companies invest in research and development to improve efficiency, reliability, and compactness of diode bridge rectifiers. For example, they use advanced materials like silicon carbide and gallium nitride to enhance performance. Key player Onsemi has been selected to power Volkswagen’s next-generation electric vehicles. It will provide silicon carbide technologies as part of an integrated module solution that can scale across all power levels i.e., from high-power to low-power traction inverters for all vehicle categories. The key players in the diode bridge rectifier market are given below.

Recent Developments

- In November 2024, Infineon and Quantinuum announced a partnership to accelerate quantum computing towards real-world applications. This partnership is expected drive growth in fields such as generative chemistry, material science, and artificial intelligenceIn

- August 2024, Infineon introduced the world’s largest 200-millimeter SiC Power Fab in Kulim, Malaysia, leading to a total revenue potential of about seven billion euros by the end of the decade. Kulim fab operates on 100% green electricity and implements advanced energy efficiency and sustainable practices

- Report ID: 7033

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Diode Bridge Rectifier Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.