Automotive Fuel Tank Market Outlook:

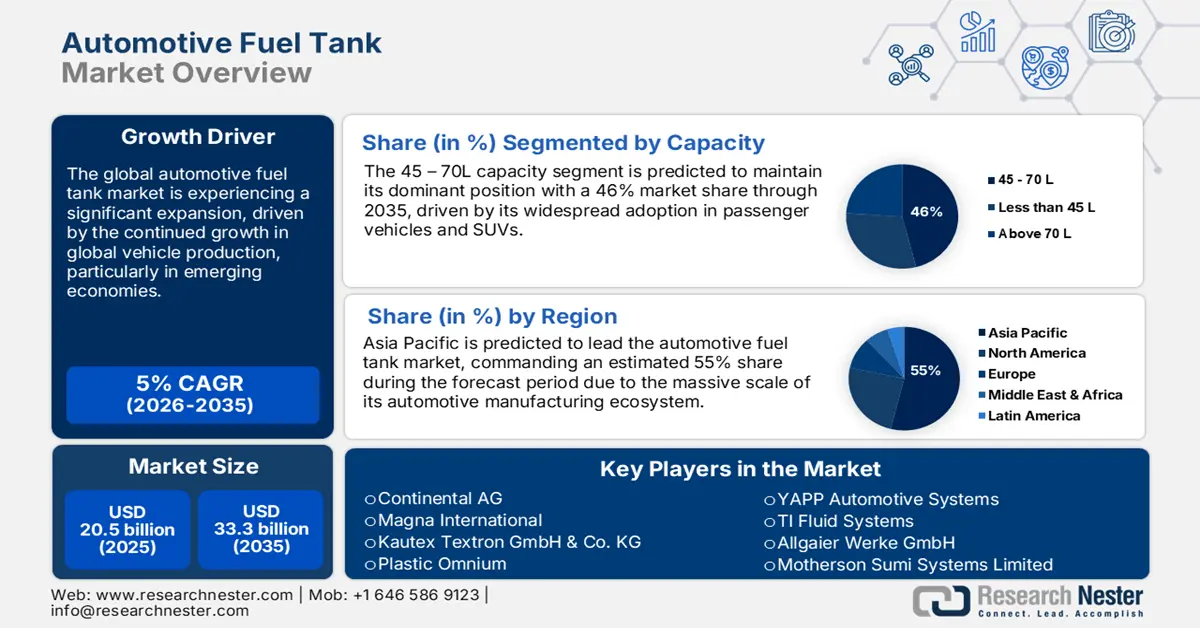

Automotive Fuel Tank Market size is valued at USD 20.5 billion in 2025 and is projected to reach a valuation of USD 33.3 billion by the end of 2035, rising at a CAGR of 5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of automotive fuel tanks is assessed at USD 21.5 billion.

The global automotive fuel tank market is experiencing a significant expansion, driven by the dual requirements of vehicle light weighting and moving to alternative powertrains. The most important growth opportunity lies in developing new, lightweight fuel storage systems, particularly plastic composite ones, to help auto manufacturers meet stringent emissions and fuel economy standards. Producers are working hard to innovate in this space, such as in September 2023, when BMW Motorrad debuted its updated F 900 GS with a new plastic fuel tank that is 4.5 kilograms lighter than its steel counterpart, which directly benefits vehicle handling and performance.

Government regulations are a powerful driver for the industry, compelling producers to get their act together and employ cleaner technologies and more efficient designs on every kind of vehicle. This regulatory push is fueling an ongoing need for lighter fuel tanks that are also compatible with the next-generation hybrid architectures and alternative fuels.

Key Automotive Fuel Tank Market Insights Summary:

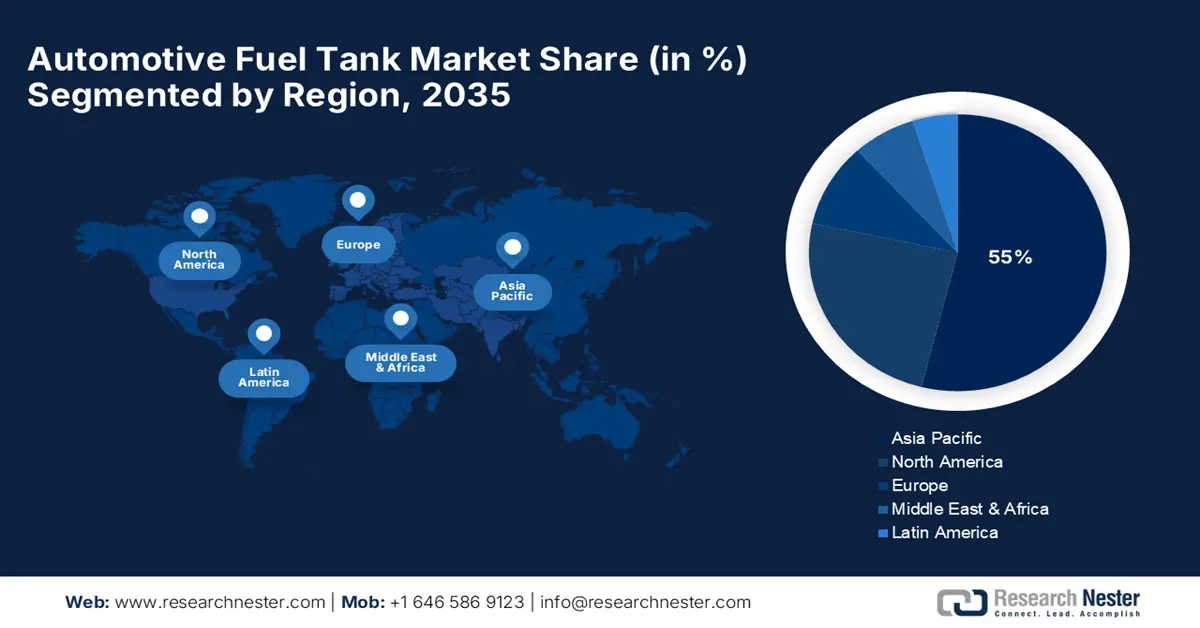

Asia Pacific is projected to dominate the automotive fuel tank market, securing approximately 55% share during the forecast timeframe.

Europe’s automotive fuel tank market is currently undergoing a significant transformation.

North America is expected to witness steady growth in the automotive fuel tank market, with a consistent CAGR of 4% from 2026 to 2035.

The 45 - 70 L capacity segment is forecasted to retain its leading position with a 46% market share by 2035.

The passenger car segment is anticipated to command a strong 65% share of the market by 2035.

The gasoline segment is projected to account for nearly 69% of the market share through 2035.

Key Growth Drivers:

- Growing pressure for lightweighting of vehicles.

- Rising use of alternative fuel vehicles.

Key Players:

- Continental AG, Magna International, Kautex Textron GmbH & Co. KG, Plastic Omnium, YAPP Automotive Systems, TI Fluid Systems, Allgaier Werke GmbH, Motherson Sumi Systems Limited, Martinrea International Inc., Boyd Welding.

Global Automotive Fuel Tank Market Forecast and Regional Outlook:

2025 Market Size: USD 20.5 billion

2026 Market Size: USD 21.5 billion

Projected Market Size: USD 33.3 billion by 2035

Growth Forecasts: 5% CAGR (2026-2035)

Largest Region: Asia Pacific

Fastest Growing Region: Asia Pacific

Last updated on : 27 August, 2025

Automotive Fuel Tank Market - Growth Drivers and Challenges

Growth Drivers

- Growing pressure for lightweighting of vehicles: The ongoing pressure to reduce overall vehicle weight to improve fuel efficiency and lower emissions is a major driver for the fuel tank market. Automotive manufacturers increasingly replace heavy steel fuel tanks with lighter plastic ones, fueling robust demand for premium blow-molded products. The trend is evident in the strategic overhauls of component manufacturers, as seen in the case of Lumax Cornaglia Auto Technologies, which announced a major shift towards the manufacturing of plastic fuel tanks in September 2024. The joint venture anticipated that the light-weight components would account for over half of its revenues by 2026.

- Rising use of alternative fuel vehicles: Growing momentum for alternative fuels, particularly hydrogen, is creating new and lucrative growth prospects for specialty fuel tank makers. With the world seeking to decarbonize mobility, the need for high-pressure vessels as well as cryogenic storage units for vehicles that run on hydrogen is expanding. An example of this was highlighted in September 2023, when Plastic Omnium began the development of Europe's largest hydrogen tank manufacturing plant in France. The facility, which is expected to have a yearly capacity of 80,000 hydrogen containers, will supply key commercial vehicle makers like Stellantis.

- Consumer-friendly policies for hybrid cars: Stimulating government incentives, such as tax credits for hybrids, are significantly expanding their adoption, and with it, the demand for specialized fuel tanks designed for these advanced architectures. Hybrid cars require specially configured tanks to accommodate dual-power sources and treat fuel vapor emissions differently from traditional ICE cars. One of the key developments pushing this growth was in January 2024, when India's Trade Department endorsed a proposal to cut duties on hybrid vehicles significantly. The policy move is designed to accelerate the move towards cleaner vehicles and drive the local component ecosystem.

Natural Gas Demand Drivers & Impact on Automotive Fuel Tanks

|

Factor |

Trend in Natural Gas (NG) Market |

Impact on the Automotive Fuel Tank Market |

|

Price & Competitiveness |

Lower global gas prices enhanced competitiveness vs. coal. |

Makes Compressed Natural Gas (CNG) a more economically attractive fuel for commercial and fleet vehicles, potentially boosting demand for Type III and Type IV CNG tanks. |

|

Industrial & Economic Growth |

Slight increase in industrial consumption due to lower prices and improved economies. |

Increases demand for industrial logistics and heavy-duty trucks, which are primary candidates for LNG and CNG powertrains, requiring specialized cryogenic (LNG) or high-pressure (CNG) tanks. |

|

Power Generation Demand |

Power gen. remained the largest gas consumer (44% share). |

Supports the development of natural gas power plants, which in turn could foster the development of NG refueling infrastructure, a key barrier to wider NGV adoption. |

|

Production & Investment |

Upstream oil & gas investment surged by 12% to $587B in 2023. |

Indicates strong industry confidence in fossil fuels, ensuring long-term NG availability. This stability is crucial for automakers and fleet operators considering a shift to NG vehicles. |

|

Unconventional Gas Growth |

Unconventional gas (e.g., shale) now represents 32% of global production. |

Secures a long-term, abundant domestic supply in regions like the US and China, reducing fuel price volatility and making NG vehicle investments more predictable. |

Source: GECF

Challenges

- Uncertainty due to accelerating powertrain electrification: The rapid and mounting industry-wide shift to all battery electric vehicles (BEVs) poses a serious threat to the conventional fuel tank business. While the large automakers wager on all-electric futures, the long-term demand for gasoline, diesel, and even hybrid fuel tanks is imperiled by structural weakening, creating long-term uncertainty for suppliers. This issue was brought into focus in July 2025, when Mercedes-Benz presented its strategy of launching 18 new EV and PHEV models by 2026. The company's corporate goal to achieve a minimum of 50% of global sales through electrified vehicles by 2030 fundamentally redefines its future supply chain requirements.

- Increasing levels of complexity and stringency of fuel efficiency regulations: Automotive fuel tank producers continually face the challenge of producing products that enable OEMs to comply with increasingly stringent global fuel consumption and emissions laws. Regulations are apt to introduce new test cycles and extend their scope, necessitating continuous innovation and investment in new technology to remain compliant. In September 2024, China's Ministry of Industry and Information Technology published its Stage 4 heavy-duty vehicle fuel consumption standard. This new rule tightens fuel consumption limits by 12-16% and includes an additional stricter test cycle, which presents big engineering challenges to the manufacturers.

Automotive Fuel Tank Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5% |

|

Base Year Market Size (2025) |

USD 20.5 billion |

|

Forecast Year Market Size (2035) |

USD 33.3 billion |

|

Regional Scope |

|

Automotive Fuel Tank Market Segmentation:

Capacity Segment Analysis

The 45 - 70 L capacity segment is predicted to maintain its dominant position with a 46% automotive fuel tank market share through 2035, as this size is ideally suited for the requirements of the huge worldwide fleet of passenger cars, SUVs, and light trucks. This capacity offers the optimum compromise of vehicle range, weight, and packaging space and is thus the standard choice for most high-volume vehicle platforms. Standard labels with high visibility of a vehicle's fuel economy and range encourage makers to optimize their fuel capacity to provide the most desirable figures to consumers. In July 2024, China introduced its revised GB 44495-2024 mandatory energy consumption labeling standard for gasoline and diesel vehicles. This regulation forces OEMs to carefully engineer the tank capacity to get the best official range rating of the vehicle on standardized test protocols, solidifying the popularity of the 45-70L range.

Vehicle Type Segment Analysis

The passenger car segment is predicted to hold a commanding 65% automotive fuel tank market share by 2035, driven by the sheer scale of global passenger car production and the spread of their increasingly sophisticated fuel systems. As the industry moves toward electrification, the sheer volume of internal combustion and hybrid passenger cars that are produced annually guarantees premium-volume demand for advanced fuel tanks. The sophistication of modern fuel systems came to the fore in October 2024, when Panasonic expanded its VERZEUSE cybersecurity series to include specialized tools for monitoring the security and integrity of fuel system components in passenger cars. The ongoing evolution of passenger cars as hybrid platforms is one of the most critical reasons behind the dominance of this segment.

Fuel Type Segment Analysis

The gasoline segment is likely to hold around 69% share through 2035, with gasoline remaining the fuel of choice for the largest vehicle market to power both conventional internal combustion engines and growing hybrid electric vehicles. Global regulations are focused on extracting more from gasoline engines rather than eliminating them in the near future, ensuring continued demand for gasoline tanks. A key policy in support of this is the newly released U.S. CAFE standards in June 2024 that mandate dramatic fuel economy improvements for gasoline-powered passenger cars and light trucks through model year 2031. Dominance in the gasoline category is also secured by consumer-focused policies that strive to maximize transparency and efficiency for gasoline-powered vehicles.

Our in-depth analysis of the automotive fuel tank market includes the following segments:

|

Segment |

Subsegments |

|

Capacity |

|

|

Material Type |

|

|

Vehicle Type |

|

|

Fuel Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Fuel Tank Market - Regional Analysis

APAC Market Insights

Asia Pacific is anticipated to lead the automotive fuel tank industry, commanding an estimated 55% share during the forecast period. This is driven by the region's massive car manufacturing volumes, a developing middle class, and a growing focus on adopting cutting-edge automotive technologies. Regional part producers are rapidly expanding their capacity to produce quality parts to international standards, thereby aiding the industry's shift to alternative fuels. In February 2025, India-based INOX India Limited became the country's first manufacturer of cryogenic equipment to obtain the highly prized IATF 16949 certification for manufacturing cryogenic fuel tanks for LNG-fueled vehicles.

China is spending heavily to become the hub for hydrogen mobility, as local and international companies build massive manufacturing facilities to serve its burgeoning market for hydrogen-powered vehicles. This government-backed industrial policy is generating enormous demand for high-pressure hydrogen storage vessels. A historic investment was made in January 2025, when Plastic Omnium, via its joint venture company, broke ground to build a Shanghai-based high-pressure hydrogen vessel mega-plant. The plant, which is due to be on stream in 2026, will produce up to 60,000 hydrogen vessels every year.

India market is undergoing a dynamic transformation, with the government and industry both promoting the usage of cleaner vehicle technologies such as hybrids and alternative fuels. The transformation is creating new opportunities for component suppliers who are advanced fuel storage technology specialists. For instance, in March 2025, Jio-bp, a joint venture between Reliance and bp, staged a public showcase in Mumbai for its innovative split-fuel tank technology. This two-compartment fuel vehicle, with a special design, allows for real-time comparison testing of different fuel qualities, in response to the increasingly complex fuel system technology in India.

Europe Market Insights

Europe automotive fuel tank market is going through a profound transformation via the region's bold push for alternative fuels and the circular economy. Component suppliers are at the forefront of creating innovation to make this happen, developing cutting-edge fuel systems for a wide range of non-fossil fuels to help automakers achieve Europe's bold decarbonization strategies. In May 2025, PHINIA Inc. showcased its cutting-edge technology at the Vienna Motor Symposium. The company emphasized its latest technology in fuel systems specifically designed for alternative fuels, including hydrogen, ethanol, methanol, and compressed natural gas.

Germany is at the forefront here, with the federal government actively amending national law to make way for the introduction of new types of fuel and their accompanying infrastructure. These legislative reforms also intend to offer for a harmonious and secure market entry of alternative fuels, thereby guaranteeing transparency for both consumers and industry. In March 2025, the German government tabled a new ordinance to apply EU law on fuel quality. This amendment officially introduces B10 diesel to the German market and offers for standardized labeling requirements on vehicle and fuel compatibility under the Alternative Fuels Infrastructure Regulation.

The UK competitive landscape is being characterized by widespread strategic consolidations, leading to the emergence of more powerful and diversified Tier 1 suppliers. These Tier 1 suppliers are now in an ideal position to fulfill the evolving needs of international OEMs. This trend is particularly relevant to the UK, which remains a critical automotive market. One remarkable example was seen in July 2025, as TI Automotive marked its arrival in Europe at IAA Mobility 2025 by presenting an entire range of products for the first time across Europe. This reflects a broader industry trend towards integrated and holistic solutions. This merger not only advances supplier strength but also consolidates the UK's position in the international automotive supply base.

North America Market Insights

North America automotive fuel tank market is likely to rise at a steady CAGR of 4% from 2026 to 2035, driven by a robust regulatory framework and high customer demand for large vehicles like pickup trucks and SUVs. The region boasts a mature auto market that is rapidly transitioning to the electrification age, while also improving its capabilities in traditional combustion and hybrid technology. This dual challenge creates a complex but opportunity-rich environment for fuel tank manufacturers with solutions as varied as lightweight plastics to high-pressure hydrogen vessels.

The U.S. is actively constructing an integrated regulatory framework for emerging fuel technologies to advance public safety and allow alternative fuel vehicles to be introduced into the market. Federal authorities are developing new standards for hydrogen-powered vehicles in particular, offering manufacturers and component suppliers a clear and stable means of marketing. In January 2025, the U.S. National Highway Traffic Safety Administration (NHTSA) published a Final Rule that adopted two new Federal Motor Vehicle Safety Standards, FMVSS 307 and 308. These rules specify strict performance requirements for fuel system and storage integrity on hydrogen fuel vehicles.

Canada is also committed to preserving the safety and security of all vehicle systems, including conventional and alternative fuel tanks, through a national approach. The government is investing in research and strengthening its safety frameworks to keep up with the new challenges posed by new car technologies, such that Canadian regulations keep pace with innovation. As stated in its 2024-2025 Departmental Plan, published in July 2025, Transport Canada continues working on developing national vehicle safety strategies. One focus among these efforts is fuel system integrity requirements for conventional and alternative fuel vehicles.

Key Automotive Fuel Tank Market Players:

- Continental AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Magna International

- Kautex Textron GmbH & Co. KG

- Plastic Omnium

- YAPP Automotive Systems

- TI Fluid Systems

- Allgaier Werke GmbH

- Motherson Sumi Systems Limited

- Martinrea International Inc.

- Boyd Welding

- DALI & SAMIR ENGINEERING PVT. LTD.

- Posco Co., Ltd.

The competitive landscape of the automotive fuel tanks market is dominated by a close clustering of Tier 1 giants having a deep, long-term relationship with international automakers. Market leaders such as Continental AG, Magna International, Kautex Textron, and Plastic Omnium dominate the market with their significant production bases, material science expertise, and ability to provide end-to-end fuel storage and delivery solutions. They are assisted by regional giants like YAPP Automotive Systems and Motherson Sumi Systems Limited, which service rapidly growing markets in Asia.

The industry is also undergoing a significant strategic consolidation as companies try to create more diversified, resilient, and globally competitive businesses capable of surviving the industry's shift to new powertrains. One significant development was the acquisition of TI Fluid Systems by ABC Technologies, completed in April 2025. With combined revenues of $5.4 billion, the rebranded TI Automotive is a Tier 1 supplier with an agnostic propulsion portfolio, strategically positioned to serve a wide range of customers across all vehicle architectures.

Here are some leading companies in the automotive fuel tank market:

Recent Developments

- In February 2025, Toyota Motor Corporation unveiled its advanced third-generation fuel cell system offering major improvements in durability, fuel efficiency, and cost, featuring more compact and efficient high-pressure hydrogen tanks with modular design for versatile application.

- In March 2024, Eaton officially launched its next-generation fuel tank isolation valve designed specifically for hybrid electric vehicles, representing a crucial component for fuel systems that must manage complex dual-power architectures. The redesigned fuel tank isolation valve is 27% lighter and 39% smaller than its predecessor, significantly simplifying integration into increasingly crowded vehicle architectures of modern hybrids where space optimization is critical.

- Report ID: 528

- Published Date: Aug 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Fuel Tank Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.