Posted Date : 26 September 2025

Posted by : Akshay Pardeshi

In a world where financial transactions are increasingly fueled by speed, convenience, and security, digital payment infrastructure has arisen as the invisible yet powerful support of modern commerce. Whether it's scanning a QR code at a local street vendor, using UPI to pay rent, or shopping online with a credit card, digital payments are now deeply embedded in everyday use. But what makes these seamless experiences possible? The answer depends on a strong, ever-changing digital payment infrastructure. This blog explores what digital payment infrastructure is, why it matters, its key components, current global trends, and the way forward for building a secure, inclusive digital economy.

Key Components of Digital Payment Infrastructure

To support the wide range of digital transactions happening every second, multiple interconnected components work in harmony:

- Payment Gateways: Payment gateways act as a bridge between merchants and banks. These gateways maintain compliance with security standards like PCI-DSS, lowering the risk of fraud or data breaches. Once the transaction is authenticated, the gateway starts processing the fund transfer request to the appropriate payment processor or payment bank. Some of the most commonly used payment gateways are PayPal, Razorpay, Stripe, and PayU, serving different startups and MNCs.

- Payment Processors: Processors oversee transaction validation, connection with banks, and guaranteeing money transfers. For instance, when an individual swipes a card or uses UPI to pay, the processor first checks for the availability of the required funds, applies fraud detection rules, and facilitates the debit and credit to the respective accounts. In India, the National Payments Corporation of India (NPCI) plays an important role as a domestic processor for systems like UPI and RuPay. Major global processors are Visa, Mastercard, American Express, and regional networks that provide payment settlement services on time.

- Real-Time Transaction Platforms: Instant payment systems are rapidly changing the way money moves. Unlike traditional systems that depend on batch processing or delayed settlements, real-time systems help in instant transfer of funds, 24/7, 365 days a year. These systems are highly effective for peer-to-peer transactions, small business payments, and emergencies.

- Use of Mobile Wallets: Mobile wallets in apps have made the payment process more user-friendly and convenient. These apps contain encrypted details and allow users to pay without physically entering the card details every time. Wallets also generally consist of features such as bill payments, ticket bookings, peer-to-peer transfers, and loyalty rewards, which encourage consumers to use the respective wallet. In India, apps such as PhonePe, Paytm, and Google Pay have become extremely popular, as they support UPI transactions, QR code scanning, and all bill payments. Globally, platforms like Google Pay, Apple Pay, and Samsung Pay cater to millions of users by providing seamless Near Field Communication (NFC) capabilities and convenient online payment options.

- Core Banking Systems (CBS): The CBS allows banks to unify operations and provide real-time access to account information across all branches, ATMs, and digital platforms. CBS platforms make sure that when a payment is done, whether by UPI, NEFT, or IMPS, the customer’s bank account reflects the change immediately. This real-time coordination helps in fast fund settlements, fraud detection, and digital banking experiences across all devices.

- Authentication and Security: Providing security is the foundation of trust in digital payments. As fraud and cyberattacks become more dynamic, payment infrastructure must adopt multi-layered authentication mechanisms to protect user data and transactions. Many UPI apps, for example, have mandated biometric or PIN-based login, along with device lock, for added safety.

- Robust Regulatory Guidelines: A strong regulatory environment assures that digital payments are not only fast and easy but also safe, secure, and inclusive. Regulatory bodies around the world set the legal guidelines within which payment infrastructure operates. In India, the Reserve Bank of India (RBI) plays a central role in regulating digital payments through initiatives like the Payments Vision 2025, the Payment Infrastructure Development Fund (PIDF), and by overseeing entities like NPCI. It also imposes guidelines on Know Your Customer (KYC) norms, data privacy, and fraud mitigation. In Europe, the Revised Payment Services Directive (PSD2) enhances consumer rights and promotes open banking. These frameworks help ensure interoperability, data protection, and financial inclusion while encouraging innovation across the fintech and banking sectors.

India’s Digital Payment Revolution: The UPI Story

Since its launch in 2016 by the National Payments Corporation of India (NPCI), the Unified Payments Interface has risen to one of the most powerful and widely used real-time payment systems in the world. Originally made to simplify peer-to-peer money transfers, UPI has rapidly evolved into a full-fledged digital payments platform used by individuals, merchants, and large businesses alike.

Surging Volumes and Widespread Adoption

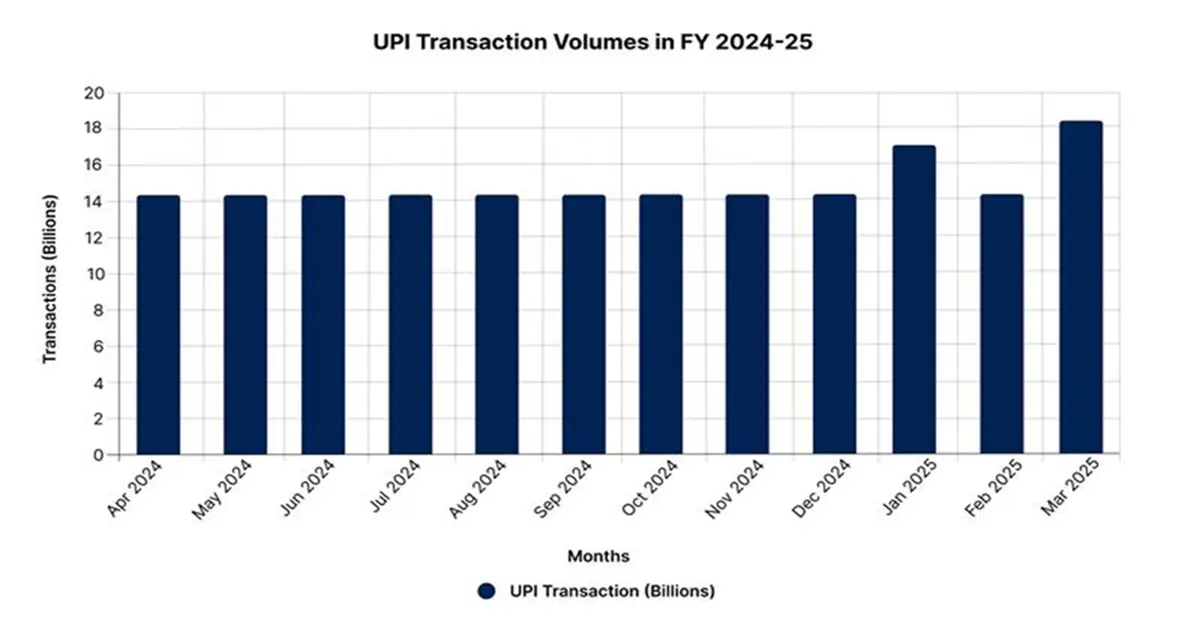

In the financial year 2024-25, UPI recorded a staggering 173.6 billion transactions, valued at ₹173.6 trillion, highlighting a 32% increase in volume compared to the previous year. Monthly transaction averages now remain close around 14.46 billion, with January 2025 hitting a high of 16.99 billion transactions. The momentum continued into May 2025, when UPI achieved its highest monthly performance to date, i.e., 18.68 billion transactions worth approximately INR 25 trillion. Overall, for FY 2024-25, UPI handled 185.8 billion payments worth ₹261 trillion, accounting for 83.7% of all digital payments in India. Globally, this success has placed India at the top. As of FY 2025, India contributed 48.5% of all real-time digital payments made worldwide, far ahead of other countries.

Source: PIB

Market Share and Key Players in the Digital Payment Market

UPI is responsible for nearly 84% of India’s digital payment volume. Within this space, PhonePe dominated the market, accounting for nearly 48% of the share, holding over 590 million users, and recording 310 million daily transactions. Google Pay follows at the 2nd with about 36%, while Paytm grabs around 11%. Other active companies in the market are BHIM, CRED, and Amazon Pay, each with its dedicated user community and services. This competitive environment has boomed due to UPI’s open API architecture, which promotes app integration, collaboration, and innovation across different platforms.

Contact Us