Soil Fertility Testing Market Outlook:

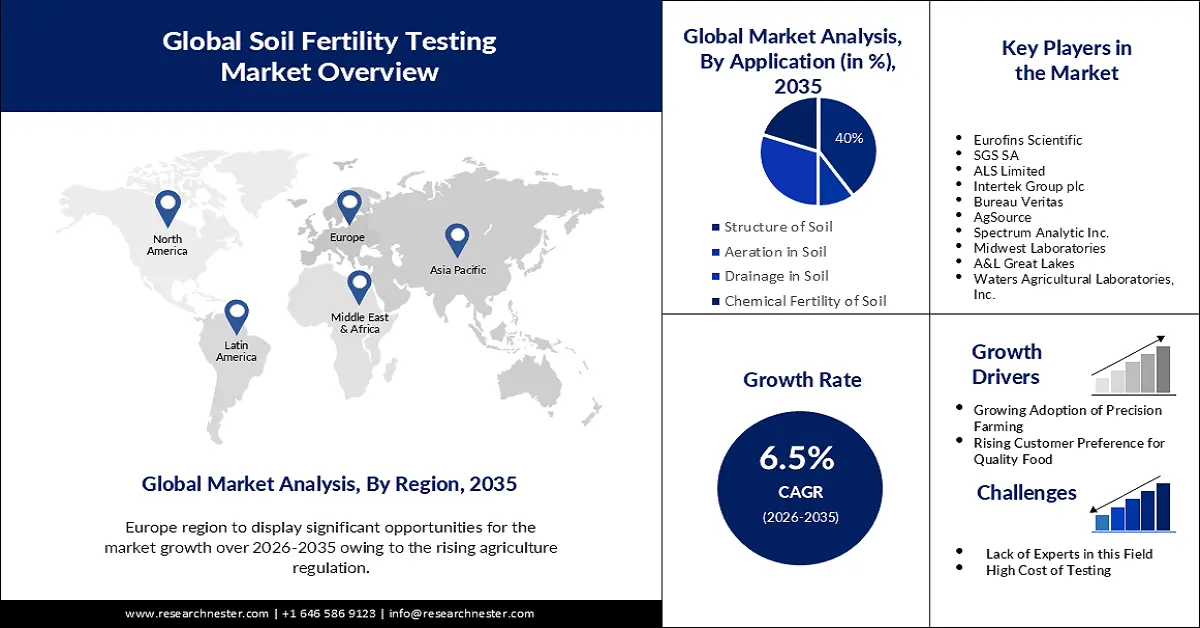

Soil Fertility Testing Market size was over USD 1.35 billion in 2025 and is anticipated to cross USD 2.53 billion by 2035, growing at more than 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of soil fertility testing is assessed at USD 1.43 billion.

The growth of the market is set to be dominated by growing soil degradation all across the world. Every five seconds, a soccer field's worth of soil is lost to erosion, and by 2050, it's predicted that about 89% of the planet's soils will be degraded. Current soil deterioration is mostly caused by phenomena including loss of organic carbon, increasing salt content, compacting, acidification, and chemical contamination.

Moreover, increasing mineral extraction, military operations, industrial waste management, wastewater treatment from households, farming, animal breeding, and the construction of urban and transportation infrastructure are some of the most frequent causes of soil pollution brought on by human activity. Hence, the need to test soil fertility is growing which is pushing market expansion.

Key Soil Fertility Testing Market Insights Summary:

Regional Highlights:

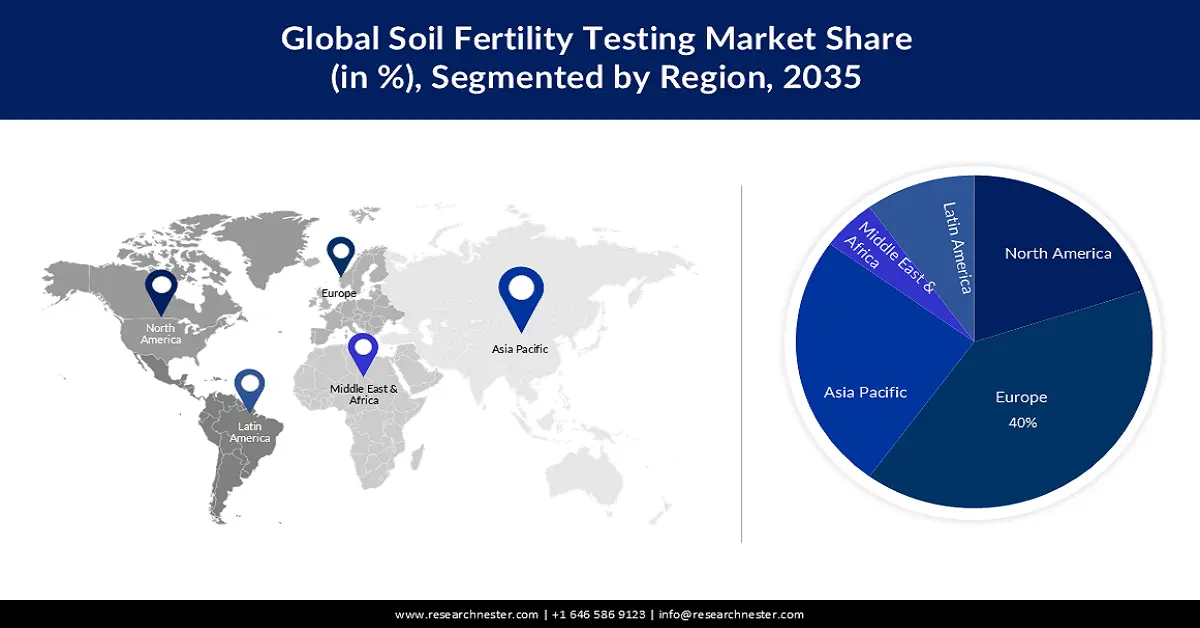

- The Europe soil fertility testing market will dominate more than 40% share by 2035, driven by rising agriculture regulations.

Segment Insights:

- The chemical segment in the soil fertility testing market is expected to capture a 65% share by 2035, driven by its vital role in preventing over-nutrient input through soil monitoring.

- The structure of soil segment in the soil fertility testing market is projected to achieve a 40% share by 2035, attributed to its broad applications across farms, gardens, neighborhoods, and industrial sites.

Key Growth Trends:

- Growing Adoption of Precision Farming

- Rising Customer Preference for Quality Food

Major Challenges:

- Lack of Experts in this Field

- High Cost of Testing

Key Players: Eurofins Scientific, SGS SA, Bureau Veritas S.A., ALS Limited, AgroLab GmbH, Actlabs Group, A&L Canada Laboratories Inc., Waters Agricultural Laboratories, Inc., Element Materials Technology, SoilOptix Inc.

Global Soil Fertility Testing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.35 billion

- 2026 Market Size: USD 1.43 billion

- Projected Market Size: USD 2.53 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Germany, Brazil

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 11 September, 2025

Soil Fertility Testing Market Growth Drivers and Challenges:

Growth Drivers

- Growing Adoption of Precision Farming: The adoption of precision farming has been observed in many developed countries. When fertilizer is administered to correspond with requirements identified through soil tests, precision farming offers to increase fertilizer use efficiency. By using soil test results from specific areas in the field, precision agriculture technology attempts to make it possible to administer nutrients and other inputs for crop production at those locations with pinpoint accuracy. Hence, with the growing precision farming the soil fertility testing market is also set to rise.

- Rising Customer Preference for Quality Food: Fresh organic vegetables are in high demand, among customers. This is since, customers are aware of issues related to their health, the environment, the dangers of pesticides, nutrition, and safe food. As a result, of the growing demand for organic food the use of soil fertility testing is growing.

- Surge in Prevalence of Crop Disease: According to the Food and Agriculture Organization (FAO), pests cause up to 40% of the globe's crop yield to be destroyed each year. Over USD 220 billion is lost annually to plant diseases and at least USD 70 billion to invasive insects in the global economy. Most of the time the plant is affected by soil-borne disease. For some plant illnesses, the soil may serve as a reservoir where the disease-causing organisms dwell until the ideal conditions are present for their emergence. Therefore, with the utilization of soil fertility testing the health of the plant could be maintained.

Challenges

-

Lack of Experts in this Field - The absence of trained and experienced soil inspectors worldwide is one possible obstacle for the soil fertility testing market. When compared to the number of tests required to be performed, there are not many soil evaluators and system inspectors. Data inspection can occasionally be inaccurate due to a shortage of qualified inspectors, which can also result in incorrect interpretation of the data. These inspectors or assessors are also out of touch with modern technology, thereby decreasing the precision of the entire procedure.

- High Cost of Testing

- Lack of Knowledge Among People Related to Soil Fertility Testing

Soil Fertility Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 1.35 billion |

|

Forecast Year Market Size (2035) |

USD 2.53 billion |

|

Regional Scope |

|

Soil Fertility Testing Market Segmentation:

Type Segment Analysis

The chemical segment in the soil fertility testing market is poised to capture a share of about 65% over the forecast period. In order to prevent over-nutrient input into the farming system, soil chemical tests have grown into a vital monitoring tool. Chemical testing involves employing instruments to measure pH, salinity, test kits, and reagents. A chemical soil test additionally reveals the levels of important plant nutrients including phosphorus, nitrogen, potassium, humus content, accessible lime, organic matter, sulfur, and trace elements, as well as other physical characteristics including capacity, permeability, density, and pH-value. Utilizing a chemical test that determines the nutrient content of the soil for a certain yield, it is simpler to determine the amount of fertilizer needed to obtain high-quality yields.

Application Segment Analysis

Soil fertility testing market from the structure of soil segment is expected to grow at a share of approximately 40% over the forecast period. This is due to its broad range of potential applications across multiple structures encompassing farms, gardens, neighborhoods, and industrial sites. When creating a garden or building development, it is important to examine how soil's texture, structure, and composition affect its chemical qualities.

Our in-depth analysis of the global soil fertility testing market includes the following segments:

|

Type |

|

|

Application |

|

|

Method |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Soil Fertility Testing Market Regional Analysis:

European Market Insights

The soil fertility testing market in Europe is set to gather a share of about 40% over the projected period. This growth of the market in this region could be owing to rising agriculture regulations. For instance, the EU has launched rules for organic production and labelling of these organic products which was expected to be implemented in 2022. For Organic farming, according to this EU legislation, the farmer should maintain the natural fertility of the soil and enhance its life. Hence, with this the need for soil fertility testing is growing.

APAC Market Insights

The Asia Pacific soil fertility testing market is also expected to grow over the coming years. The demand for food is growing in this region, and on the other hand, the availability of land for production is not enough to satisfy this demand. As a consequence, the adoption of soil fertility testing is growing further giving scope for the treatment of soil which is found infertile.

Soil Fertility Testing Market Players:

- Eurofins Scientific

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SGS SA

- ALS Limited

- Intertek Group plc

- Bureau Veritas

- AgSource

- Spectrum Analytic Inc.

- Midwest Laboratories

- A&L Great Lakes

- Waters Agricultural Laboratories, Inc.

Recent Developments

- March, 2023: The first laboratory facility for Eurofins BioPharma Product Testing was opened in Shanghai in March 2023, the company has announced. The location for Eurofins BPT Shanghai has been under construction since 2021 and is about 2000 m2 in size. With the assistance of Eurofins' European and US laboratories, the laboratory was built utilizing a globally harmonized LIMS that complies with GMP norms in China, the US, and Europe.

- June 6, 2023: SGS SA announced a partnership with AgriCircle, a cutting-edge agri-tech company, to offer ground-breaking approaches to soil health and regenerative farming. This collaboration aims to equip farmers and other industry participants with cutting-edge technologies and knowledge to promote sustainable farming methods.

- Report ID: 5243

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Soil Fertility Testing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.