Zinc Oxide Market Outlook:

Zinc Oxide Market size was over USD 5.91 billion in 2025 and is poised to exceed USD 10.29 billion by 2035, growing at over 5.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of zinc oxide is estimated at USD 6.21 billion.

Zinc and its derivatives have comprehensive use cases in several topical medicines and creams. Its versatility is such that it has emerged as the fourth most used metal after iron, copper, and aluminum. Its position in protecting steel from corrosion has made it indispensable in a vast array of industrial and consumer products, across healthcare, manufacturing, and agriculture sectors. According to the International Zinc Association, zinc is a USD 40 billion market and is projected to record a consumption demand of 652k tons in the renewable energy segment by 2030. The automotive sector is expected to generate a demand of 140k tons while complying with all 17 UN sustainable development goals.

Zinc Global Uses, in 2022

|

End use |

Share (%) |

|

Galvanizing |

60 |

|

Die-casting alloys |

13 |

|

Brass & casting |

11 |

|

Oxides & chemicals |

9 |

|

Semi-manufactured products |

5 |

|

Miscellaneous |

2 |

Source: Government of Canada

The anticipated value of zinc mined was roughly USD 2.4 billion in 2023 and it was mined at seven mining operations in five States by five companies. Two smelter facilities operated by two companies, including one secondary and one primary, amounted to the majority of the commercial-grade zinc metal in the country. Of the overall reported zinc, most were utilized to manufacture galvanized steel, bronze, brass, zinc-base alloys, and zinc oxide. The presence of a robust raw material supply chain is fostering the zinc oxide market growth.

U.S. Zinc Commodity Summary, through 2023 (Data in thousand metric tons)

|

Salient Statistics |

2020 |

2021 |

2022 |

2023 |

|

Mine, zinc in concentrates (production) |

723 |

704 |

761 |

750 |

|

Refined zinc (production) |

180 |

220 |

220 |

220 |

|

Zinc in ores and concentrates (Imports) |

3 |

13 |

5 |

20 |

|

Refined zinc (Imports) |

700 |

701 |

762 |

750 |

|

Zinc in ores and concentrates (Exports) |

546 |

644 |

644 |

730 |

|

Refined zinc (Exports) |

2 |

13 |

8 |

5 |

Source: USGS

Key Zinc Oxide Market Insights Summary:

Regional Highlights:

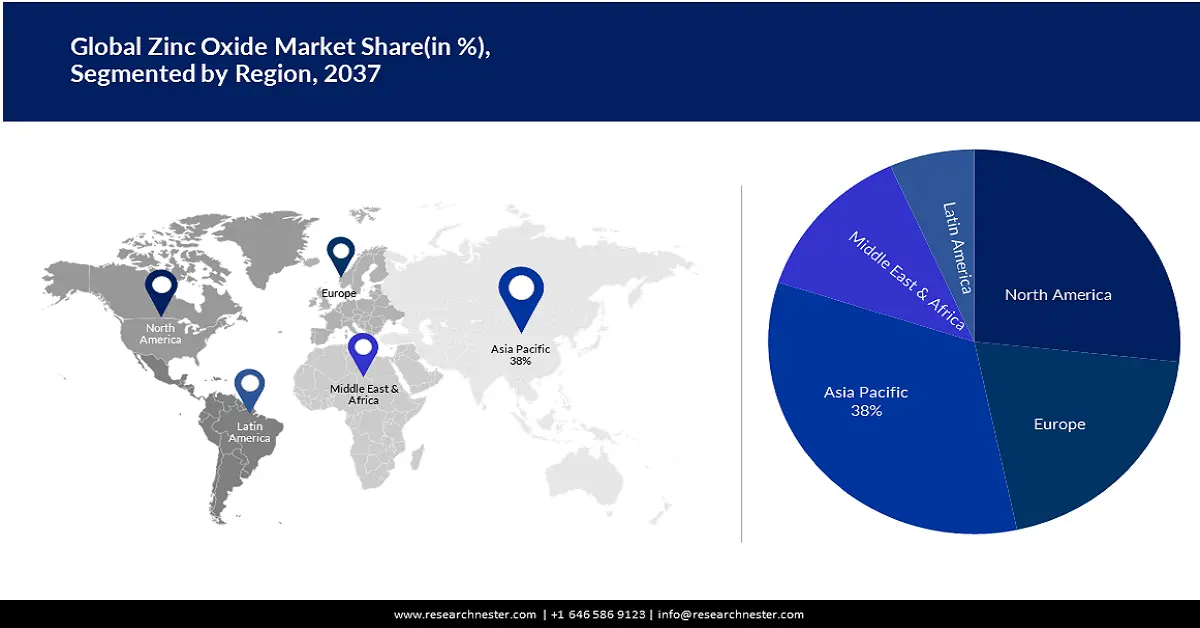

- Asia Pacific zinc oxide market is anticipated to achieve a 38% share by 2035, driven by rising production of gallium and germanium.

- North America market is forecasted to secure the second largest share by 2035, driven by Canada's role in global zinc production.

Segment Insights:

- The chemical segment in the zinc oxide market is anticipated to achieve a 60% share by 2035, driven by the wide use of ZnO in rubber vulcanization and ceramics processing.

- The pharmaceuticals segment in the zinc oxide market is forecasted to achieve a significant share by 2035, fueled by ZnO’s antiseptic properties and nanoparticle applications.

Key Growth Trends:

- High recyclability of zinc and corresponding tariff reduction in global trade relations

- Growth in global trade

Major Challenges:

- Volatility in raw material prices

Key Players: Umicore N.V., EverZinc, American Zinc Recycling, Weifang Longda Zinc Industry Co., Ltd., GH Chemicals Limited, Rubamin Ltd., ZOchem Inc., Seyang Zinc Technology (Shanghai) Co., Ltd., Mario Pilato Blat S.A., Grillo-Werke AG.

Global Zinc Oxide Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.91 billion

- 2026 Market Size: USD 6.21 billion

- Projected Market Size: USD 10.29 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Thailand, Indonesia, Brazil

Last updated on : 11 September, 2025

Zinc Oxide Market Growth Drivers and Challenges:

Growth Drivers

- High recyclability of zinc and corresponding tariff reduction in global trade relations: Zinc is recyclable and aligns with the rising focus on sustainability. Refined or recycled zinc is recovered from secondary materials at both primary and secondary smelters. Secondary materials include crude zinc oxide and galvanizing residues and crude zinc oxide retrieved from electric arc furnace dust. As of December 2023, zinc ores and concentrates, zinc oxide, zinc content, and zinc peroxide in the U.S. had free trade relations. According to a Commonwealth of Pennsylvania May 2024 report, Befesa (previously known as American Zinc Recycling Corp.) in Delaware recycles and stores electric arc furnace dust (EAFD), where kilns are used to generate crude zinc oxide (CAO) and other iron from EAFD to crude zinc oxide (CZO) and iron-based material.

- Growth in global trade: Zinc oxide held a total trade value of USD 1.47 billion in 2023 and was the 845th most traded item out of 1217 products. Zinc oxide and peroxide represent 0.0065% of total world trade. In 2023 the top exporters comprised Mexico (USD 224 million), Canada (USD 138 million), the U.S. (USD 105 million), the Netherlands (USD 101 million), and Peru (USD 93.3 million). The top five zinc oxide and peroxide importers were the U.S. (USD 312 million), Germany (USD 103 million), Mexico (USD 82.5 million), Spain (USD 74.8 million), and Vietnam (USD 74.4 million). Between 2022 and 2023, the outbound supply grew the fastest in Thailand (USD 15.5 million), Egypt (USD 3.74 million), Nigeria (USD 3.23 million), Australia (USD 2.68 million), and Pakistan (USD 1.5 million). The highest export potential is China which has an export gap of USD 2.05 million, whereas the highest import potential is the U.S. with a gap of USD 2.76 million.

Challenge

- Volatility in raw material prices: The cost and availability of raw materials, particularly zinc metal, can be subject to fluctuations, impacting the production costs and profitability of zinc oxide manufacturers.

Zinc Oxide Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 5.91 billion |

|

Forecast Year Market Size (2035) |

USD 10.29 billion |

|

Regional Scope |

|

Zinc Oxide Market Segmentation:

End user Segment Analysis

The pharmaceuticals segment in zinc oxide market is expected to garner a significant share in 2035. Zinc oxide is popular as an astringent and antiseptic, making it viable for pharmaceutical products such as creams, ointments, and other topical formulations. Furthermore, zinc oxide nanoparticles are non-toxic, safe, and biocompatible. An October 2024 National Library of Medicine research report suggests the efficacy of ZnO against in vitro antifungal and antibacterial activities against Staphylococcus aureus, Bacillus subtilis, Escherichia coli, Salmonella typhi, Pseudomonas aeruginosa, Candida albicans, Aspergillus flavus, Penicillium notatum, and Aspergillus niger. UV-visible spectrophotometry showcased a characteristic absorption peak, underscoring the efficacy of ZnO nanoparticles.

Type Segment Analysis

The chemical segment in zinc oxide market is estimated to gain the largest revenue share of 60% in 2035. Zinc oxide is widely used as a vulcanization accelerator in the rubber industry, promoting cross-linking of rubber molecules and enhancing the mechanical properties of rubber compounds. In the ceramics industry, zinc oxide is utilized in glazes and as a flux material to improve the flow of ceramic materials during firing and enhance the final product's properties.

Our in-depth analysis of the global zinc oxide market includes the following segments:

|

Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Zinc Oxide Market Regional Analysis:

APAC Market Insights

Asia Pacific zinc oxide market is likely to account for the largest revenue share of 38% by 2035, owing to the rising production of gallium and germanium. Specifically, gallium is recovered from the sodium aluminate Bayer liquor by ion exchange during bauxite ore processing and, from the residues during the zinc oxide leaching by roasting sphalerite ores. Years of sweeping industrial policies have enabled China to gain a near-total monopoly on gallium supply, widely used to manufacture microchips for the U.S.’ advanced military technologies. CSIS says that China generates 98% of the global raw gallium, resulting in a far-reaching influence on U.S. semiconductor production.

China’s export controls on germanium and gallium exemplify the demand for zinc oxide and are vital for the world’s economic development, and transition to renewable energy, and have a direct impact on U.S. GDP. According to a USGS 2024 report, China’s net exports of germanium and gallium exports can possibly slump the U.S. GDP to USD 3.1 billion (with upper and lower projections of USD 8.2 billion and USD 1.7 billion) and USD 0.4 billion (USD 0.01 billion to USD 1.1 billion), if disrupted separately, and USD 3.4 billion (USD 1.7 billion to USD 9.0 billion) in case of simultaneous disruption.

North America Market Insights

The zinc oxide market in North America is projected to hold the second-largest share during the forecast period. Both Canada and the U.S. play a pivotal role in the global mine production of zinc. Canada predominantly sources zinc in Ontario and Quebec, whereas its co-products in British Columbia, Manitoba, and the Yukon. It is being widely used in Canada in the form of zinc oxides for skin creams. Canada’s zinc and zinc product exports were USD 2.1 billion in 2023, as per the Government of Canada, which was 562,365 tons of zinc oxide, ore concentrate, unwrought zinc, and zinc metal items and cumulatively represented a 4% spike from 2022.

According to USGS estimates, the production of zinc mines in the U.S. slumped marginally in 2023 as compared to 2022. In the second half of the year, two mines that produce zinc suspended production. Due to declining zinc prices and the impact of inflation on input costs, the Middle Tennessee zinc mines temporarily suspended production in late November. Drilling would be done to identify further zinc, germanium, and gallium deposits during the closure. According to projections, domestic refined production was essentially unchanged in 2023 compared to the previous year, and apparent consumption was also essentially unchanged. Additionally, net imports of refined zinc were estimated to have decreased slightly.

Average monthly prices dipped particularly during the initial two quarters of 2024. High interest rates in the U.S. and Europe, high energy prices in Europe, the relative strength of the U.S. dollar, and concerns about a downturn in China’s real estate industry were cited by the USGS as factors leading to the price decrease. The monthly average premium to the London Metal Exchange (LME) cash price declined in 2023 but was comparatively higher than historical levels. As per the International Lead and Zinc Study Group, worldwide refined zinc in 2023 surged by 3.7% and reached 13.8 million tons, while metal consumption rose by 1.1% to 13.6 million tons, thereby leading to 248,000 tons production-to-consumption surplus.

Zinc Oxide Market Players:

- Umicore N.V.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- EverZinc

- American Zinc Recycling

- Weifang Longda Zinc Industry Co., Ltd.

- GH Chemicals Limited

- Rubamin Ltd.

- ZOchem Inc.

- Seyang Zinc Technology (Shanghai) Co., Ltd.

- Mario Pilato Blat S.A.

- Grillo-Werke AG

- Pleasing

- Revision Skincare

A major shift has been observed from mineral-free sunscreens to zinc oxide-based alternatives in the skincare market. The key players are adapting to the evolving zinc oxide market dynamics and incorporating strategic collaborations, geographical expansions, and mergers and acquisitions to strengthen their positions. Few of the prominent players operating in the zinc oxide industry include:

Recent Developments

- In July 2024, Pleasing entered the sunscreen market with its skincare product line that include zinc oxide-infused Big Lip HA Moisture Balm SPF 30+ and Solar Dew Mineral Serum SPF 50+. The brand is keen on diversifying its offerings and introduce novel categories, thereby expanding its consumer base and community of collaborators.

- In March 2024, Revision Skincare launched Intellishade collection with all-mineral zinc oxide UV filters, targeting photoaging and free radical stressors. With the product, Revision aims to fill gaps in the market and cater to consumers looking a moisturizing sunscreen with no-white cast and antiaging benefits.

- Report ID: 5167

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Zinc Oxide Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.