Smart Warehousing Market Outlook:

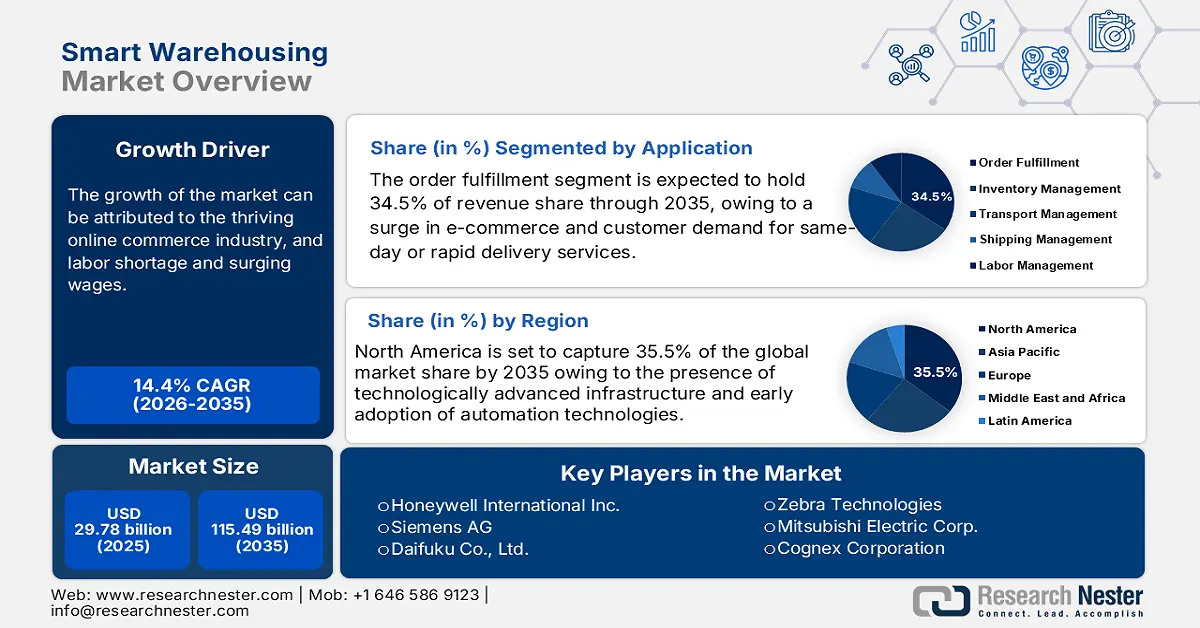

Smart Warehousing Market was valued at USD 29.78 billion in 2025 and is projected to reach USD 115.49 billion by the end of 2035, rising at a CAGR of 14.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of smart warehousing is evaluated at USD 33.96 billion.

The market is undergoing a remarkable transition fueled by shifts in trade dynamics and technological advancements. The warehouse operations are directly dependent upon the export and import of raw materials and goods. Technological advancements such as the inclusion of blockchain, AI, and ML. Additionally, a study showcased that unmanned aerial vehicle systems have also automated the inventory tasks management and upgraded the traceability of products in the supply chain. These concoctions are pivotal for facilitating warehouse processing and ensuring transparency in the supply chain. The smart warehousing industry is transforming itself to adapt to the technologically advancing landscape. Companies are embracing novel technologies and responding positively, even to the highly volatile trade patterns. Smart warehousing holds the capability to address key challenges of the traditional warehousing systems, such as labor shortage, exhaustive logistics, and managing an intricate supply chain.

One of the key trends is a growing reliance on artificial intelligence (AI) and generative AI technologies to help support inventory planning, forecast demand, and drive automation of routine decisions in warehouse operations. Warehouses are also increasingly implementing robotics, and in most cases, the robotics are being used to work collaboratively with people. Another significant trend involves the use of Internet of Things (IoT) devices and digital twin technology providing visibility into what is happening in the warehouse. Cloud-based Warehouse Management Systems (WMS) are gaining in prominence, with companies seeing new ways to expand scalability, gain remote access, and connect to commerce systems.

Key Smart Warehousing Market Insights Summary:

Regional Highlights:

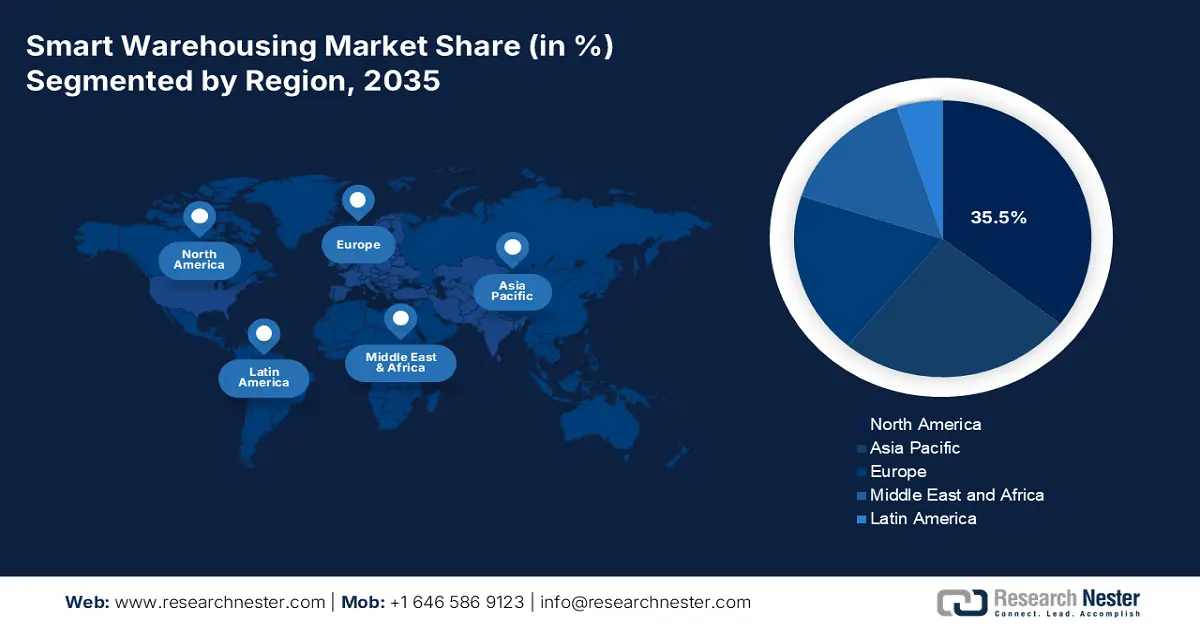

- North America is anticipated to command a 35.5% share by 2035 in the smart warehousing market as advanced infrastructure, automation readiness, and strong government-backed ICT initiatives accelerate widespread adoption impelled by rising logistics automation needs.

- Asia Pacific is projected to secure a 27.5% share by 2035 as government-driven digitalization programs and the surge in regional e-commerce volumes stimulate demand for automated warehousing solutions owing to large-scale industrial modernization.

Segment Insights:

- The order fulfillment segment is expected to capture a 34.5% share by 2035 in the smart warehousing market as the expansion of e-commerce and demand for rapid deliveries strengthen the shift toward real-time inventory tracking enabled by robotics and AI.

- The transportation and logistics segment is set to account for a 30.5% share by 2035 as companies adopt IoT-enabled fleets and AI-based analytics to optimize routing and accelerate deliveries supported by growing automation in global supply chains.

Key Growth Trends:

- Thriving online commerce industry

- Laborr shortage and surging wages

Major Challenges:

- Lack of adequate infrastructure

- Unavailability of skilled workforce

Key Players: Siemens AG, Daifuku Co. Ltd., Zebra Technologies, Mitsubishi Electric Corp., Samsung SDS, Cognex Corporation, Blue Yonder (JDA Software), ABB Ltd., Schneider Electric, Infosys Ltd., Flextronics International, Hitachi Ltd., Telstra Corporation Ltd., Scientech Technologies.

Global Smart Warehousing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 29.78 billion

- 2026 Market Size: USD 33.96 billion

- Projected Market Size: USD 115.49 billion by 2035

- Growth Forecasts: 14.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Indonesia, Mexico

Last updated on : 1 October, 2025

Smart Warehousing Market - Growth Drivers and Challenges

Growth Drivers

- Thriving online commerce industry: The e-commerce platforms manage millions of daily orders, needing instant processing. Smart warehouses have become integral to managing the burgeoning e-commerce sector that includes robots and guided vehicles. Furthermore, e-commerce has a high rate of product returns and the production of customized goods. Smart warehousing simplifies such complexities by supporting reverse logistics and adaptable routing of orders. In addition, real-time visibility into inventory has become important to reduce stockouts and manage omnichannel retailing. Rising labor costs and a shortage of workers in the warehousing space are leading to investment in automated processes to the extent that there will be less reliance on people to run as efficiently as needed. Also, smart warehousing offers scalability, giving businesses room to effectively manage seasonal peaks in demand and business expansions.

- Laborr shortage and surging wages: A traditional warehouse system faces a critical labor shortage around the world. Smart warehousing that includes AI, IoT, and robotics, lessens the pressure on workforce demands. Smart warehousing solutions, that utilize robotics, AI, and automation, minimize reliance on manual labor, having the potential to improve efficiency, accuracy and scalability. Companies can improve productivity while avoiding dependence on labor market challenges utilizing solutions such as autonomous mobile robots (AMRs), automated storage and retrieval systems (AS/RS) and AI-enhanced warehouse management systems.

- Rising demand for sustainability: Smart warehousing includes smart lighting systems and employs Internet of Things (IoT) sensors to adjust lighting and control temperatures. Smart warehouses utilize energy-efficient technologies such as electric autonomous vehicles, solar power, and recyclable packaging systems to enhance efficiency and lower environmental impact. This supports companies in achieving sustainability targets and complying with environmental regulations, while enhancing brand reputation.

Global Comparison of Industrial Robot Adoption (2023)

|

Country |

Robot Installations (2023) |

Growth Rate (YoY) |

Global Rank |

Robot Density (Overall)<br>(robots per 10,000 manufacturing employees) |

Robot Density in Automotive |

|

India |

8,510 |

+59% |

7th |

7 |

148 |

|

South Korea |

Not specified |

Not specified |

Top 5 |

Highest globally |

2,867 |

|

Germany |

Not specified |

Not specified |

Top 5 |

High |

1,500 |

|

China |

Not specified |

Not specified |

1st |

Above the global average |

772 |

|

France |

Fewer than India |

Not specified |

Below India |

Not specified |

Not specified |

|

Mexico |

Fewer than India |

Not specified |

Below India |

Not specified |

Not specified |

|

Spain |

Fewer than India |

Not specified |

Below India |

Not specified |

Not specified |

|

Italy |

Fewer than India |

Not specified |

Below India |

Not specified |

Not specified |

Source: IBEF

U.S. Labor Force Participation Rate: Trends from 2005 to 2025

|

Year |

Participation Rate (%) |

Key Notes |

|

2005 |

~66% |

Stable high rate |

|

2007-2009 |

~66% → 64% |

Gradual decline; Great Recession period |

|

2010-2015 |

~64% → ~62.5% |

Continued steady decline |

|

2016-2019 |

~62.5% |

Stabilized with slight fluctuations |

|

2020 |

~63% → ~60% |

Sharp drop due to the COVID-19 pandemic |

|

2021-2023 |

~60% → ~62.3% |

Partial recovery post-pandemic |

|

2025 |

62.3% |

Slight plateau after recovery |

Source: U.S. Chamber of Commerce

U.S. Retail E-Commerce Sales: Q2 2025 Summary

|

Metric |

Value |

Change from Q1 2025 |

Change from Q2 2024 |

|

E-commerce Sales (Q2 2025) |

$304.2 billion |

+1.4% (±0.9%) |

+5.3% (±1.2%) |

|

Total Retail Sales (Q2 2025) |

$1,865.4 billion |

+0.4% (±0.4%) * |

+3.9% (±0.4%) |

|

E-commerce Share of Total Sales |

16.3% |

- |

- |

Source: United States Census Bureau

Challenges

- Lack of adequate infrastructure: The successful execution of a smart warehousing solution largely depends on the availability of a resilient digital infrastructure. Some of the emerging economies lack such infrastructure to deploy these technologies. For instance, an inadequate power supply and energy instability issues result in frequent blackouts.

- Unavailability of skilled workforce: The establishment of smart warehouses needs a team of technicians, robotics experts, and data analysts. In underdeveloped regions, these skills are often in short supply and cause disruptions in the execution of various programs. Warehouses in emerging economies may lack training for workers to implement AI-based operations.

Smart Warehousing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14.4% |

|

Base Year Market Size (2025) |

USD 29.78 billion |

|

Forecast Year Market Size (2035) |

USD 115.49 billion |

|

Regional Scope |

|

Smart Warehousing Market Segmentation:

Application Segment Analysis

The order fulfillment segment is projected to register the largest smart warehousing market share, registering 34.5% by 2035. The growth of the market can be attributed to the surge in e-commerce and customer demand for same-day or rapid delivery services. The inclusion of smart warehousing solutions is speeding up the order processing operation by using real-time inventory trackers. Other than this, the inclusion of automated guided vehicles replaces the manual picking of the products and reduces the reliance on human labor. Big players such as Amazon are investing a significant amount in AI and robotics to streamline order fulfillment.

End user Segment Analysis

The transportation and logistics segment is expected to garner the maximum revenue with a 30.5% share value. The sector is the backbone of the worldwide supply chains, and embracing smart warehousing to enhance efficiency. There has been a rising reliance on real-time tracking and data-driven decision-making. Companies are adopting IoT and GPS-enabled fleets to integrate logistics analytics for route optimization and speed up the delivery times. For instance, DHL and Maersk utilize AI-enabled logistics dashboards to reduce costs and speed up delivery time. Autonomous delivery bots are also deployed by companies to conduct efficient operations. Various other companies are also leveraging AI, ML, IoT, and blockchain to get an edge in growth-determining factors such as sustainability and timely delivery.

Technology Segment Analysis

The robotics and automation segment accounted for the largest share in the smart warehousing market based on technology due to its transformative capabilities in moving traditional warehouse operations to efficient, high-performance logistics centers. Robotics and automation technologies, including autonomous mobile robots (AMRs), automated guided vehicles (AGVs), robotic picking systems, and automated storage and retrieval systems (AS/RS), are key solutions to the following industry challenges: labor shortages and escalating operational costs.

Our in-depth analysis of the smart warehousing market includes the following segments:

|

Segments |

Subsegments |

|

Component |

|

|

Deployment Mode |

|

|

Organization Size |

|

|

Technology |

|

|

Application |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Warehousing Market - Regional Analysis

North America Market Insight

The North America smart warehousing market is anticipated to hold 35.5% of the share by 2035, fueled by the presence of technologically advanced infrastructure and early adoption of automation technologies. Canada and the United States are dominating the market by integrating modern technologies such as IoT and robotics into various operations. Also, government initiatives are supporting the development of smart warehousing by allocating a budget for ICT initiatives. In the U.S., the smart warehousing market is projected to garner USD 11.8 billion by 2030. The growth is propelled by increasing demand for supply chain management and automation in logistics. In 2022, the Department of Defense (DoD) launched a 5G Smart Warehouse at the Naval Base Coronado in California.

The U.S. leads the world in smart warehousing, helped by its already established logistics system and rapid adoption of technologies associated with Industry 4.0. For example, some of the biggest names in e-commerce, such as Amazon and Walmart, are aggressively investing in automation, robotics, and IoT (the Internet of Things) to enhance their warehouse operations. The associated high labor cost in the U.S. is another supporting factor pushing companies in that direction. Meanwhile, cloud computing is enabling new software such as AI-enabled inventory management systems, while autonomous mobile robots (AMRs) have also entered the market to work in warehouses as new solutions.

Canada is also witnessing significant growth due to the rising adoption of smart warehousing solutions. Government bodies are actively supporting broadband expansion and ICT developments that are crucial for smart warehousing infrastructure. The Deloitte Smart Factory in Montreal is an exemplary establishment of smart housing in Canada, integrating advanced technologies. These developments showcase countries’ will to expand the smart warehousing operations with the rising demand for modern supply chains. Also, companies such as Shopify are also investing in automated fulfillment centers, fostering efficiency.

APAC Market Insight

The Asia Pacific market is anticipated to garner 27.5% share of the global market, driven by government-led initiatives in various countries and the rapid expansion of the e-commerce sector. For instance, the e-commerce sales in China alone have surpassed USD 1.74 trillion in 2022, instilling the need for automated warehousing solutions. Additionally, in South Korea, the smart factory initiative has been launched, and the government has infused USD 1.08 billion to innovate manufacturing facilities. The development across Asia Pacific countries showcases the efforts made by the public and private sectors to advance the logistics and transportation sector.

India is seeing rapid growth in smart warehousing and fulfilment centres due to the rise of e-commerce platforms such as Flipkart and Amazon India, and the influx of consumer demand from tier 2 and 3 cities. The Government initiatives, such as "Make in India" and the National Logistics Policy development, are improving infrastructure in logistics centres and leading to a higher level of automation of smart warehousing. There is a strong labor market; however, the need for higher levels of efficiency, in the context of smart warehousing, is beginning to push technology acceptance in areas such as AI, IoT, and real-time tracking.

China's advanced status as the foremost nation in global manufacturing and e-commerce is fostering rapid growth in the smart warehousing sector. The government's emphasis on smart logistics since the "Made in China 2025" initiative is stimulating many industries to move in this direction. While some industries have struggled with labor shortages up to now, there are increasing labor costs that will inevitably "push" companies to more automated storage and retrieval systems (AS/RS). China also produces the greatest volume of hardware for automation, which helps to enable the use of smart technologies.

Europe Market Insight

There is an enormous surge in smart warehousing in Europe due to rapid e-commerce growth, shifting consumer expectations for faster. In response, businesses and companies are increasingly investing in automation, robotics, and AI to improve efficiencies while reducing labor costs. Moreover, to help businesses modernize, the European Union has strict environmental standards and sustainability goals. This is creating an impetus for energy-efficient, digital warehousing systems. As well, governments and the EU have developed funding programs to support digitization. Finally, logistics hubs such as Rotterdam, Hamburg, and Antwerp, along with Europe's extensive and efficient transport networks provides the perfect geographic location for smart warehouse implementations.

The complications of the supply chain in the UK post-Brexit and the need for improved efficiency in domestic logistics are allowing the UK to make further advancements in smart warehousing and artificial intelligence, robotics, and warehouse management systems (WMS) is the strongest driving force behind this change, in addition to the e-commerce sector, especially retailer and grocery deliveries. Labor shortages and the costs of labor have also contributed to the appeal of automating warehousing processes. Companies are deploying drones and autonomous vehicles to check inventory and move inventory from one place to another. Government funding is also providing more assistance to change the digital infrastructure.

The smart warehousing industry in France is growing as companies look to optimize logistics in relation to workforce challenges and rising consumer expectations. The French government has high political capital for Industry 4.0 and digitization policies, further reinforced with financial support for the deployment of solutions that automate logistics and support an automated smart warehousing system. A central geographic and economic location in Europe presents a market opportunity to operate as a logistics hub with increasing demands for high-performance warehousing. Additionally, the sustainability agenda is spurring the deployment of energy-efficient smart systems.

Key Smart Warehousing Market Players:

- Honeywell International Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens AG

- Daifuku Co., Ltd.

- Zebra Technologies

- Mitsubishi Electric Corp.

- Samsung SDS

- Cognex Corporation

- Blue Yonder (JDA Software)

- ABB Ltd

- Schneider Electric

- Infosys Ltd

- Flextronics International

- Hitachi Ltd

- Telstra Corporation Ltd.

- Scientech Technologies

The competitive landscape of the smart warehousing market is rapidly evolving as established key players, IT giants, and new entrants are investing in logistics. Key players in the market are focused on developing new technologies and products that cater to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position.

Here are some key players operating in the smart warehousing market:

Recent Developments

- In March 2025, Honeywell International Inc. launched the Forge Warehouse Execution System, integrated with AI-driven analytics to optimize workflows. The early adoption resulted in a 15.5% surge in operational efficiency, driving 12.5% revenue growth in the automation division.

- In January 2024, Siemens AG announced a partnership with Universal Robots and Zivid to design a warehouse automation solution that will address the challenges of intra-logistics fulfillment tasks and bring effortless picking to any environment.

- Report ID: 5313

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Warehousing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.