Viral Warts Treatment Market Outlook:

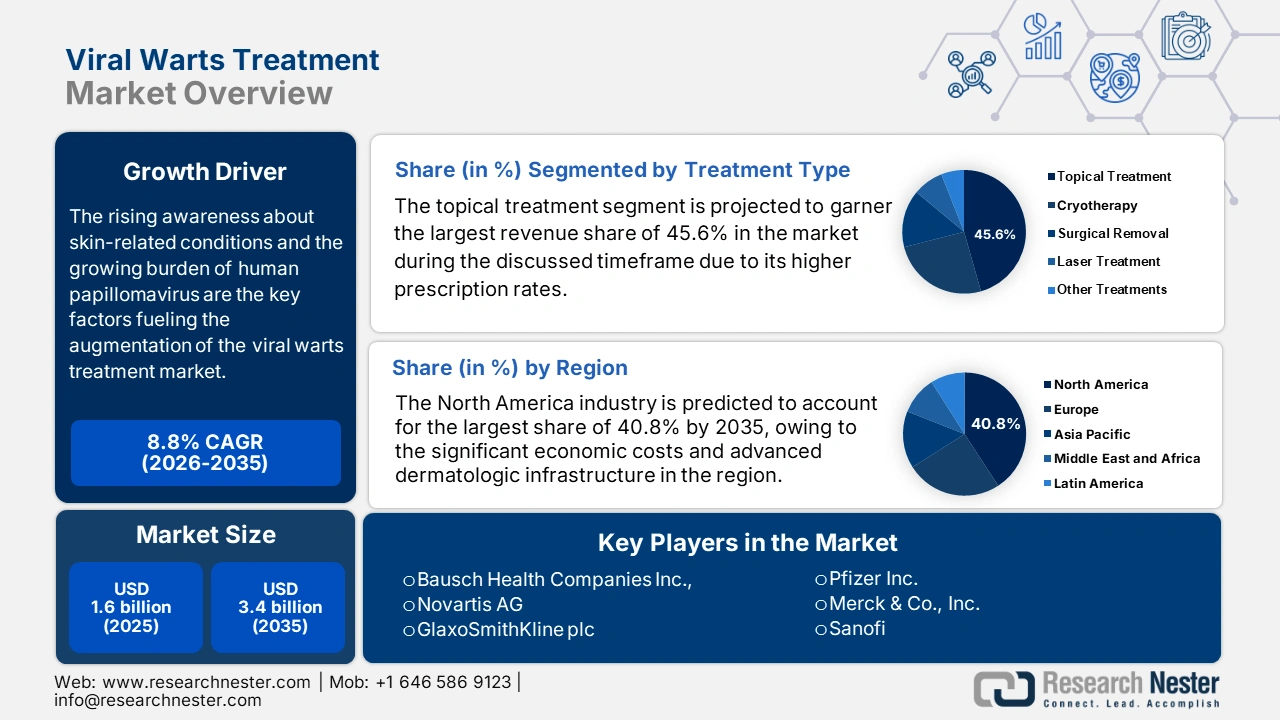

Viral Warts Treatment Market size was valued at USD 1.6 billion in 2025 and is projected to reach USD 3.4 billion by the end of 2035, rising at a CAGR of 8.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of viral wart treatment at USD 1.7 billion.

The rising awareness about skin-related conditions and the growing burden of human papillomavirus are the key factors fueling the augmentation of the market. Testifying to this, the article published by the World Health Organization in March 2024 reported that HPV is a group of over 200 viruses, with some high-risk types causing genital warts and several cancers. It also stated that in a year, HPV was linked to approximately 620,000 cancer cases in women and 70,000 in men, highlighting the strong necessity of effective treatment.

Furthermore, the landscape is influenced by the existence of payers, which include insurance companies, government healthcare systems, and private health plans, that play an extremely crucial role in determining access and affordability of treatments through their pricing and reimbursement policies. In this regard, NIH in October 2021 evaluated six main treatments for genital warts in Peru, finding that the cost per treatment session ranged from USD 11 for trichloroacetic acid to USD 24.59 for surgical excision, with human resources accounting for 70% to 95% of these costs.

Key Viral Warts Treatment Market Insights Summary:

Regional Highlights:

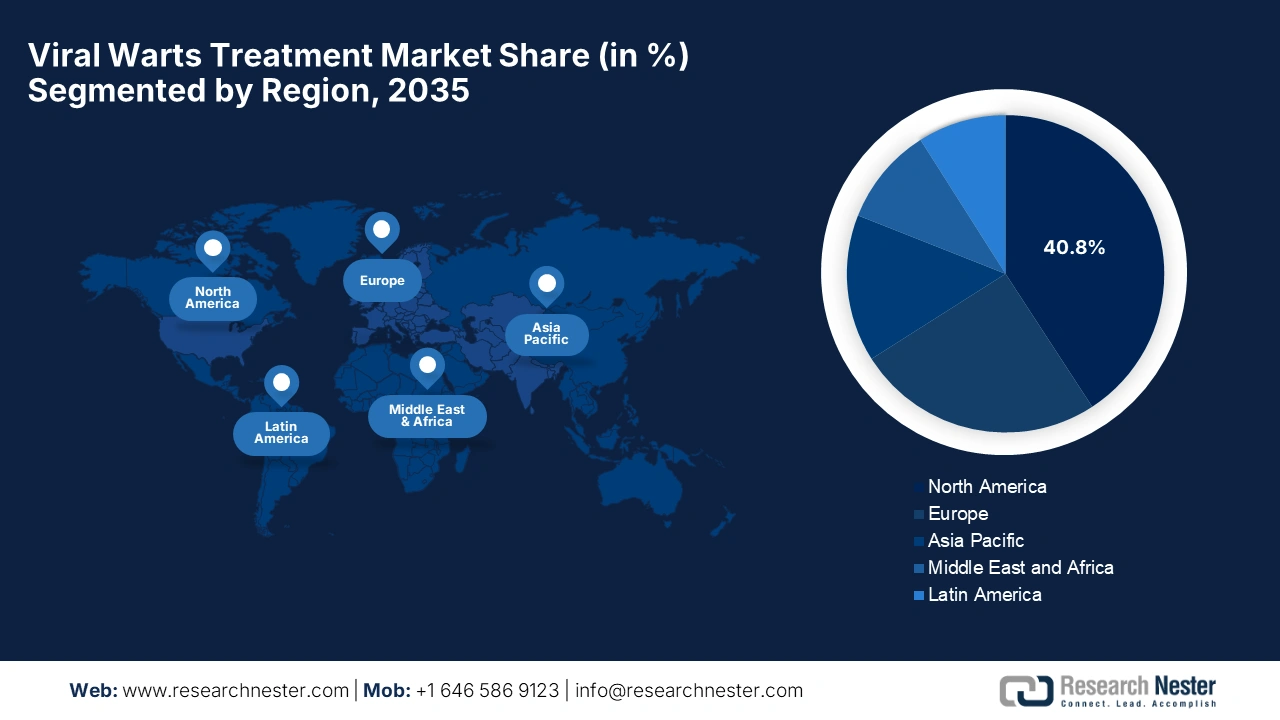

- North America is projected to command a 40.8% share by 2035 in the viral warts treatment market, stemming from high awareness, significant economic costs, and advanced dermatologic infrastructure.

- The Asia Pacific region is anticipated to expand rapidly through 2026-2035, attributable to rising HPV prevalence, broader reimbursement schemes, and improved dermatological infrastructure.

Segment Insights:

- The topical treatment segment is projected to secure a 45.6% share by 2035 in the viral warts treatment market, supported by its broad first-line therapy adoption owing to non-invasiveness, cost-effectiveness, and suitability for home-based care.

- The genital warts segment is anticipated to account for 38.5% of the market by 2035, bolstered by the escalating prevalence of HPV.

Key Growth Trends:

- Advancements in treatment methodologies

- Research & development

Major Challenges:

- Limited awareness

- Variability in treatment efficacy

Key Players: Bausch Health Companies Inc., Novartis AG, GlaxoSmithKline plc (GSK), Pfizer Inc., Merck & Co., Inc., Sanofi, Aclaris Therapeutics, Inc., Perrigo Company plc, Teva Pharmaceutical Industries Ltd., Viatris Inc., Sun Pharmaceutical Industries Ltd., Leo Pharma A/S, Taro Pharmaceutical Industries Ltd., Cipher Pharmaceuticals Inc., Hisamitsu Pharmaceutical Co., Inc., Apotex Inc., CSL Limited, Bristol Myers Squibb, Hikma Pharmaceuticals PLC, Cipla Ltd.

Global Viral Warts Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.6 billion

- 2026 Market Size: USD 1.7 billion

- Projected Market Size: USD 3.4 billion by 2035

- Growth Forecasts: 8.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, Brazil, South Korea, Mexico, Indonesia

Last updated on : 6 October, 2025

Viral Warts Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Advancements in treatment methodologies: This is the key factor reshaping the growth trajectory of the market since there have been continued innovations in terms of laser therapy, immunotherapy, and microwave treatments. In March 2024, Pulse Biosciences announced that it received FDA 510(k) acceptance for its CellFX nsPFA Percutaneous Electrode System, which precisely ablates soft tissue without thermal damage, offering a minimally invasive option for various surgical procedures.

- Research & development: The remarkable investments in developing novel therapies, including oral and combination treatments, are enhancing both efficacy and patient outcomes in this field. KI in March 2023 reported that a multi-country, five-year study funded by nearly USD 15 million from the Bill & Melinda Gates Foundation, with USD 1 million co-funding from the Swedish government, to understand the global burden of HPV among girls and women, which was led by the International Vaccine Institute in collaboration with Karolinska Institutet (KI) and other partners.

- Emergence of over-the-counter solutions: This is one of the principal drivers in this field since products such as salicylic acid, cryotherapy kits, and topical creams are becoming more popular, enabling convenient options for patients who prefer to manage their warts without visiting a healthcare professional. In May 2025, CryoConcepts, LP introduced the Skin Clinic, which is an FDA-cleared at-home cryotherapy solution skin tag remover designed for safe and effective skin tag removal, hence denoting a positive market outlook.

Key Statistics on Genital HPV Prevalence and Impact (Global, 2023 Study)

|

Metric |

Value |

|

Global prevalence of any genital HPV (men) |

31% |

|

Global prevalence of high-risk HPV (men) |

21% |

|

Prevalence of HPV-16 (most common genotype) |

5% |

|

Prevalence of HPV-6 (second most common) |

4% |

|

Peak prevalence age group |

25-29 years |

|

Cervical cancer deaths in women (annually) |

Over 340,000 deaths |

|

Genital HPV prevalence comparison (Asia) |

~50% lower than other regions |

Source: WHO

Regulatory Developments in HPV Vaccines and Skin Wart Treatments

|

Company / Entity |

Details |

Notes |

|

Merck Canada |

Confirms current GARDASIL9 dosing; plans single-dose trials. |

FDA requires strong evidence for single-dose efficacy; 2- and 3-dose regimens remain standard. |

|

KinoPharma Inc. |

Reports Phase 2 results for a novel ointment treating common warts. |

The study showed safety and efficacy; minor skin reactions were observed. |

|

China National Medical Products Administration |

Approves Cecolin 9, the first domestic 9-valent HPV vaccine. |

Strong protection against multiple HPV strains; two-dose regimen effective for younger girls. |

Source: Company Official Press Releases

Challenges

- Limited awareness: This is one of the major hindering factors in the market since the lack of proper awareness among patients about the condition and available treatment options restricts adoption. Also, many individuals hesitate to seek medical guidance due to the asymptomatic nature of warts or the social stigma associated with them. Therefore, this delay often leads to warts becoming extremely persistent, making treatment ultimately prolonged.

- Variability in treatment efficacy: This is another major factor affecting the progress of the viral warts treatment market since the current procedures can vary significantly in effectiveness depending on wart type, size, and patient immune response. Besides, even after the removal, warts can recur owing to the underlying human papillomavirus infection. Hence, this unpredictability can lead to patient inconvenience and increased healthcare costs, posing a barrier to market growth.

Viral Warts Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.8% |

|

Base Year Market Size (2025) |

USD 1.6 billion |

|

Forecast Year Market Size (2035) |

USD 3.4 billion |

|

Regional Scope |

|

Viral Warts Treatment Market Segmentation:

Treatment Type Segment Analysis

The topical treatment segment is projected to garner the largest revenue share of 45.6% in the market during the discussed timeframe. The dominance of the segment is effectively attributable to their higher prescription rate as a first-line therapy due to their non-invasiveness, cost-effectiveness, and suitability in home-based care. NIH in January 2023 revealed that salicylic acid is the most widely used and well-studied topical agent for the treatment of viral warts, which showcased a clearance rate of about 39% compared to 25% with a placebo.

Type Segment Analysis

The genital warts segment is expected to capture a significant share of 38.5% in the viral warts treatment market by the end of 2035. The growth in the segment is highly subject to the escalating prevalence of HPV, the critical causative agent. In April 2023, KinoPharma and IWAKI SEIYAKU reported that they have initiated a Phase 2 clinical trial to evaluate the efficacy of a novel antiviral ointment targeting human papillomavirus for the treatment of cutaneous warts, which aims to confirm safety and effectiveness in humans following successful preclinical studies.

End user Segment Analysis

Based on end user hospitals segment, it is likely to gain a share of 35.4% in the market during the analyzed timeframe. The capability of the subtype to handle complex cases necessitates advanced procedures such as cryotherapy and electrosurgery. These facilities are equipped with specialized dermatology departments and are the primary point of care for severe, recurrent, or extensive warts, especially genital warts, hence denoting a positive market outlook.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Treatment Type |

|

|

Type |

|

|

End user |

|

|

Location of Wart |

|

|

Mode of Administration |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Viral Warts Treatment Market - Regional Analysis

North America Market Insights

North America is the dominant region in the market and is expected to have a market share of 40.8% by the end of 2035. The market is driven by high awareness, significant economic costs, and advanced dermatologic infrastructure. The NIH article published in March 2024 revealed that the annual direct medical costs for treating HPV-related anogenital warts and recurrent respiratory papillomatosis are USD 104 million. It also stated that anogenital warts account for approximately USD 46 million, while adult-onset RRP contributes around USD 56 million.

The U.S. viral warts treatment market is augmenting its leadership in the regional landscape owing to the increased HPV vaccination rates, which are expected to reduce the prevalence of HPV-related warts, impacting demand for treatment options. This can be testified from the NIH study in July 2023, which found that pediatricians receive the highest total return from vaccine cost reimbursements, which averaged about USD 5.08 per dose, whereas family physicians have a return margin of USD 0.34 per dose, thus suitable for market expansion.

Canada is showcasing a positive growth trajectory in the market on account of increasing awareness of sexually transmitted infections, rising healthcare access, and growing demand for both over-the-counter and prescription treatment options. As of September 2025, Health Canada reports that 5% of sexually active individuals contract HPV at some point, and many types of HPV, low-risk strains can lead to genital warts, while high-risk types are linked to various cancers, including cervical, anal, penile, and throat cancers.

Gardasil9 and Trumenba - CDC and Private Sector Pricing Overview

|

Vaccine |

Brand Name / Trade Name |

Packaging |

CDC Cost / Dose |

Private Sector Cost / Dose |

Manufacturer |

|

HPV - Human Papillomavirus 9-valent |

Gardasil9 |

10 pack - 1 dose syringe |

USD 257.07 |

USD 329.09 |

Merck |

|

MENB - Meningococcal Group B |

Trumenba |

10 pack - 1 dose syringe |

USD 142.73 |

USD 207.32 |

Pfizer |

Source: CDC

APAC Market Insights

The Asia Pacific is the fastest-growing region in the viral warts treatment market, significantly driven by a rise in HPV prevalence, expanding government reimbursement frameworks, and improved dermatological infrastructure. The region is experiencing a drastic shift from surgical and cryotherapy-based solutions to topical immunotherapies and affordable antiviral formulations. This transformation is mainly seen in countries such as India and China, as their market access is crucial. Market access is heavily reliant on government procurement, regional R&D incentives, and multi-tier reimbursement schemes.

China holds the largest share of the regional market owing to the rising awareness of skin-related conditions and an expanding urban population seeking medical and cosmetic treatment options. For instance, in June 2023, Pierre Fabre announced that it had inaugurated its China Innovation Center in Shanghai, marking a major step in the expansion of its R&D capabilities in this region. The center includes a formulation laboratory and consumer testing facilities, with an understanding of skin needs through collaboration with local institutions such as Beijing University Hospital.

India is gaining traction in the Asia Pacific’s viral warts treatment market, extremely supported by improved public health awareness, novel product introductions, and access to dermatological care. Flychem India Pvt Ltd in March 2025 reported that it has launched KOSAVA, which is a revolutionary high-purity encapsulated salicylic acid product that offers stability, superior skin penetration, making it highly effective for personal care and pharmaceutical formulations. The product is available both in liquid and powder variants and is designed to treat skin issues, hence denoting a wider market scope.

Europe Market Insights

Europe is the leading region in the viral warts treatment market, backed by increased HPV vaccination coverage, a growing elderly population susceptible to viral wart infections, and government-subsidized dermatologic care. As per the report from Research Nester, the HPV-associated disorders treatment market, a crucial segment of which is genital warts, is projected to grow at a steady CAGR of 4.8%. This expansion highlights the increasing economic importance and sustained demand for effective treatments within the viral warts segment of the market.

Germany is one of Europe's biggest and most organized markets, facilitated by comprehensive outpatient wart treatments, such as immunotherapies, nitric oxide gels, and wart excisions. In February 2024, Avia Pharma Holding AB reported that it acquired Neubourg Skin Care GmbH, which is a dermatology company known for its foam-based footcare brand Allpresan. Hence, this acquisition enhances Avia’s dermatology portfolio, strengthening its position in the global landscape.

The U.K. is one of the most influential landscapes for the viral warts treatment market, strongly benefiting from therapeutic options such as cryotherapy, topical treatments, and immunomodulatory therapies. On the other hand, topical treatments such as salicylic acid are also extensively utilized owing to their cost-effectiveness. Furthermore, specialty clinics in the country are gaining enhanced traction since patients are seeking specialized care, thereby making them suitable for overall market growth.

Key Viral Warts Treatment Market Players:

- Bausch Health Companies Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis AG

- GlaxoSmithKline plc (GSK)

- Pfizer Inc.

- Merck & Co., Inc.

- Sanofi

- Aclaris Therapeutics, Inc.

- Perrigo Company plc

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

- Sun Pharmaceutical Industries Ltd.

- Leo Pharma A/S

- Taro Pharmaceutical Industries Ltd.

- Cipher Pharmaceuticals Inc.

- Hisamitsu Pharmaceutical Co., Inc.

- Apotex Inc.

- CSL Limited

- Bristol Myers Squibb

- Hikma Pharmaceuticals PLC

- Cipla Ltd.

The worldwide market is extremely fragmented, which features a combination of large pharmaceutical giants and specialized dermatological firms. The pioneers, such as Bausch Health and Novartis, are showcasing their dominance in this field, highly attributed to the well-established topical and immunomodulator brands. On the other hand, the competitive strategy revolves heavily around research and development for more effective and patient-friendly formulations, such as novel immunomodulators, intensifying the rivalry in this sector.

Below is the list of some prominent players operating in the market:

Recent Developments

- In June 2024, Phio Pharmaceuticals announced that it received a patent in South Korea for its INTASYL RXI-185 compound, which targets photo-aging by slowing UV-induced collagen breakdown, enhancing its portfolio of RNAi-based therapies focused on skin disorders and immuno-oncology.

- In March 2024, Nielsen BioSciences, Inc. reported the first patient enrollment in its CFW-3A Phase 3 study to evaluate the safety and efficacy of CANDIN for the treatment of Verruca vulgaris, i.e., common warts in adolescents and adults.

- Report ID: 3632

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Viral Warts Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.