Transaction Monitoring Market Outlook:

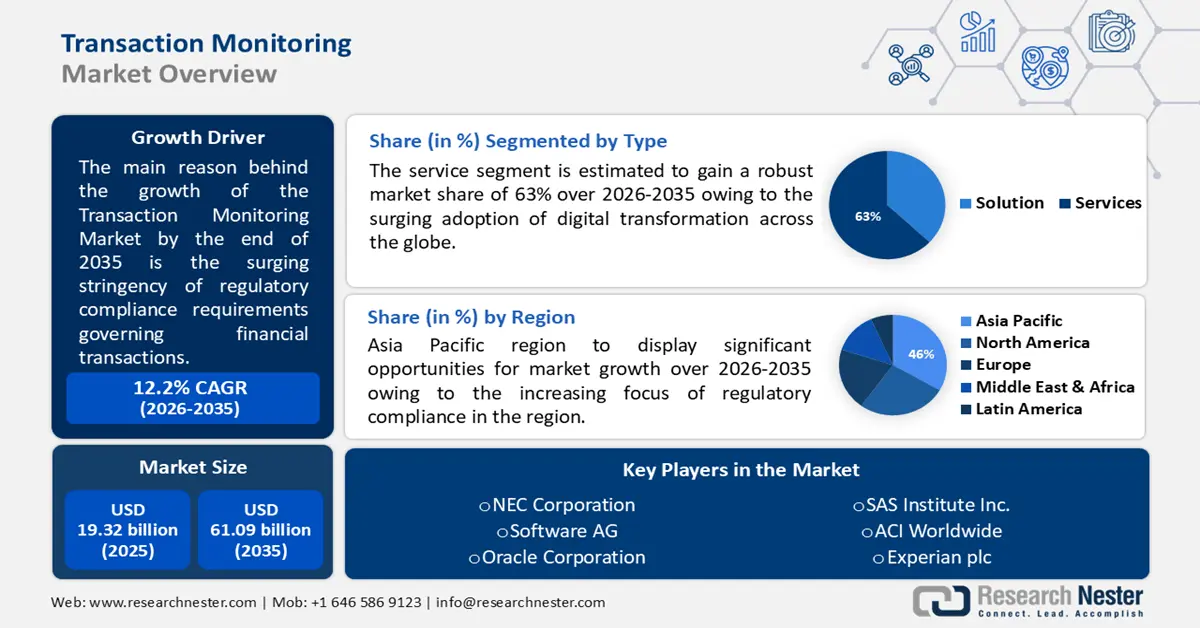

Transaction Monitoring Market size was valued at USD 19.32 billion in 2025 and is likely to cross USD 61.09 billion by 2035, registering more than 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of transaction monitoring is assessed at USD 21.44 billion.

The primary growth propelling factors for the transaction monitoring market market are the rising number of financial crimes and the surge in cases of money laundering cases. According to data published by the European Union in January 2024, each year, almost USD 715 billion to USD 1.87 trillion of the worldwide Gross Domestic Product is defiled by money laundering activities. Financial institutions and organizations across the globe are under mounting pressure to adhere to stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. Transaction monitoring solutions have become indispensable tools for financial entities to mitigate the risks associated with non-compliance.

There are chances of financial penalties, reputational damage, and legal action associated with breaking regulatory norms. Given the growing non-compliance penalty, organizations are strongly pushed to invest in reliable transaction monitoring solutions.

Key Transaction Monitoring Market Insights Summary:

Regional Highlights:

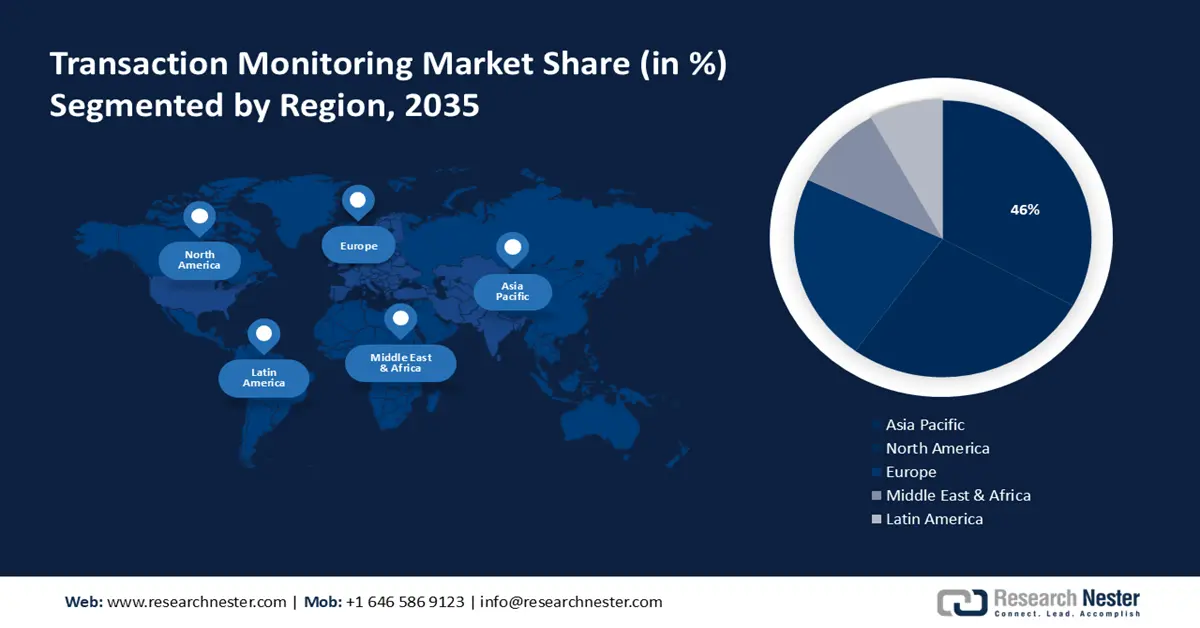

- Asia Pacific transaction monitoring market is expected to capture 46% share by 2035, driven by the rising cases of money laundering and digital payments.

- North America market will hold the second largest share by 2035, driven by cross-border transactions and FinTech adoption.

Segment Insights:

- Services segment in the transaction monitoring market is projected to achieve 63% growth by the forecast year 2035, driven by the rapid digital transformation across sectors.

Key Growth Trends:

- Rise in digital transactions

- Surge of cryptocurrencies and blockchain transactions

Major Challenges:

- False positive and alert fatigue

- Privacy concerns

Key Players: NICE Actimize, SAS Institute Inc., FICO (Fair Isaac Corporation), BAE Systems Applied Intelligence, ACI Worldwide, Oracle Corporation, Software AG, Bottomline Technologies, ComplyAdvantage, Experian plc.

Global Transaction Monitoring Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 19.32 billion

- 2026 Market Size: USD 21.44 billion

- Projected Market Size: USD 61.09 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: China, India, Singapore, Japan, South Korea

Last updated on : 16 September, 2025

Transaction Monitoring Market Growth Drivers and Challenges:

Growth Drivers

-

Rise in digital transactions: The volume and complexity of digital transactions are rising in tandem with firms' and customers' growing reliance on online and mobile platforms. According to the World Bank in 2022, 2/3rd of adults globally now receive or make a digital payment. Transaction monitoring is pivotal in digital transactions to find out and prevent financial crimes such as tax evasion, embezzlement, terror financing, bribery, and corruption. These factors are fueling the growth of the transaction monitoring market during the assessed time.

-

Surge of cryptocurrencies and blockchain transactions: As digital currencies gain traction; the market is experiencing a surge in demand for solutions that can effectively track and analyze blockchain transactions. For instance, the World Economic Forum projects that 10% of the total global GDP could be stockpiled and tokenized on the blockchain by 2027. Transaction monitoring accumulates and combines both off-chain and on-chain data and identifies associated risks.

-

Helpful in fulfilling regulatory compliance: Various financial institutions are required to collect and scrutinize data on deposits, withdrawals, etc. Anti-money laundering transaction monitoring is important to review customer transactions accurately and ensure compliance. In case of non-compliance, the government imposes penalties on the banks. For instance, the Consumer Financial Protection Bureau (CFPB) in July 2023 stated that Bank of America would pay USD 100 million to the consumers as a refund and USD 150 million in penalties to CFPB. Banks are adopting transaction monitoring tools to avoid such incidents.

Challenges

-

False positive and alert fatigue: Transaction monitoring systems often produce false positives, triggering alarms for legitimate transactions. When investigators have to shift through numerous false alarms, they may become fatigued, diverting their attention from real case threats.

-

Privacy concerns: The utilization of transaction monitoring tools poses a privacy threat to the users. Transaction monitoring can invade privacy by gathering vast amounts of personal financial data.

Transaction Monitoring Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 19.32 billion |

|

Forecast Year Market Size (2035) |

USD 61.09 billion |

|

Regional Scope |

|

Transaction Monitoring Market Segmentation:

Type Segment Analysis

In the transaction monitoring market, the services segment is poised to capture around 63% in the coming decade. The speed at which digital transformation is occurring across sectors is a major factor in the services segment's growth. Organizations are investing in digital transformation services to stay competitive, increase operational efficiency, and improve customer experiences. Research Nester found that by 2027, global spending on digital transformation would reach USD 3.9 trillion. Cloud computing and managed services usage are fueling the services segment's expansion. Businesses are using cloud services to cut costs, increase flexibility, and achieve scale. Businesses are spending money on services to safeguard their digital assets and defend against online threats.

End User Segment Analysis

The healthcare segment in the transaction monitoring market is expected to garner a significant share in the year 2035. One of the main factors propelling the healthcare sector's growth is the quick development of telehealth and remote patient monitoring. Healthcare professionals may improve clinical decision-making and patient outcomes by using advanced analytics to glean valuable insights from large datasets. According to data published by the World Economic Forum in January 2024, 77% of healthcare systems don't include a coherent integrated analytics strategy. transaction monitoring market players are including systems to scrutinize financial transactions, and potential fraud and ensure compliance. Wearable technology and remote healthcare services are becoming more popular, which is helping the healthcare industry expand. Health parameters may be continuously monitored due to wearable technology, which encourages preventative treatment.

Our in-depth analysis of the global transaction monitoring market includes the following segments:

|

Type |

|

|

End User |

|

|

Enterprise Size |

|

|

Application |

|

|

Deployment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Transaction Monitoring Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific transaction monitoring market is predicted to hold the largest revenue share of 46% by 2035. The growth of the market can be attributed to the rising cases of money laundering in Asian countries. Market players in the countries are demanding efficacious solutions to handle anti-money laundering compliance. This creates growth opportunities for the market in South Asia and the Pacific region. Additionally, there has been an increasing adoption of digital payments in the region. For instance, according to the Press India Bureau in September 2024, UPI transactions have grown to 130 billion in the financial year 2023-2024. Companies are opting for robust transaction monitoring to prevent financial crimes.

North America Market Insights

The transaction monitoring market in the North America region is projected to hold the second-largest share. The prevalence of cross-border transactions in North America is a significant factor driving the demand for comprehensive transaction monitoring solutions. For instance, the United States Trade Representative stated that the U.S. goods and services trade under the United States-Mexico-Canada Agreement totaled USD 1.8 trillion in 2022. Additionally, the adoption of FinTech solutions is contributing to the growth of transaction monitoring in North America. FinTech companies, known for innovative financial services, face regulatory scrutiny, necessitating advanced monitoring systems. The escalating sophistication of cybersecurity threats is driving the demand for advanced transaction monitoring solutions.

Transaction Monitoring Market Players:

- NICE Actimize

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SAS Institute Inc.

- FICO (Fair Isaac Corporation)

- BAE Systems Applied Intelligence

- ACI Worldwide

- Oracle Corporation

- Software AG

- Bottomline Technologies

- ComplyAdvantage

- Experian plc

The competitive landscape of the transaction monitoring market is rapidly evolving as established key players, IT giants and new entrants are investing in cybersecurity. Key players in the market are focused on developing new technologies and products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global market:

Recent Developments

- In December 2024, Fenergo was recognized as a category leader for providing a holistic AML transaction monitoring quadrant. The company is known to render impeccable solutions for Know Your Customer, anti-money laundering, and client lifecycle management.

- In October 2024, NICE Actimize won the 2024 Datos Insights Fraud & AML Impact Award. The solution includes Artificial Intelligence to improve customer experience and provides disruptive financial crime solutions.

- Report ID: 5731

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Transaction Monitoring Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.