Toluene Diisocyanate Market Outlook:

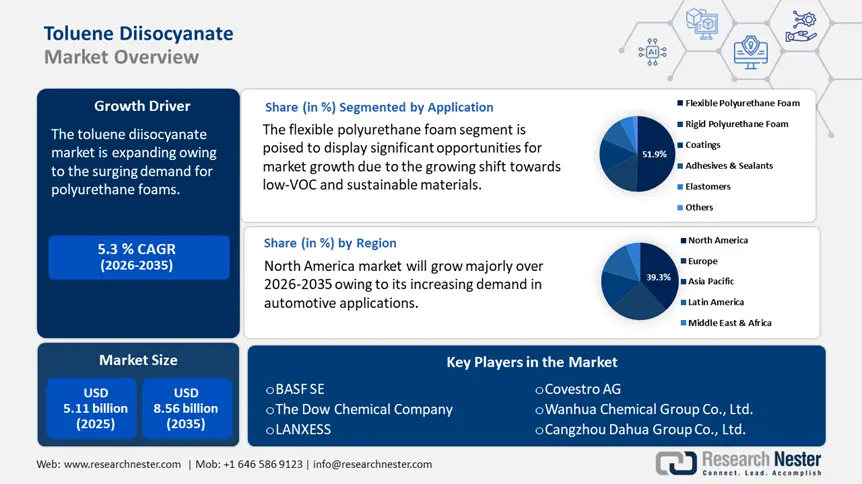

Toluene Diisocyanate Market size was valued at USD 5.11 billion in 2025 and is set to exceed USD 8.56 billion by 2035, expanding at over 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of toluene diisocyanate is estimated at USD 5.35 billion.

The global toluene diisocyanate market is expected to grow substantially due to the surging demand for polyurethane foams. Derived from toluene diisocyanates, polyurethane foams find extensive use in the furniture, automotive, and construction sectors. Growing consumer demand for lightweight automobile parts, energy-efficient buildings, and cozy furniture has spurred the use of polyurethane foams, which in turn has increased demand for toluene diisocyanates. Because of their superior thermal insulation qualities, polyurethane foams are widely utilized for insulation in the building sector.

Furthermore, the growing demand for energy-saving materials such as polyurethane foams, brought on by environmental concerns and energy efficiency legislation. In addition, the need for lightweight materials to increase fuel efficiency has increased in the automotive sector. As producers seek effective, lightweight solutions, this trend is expected to fuel demand for toluene diisocyanates.

Key Toluene Diisocyanate Market Insights Summary:

Regional Highlights:

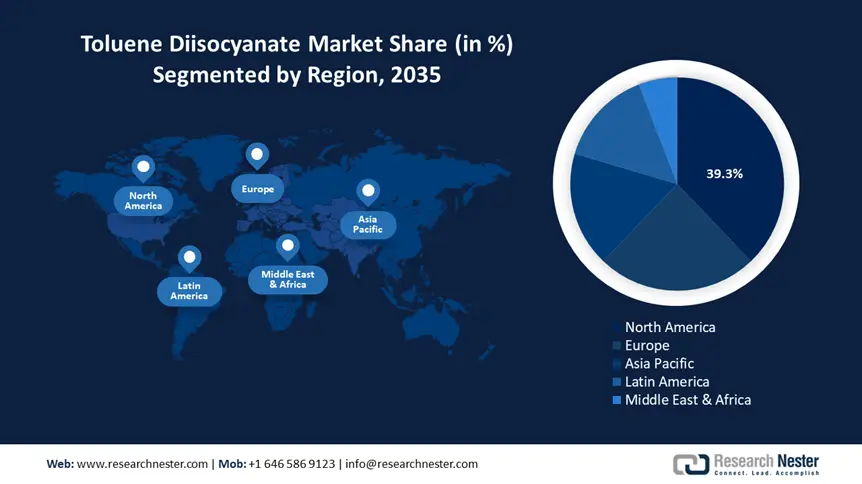

- North America commands a 39.3% share in the Toluene Diisocyanate Market, fueled by high demand in automotive applications and sustainable construction, driving significant growth by 2035.

- Europe’s toluene diisocyanate market is set to maintain a strong share by 2035, driven by laws promoting energy efficiency and environmental sustainability.

Segment Insights:

- The Flexible Polyurethane Foam segment is forecasted to capture around 51.9% share by 2035, propelled by widespread use in furniture, bedding, and car interiors.

- The Furniture & Bedding segment of the Toluene Diisocyanate Market is expected to capture a significant share from 2026 to 2035, driven by urbanization and demand for ergonomic and eco-friendly furniture.

Key Growth Trends:

- Increasing manufacture of automobiles

- Augment of digitalization and AI

Major Challenges:

- Fluctuating raw material prices

- Availability of alternatives

- Key Players: BASF SE, The Dow Chemical Company, LANXESS, Covestro AG, Wanhua Chemical Group Co., Ltd., Cangzhou Dahua Group Co., Ltd., China National Bluestar Co., Ltd., Anderson Development, Huntsman Corporation, Circularise.

Global Toluene Diisocyanate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.11 billion

- 2026 Market Size: USD 5.35 billion

- Projected Market Size: USD 8.56 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 12 August, 2025

Toluene Diisocyanate Market Growth Drivers and Challenges:

Growth Drivers

- Increasing manufacture of automobiles: The utilization of polyurethane foams within the automotive industry is anticipated to experience significant growth throughout the forecast period, driven by the increasing production of luxury vehicles and heightened competition within the sector. It is projected that the rising demand for coatings and sealants to prevent leaks will have a favorable impact on the expansion of the toluene diisocyanate (TDI) industry. Furthermore, the anticipated growth in the packaging sector, alongside the increasing demand for rigid foams, is expected to further stimulate market development. However, the advancement of environmental regulations concerning the presence of harmful substances in these products may pose a challenge to toluene diisocyanate (TDI) market growth during the forecast period.

- Augment of digitalization and AI: The advancements in technology are streamlining supply chain operations and facilitating predictive maintenance within manufacturing facilities. The implementation of Industry 4.0 enables manufacturers to monitor production parameters in real-time, which enhances both cost efficiency and quality control.

Challenges

- Fluctuating raw material prices: Unpredictable production costs spurred by changes in the price of crude oil globally may have an impact on the toluene market. The cost of refining toluene rises in tandem with the price of crude oil, which raises the cost of toluene-dependent products, including paints, coatings, adhesives, and gasoline additives. Because it is hard to pass on these higher costs to end users without compromising demand, this volatility might limit the profitability of toluene producers, particularly during price spikes. Because businesses are wary of possible economic instability in the oil markets, crude oil prices might restrict toluene diisocyanate (TDI) market market growth by deterring investment in new production methods or the expansion of toluene manufacturing capacity.

- Availability of alternatives: Volatile organic compounds (VOCs), including toluene, are substances that easily evaporate into the atmosphere and cause air pollution. One of the negative consequences of releasing them into the environment is the creation of ground-level ozone, a major contributor to smog. These solvents are hazardous to human health in addition to their effects on the environment. While continuous or high-level exposure may cause more serious health problems, such as liver and kidney damage, short-term exposure might cause symptoms like headaches, nausea, and dizziness. The paint and coating industry is seeing an increase in demand for alternative solvents as a result of these worries. Cyclohexane, methylcyclohexane, n-heptane, and n-octane are all alternatives to toluene. Similar solvent capabilities may be provided by these substitutes; however, they frequently have lower toxicity and a less environmental impact.

Toluene Diisocyanate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 5.11 billion |

|

Forecast Year Market Size (2035) |

USD 8.56 billion |

|

Regional Scope |

|

Toluene Diisocyanate Market Segmentation:

Application (Flexible Polyurethane Foam, Rigid Polyurethane Foam, Coatings, Adhesives & Sealants, Elastomers, Others)

Flexible polyurethane foam segment is expected to account for around 51.9% toluene diisocyanate market share by 2035. Demand for flexible polyurethane foam is rising, mostly as a result of its widespread use in bedding, furniture, and car interiors. Manufacturers are responding to consumer demands for comfort and durability by developing new formulas that offer better resilience and cushioning. Additionally, research into bio-based flexible foams is being driven by the need for low-VOC and sustainable materials. The demand for foam goods designed for effective transportation is also being increased by the growing e-commerce furniture industry.

End use (Furniture & Bedding, Construction, Automotive, Electronics, Packaging, Textiles, Others)

The furniture & bedding segment in toluene diisocyanate market is anticipated to garner a significant share during the assessed period. The furniture and bedding sector is becoming the largest user of TDI due to factors like urbanization, changing lifestyles, and increased discretionary spending. The increasing need for ergonomic and personalized furniture designs is driving advancements in polyurethane foams. Additionally, eco-friendly methods, such as using recyclable foam, are becoming more and more popular. The need for cozy furniture has increased due to the growing trend of working from home.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Toluene Diisocyanate Market Regional Analysis:

North American Market Statistics

North America in toluene diisocyanate market is anticipated to dominate over 39.3% revenue share by 2035. It is anticipated that there will continue to be a high demand for TDI in automotive applications such as insulation, interior panels, and seat cushions. Furthermore, the market for TDI-based insulating materials was supported by the expanding trend of energy-efficient buildings and sustainable construction methods.

Furthermore, in the U.S., TDI is experiencing increased consumption due to the rising living standards, urbanization, and a booming housing market. Additionally, government initiatives promoting energy-efficient buildings have fueled the use of polyurethane insulation materials. The resurgence of domestic manufacturing and growing investments in infrastructure are also bolstering the demand for TDI-based products, further driving the market.

Europe Market Analysis

Europe toluene diisocyanate market is expected to grow at a significant rate during the projected period. The strict laws about energy efficiency and environmental sustainability have caused TDI-based polyurethane foams and coatings to become more widely used, giving Europe the second-largest market share for toluene diisocyanates. Furthermore, the market for toluene diisocyanates in the UK was expanding rapidly in the European region, while the market in Germany retained the biggest market share.

Also, the toluene diisocyanate (TDI) market market is growing in the UK due to the robust performance of established brands and the opportunity for companies to capture increased TDI market share. This success is attributed to effective marketing strategies, innovative product offerings, and a deep understanding of consumer preferences. The emphasis on sustainability and energy efficiency in these sectors further propels the demand for TDI-based products.

Key Toluene Diisocyanate Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Dow Chemical Company

- LANXESS

- Covestro AG

- Wanhua Chemical Group Co., Ltd.

- Cangzhou Dahua Group Co., Ltd.

- China National Bluestar Co., Ltd.

- Anderson Development

- Huntsman Corporation

- Circularise

The toluene diisocyanate market will continue to rise as a result of major industry players making significant R&D investments to broaden their product lines. Important market developments include new product releases, contractual agreements, mergers and acquisitions, increased investments, and cooperation with other organizations. Market participants are also engaging in a variety of strategic initiatives to broaden their presence. The toluene diisocyanates sector needs to provide affordable products to grow and thrive in a more competitive and expanding TDI market environment.

Recent Developments

- In April 2024, Huntsman's automotive expertise added a set of new lightweight, durable polyurethane foam technologies to the company's battery solutions portfolio, specifically designed for the potting and fixing of cells put in electric vehicle (EV) batteries. The new line also includes moldable encapsulants for battery modules or packs.

- In December 2024, Circularise announced considerable progress as a result of its participation in the Circular Foam initiative, which aims to transform the recycling of hard polyurethane (PU) foam. The project, which runs from October 2021 to September 2025, brings together a diverse group of industry professionals to address the recycling issues faced by PU foam, a material commonly used in construction, appliances, and insulation.

- Report ID: 7506

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Toluene Diisocyanate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.