Titanium Sponge Market Outlook:

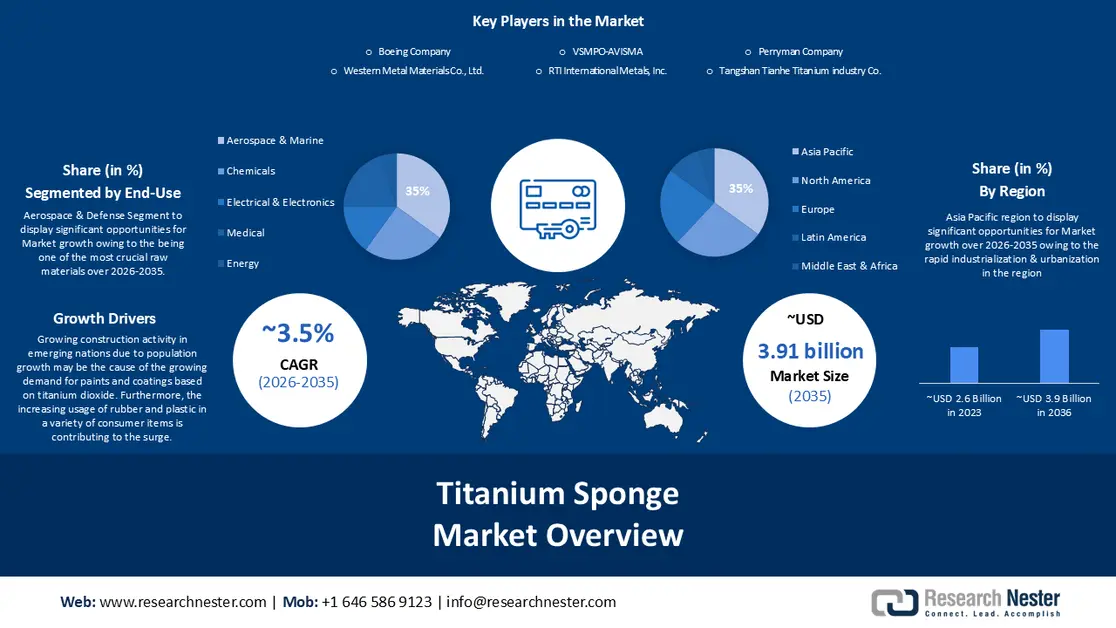

Titanium Sponge Market size was valued at USD 2.77 billion in 2025 and is set to exceed USD 3.91 billion by 2035, expanding at over 3.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of titanium sponge is estimated at USD 2.86 billion.

Growing construction activity in emerging nations due to population growth may be the cause of the growing demand for paints and coatings based on titanium dioxide. After adding 1 billion since 2010 and 2 billion since 1998, the anticipated population of humans worldwide increased to 8.0 billion in mid-November 2022 from 2.5 billion in 1950.

Furthermore, the increasing usage of rubber and plastic in a variety of consumer items is contributing to the surge. The titanium sponge market is expanding because of the recent coronavirus outbreak, which raised demand for medical supplies such as respirators, insulin pens, IV bags, gloves, and micro-implants. These goods are made of plastic and are colored with titanium elements.

Key Titanium Sponge Market Insights Summary:

Regional Highlights:

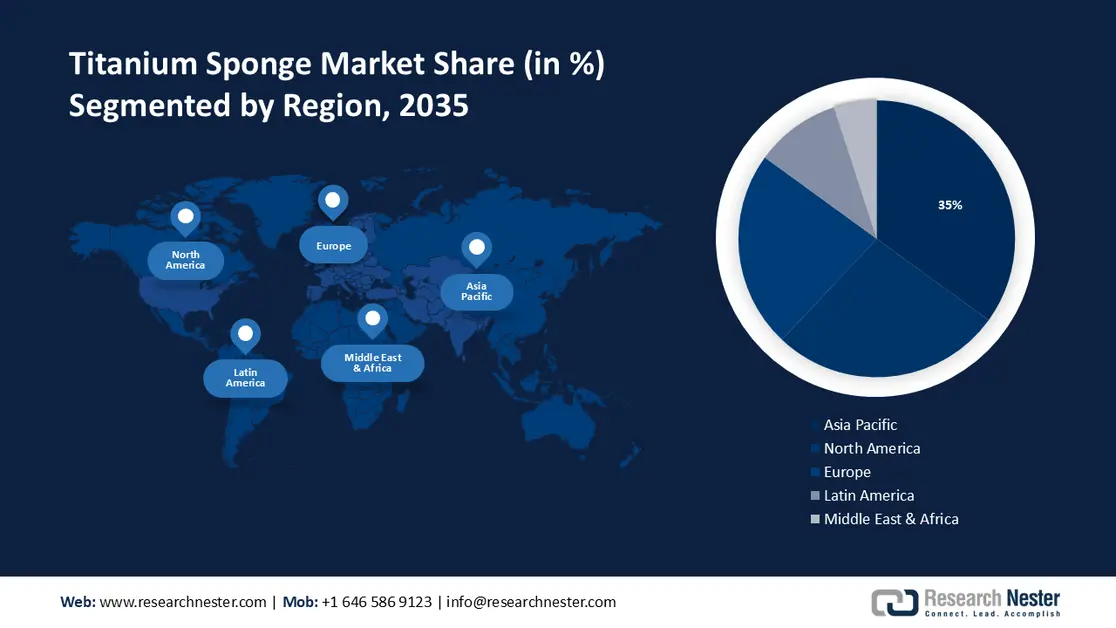

- Across 2026–2035, the Asia Pacific region is set to secure a 35% revenue share in the titanium sponge market by 2035, supported by accelerating industrialization and urban expansion in China and India.

- By 2035, North America is estimated to account for a 27% revenue share, bolstered by the expanding use of titanium-based pigments across advanced healthcare and medical device manufacturing.

Segment Insights:

- By 2035, the aerospace & marine segment is projected to capture a 35% share of the titanium sponge market, strengthened by the rising integration of titanium alloys in high-performance aerospace systems.

- By 2035, the alpha & near alpha segment is expected to hold a 49% share, upheld by its microstructural benefits.

Key Growth Trends:

- Growing demand from the aerospace sector propels the titanium sponge market expansion

- Growth opportunities due to the rising Automotive Industry

Major Challenges:

- Tight Environmental Regulations and Exorbitant Manufacturing Setup Expenses

Key Players: Boeing Company Western Metal Materials Co., Ltd., Baoji Yongshengtai Titanium Industry Co., Ltd., Luoyang Sunrui Wanji Titanium Co., Ltd., Baoti Huashen Titanium Industry Co., Ltd., VSMPO-AVISMA, RTI International Metals, Inc., Perryman Company, Ust-Kamenovgorsk Titanium & Magnesium Plant JSC, Pangang Group Vanadium Titanium & Resources Co., Ltd.

Global Titanium Sponge Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.77 billion

- 2026 Market Size: USD 2.86 billion

- Projected Market Size: USD 3.91 billion by 2035

- Growth Forecasts: 3.5%

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: – United States, China, Japan, Germany, South Korea

- Emerging Countries: – India, Brazil, Vietnam, Indonesia, Mexico

Last updated on : 28 November, 2025

Titanium Sponge Market - Growth Drivers and Challenges

Growth Drivers

- Growing demand from the aerospace sector propels the titanium sponge market expansion- The need for new aircraft has increased as a result of the rise in global air travel, which is being driven by factors including globalization, economic expansion, and a rising middle class. As a result, the commercial aviation industry has grown significantly. Two of the biggest aircraft manufacturers, Boeing and Airbus, have regularly reported rising order backlogs and deliveries. For instance, Airbus delivered more than 863 commercial aircraft in 2020, whereas Boeing recorded more than 345 deliveries of commercial aircraft.Titanium makes use of important properties including corrosion resistance and strength-to-weight ratio. Both the military and commercial aircraft industries are driving up titanium demand in the aerospace industry. Increased demand for titanium-rich components is brought about by manufacturers experiencing an increased volume of orders and deliveries due to the worldwide upsurge in air travel.

- Growth opportunities due to the rising Automotive Industry- There has been a notable increase in the titanium sponge market due to the automobile industry's boom. The rising demand for titanium is a result of automakers using it in more and more parts of their vehicles. Because of its extraordinary qualities such as its exceptional strength-to-weight ratio, resistance to corrosion, and exceptional durability this versatile metal is becoming more and more well-known. These characteristics make titanium a perfect material for a variety of automobile applications, from lightweight structural elements to engine components. The industry's transition to more ecologically friendly and fuel-efficient automobiles is increasing titanium utilization. By lowering the overall weight of the car, its integration improves fuel economy and lowers pollution.

- Commonly Used Titanium Dioxide Nanomaterials in Cosmetic Products- Titanium dioxide with particles smaller than 100 nm is referred to as ultrafine or nanoscale titanium dioxide. Titanium dioxide is an ultrafine nanomaterial that has superior UV scattering and absorption capabilities, improved dispersibility, and outstanding transparency. Many cosmetic items, including creams, loose and compacted powders, blush, eye makeup, and sunscreens, contain ultrafine titanium dioxide nanomaterial.

Challenges

- Tight Environmental Regulations and Exorbitant Manufacturing Setup Expenses- The two primary techniques for producing titanium are the sulfate method and the carbo-chlorination process. The sulfurate method, which was once widely used due to its low cost, has increased in cost due to environmental regulations on the disposal of waste chemicals becoming more stringent. The setup cost of the carbo-chlorination process is higher than that of the sulfate technique, despite the former being more environmentally benign. Businesses that heavily depend on the sulphate process mostly in China may face challenges during the shift.

- Every metal or mineral is extracted from its ore, which is extracted from the planet's lithosphere crust. Finding the location of the titanium mineral ore, securing environmental permissions from the relevant authorities, and buying the costly machinery and equipment required for mining are all part of the costly mining process. In addition, the extraction of titanium from its mineral ore is costly, challenging, and time-consuming.

- One major obstacle to the growing titanium business is the limited supply of high-quality titanium ore.

Titanium Sponge Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.5% |

|

Base Year Market Size (2025) |

USD 2.77 billion |

|

Forecast Year Market Size (2035) |

USD 3.91 billion |

|

Regional Scope |

|

Titanium Sponge Market Segmentation:

End-Use Segment Analysis

Based on end-use, the aerospace & marine segment in the titanium sponge market is anticipated to hold 35% of the revenue share by 2035. One of the most crucial raw materials for the aerospace sector is titanium. Aluminium alloys are closely behind titanium alloys in terms of market share for aerospace raw materials. When raw materials are weighed, titanium alloys rank third in importance among the materials used in the aerospace sector. The aerospace sector uses around 75% of the premium titanium sponge that is available. Aircraft engines, shafts, blades, and airframe applications all employ it. Furthermore, titanium alloys are useful in aviation engine casings and other applications due to their ability to function at extreme temperatures, ranging from below zero to over 600°C. Their low density and high strength make them ideal for use in airframes. Boeing and Airbus, the two biggest corporations in the world, manufacture aircraft, jets, helicopters, and other related equipment. As a result, these businesses are the aerospace industry's main users of titanium alloys. Airbus received gross orders for 909 aircraft in 2021. Boeing, on the other hand, received 771 gross orders, double what it had in 2020.

Microstructure Segment Analysis

Based on microstructure, alpha & near alpha in the titanium sponge market is anticipated to hold 49% of the revenue share by 2035. The growth is because of its distinct microstructure properties. The alpha phase, which gives these alloys their exceptional strength, corrosion resistance, and high-temperature characteristics, makes up the majority of their composition. In aerospace applications, where lightweight and durable materials are critical, their microstructure enables optimal performance. These alloys' biocompatibility and resilience to corrosive environments also make them useful in key industries like chemical processing and medical implants. Alpha and near-alpha alloys are favored due to their microstructural characteristics, which help them maintain a sizable portion of the titanium titanium sponge market.

Our in-depth analysis of the global titanium sponge market includes the following segments:

|

Product Type |

|

|

Microstructure |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Titanium Sponge Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is poised to hold largest revenue share of 35% by 2035. The building, aerospace, and automobile industries have seen a major increase in demand for titanium due to the rapid industrialization and urbanization of nations like China and India. Significant infrastructure development is taking place in these countries, which is increasing demand for materials like titanium that are strong and resistant to corrosion. Titanium is being used more frequently in a variety of applications, such as the manufacture of consumer items, industrial equipment, and medical devices, owing to the Asia-Pacific region's thriving manufacturing industry. The medical device industry in the Asia-Pacific area saw total sales of over 160 billion dollars in 2022.

North American Market Insights

Titanium sponge market is projected to hold second second-largest revenue share of about 27% during the forecast period. There are reputable healthcare facilities in the United States. The more diverse hospitals and clinics that comprise the US healthcare system make it more potent. Because infectious diseases are becoming more common and people are becoming more conscious of healthcare issues, the government has constructed more healthcare facilities. This is probably going to lead to a rise in titanium dioxide demand throughout the paint and coatings industry throughout the forecast period. Furthermore, titanium pigments are widely utilized for coloring a variety of medical devices, including insulin pens, IV bags, gloves, respirators, and more, which is increasing titanium pigment sales.

Titanium Sponge Market Players:

- Tangshan Tianhe Titanium Industry Co.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Boeing Company

- Western Metal Materials Co., Ltd.

- Baoji Yongshengtai Titanium Industry Co., Ltd.

- Luoyang Sunrui Wanji Titanium Co., Ltd.

- Baoti Huashen Titanium Industry Co., Ltd.

- VSMPO-AVISTA

- RTI International Metals, Inc.

- Perryman Company

- Ust-Kamenovgorsk Titanium & Magnesium Plant JSC

- Pangang Group Vanadium Titanium & Resources Co., Ltd.

Recent Developments

- September 2018: Chinese Airlines will purchase 7,690 new aircraft valued at USD 1.2 trillion over the next 20 years, according to a statement from Boeing Company, to meet the country's increasing demand for air travel. This will have a favorable effect on the market for titanium sponge demand worldwide.

- July 2022: Perryman Company, Houston, Pa., planned to significantly expand its titanium melting capacity by installing more electron beam and vacuum arc remelt furnaces. They were to be situated in Washington County, Pennsylvania. The new furnaces would increase Perryman's overall titanium melting capacity to 42 million pounds and add 16 million pounds of melting capacity, solidifying Perryman's position as a global leader in titanium melting for aerospace and medical applications.

- Report ID: 5864

- Published Date: Nov 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Titanium Sponge Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.