Tin Fluoborate Market Outlook:

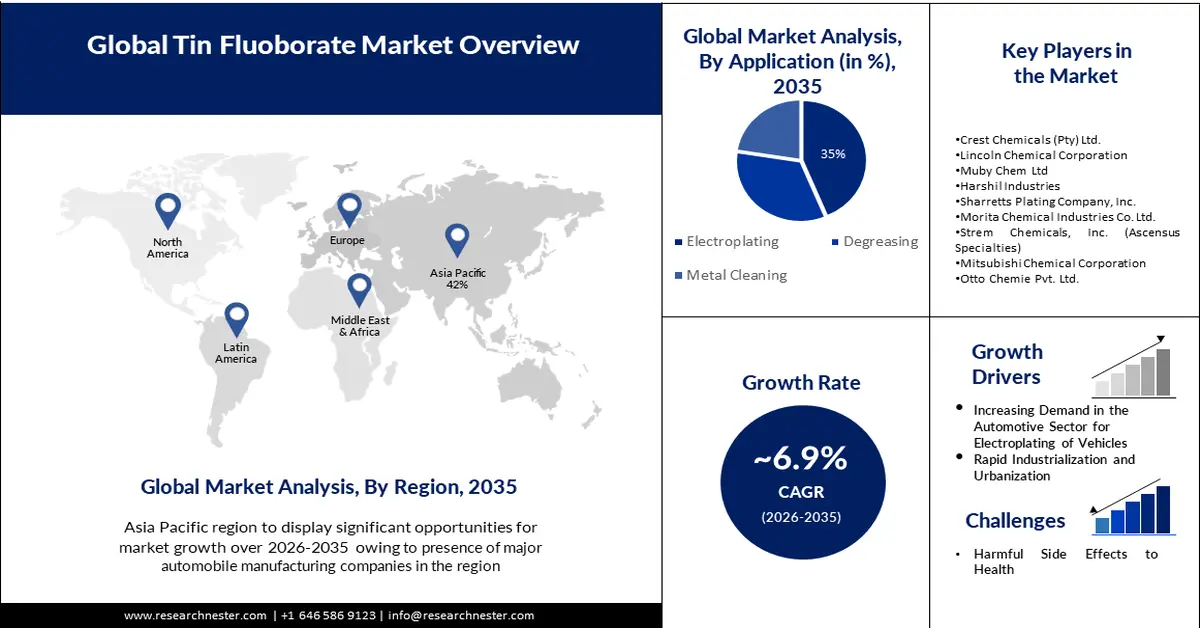

Tin Fluoborate Market size was over USD 1.27 billion in 2025 and is poised to exceed USD 2.48 billion by 2035, witnessing over 6.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of tin fluoborate is evaluated at USD 1.35 billion.

The growing use of electroplating in various end-user industries such as automotive, aircraft, electronics, and agriculture is the primary factor driving the growth of this market. As per ASEAN Automotive Federation, around 256,160 motor vehicles were sold in 2020.

Furthermore, metal cleaning is another factor driving the growth of this market. Various end use industries increase the demand for metal usage which further upsurges the demand for metal cleaning. As per data, the global metal cleaning material market held a market revenue of USD 15 billion in 2022.

Key Tin Fluoborate Market Insights Summary:

Regional Highlights:

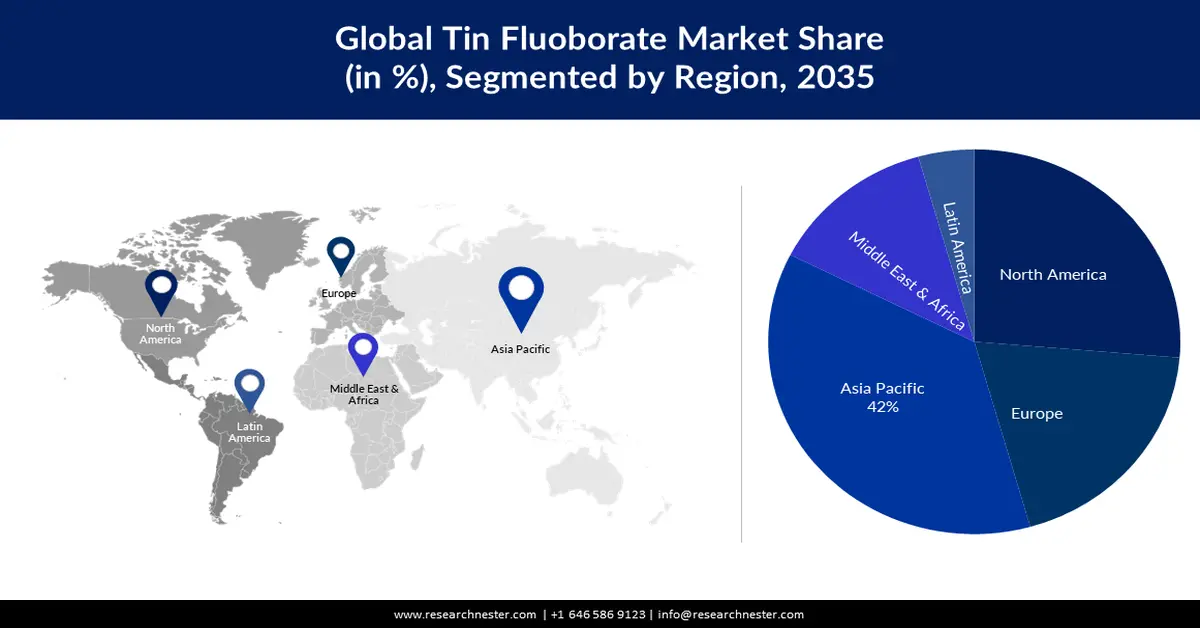

- Asia Pacific is projected to command a 42% share of the tin fluoborate market by 2035, supported by the strong presence of major automotive and electronics manufacturers across China, Japan, India, and South Korea.

- North America is expected to capture a 30% share by 2035, fueled by the rising adoption of electric vehicles and the expanding healthcare sector across the region.

Segment Insights:

- The electroplating segment is anticipated to secure a 35% share by 2035 in the tin fluoborate market, reinforced by its essential role in preventing corrosion in electronics and automobiles.

- The automotive segment is poised to hold a 38% share by 2035, propelled by the growing demand for lightweight, fuel-efficient vehicle components utilizing tin fluoborate.

Key Growth Trends:

- Increasing Demand in the Automotive Sector for Electroplating of Vehicles

- Rapid Industrialization and Urbanization

Major Challenges:

- Harmful Side Effects to Health

- Ruptured Demand and Supply Chain Owing to COVID 19

Key Players: Kuntz Electroplating Inc. (KEI), Crest Chemicals (Pty) Ltd., Lincoln Chemical Corporation, Muby Chem Ltd, Harshil Industries, Sharretts Plating Company, Inc., Morita Chemical Industries Co. Ltd., Strem Chemicals, Inc. (Ascensus Specialties), Mitsubishi Chemical Corporation, Otto Chemie Pvt. Ltd.

Global Tin Fluoborate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.27 billion

- 2026 Market Size: USD 1.35 billion

- Projected Market Size: USD 2.48 billion by 2035

- Growth Forecasts: 6.9%

Key Regional Dynamics:

- Largest Region: Asia Pacific (42% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, India, Japan, Germany

- Emerging Countries: Indonesia, Vietnam, Brazil, Mexico, United Arab Emirates

Last updated on : 20 November, 2025

Tin Fluoborate Market - Growth Drivers and Challenges

Growth Drivers

- Increasing Demand in the Automotive Sector for Electroplating of Vehicles – The upsurge in the automotive sector for the electroplating of vehicles is driving the growth of this market. Electroplating of the vehicle is one of the most common and rapid utilization of tin fluoroborate.

- Rapid Industrialization and Urbanization – With the growing disposable income of people and urbanization the growth of the market is also increasing. As more and more people are opting for electroplating of their automobiles and ornaments & other devices. For instance, industrialization has contributed around 23% to the global GDP.

- Growing Investment in Research and Development of Product – Key market players and government authorities of various regions are focusing on the research and development of tin fluoborite to provide the population with better products and services. According to a study focused on developing a new tin fluoroborate electrolyte for tin electroplating, the research team sought to optimize the composition of the electrolyte to improve the efficiency of the plating process and reduce waste. This study demonstrates investment in research and development of new and improved products in the tin fluoroborate market.

Challenges

- Harmful Side Effects to Health – Tin Fluoborate is a chemical that comes from the family of stannous or tin. Therefore, this chemical must be used with caution and proper safety measures. If it is not used properly then this might cause serious health issues such as burning the skin.

- Ruptured Demand and Supply Chain Owing to COVID-19

- Requirement of High Initial Investment

Tin Fluoborate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 1.27 billion |

|

Forecast Year Market Size (2035) |

USD 2.48 billion |

|

Regional Scope |

|

Tin Fluoborate Market Segmentation:

Application (Metal Cleaning, Electroplating, Degreasing)

The electroplating segment in the tin fluoborate market is anticipated to hold the largest revenue share of around 35% in the forecast period. Since electronics and electrical products can get exposed to air, which results in the corrosion of the product. To protect those products from corrosion electroplating is used.

Also, electroplating is highly used in automobiles to coat the body of the vehicle with sunroof and non-corrosive compounds. This increases the demand for electroplating in the automotive industry. The automotive electroplating market is anticipated to grow at a CAGR of 6% by the end of 2028.

End-User (Automotive, Kitchen-Ware, Healthcare, Consumer Electronics)

The automotive segment is anticipated to account for 38% share of the global tin fluoborate market by the end of 2035. Tin fluoborate is widely used as a lightweight material for automobiles in the automotive industry. Furthermore, the growing need for lightweight and fuel-efficient car parts is propelling the expansion of this segment of the market. Also, lightweight vehicle parts or automobiles in general reduce the weight of the car at the same time it does not affect the performance and fuel efficiency of the vehicles. Therefore, the automobile industry is driving the industry growth.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

End User |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Tin Fluoborate Market - Regional Analysis

APAC Market Forecast

Asia Pacific industry is estimated to hold largest revenue share of 42% by 2035. This is attributed to the presence of major automobile manufacturing companies in the countries, such as Japan, India, China, and South Korea. These countries are a few of the biggest producers of automobiles and electronics in the world. As per the statistics by IEA, Japan, and India together registered sales of 8 million cars in 2019, whereas China alone saw the sale of 25 million cars in the same year. Besides, the metal cleaning industry is also anticipated to drive the growth of this market in the Asia Pacific region.

North American Market Statistics

The tin fluoborate market in the North America is anticipated to account for the second-largest share of 30% in the forecast period. This can be attributed to the growing demand for electric vehicles in the region. As per data, the United States solely generated a market revenue of USD 62 billion with the production of Electric Vehicles in 2023, and it is anticipated account for a market revenue of 140 billion by the end of 2027.

Moreover, the advancing healthcare sector in the United States is another major growth factor for the regional market. re is anticipated to boost the growth of the market in this region.

Tin Fluoborate Market Players:

- Kuntz Electroplating Inc. (KEI)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Crest Chemicals (Pty) Ltd.

- Lincoln Chemical Corporation

- Muby Chem Ltd

- Harshil Industries

- Sharretts Plating Company, Inc.

- Morita Chemical Industries Co. Ltd.

- Strem Chemicals, Inc. (Ascensus Specialties)

- Mitsubishi Chemical Corporation

- Otto Chemie Pvt. Ltd.

Recent Developments

- Ascensus Specialty LLC ("Ascensus") and Wind Point Partners announced that Ascensus has successfully acquired Strem Chemicals, Inc. In terms of research-grade, high-purity catalysts, ligands, organometallics, metal carbonyls, and CVD/ALD precursors, Strem is a world leader.

- Mitsubishi Chemical Corporation acquired all shares of Gelest Intermediate Holdings, Inc., the parent of Gelest, Inc. which is an America-based manufacturer, and supplier of silicones, organosilanes, metal-organics, and specialty monomers for advanced technology end markets.

- Report ID: 4015

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Tin Fluoborate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.