Therapy Gloves Market Outlook:

Therapy Gloves Market size was valued at USD 3.5 billion in 2025 and is projected to reach USD 6.6 billion by the end of 2035, rising at a CAGR of 8.3% during the forecast period 2026-2035. In 2026, the industry size of therapy gloves is assessed at USD 3.7 billion.

The global therapy gloves market is driven by the rise in patients admitted to hospitals with musculoskeletal and degenerative joint conditions. According to the U.S. Centers for Disease Control and Prevention (CDC) report, nearly 54 million people in the U.S. have received arthritis treatment, with osteoarthritis accounting for the majority. The Institute for Health Metrics and Evaluation also estimated that over 1 billion people are likely to be affected by osteoarthritis in 2050, and this number is expected to increase due to the increase in the aging population and sedentary lifestyles. This rising base is surging the need for non-invasive, at-home-based treatment solutions. The cost of production lies in the material shortages and changes in the supply chain, impacting the inputs such as elastic textiles and copper-infused yarns. Further, India and Malaysia export a high volume of raw materials and have experienced a shortage post-pandemic.

Newer technologies are allowing for better functional and user experience of gloves. The combination of therapy gloves and telehealth/remote monitoring platforms is extending their use in post-stroke and chronic care. Newer, lighter, and breathable materials are helping with compliance and wearability of therapy gloves. Barriers to entry exist at higher price points and limited insurance coverage, especially in lower-income markets. The growth is regionally stronger in Asia-Pacific, due to higher dollar spend in healthcare and more awareness strategies in the space. Generated markets continue to see new production and innovation of smart therapeutic wearables. But the overall development is changing the market regime towards an easy-to-use, tech-enabled rehabilitation solution that allows for clinical rehabilitation to be done from a home or in community care.

Key Therapy Gloves Market Insights Summary:

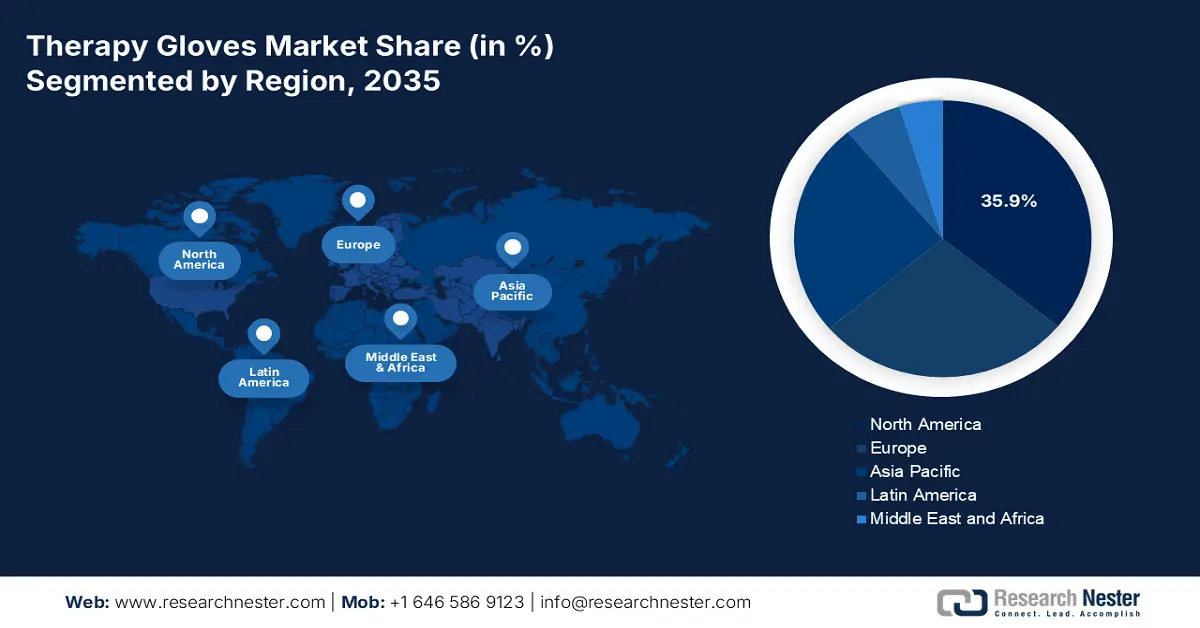

Regional Insights:

- North America is projected to hold 35.9% share by 2035, driven by the adoption of assistive and rehabilitative medical devices, rising geriatric populations, and expanded public reimbursement.

- APAC is expected to hold 25.2% share by 2035, impelled by the rise in musculoskeletal and arthritis conditions, aging population, and growing public healthcare investments.

Segment Insights:

- Compression Therapy is projected to account for 38.9% share by 2035, propelled by its effectiveness in reducing hand inflammation, relieving chronic pain, and enhancing circulation related to carpal tunnel syndrome and arthritis.

- Home Care End Users are expected to hold 31.9% share by 2035, owing to the rising geriatric population, increasing chronic musculoskeletal conditions, and the global shift toward non-invasive, self-managed rehabilitation.

Key Growth Trends:

- Growing government healthcare spending & reimbursement coverage

- Aging population and rising prevalence of arthritis

Major Challenges:

- High cost of advanced and robotic therapy gloves

- Limited clinical validation and regulatory hurdles

Key Players:3M Healthcare,Bauerfeind AG,IMAK Products Corp.,DJO Global / Enovis,Medi GmbH & Co. KG,Tynor Orthotics,Thermoskin,Nipro Corporation,Mueller Sports Medicine,Jobskin Ltd.,Saebo Inc.,Orthosleeve,Wellchem Pharmaceuticals,Oppo Medical Inc.,HansoMed GmbH,Doshisha Health,Maxflex,Truelife,Cigna Medical,Alpha Lifecare

Global Therapy Gloves Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.5 billion

- 2026 Market Size:USD 3.7 billion

- Projected Market Size: USD 6.6 billion by 2035

- Growth Forecasts: 8.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.9% Share by 2035)

- Fastest Growing Region: APAC

- Dominating Countries: United States, Germany, Japan, Canada, France

- Emerging Countries: China, India, South Korea, Brazil, Australia

Last updated on : 1 October, 2025

Therapy Gloves Market - Growth Drivers and Challenges

Growth Drivers

- Growing government healthcare spending & reimbursement coverage: Spending under Medicare on therapeutic hand devices—e.g., heat therapy gloves, compression gloves, and a variety of other passive modalities—grows steadily, pointing to increasing demand among an older population for more conservative, home-based treatments of musculoskeletal pain, joint stiffness, and conditions related to arthritis. Rehabilitative gloves can now be partially or fully reimbursed under Durable Medical Equipment (DME) coverage due to the introduction of HCPCS codes, which greatly increase patient access and affordability. This policy shift reduces out-of-pocket expenses and incentivizes healthcare providers to provide therapeutic gloves as part of routine care in rehabilitation plans.

- Aging population and rising prevalence of arthritis: A 2023 report by the World Health Organization states that, over 55-year-olds make up about 73% of those with osteoarthritis, and 60% of them are women. As people age, they are much more susceptible to musculoskeletal problems, especially arthritis, osteoarthritis, and rheumatoid arthritis. According to global health statistics, there are over 350 million individuals with arthritis, a very large proportion being older adults. Therapy gloves (heat therapy and compression therapy gloves) are gaining acceptance as a non-invasive method that reduces joint pain, swelling, and stiffness. As a non-invasive way to mitigate pain, they are a realistic and attainable alternative to medicines or surgery. These individuals also prefer independence and mobility. Age-related conditions will continue to grow and maintain the demand for these therapeutic devices.

- Technological advancements in smart and robotic gloves: Wearable health technology is rapidly innovating rehabilitation therapy gloves into smart rehabilitation therapies. The technology is becoming available for glove-type devices that have embedded sensors, artificial intelligence (AI) feedback mechanisms, and robotic features for hand mobility recovery, particularly for those who have had a stroke or spinal injury or other neurological deficits. These glove technology smart devices can track the movements of the patient’s hands in a treatment session, provide haptic feedback to the patient, modify the treatment session protocol in real time, and manage data obtained from the treatment. Smart gloves are valuable rehabilitation therapy tools in telephone-based or home rehabilitation care to minimize clinical in-person supervision from therapists.

Challenges

- High cost of advanced and robotic therapy gloves: Though basic compression and heat therapy gloves come at a modest price, more advanced gloves like robotic and sensory rehabilitation gloves can be incredibly expensive for many users. Moreover, the cost of the glove may include items such as maintenance, software updates, and even training, which, when factored in, could further increase total costs of ownership. As a result, despite clinical advantages in stroke rehabilitation, adoption remains low, especially for those where there is a lack of certain healthcare resources, usually only available in larger specialized hospitals or research facilities.

- Limited clinical validation and regulatory hurdles: A large number of novel therapy gloves, particularly those based on new technologies including artificial intelligence, haptic feedback, or soft robotics, lack reliable clinical validation. Without robust clinical trials and FDA or CE approval, most health professionals are reluctant to prescribe or recommend their use, and may have concerns about reimbursement permitting use as a medical device. Therefore, the delay in acceptance of a product into practice becomes clear and may also ultimately delay implementation and/or eligibility for reimbursement. In addition, the cumbersome and often expensive regulatory pathways for manufacturers lead to an increased cost and added length of time to introduce the devices or products to market for some manufacturers, discouraging new entrants into this area of the market.

Country-Specific Increase in Osteoarthritis (OA) Prevalence (1990–2019)

|

Country |

Prevalent Cases in 1990<br> (in millions) |

Prevalent Cases in 2019<br> (in millions) |

% Change (1990–2019) |

|

China |

~51.78 |

132.81 |

+156.58% |

|

India |

~23.47 |

62.36 |

+165.75% |

|

United States |

~28.88 |

51.87 |

+79.63% |

|

United Arab Emirates |

Not specified |

Not specified |

+1,069.81% |

|

Georgia |

Not specified |

Not specified |

–5.90% |

Source: John Wiley & Sons, In

Prevalent, incidence, and DALYs for knee osteoarthritis (KOA) in 2019 for sex, percent and rate by global and WHO regions

|

Region |

Prevalence (%) (Both) |

Prevalence Rate (Both) |

Incidence (%) (Both) |

Incidence Rate (Both) |

DALYs (%) (Both) |

DALYs Rate (Both) |

|

Global |

4.90% |

4,711.84 |

0.07% |

381.40 |

0.45% |

149.07 |

|

African Region |

1.82% |

1,763.73 |

0.03% |

174.75 |

0.12% |

114.56 |

|

Western Pacific Region |

7.64% |

7,319.87 |

0.13% |

558.28 |

0.86% |

234.01 |

|

Eastern Mediterranean |

2.40% |

2,284.79 |

0.04% |

227.09 |

0.22% |

72.59 |

|

South-East Asia Region |

3.49% |

3,399.97 |

0.06% |

302.33 |

0.33% |

106.71 |

|

Region of the Americas |

5.96% |

5,671.63 |

0.08% |

446.58 |

0.59% |

177.09 |

|

European Region |

6.76% |

6,424.67 |

0.09% |

476.46 |

0.62% |

201.91 |

Source: frontiers

Therapy Gloves Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.3% |

|

Base Year Market Size (2025) |

USD 3.5 billion |

|

Forecast Year Market Size (2035) |

USD 6.6 billion |

|

Regional Scope |

|

Therapy Gloves Market Segmentation:

Product Type Segment Analysis

The compression therapy leads the segment and is expected to hold the market share of 38.9% by 2035. The compression therapy sub-segment is driven by the effectiveness in the reduction of hand inflammation, relieving chronic pain symptoms, and enhancing circulation related to carpal tunnel syndrome and arthritis. As per the Agency for Healthcare Research and Quality, the use of compression gloves among patients has enhanced the affordability, surging adoption among elderly patients in outpatient settings. These gloves are high used in clinical care guidelines for home-based rehabilitation, due to their long-term chronic pain management.

End user Segment Analysis

By 2035, there will be a shift in end users of therapy gloves, as home care environments will account for 31.9% of worldwide revenues. This will be made possible due to a greater geriatric population, increasing prevalence of chronic musculoskeletal conditions, and an overall global trend toward non-invasive, self-managed rehabilitation; in particular, more chronic joint management and post-operative healing are taking place in home care settings. This trend will quickly escalate with the widespread availability of therapy gloves, through e-commerce and direct-to-consumer health platforms, allowing patients- especially in remote and underserved areas- an easier option to obtain therapy gloves.

Application Segment Analysis

Rheumatoid Arthritis is anticipated to be the leading subsegment in the therapy gloves market because it is a chronic disease and potentially has broad prevalence and a consistent need for long-term management of symptoms. Compression and heat therapy gloves will present a non-invasive way for patients to manage their symptoms, thus increasing compliance on a daily basis. As for the rheumatoid arthritis subsegment, this will benefit from a wide array of innovations in the product development phase, including copper-infused gloves, thermal gloves, and gloves made with smart technology that utilize motion sensors - all made to increase comfort and mobility for chronic users.

Our in-depth analysis of the global therapy gloves market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Therapy Gloves Market - Regional Analysis

North America Market Insights

The therapy gloves market in North America is projected to hold the market share of 35.9% at a CAGR of 8.2% by 2035. The market is driven by the adoption of assistive and rehabilitative medical devices, rising geriatric populations, and expanded public reimbursement. The Medicare and Medicaid reimbursements are covered with the introduction of HCPCS codes for therapy gloves under durable medical equipment. On the other hand, Canada has maximized the investments under provincial and federal budgets for non-invasive therapies. The technology advancements are the key factors driving the demand, with the investments in sensor-integrated gloves and digital rehabilitation protocols. The region has strong support from health care providers and favorable government policies targeting stroke and arthritis recovery.

The U.S. market for therapy gloves is steadily expanding. The growth is influenced by an aging population susceptible to arthritis and musculoskeletal disorders. Medicare and private insurance programs are increasingly covering therapeutic devices. Further, this is improving access to therapy gloves. Technological advancements with simple gloves all the way to smart and robotic gloves are widely embraced in rehabilitation centers and at home. An increase in non-invasive therapies and an increase in outpatient and home care have influenced market growth.

Market growth in Canada is driven by heightened cases of arthritis and chronic hand conditions in older populations. The strength of the healthcare infrastructure and reimbursement policies in Canada promotes the demand for therapy gloves. A quickening take-up of home care services, rehabilitation programs, and healthcare models exhibiting greater uptake of non-invasive / self-managed therapies bolsters demand. Furthermore, public health programs promoting early intervention and management of pain can also support the market display of demand.

Asia Pacific Market Insights

The APAC is the fastest-growing region in the therapy gloves market is expected to have a market share of 25.2% at a CAGR of 9.4% by 2035. The region is experiencing a rapid expansion and is driven by a rise in the prevalence of musculoskeletal and arthritis conditions, an increase in the aging population, and growing public healthcare investments. In 2024, countries such as China and Japan 2024 have made financial allocations to outpatient recovery programs and rehabilitative devices. Further, South Korea and India experience a rise in patient volumes, and access to non-invasive therapy devices is increasing based on the insurance coverage and domestic production. Localized R&D, advantageous reimbursement programs, and the creation of inexpensive, sensor-integrated gloves to improve accessibility and adherence in outpatient care all contribute to this regional impetus.

India's therapy gloves market growth stems from the increasing geriatric population and the growing incidence of arthritis and lifestyle-related musculoskeletal disorders, seeing consistent growth. Another market penetration support element includes awareness of healthcare leverage, the increasing affordability of therapy gloves, Toyota walikota through indigenous manufacturing and imports. The global trend of providing home-based rehabilitation care combined with a shift towards non-invasive treatments is gaining traction in India as hospital infrastructure is insufficient and there are growing costs associated with hospitalization. Urbanization and disposable income will enable broader access to these aids.

The market in China is experiencing growth from an elderly population and increased prevalence of chronic diseases or conditions such as arthritis and arthritis-related disabilities as a result of stroke. The recent infrastructure investment in human capital and the advent of private rehabilitation centers have increased both the provision and awareness of therapy gloves. The growing middle class, combined with the health challenges of adopting digital health and telemedicine, creates expanding both direct and indirect demand for smart therapeutic gloves and wearable gloves. Local production capability and value chains are evolving to enhance local production and reduce costs while increasing user access equity.

Europe Market Insights

Europe’s market in the therapy gloves market is expanding and is expected to have a market share of 27.9% with a CAGR of 7.9% by 2035. The market is fueled by rising arthritis, aging demographics, musculoskeletal cases, and rising public investments in outpatient rehabilitation care. Countries including France, Japan, and the UK are experiencing strong growth by incorporating non-invasive therapy into national health strategies. The government programs have also focused on post-operative rehabilitation, and early-stage arthritis has enhanced the reimbursement pathways for therapeutic gloves. Furthermore, the EU's emphasis on preventative care, particularly for the elderly and stroke survivors, makes therapeutic gloves an affordable and expandable option.

Germany is Europe's biggest therapy glove market and is poised to have a market share of 8.9% by 2035. The Federal Ministry of Health (BMG) widened reimbursement coverage under the GKV statutory health insurance scheme, making therapy gloves reimbursable for patients suffering from chronic rheumatic and neuromuscular conditions. The German Medical Association also started new initiatives, such as revised clinical guidelines supporting the early use of therapeutic wearables. Investment in R&D for intelligent glove technology within the country's Digital Health Strategy has made Germany a development hotbed for AI-based therapeutic products.

The stable upward trajectory of therapy gloves in France is still driven simply by the existing healthcare routing and strong reimbursement protocols related to therapeutic devices. An aging population and high incidence of arthritis and chronic joint conditions, creates a need for non-invasive treatment options, where therapy gloves are ideal. France has an additional advantage of high patient awareness of therapy gloves and physician recommendation of the gloves as part of conservative care approaches. Moreover, the availability of advanced, clinically-validated gloves in the market promotes consistent adoption.

Key Therapy Gloves Market Players:

- 3M Healthcare

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bauerfeind AG

- IMAK Products Corp.

- DJO Global / Enovis

- Medi GmbH & Co. KG

- Tynor Orthotics

- Thermoskin

- Nipro Corporation

- Mueller Sports Medicine

- Jobskin Ltd.

- Saebo Inc.

- Orthosleeve

- Wellchem Pharmaceuticals

- Oppo Medical Inc.

- HansoMed GmbH

- Doshisha Health

- Maxflex

- Truelife

- Cigna Medical

- Alpha Lifecare

The global therapy gloves market is very competitive with the key players such 3M Healthcare and Bauerfeind, and the regional players including Tynor Orthotics and Thermoskin. These companies adopt various strategies to enhance access and affordability through local manufacturing and strategic partnerships. Growing investments in smart therapeutic wearables by companies such as Saebo Inc. and Doshisha Health indicate a move towards digital rehabilitation. Further, the market leaders are also undergoing reimbursement partnerships and entering the start-up markets via regional alliances to address the aging populations and chronic disease prevalence.

Recent Developments

- In April 2025, using state-of-the-art neuroscience, two Rice University students are creating a wearable, reasonably priced treatment for Parkinson's disease sufferers worldwide. The promising research from Stanford University's Peter Tass lab investigates how randomized vibratory impulses applied to the fingertips may aid in rewiring misfiring neurons in the brain.

- In February 2024, Research on integrating "smart gloves" into therapy regimens began with a group of stroke survivors in British Columbia. The gloves, which were created in partnership with the Faculty of Medicine, Faculty of Applied Science, and Vancouver-based startup Texavie Technologies Inc., are intended to offer treatment feedback at a significantly lower cost than current motion-capture systems.

- Report ID: 1882

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Therapy Gloves Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.