Tetrahydrophthalic Anhydride Market Outlook:

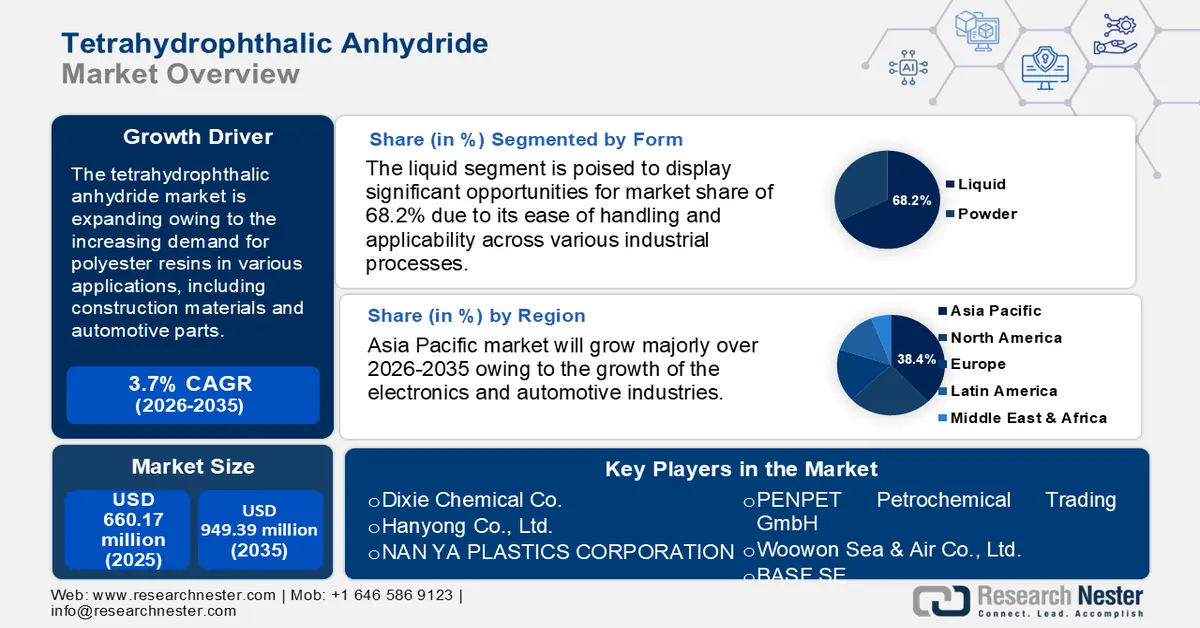

Tetrahydrophthalic Anhydride Market size was over USD 660.17 million in 2025 and is poised to exceed USD 949.39 million by 2035, growing at over 3.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of tetrahydrophthalic anhydride is estimated at USD 682.15 million.

The global tetrahydrophthalic anhydride market is anticipated to expand due to the surging demand for polyester resins. Polyester resins are widely used in a variety of applications, from construction materials to automotive body parts, and are renowned for their strength, flexibility, and resilience to environmental influences.

The construction business is expanding significantly as a result of the global acceleration of urbanization, particularly in emerging economies. The demand for cost-effective and performance-oriented building materials, such as polyester resins that guarantee structural integrity and aesthetic excellence, is being driven by this increase.

Polyester resins are essential to the growing usage of composite materials in the automotive industry as a result of the drive for lighter and more fuel-efficient automobiles. Panels, fittings, and linings are just a few of the automotive parts made from these resins that help lighten vehicles and improve fuel economy. Tetrahydrophthalic anhydride is a crucial component in the synthesis of these materials, and its adoption is encouraged by environmental restrictions that aim to reduce emissions.

Key Tetrahydrophthalic Anhydride Market Insights Summary:

Regional Highlights:

- Asia Pacific is predicted to hold a 38.4% share by 2035, propelled by rapid industrialization and growth in electronics and automotive industries.

- North America is expected to grow significantly during 2025–2035, owing to strong demand for THPA in high-performance coatings and resins supported by advanced manufacturing and regulatory frameworks.

Segment Insights:

- Liquid segment is projected to account for 68.2% share by 2035, driven by ease of handling and versatile applicability across industrial processes.

- Industrial segment is anticipated to secure a significant market share by 2035, owing to the growing demand for polyester resins in construction and automotive sectors.

Key Growth Trends:

- Rising demand for eco friendly and bio based products

- Surging utilization in the production of high performance composite materials

Major Challenges:

- Stringent environmental regulations

- Fluctuating raw material prices

Key Players: ANHUI MEISENBAO TECHNOLOGY CO., LTD., Dixie Chemical Co., Hanyong Co., Ltd., NAN YA PLASTICS CORPORATION, PENPET Petrochemical Trading GmbH, Puyang Huicheng Electronic Material Co., Ltd., Woowon Sea & Air Co., Ltd., Xiamen Ditai Chemicals Co., Ltd., BASF SE, Evonik Industries AG.

Global Tetrahydrophthalic Anhydride Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 660.17 million

- 2026 Market Size: USD 682.15 million

- Projected Market Size: USD 949.39 million by 2035

- Growth Forecasts: 3.7%

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.4% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, India, United States, Germany, Japan

- Emerging Countries: South Korea, Brazil, Mexico, Canada, Australia

Last updated on : 3 December, 2025

Tetrahydrophthalic Anhydride Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand for eco-friendly and bio-based products: Industries are moving toward greener solutions that lessen their impact on the environment without sacrificing performance as environmental sustainability becomes a more urgent worldwide priority. In the chemical industry, where conventional production methods and products frequently result in hazardous emissions and poisonous byproducts, this tendency is especially pertinent. Tetrahydrophthalic anhydride is a crucial component in the manufacturing of polyester resins, coatings, and plasticizers, and it is mostly utilized as a curing agent in epoxy resins. These applications are essential to many different industries, such as electronics, construction, and the automobile sector.

Additionally, the tetrahydrophthalic anhydride production process can be made more sustainable overall by implementing green chemistry principles. The production process can be made more ecologically friendly by integrating strategies like solvent recovery, waste reduction, and process intensification. In addition to opening up new tetrahydrophthalic anhydride markets, this strategy change may help producers by lowering expenses related to waste management and the acquisition of raw materials. - Surging utilization in the production of high-performance composite materials: These composites are essential in sectors including sports equipment, automotive, and aircraft, where material performance is crucial. Tetrahydrophthalic anhydride's special qualities make it an essential part of advanced manufacturing since they improve the mechanical strength, durability, and heat resistance of composites when used as a curing agent in epoxy resins. The need for advanced composites has increased due to the push for materials that are stronger, lighter, and use less energy. For instance, lowering aircraft weight is a crucial objective in the aerospace sector to increase fuel economy and lower carbon emissions. The use of epoxy resins based on tetrahydrophthalic anhydride is used to create lightweight components that can endure the high stresses of flight.

Challenges

- Stringent environmental regulations: A derivative of phthalic anhydride, tetrahydrophthalic anhydride, finds widespread application as a curing agent for epoxy resins as well as in the production of polyester resins, coatings, and plasticizers. It is used in several industries, including electronics, construction, and automobiles. However, the materials used in its production have sparked health and environmental concerns, prompting stringent regulatory oversight worldwide. To lessen their effects on the environment and public health, environmental organizations like the European Chemicals Agency (ECHA) in Europe and the Environmental Protection Agency (EPA) in the United States have placed strict rules on chemicals. These rules mandate that producers follow safe production procedures, make sure waste is disposed of properly, and reduce volatile organic compound (VOC) emissions.

- Fluctuating raw material prices: Manufacturers' profit margins may suffer from changes in the cost of petrochemicals, a crucial component in the production of THPA. The U.S. Energy Information Administration reports that the price of crude oil has fluctuated significantly in recent years, which has a direct impact on the expenses related to the production of THPA. Furthermore, strict laws governing the manufacture and emissions of chemicals may present further difficulties as businesses attempt to meet environmental requirements while preserving production effectiveness.

Tetrahydrophthalic Anhydride Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.7% |

|

Base Year Market Size (2025) |

USD 660.17 million |

|

Forecast Year Market Size (2035) |

USD 949.39 million |

|

Regional Scope |

|

Tetrahydrophthalic Anhydride Market Segmentation:

Form Segment Analysis

The liquid segment in tetrahydrophthalic anhydride market is projected to gain a 68.2% market share by 2035. The widespread adoption of the liquid form can be primarily attributed to its ease of handling and its applicability across various industrial processes, particularly in the production of coatings and resins. The fluidity of this form enhances both mixing efficiency and chemical reactions. Numerous companies seeking to optimize their processes and ensure consistent quality prefer the liquid form due to its versatility and production efficiency.

Application Segment Analysis

The industrial segment in tetrahydrophthalic anhydride market is anticipated to garner a significant share during the assessed period. The widespread use of polyester resins in the construction and automotive sectors, where their resilience to environmental influences and longevity are highly prized, is the main reason for this segment's dominance. Because polyester resins are used in fiberglass and coatings, there is a steady increase in demand for them in this sector.

Our in-depth analysis of the global tetrahydrophthalic anhydride market includes the following segments:

|

Purity |

|

|

Form |

|

|

Application |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Tetrahydrophthalic Anhydride Market - Regional Analysis

APAC Market Insights

The Asia Pacific tetrahydrophthalic anhydride market is predicted to garner a 38.4% share by 2035. Rapid industrialization, the growth of the electronics and automotive industries, and significant expenditures in infrastructure development—particularly in China and India—are all factors contributing to this region's supremacy. The demand for THPA, which is widely utilized in both electrical and automotive components, is driven by these variables taken together.

Despite their diminutive size, these places are showing promise as prospects for expansion. Urbanization and the slow expansion of industry are predicted to boost the use of THPA-based goods. Over the course of the forecast period, the growth of the automotive and construction industries, as well as the development of local manufacturing capabilities, is anticipated to support market expansion in these regions.

North America Market Insights

North America tetrahydrophthalic anhydride market is expected to grow at a significant rate during the projected period. Given its wide range of applications in sectors like resins, coatings, and chemical intermediates, the market exhibits unique dynamics and growth potential across multiple worldwide regions. Demand for THPA in high-performance coatings and resins is increased in North America due to strong manufacturing sectors and strict environmental laws. Important growth drivers in this area include the existence of major chemical producers and improvements in production technology.

Tetrahydrophthalic Anhydride Market Players:

- ANHUI MEISENBAO TECHNOLOGY CO., LTD.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent developments

- Regional Presence

- SWOT Analysis

- Dixie Chemical Co.

- Hanyong Co., Ltd.

- NAN YA PLASTICS CORPORATION

- PENPET Petrochemical Trading GmbH

- Puyang Huicheng Electronic Material Co., Ltd.

- Woowon Sea & Air Co., Ltd.

- Xiamen Ditai Chemicals Co., Ltd.

- BASF SE

- Evonik Industries AG

Several major players are present in the tetrahydrophthalic anhydride market, and they greatly influence its dynamics through strategic initiatives, manufacturing capacity, and innovation. Huntsman Corporation, Evonik Industries AG, and BASF SE are notable firms in this sector that have a significant impact on the tetrahydrophthalic anhydride market environment.

Recent Developments

- In March 2025, BASF and Sika collaborated to develop a novel amine building block for curing epoxy resins, which is currently commercially accessible under BASF's Baxxodur EC 151 trademark. This discovery is especially interesting for flooring applications in manufacturing plants, storage and assembly halls, and parking decks.

- In September 2024, Evonik's comprehensive curing agent range now include two new polyamide-based epoxy curing agents for the Americas region: Ancamide 2853 and Ancamide 2865. These new products are part of Evonik's commitment to offering innovative, high-performance solutions to the coatings industry to set new benchmarks in flexibility, strength, and environmental safety.

- Report ID: 7669

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Tetrahydrophthalic Anhydride Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.