Telepsychiatry Software Market Outlook:

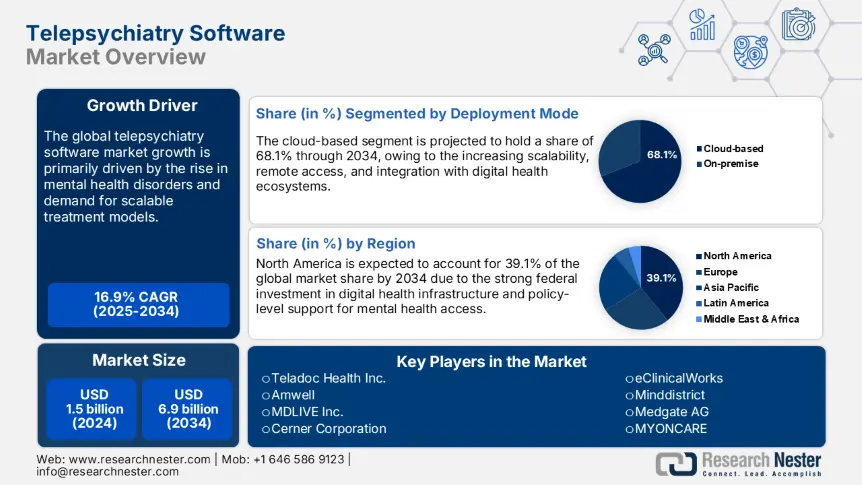

Telepsychiatry Software Market size was valued at USD 1.5 billion in 2024 and is projected to reach USD 6.9 billion by the end of 2034, rising at a CAGR of 16.9% during the forecast period, from, 2025 to 2034. In 2025, the industry size of telepsychiatry software is estimated at USD 1.8 billion.

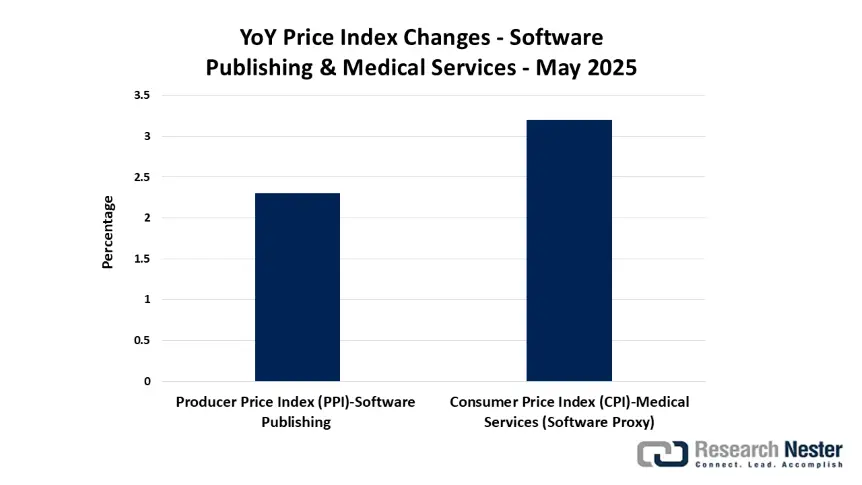

The specialized components and materials are vital for the production and commercialization of efficient telepsychiatry software solutions. The upstream vendors rely on FedRAMP-certified cloud hosting and secure video APIs to ensure compliance and scalability. Considering the midstream segment, the software development is intensified in the U.S., EU, and some parts of Asia, with HIPAA-compliant hardware sourced through regulated IT channels. Around 2.3% year-over-year rise in the producer price index for software publishing was reported in May 2025, underlining moderate cost pressures in this segment, says the U.S. Bureau of Labor Statistics (BLS).

In the downstream segment, it is disclosed that the healthcare providers integrate telepsychiatry platforms into Electronic Health Record systems, prioritizing interoperability to improve patient care. The same source also states that the consumer price index for medical services, a proxy for software cost pass-through, grew by 3.2% year-over-year, revealing stable cost absorption by healthcare institutions. Also, as the demand for virtual mental health solutions grows, the market continues to balance innovation, regulatory compliance, and economic stability to support seamless delivery of telepsychiatry services. Furthermore, the federal grants and innovation programs are supporting technological innovations. Telehealth infrastructure modernization programs are set to boost the sales of telepsychiatry software solutions in the coming years.

Telepsychiatry Software Market - Growth Drivers and Challenges

Growth Drivers

-

Rise in mental health disorders and demand for scalable treatment models: The rising cases of mental health disorders are estimated to boost the sales of telepsychiatry software solutions globally. As per World Health Organization (WHO) reports, depression affects more than 280.3 million people globally, followed by anxiety disorders. The surge in depression cases is necessitating healthcare systems to adopt scalable and tech-driven interventions. Some high-income countries are scaling their national telehealth programs to expand mental health coverage, which is likely to open lucrative doors for key market players. The telepsychiatry software technologies are poised to bridge the gap between the growing demand and limited psychiatric care availability across the world. Furthermore, the industry giants are focusing on localizing software for different languages to earn high profits.

-

Increase in corporate mental health programs: The increasing shift in employer preference toward mental health is driving corporations to expand teletherapy benefits to their employees. As per Mercer’s 2024 Global Benefits Survey, nearly 67.5% of multinational companies now offer remote psychiatric services, up from 41.6% in 2022. Moreover, anonymous access through employer-sponsored services is uplifting in Southeast Asia and Latin America, where stigma remains high. Overall, the corporate sector is expected to double the profits of leading telepsychiatry software companies in the years ahead.

Technological Innovations in the Telepsychiatry Software Market

The AI-powered diagnostics, EHR integration, and cloud-native architecture are expected to boost the sales of telepsychiatry software. Beyond healthcare, in finance, AI-driven mental health platforms are gaining traction through employee wellness programs. The continuous investments in technological innovations are further set to open high-earning opportunities for key players. The table below reveals the current technological trends and their outcomes.

|

Technology |

Industry |

Adoption |

Company Example |

Outcome/Impact |

|

AI Diagnostic Tools (NLP/Chatbots) |

Finance |

61.5% |

PwC (via Wysa AI) |

33.5% drop in stress-related absenteeism |

|

EHR Integration (FHIR APIs) |

Healthcare |

89.4% |

Teladoc Health |

27.2% faster clinician response time |

|

Cloud-Native Deployment |

Telecom |

72.2% |

AT&T |

2.5x rise in employee teletherapy access |

Industry Strategies Driving Telepsychiatry Software Momentum

|

Company / Program |

Strategy |

2023 Metric |

Revenue Impact / Saving |

|

NC‑STeP (gov‑funded) |

ED + Community telepsychiatry expansion |

63,360 ED visits; ~$59.2 M saved |

$0.98M saved per 1k visits |

|

Telehealth software sector |

US telehealth CAGR 23.6% (2023–28) |

$120.7 B → $285.9 B market |

Market expansion potential |

|

APA member practices |

Hybrid telepsychiatry adoption |

95% providers; 82% video use |

Captures reimbursement revenue |

|

US telehealth total valuation |

Growth in overall industry |

$48.8 B in 2023; projected higher |

Implicit software licensing uplift |

|

Rural telehealth deployment |

Workflow + broadband integration |

Informs equipment/software needs |

Opens rural licensing revenue |

Source: ACPL, HRSA

Challenges

-

Pricing pressures due to public sector procurement norms: The high costs of telepsychiatry software technologies are likely to hamper the sales of telepsychiatry software technologies to some extent. Governments are imposing price caps or demanding low-cost procurement, making SaaS-based telepsychiatry platforms financially unsustainable in emerging markets. Digital health contracts in Kenya, Brazil, and Thailand required fixed pricing models that excluded scalability tiers, per the WTO Government Procurement Review. Such pricing pressure is deterring companies from investing in developing regions. Tight margins and hefty capex requirements are set to lower the SMEs' interest in expansion strategies.

-

Limited digital infrastructure in emerging markets: The low internet penetration and poor broadband quality are some of the prime factors hampering the sales of telepsychiatry software solutions in emerging markets. Only 37.5% of sub-Saharan Africa had stable internet access in 2024, as per World Bank’s ICT data. The developing regions are expected to offer low ROIs to key players owing to budget constraints for infrastructure expansions. However, some industry giants are entering emerging economies and forming strategic partnerships with public entities to expand their operations.

Telepsychiatry Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

16.9% |

|

Base Year Market Size (2024) |

USD 1.5 billion |

|

Forecast Year Market Size (2034) |

USD 6.9 billion |

|

Regional Scope |

|

Telepsychiatry Software Market Segmentation:

Deployment Mode Segment Analysis

The cloud-based segment is projected to capture 68.1% of the global telepsychiatry software market share by 2034. The increasing scalability, remote access, and integration with digital health ecosystems are driving the sales of cloud-based solutions. More than 91.5% of Medicare-participating providers in 2024 used some form of cloud-integrated telehealth system, says the U.S. Department of Health and Human Services (HHS). Cloud-based solutions are most sought-after owing to their real-time data processing, EHR integration, and multi-device access. The public and private infrastructures are both deploying cloud-based telepsychiatry software solutions.

End user Segment Analysis

The hospitals & clinics segment is poised to account for 43.5% of the global market share throughout the forecast period. The institutional funding, multi-specialty service delivery, and integration with insurance reimbursement programs are propelling the adoption of telepsychiatry software solutions in hospitals & clinics. The Centers for Medicare & Medicaid Services (CMS) has expanded telepsychiatry reimbursement permanently under the 2024 Medicare Physician Fee Schedule, incentivizing clinics and hospitals to deploy licensed platforms in the U.S. The hospital-based psychiatric care also expanded post-COVID due to high suicide and depression rates, which directly drives the demand for tech-based support systems.

Our in-depth analysis of the global telepsychiatry software market includes the following segments:

|

Segment |

Subsegments |

|

Deployment Mode |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

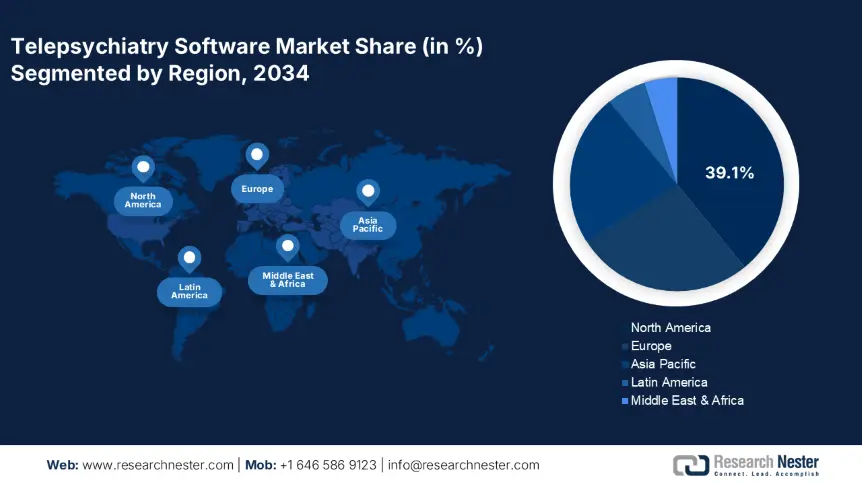

Telepsychiatry Software Market - Regional Analysis

North America Market Insights

The North America telepsychiatry software market is estimated to hold 39.1% of the global revenue share through 2037, owing to strong federal investment in digital health infrastructure and policy-level support for mental health access. The mature ICT ecosystems and high broadband penetration are also contributing to the increasing adoption of telepsychiatry software systems. The structured reimbursement systems that make virtual psychiatric services both viable and scalable are further pushing the production and commercialization of telepsychiatry software solutions.

In the U.S., telepsychiatry software sales are driven by the supportive regulatory polices and healthcare reimbursement models. The hefty government spending on healthcare and ICT sectors is likely to accelerate the trade of telepsychiatry software solutions in the years ahead. The Federal Communications Commission’s (FCC) Connected Care Pilot Program invested nearly USD 100.5 million to fund virtual care initiatives in 2023, prioritizing rural and underserved mental health needs. The strong presence of advanced healthcare infrastructure and skilled medical experts is also promoting the adoption of telepsychiatry software solutions.

Europe Market Insights

The Europe market is expected to account for 27.5% of global revenue share throughout the study period. The substantial digital health funding and institutional EHR integration are propelling the sales of telepsychiatry software solutions. The growing mental health concerns are leading to expanded digital health access via EU-backed programs. The European Commission’s Digital Europe Programme invested nearly €7.6 billion in digital health innovations in 2023, including scalable psychiatric software systems. The digital shift and multilingual teletherapy service needs are further promoting the adoption of advanced telepsychiatry software solutions.

The sales of telepsychiatry software technologies in Germany are likely to be driven by digital health policy mandates and insurance-backed integration. The presence of advanced healthcare infrastructure is contributing to the increasing sales of telepsychiatry software solutions. The country’s telepsychiatry software spending reached €730.5 million in 2024. The rollout of the Digital Health Act is also aiding companies to earn lucrative gains. The Federal Ministry for Digital and Transport (BMDV) invested more than €1.4 billion to expand eHealth infrastructure under its Digital Healthcare Agenda 2025. Overall, government support in the form of subsidies and policies is driving the sales of telepsychiatry software systems.

Country-Specific Insights

|

Country |

Telepsychiatry Demand (2024) |

% of National ICT Budget to Telepsychiatry |

|

United Kingdom |

£480.3 million |

4.4% (2023) → 5.9% (2024) |

|

Germany |

€730.5 million |

5.5% (2023) → 6.9% (2024) |

|

France |

€460.2 million |

4.0% (2021) → 5.5% (2023) |

APAC Market Insights

The Asia Pacific telepsychiatry software market is foreseen to increase at a CAGR of 17.6% from 2025 to 2034. The large-scale government digital health investments and expanding broadband infrastructure are expected to increase the adoption of telepsychiatry software technologies. The regional governments are actively integrating telepsychiatry solutions into national e-health strategies, which is attracting several international players. The digital shift and telehealth initiatives are also poised to double the revenues of key players in the years ahead. China, India, South Korea, and Japan are the most lucrative marketplaces in the region.

China leads the sales of telepsychiatry software solutions due to the massive government investments and favorable regulatory reforms. The public spending on telepsychiatry solutions has increased by 180.4% over the past five years. The presence of high-tech companies is leading to innovation in the telepsychiatry software field. The Ministry of Industry and Information Technology (MIIT) and China Academy of Information and Communications Technology (CAICT) prioritize mental health AI platforms and cloud-based psychiatric systems under the Health China 2030 strategy, which directly promotes the sales of telepsychiatry software technologies.

Country-Specific Insights

|

Country |

2023 Govt. Spend |

Adoption Statistics |

|

Japan |

$2.0B |

2.9% of the national tech budget |

|

India |

$3.2B |

5.8M+ businesses using platforms (2023) |

|

Malaysia |

↑112.2% |

Adoption doubled (2013-2023) |

|

South Korea |

KRW 310B |

National integration of e-consults in 2023 |

Key Telepsychiatry Software Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global market is characterized by the presence of gigantic players and the increasing emergence of new companies. Top companies are each leveraging EHR integration, AI-driven diagnostics, and payer-friendly models to attract a wider consumer base. They are also collaborating with other players to enhance their product offerings. Leading companies are entering into merging markets to earn fruitful gains from untapped opportunities. The organic and inorganic strategies are anticipated to double the revenues of key players in the coming years.

Here is a list of key players operating in the global market:

|

Company Name |

Country of Origin |

Revenue Share 2024 |

|

Teladoc Health Inc. |

United States |

14.3% |

|

Amwell (American Well Corporation) |

United States |

10.8% |

|

MDLIVE Inc. |

United States |

8.7% |

|

Cerner Corporation (Oracle Health) |

United States |

8.0% |

|

eClinicalWorks |

United States |

6.5% |

|

Minddistrict |

Netherlands |

xx% |

|

Medgate AG |

Switzerland |

xx% |

|

MYONCARE (Qurasoft GmbH) |

Germany |

xx% |

|

1DocWay (acquired by Genoa Healthcare) |

United States |

xx% |

|

Healthdirect Australia |

Australia |

xx% |

|

Wysa Ltd. |

India |

xx% |

|

MindBeacon Group |

Canada |

xx% |

|

Doctor Anywhere |

Singapore |

xx% |

|

QueueMed Healthtech |

Malaysia |

xx% |

Below are the areas covered for each company in the market:

Recent Developments

- In April 2024, Wysa announced the launch of Wysa Insights for corporate wellness programs. The company states that this launch led to a 36.3% rise in enterprise adoption in FY 2024.

- In March 2024, Teladoc Health introduced the Mental Health Navigator platform. This solution offers AI-based triaging and personalized therapist matching.

- In January 2024, Amwell and Cisco collaborated to introduce a Zero-Trust cybersecurity architecture tailored for telepsychiatry platforms. Early adopters in the U.S. healthcare system reported a 42.5% fall in unauthorized access attempts compared to legacy systems.

- Report ID: 3903

- Published Date: Jul 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Telepsychiatry Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert