Telecom Transformers Market Outlook:

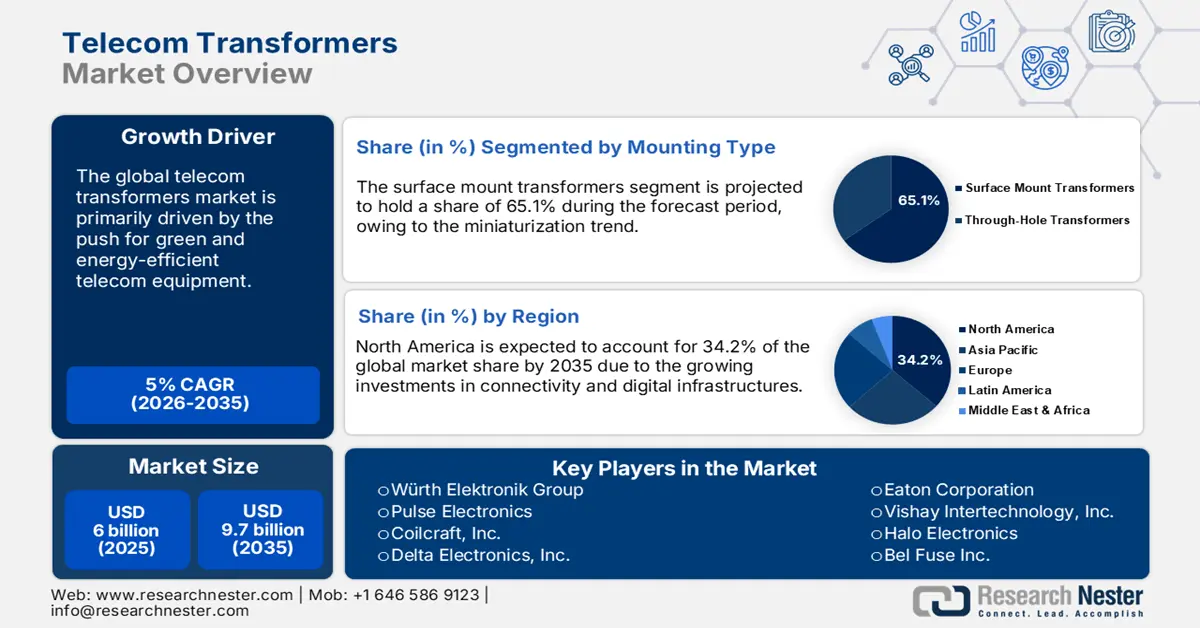

Telecom Transformers Market size was USD 6 billion in 2025 and is estimated to reach USD 9.7 billion by the end of 2035, expanding at a CAGR of 5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of telecom transformers is assessed at USD 6.3 billion.

The steady supply of raw materials and specialized components is expected to drive the sales of telecom transformers in the years ahead. Asia, North America, and Europe dominate the specialized assembly and production of telecom transformers. Copper, ferrites, and laminated cores are primary materials used in telecom transformer components. Global copper mine production grew from 22.2 million metric tons in 2022 to 22.8 million metric tons in 2023, according to the U.S. Geological Survey (USGS). The growing availability of copper and ferrites, along with innovations in core materials, directly supports stable production and cost efficiency in telecom transformers. According to the Observatory of Economic Complexity, the global trade of copper alloys reached USD 308 million in 2023. This stable raw material supply ensures that manufacturers can meet the rising global demand from 5G and broadband network expansions.

Top Exporters and Importers of Copper Alloys in 2023

|

Countries |

Value |

|

Exporters |

|

|

Democratic Republic of the Congo |

USD 107 million |

|

Belgium |

USD 66.1 million |

|

South Korea |

USD 21.5 million |

|

Importers |

|

|

China |

USD 123 million |

|

Germany |

USD 57.3 million |

|

Italy |

USD 11.5 million |

Source: OEC

The rising demand for high-speed internet and increasing data traffic is expected to fuel the telecom transformers market growth further. With the explosion of video streaming, cloud services, remote work, IoT, and richer content, per-user internet data U.S.ge has climbed sharply. In many markets, users are consuming several tons of gigabytes per month, up from just a few gigabytes a few years ago. This growth has encouraged telecom operators and infrastructure providers to scale up backhaul capacity, deploy more base stations, especially 5G, expand edge computing, and build larger data centers.

All of this needs robust, efficient transformer components to supply stable, isolated power, handle higher loads, and enhance signal integrity. A recent instance from India depicts these pressures. According to Nokia’s Mobile Broadband Index (MBiT) 2025, India’s average monthly data consumption per user reached 27.5 GB in 2024, and 5G data traffic in India tripled over the year. Alongside, broadband subscriber numbers rose sharply from 84.6 crore in March 2023 to 92.4 crore in March 2024, which is nearly a 9.1% annual boost.

Key Telecom Transformers Market Insights Summary:

Regional Highlights:

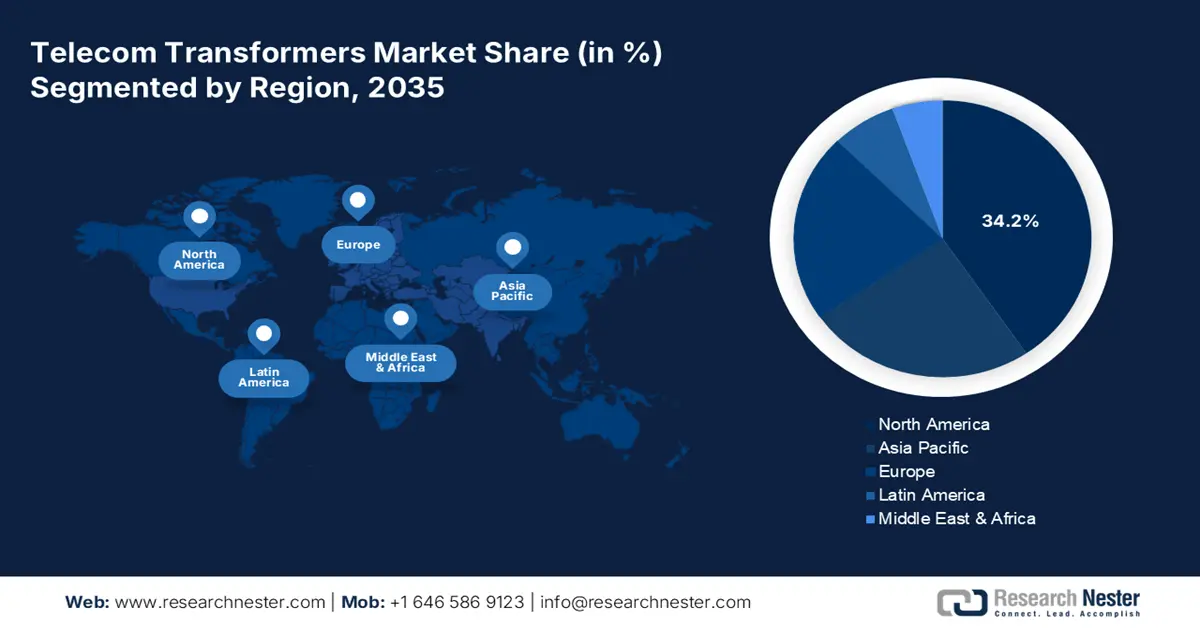

- North America is projected to command a 34.2% share of the telecom transformers market between 2026 and 2035, owing to large-scale 5G infrastructure investments and broadband modernization across the U.S. and Canada.

- Asia Pacific is anticipated to maintain a substantial market position through 2035, supported by extensive 5G rollouts, government ICT initiatives, and increasing demand for energy-efficient telecom components.

Segment Insights:

- The surface mount transformers segment is projected to dominate the telecom transformers market with a 65.1% share throughout the forecast period, propelled by growing miniaturization trends in IoT modules and small-cell network deployments.

- The telecommunications segment is anticipated to secure a 42.5% share by 2035, driven by the rapid expansion of 5G infrastructure and increasing investments in fiber optic and satellite communication networks.

Key Growth Trends:

- Growth of Fiber-to-the-Home (FTTH) and data centers

- Governmental policy, regulatory support, and infrastructure modernization

Major Challenges:

- Price volatility in raw materials

- Trade tariffs and geopolitical barrier

Key Players: Würth Elektronik Group, Pulse Electronics (Yageo Group), Coilcraft, Inc., Delta Electronics, Inc., Eaton Corporation, Vishay Intertechnology, Inc., Halo Electronics, Bel Fuse Inc., Samsung Electro-Mechanics, Premier Magnetics, Würth Elektronik eiSos GmbH, Bourns, Inc., Santronics Sdn Bhd, Amtronics Pty Ltd., TDK Corporation, Murata Manufacturing Co., Ltd., Taiyo Yuden Co., Ltd., Sumida Corporation, Alps Alpine Co., Ltd., Tamura Corporation

Global Telecom Transformers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6 billion

- 2026 Market Size: USD 6.3 billion

- Projected Market Size: USD 9.7 billion by 2035

- Growth Forecasts: 5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.2% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, France, Canada, Italy

Last updated on : 30 September, 2025

Telecom Transformers Market - Growth Drivers and Challenges

Growth Drivers

- Growth of Fiber-to-the-Home (FTTH) and data centers: The Fiber-to-the-Home (FTTH) trend is expected to promote the sales of telecom transformers in the coming years. The telecom transformers are also in demand for optical line terminals and network interface devices. The data center sector is also fueling sales of signal isolation and power regulation transformers in North America and Europe. Moreover, the leading telecom transformer companies are offering high-efficiency transformers for optical transceivers and Ethernet PHYs to remain competitive in the market.

- Governmental policy, regulatory support, and infrastructure modernization: Governments invest in digital infrastructure, set policy enabling faster deployment, promote rural connectivity, establish backhaul networks, or mandate efficiency or standards. These necessitate demand for telecom hardware such as transformers. For instance, India’s Department of Telecommunications has amended the Telegraph Right of Way Rules (2023) to include street furniture, etc., which lowers regulatory delays, making it convenient to use telecom infrastructure like towers, poles. This helps boost 5G/network infrastructure, increasing demand for supporting hardware.

- Global push for green and energy-efficient telecom equipment: The sustainability trend is accelerating the sales of energy-efficient telecom transformers. The strict carbon emission standards are also fueling the demand for advanced telecom transformer systems. The increasing role of telecom transformers in energy consumption is likely to open up innovation strategies. The transformer manufacturers are also focusing on amorphous core and planar transformer designs to cut core losses by up to 60.5%. Overall, the green infrastructure trend is likely to fuel the sustainable telecom transformers.

Government & Regulatory Initiatives for Energy-Efficient Telecom / Power Equipment

|

Region / Country / Agency |

Initiative / Regulation |

Details |

|

European Union |

Ecodesign / Ecodesign for Sustainable Products Regulation (ESPR) |

Sets minimum energy efficiency and design requirements for energy-related products, including power supplies, transformers, and ICT/electronics. The new Regulation (EU) 2024/1781 replaces and extends earlier ecodesign rules |

|

United States (Federal / DOE / EPA) |

ENERGY STAR / FEMP / product efficiency standards |

The U.S. EPA’s ENERGY STAR program certifies efficient IT/network / electronic equipment. It sets acquisition guidelines for energy-efficient electronics, including power supplies, computers |

|

United States (Rural / Utilities) |

Energy Efficiency & Conservation Loan Program (EECLP) |

Provides loans for energy efficiency/conservation investments in rural electrical systems |

|

India (TRAI / DOT)

|

Green Telecom Policy & NDCP 2018 |

TRAI Green Telecom guidelines push operators to cut power consumption & emissions. NDCP 2018 emphasizes sustainable digital infrastructure, requiring efficient telecom transformers

|

Source: EU, U.S. Department of Energy, TRAI, RD USDA

Challenges

- Price volatility in raw materials: The price fluctuations in raw materials are set to hamper the trade of telecom transformers. Copper, ferrite, and laminated steel are vital for telecom transformers and often witness substantial price fluctuations. This volatility squeezes profit margins and creates procurement risk, especially in the price-sensitive markets.

- Trade tariffs and geopolitical barriers: Ongoing trade tensions are expected to result in high tariffs on electronic components, hampering the sales of telecom transformers. According to the World Trade Organization’s (WTO) Trade Monitoring Report, more than 169 new trade-restrictive measures were introduced globally in 2024, with trade coverage of USD 887.7 billion. Thus, high traffic rates are likely to affect the trade of telecom transformers in the coming years.

Telecom Transformers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5% |

|

Base Year Market Size (2025) |

USD 6 billion |

|

Forecast Year Market Size (2035) |

USD 9.7 billion |

|

Regional Scope |

|

Telecom Transformers Market Segmentation:

Mounting Type Segment Analysis

The surface mount transformers segment is expected to account for 65.1% of the global telecom transformers market share throughout the forecast period. The miniaturization trend across IoT modules and small-cell networks is set to accelerate the production and commercialization of surface-mount transformers. The segment is rapidly expanding owing to its compact size, ease of automated assembly, and suitability for high-density circuit boards used in telecom equipment. With increasing demand for 5G base stations, IoT devices, and broadband equipment, manufacturers are moving to surface mount designs that save space and increase efficiency while maintaining high isolation performance. Their compatibility with modern PCB layouts makes them ideal for small-form-factor telecom and networking devices.

End user Segment Analysis

The telecommunications segment in the telecom transformers market is estimated to capture 42.5% of the global market share by 2035, owing to rapid expansion of the telecommunication services and rising investments in fiber optics, 5G, and satellite internet. Telecom operators may require reliable and energy-efficient transformers for base stations, optical line terminals, and data centers to esure uninterrupted connectivity. The segment is expanding as operators intensify networks and upgrade infrastructure to control higher bandwidth and user demand. For instance, in 2024, Nokia stated that India’s 5G data traffic tripled within one year, forcing telecom providers to invest in latest infrastructure components like transformers to support this surge. The broadband expansion activities across the globe are expected to boost the sales of telecom transformers in the coming years.

Voltage Level Segment Analysis

The low-voltage segment in the telecom transformers market is expected to expand at a rapid pace between 2026 and 2035 as modern telecom equipment, including routers, switches, and small cell base stations, increasingly operates at lower voltage levels for safety, efficiency, and compact design. Demand is further supported by the surge in IoT devices, 5G small cells, and edge computing nodes that depend on stable low-voltage power regulation and isolation. Low-voltage transformers are also cost-effective and easier to combine into surface-mount and compact PCB designs.

Our in-depth analysis of the telecom transformers market includes the following segments:

|

Segment |

Subsegments |

|

Mounting Type |

|

|

Frequency Range |

|

|

End user |

|

|

Voltage level |

|

|

Type |

|

|

Configuration |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Telecom Transformers Market - Regional Analysis

North America Market Insights

The North America telecom transformers market is expected to account for a 34.2% share from 2026 to 2035. The massive investments in 5G infrastructure and digital equity programs are likely to fuel the sales of telecom transformers. The broadband modernization across the U.S. and Canada is also fueling the sales of telecom transformers. The public-private partnerships are opening lucrative doors for telecom transformer manufacturers. The increasing investments in the defense and aerospace sectors are expected to increase the demand for advanced transformers.

The nationwide broadband expansion and 5G densification moves are fueling the sales of telecom transformers in the U.S. telecom transformers market. The increasing investments in digital transformation are also augmenting the sales of advanced transformers. The NTIA’s Broadband Equity, Access, and Deployment (BEAD) Program invested USD 42.4 billion for the improvement of connectivity infrastructure through 2030. These moves are increasing the application of telecom transformers across the country. Also, the smart city initiatives are set to promote transformer upgrades in public safety networks.

The federal and provincial investments in telecom modernization and universal broadband goals are expected to push the sales of telecom transformers in Canada telecom transformers market. The ISED reveals that under the Universal Broadband Fund (UBF), nearly CAD 3.2 billion was allocated to enhance high-speed internet access in rural and Indigenous communities by 2030. Favorable government policies and funding initiatives are likely to accelerate the production and commercialization of telecom transformers in the country. Over 89.5% of the households have broadband access, which drives the demand for telecom transformers in last-mile connectivity solutions.

APAC Market Insights

The Asia Pacific telecom transformers market is projected to hold a significant share through 2035, owing to robust 5G rollouts and industrial digitalization. The government-led ICT infrastructure development programs are also propelling the sales of advanced transformers. China is expected to lead the telecom hardware demand, followed by Japan, India, South Korea, and Southeast Asian countries. The rising government spending on ICT and digital budgets is set to propel the production and commercialization of telecom transformers. The sustainability trends are also expected to fuel the demand for energy-efficient transformers.

The telecom transformers market in China is expanding due to the country’s favorable, aggressive 5G rollout and constant investment in digital infrastructure. With the world’s largest 5G user base, operators in China are setting up millions of base stations, requiring efficient transformers for power regulation and signal integrity. According to the Ministry of Industry and Information Technology, China's 5G ecosystem is expanding at an unexpected level. The country now has 4.25 million 5G base stations and more than 1 billion 5G mobile users, achieving a market uptake of over 71%, with average monthly data usage per user touching 19 GB. In parallel, more than 200 million gigabit broadband users have been connected, and over 4,000 5G-enabled factories are operational nationwide. This rapid adoption has also promoted the growth of smart products and services, forcing digital consumption to over 6 trillion yuan, which is approximately USD 833 billion. Overall, investing in China is a win-win opportunity for key telecom transformer companies.

The India telecom transformers market is estimated to increase at the fastest CAGR from 2026 to 2035. In India, the telecom transformers market is growing strongly as mobile data U.S.ge surges and operators race to increase 5G networks. Rising broadband penetration, edge data centers, and government-backed connectivity initiatives are creating higher demand for efficient low-voltage and surface-mount transformers in telecom equipment. Rising investments by private operators in densifying networks is also propelling the segment. India’s 5G expansion is forcing providers to upgrade infrastructure with advanced components such as telecom transformers to control the surge.

Europe Market Insights

The Europe telecom transformers market is expected to register rapid growth during the forecast period owing to rising digital infrastructure investments and the rollout of 5G networks. The EU-wide support for RF-based telecom components is also contributing to the overall market growth. Through the Digital Europe Programme, the EU allocated €7.5 billion between 2021 and 2027 for advanced digital infrastructure and device innovation, with a motive to accelerate the digital transformation of Europe. Germany, France, and the U.K. are the most profitable marketplaces for telecom transformer manufacturers.

Sales of telecom transformers in Germany are influenced by the advanced telecom infrastructure and large-scale 5G deployment. The strong industrial demand for RF transformers is also contributing to the market growth. Germany’s Federal Ministry for Digital Affairs and Transport (BMDV) is boosting the expansion of Gigabit networks with an approximate national funding package of USD 7 billion. This initiative, strengthened by regional and local contributions, is built to deliver symmetrical 1 Gigabit per second connectivity nationwide by 2030. The robust federal investments are estimated to boost the demand for high-frequency transformer systems in the years ahead. The robust R&D support and high ICT budget are also estimated to propel the trade of telecom transformers.

The expansive 5G infrastructure and fiber optic deployment are set to fuel the sales of telecom transformers in the U.K. telecom transformers market. The government-backed digital transformation initiatives are also promoting the deployment of telecom transformers. The UK telecom sector, known as one of the country's five critical technology areas, is fueling demand for telecom transformers. The UK telecom sector is valued at USD 40.62 billion in 2024. The industry benefits from a net positive trade balance, exporting USD 45.5 billion against USD 6.1 billion in imports, reflecting its strong worldwide presence. Moreover, the thriving tech ecosystems and a strong academic talent pool are increasing the need for advanced telecom transformers to support expanding network infrastructure.

Key Telecom Transformers Market Players:

- Würth Elektronik Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pulse Electronics (Yageo Group)

- Coilcraft, Inc.

- Delta Electronics, Inc.

- Eaton Corporation

- Vishay Intertechnology, Inc.

- Halo Electronics

- Bel Fuse Inc.

- Samsung Electro-Mechanics

- Premier Magnetics

- Würth Elektronik eiSos GmbH

- Bourns, Inc.

- Santronics Sdn Bhd

- Amtronics Pty Ltd.

- TDK Corporation

- Murata Manufacturing Co., Ltd.

- Taiyo Yuden Co., Ltd.

- Sumida Corporation

- Alps Alpine Co., Ltd.

- Tamura Corporation

The global telecom transformers market is characterized by the presence of top companies and the increasing emergence of new players. The industry giants are focusing on technological innovations to uplift their position in the global landscape. They are forming strategic partnerships with others to increase their market reach. Collaboration with raw material suppliers is expected to increase their profit margins. Increasing expansions in the emerging markets are expected to boost the revenues of leading companies. The organic sales are also expected to offer double-digit percentage earnings opportunities for big companies.

Here is a list of key players operating in the telecom transformers market:

Recent Developments

- In May 2025, TTM Technologies, Inc., a global manufacturer of technology solutions, announced the launch of 5 new high-performance components, including transformers to meet the rising demands in telecom, test and measurement, and COTS mil-aero applications.

- In March 2025, Vishay unveiled its 1200-V MaxSiC SiC MOSFET series plus a roadmap for 650-1700 V SiC MOSFETs, along with hybrid and planar transformer products at conferences like APEC.

- Report ID: 7880

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Telecom Transformers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.