Telecom Order Management Market Outlook:

Telecom Order Management Market size was over USD 2.9 billion in 2025 and is poised to exceed USD 6.15 billion by 2035, witnessing over 7.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of telecom order management is estimated at USD 3.1 billion.

The continuous expansion of fiber optic and 5G networks is encouraging telecom operators to improve their order management systems. Governments are significantly investing to support the growth of broadband in rural areas. In October 2023, the Federal Communications Commission (FCC) authorized over USD 18 billion in Enhanced Alternative Connect America Cost Model (Enhanced A-CAM) support to expand rural broadband. This initiative aims to provide broadband speeds of at least 100/20 Mbps to more than 700,000 unserved locations and maintain or improve service to approximately 2 million locations across 44 states. Such investments in network infrastructure are demonstrating a major role for the efficient rollout of advanced broadband services, further stimulating the growth of the market.

Key Telecom Order Management Market Insights Summary:

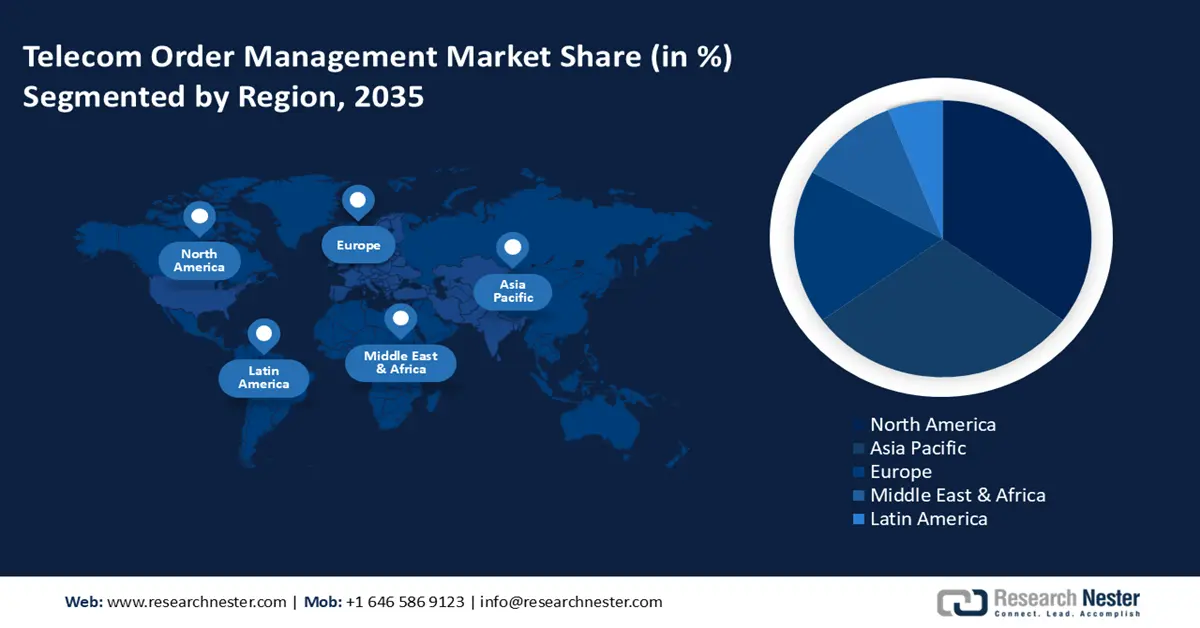

Regional Highlights:

- North America is projected to secure the largest share between 2026–2035 in the Telecom Order Management Market, owing to the increasing integration of multi-channel platforms across customer interaction points.

- In Asia Pacific, the market is anticipated to expand steadily through 2035, nurtured by the rising demand for flexible global connectivity supported by strategic partnerships enhancing subsea infrastructure.

Segment Insights:

- The cloud segment of the Telecom Order Management Market is poised to attain the highest revenue share by 2035, sustained by escalating adoption of cloud-based platforms that enhance large-scale order processing efficiency.

- By 2035, the telecom service providers segment is expected to dominate the revenue share, underpinned by operators’ growing need to manage extensive network resources and expedite service delivery through advanced order management systems.

Key Growth Trends:

- Enhancing services with network APIs

- Demand for enhanced customer experience

Major Challenges:

- Complexity of multi-channel integration

Key Players: Ericsson, Cognizant, Oracle Corporation, IBM Corporation, Pegasystems Inc., Fujitsu Limited, Comarch, ChikPea, Neustar, Inc., Cerillion.

Global Telecom Order Management Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.9 billion

- 2026 Market Size: USD 3.1 billion

- Projected Market Size: USD 6.15 billion by 2035

- Growth Forecasts: 7.8%

Key Regional Dynamics:

- Largest Region: North America (Largest Share between 2026–2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Germany, United Kingdom

- Emerging Countries: Brazil, Indonesia, Vietnam, United Arab Emirates, Mexico

Last updated on : 19 November, 2025

Telecom Order Management Market - Growth Drivers and Challenges

Growth Drivers

- Enhancing services with network APIs: The telecom service providers are significantly emphasizing advanced technologies, including network application programming interface. This shift is attributed to the ability of APIs to offer improved services and enhanced customer experience. Many companies are forming strategic partnerships to provide more tailored solutions. For instance, in September 2024, Ericsson established a joint venture with twelve major telecom operators, including Verizon, Deutsche Telekom, and Reliance Jio. This venture focuses on using network APIs to sell advanced network software, enhancing the quality of services such as credit card fraud prevention and real-time gaming speed boosts. Such developments are accelerating the telecom order management market expansion.

- Demand for enhanced customer experience: There is an increasing demand for personalized and efficient services among customers. Telecom companies are emphasizing enhancements in service delivery and providing real-time visibility into order status. This trend is resulting in increasing acquisitions in the industry, for instance, in September 2024, Verizon Communications, Inc. announced plans to acquire Frontier Communications for USD 20 billion. This development is aimed at enhancing Verizon’s fiber network, helping the company meet the rising demand for faster internet speeds and improved service delivery. The customer-centric approach is escalating the telecom order management market expansion.

Challenge

- Complexity of multi-channel integration: The integration of telecom order management solutions across these services and channels faces major complexities. This results in challenges for telecom companies to provide a streamlined process for customer orders across various platforms, further leading to service disruptions and delays in delivery.

Telecom Order Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.8% |

|

Base Year Market Size (2025) |

USD 2.9 billion |

|

Forecast Year Market Size (2035) |

USD 6.15 billion |

|

Regional Scope |

|

Telecom Order Management Market Segmentation:

Deployment Segment Analysis

The cloud segment of telecom order management market is set to account for the highest revenue share by 2035, attributed to the surging adoption of cloud-based solutions in the telecom sector. The integration of these platforms enables telecom operators to handle significant numbers of customers’ orders across the globe. For instance, in February 2024, T-Mobile US Inc. and Cisco Systems Inc. deployed a cloud native 5G core gateway to optimize their operations. This transition enables T-Mobile to accelerate service provisioning, improve real-time visibility of orders, and enhance overall customer support, resulting in a reduction in order processing time and an increase in customer satisfaction.

End use Segment Analysis

By the end of 2035, the telecom service providers segment is projected to account for the largest revenue share. This is attributed to their ability to manage large-scale network resources, customer orders, and service delivery. These operators are utilizing order management systems to reduce the time to service delivery. There is an increasing adoption of satellite telecom platforms with the rise in competition in the telecom industry. For instance, in March 2025, Bharti Airtel Limited signed an agreement with SpaceX Corporation to bring Starlink’s high-speed internet services to cater to customers in India.

Our in-depth analysis of the global telecom order management market includes the following segments:

|

Deployment |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Telecom Order Management Market - Regional Analysis

North America Market Insights

North America is expected to account for the largest share between 2026 and 2035 due to the rising focus on the integration of multi-channel platforms. The providers are integrating these channels to manage orders across the customer touchpoints, including websites, physical stores, and mobile applications. For instance, in April 2025, Comcast Technology Solutions unveiled Comcast Media360, a cutting-edge video management platform aimed at transforming how broadcasters and content owners manage their video content across multiple platforms. The new service is expected to improve efficiency and significantly reduce operational costs, further accelerating the market growth.

The telecom order management market in the U.S. is rapidly expanding, with the integration of AI and automation in management systems. Companies are coming up with new solutions to enhance service fulfillment by automating order processing and workflows. For instance, in October 2023, Amdocs Ltd. partnered with Bharti Airtel Limited to integrate AI and automation in telecom order management platforms, particularly in billing and service bundling.

APAC Market Insights

The continual surge in demand for flexible and robust global connectivity is bolstering the growth of the telecom order management market in Asia Pacific. Key players in the telecom sector are forming strategic partnerships to address the increasing need for efficient subsea infrastructure. For instance, in October 2024, OMS Group partnered with Royal IHC to introduce new cable-lying vessels to the industry. These vessels are aimed at strengthening the delivery of the networks. The first vessel is expected to be rolled out by 2027, highlighting the company’s efforts in improving telecommunications connectivity across the globe, further fostering the market growth.

The telecom order management market in India is expected to expand at a rapid pace during the forecast period, owing to rising innovations in 4G and 5G networks. Various companies are incorporating advancements in the 4G and 5G networks. For instance, in December 2024, Bharti Airtel Limited entered a multi-billion-dollar agreement with Ericsson to enhance its 4G and 5G network coverage. The partnership involves deploying a centralized radio access network and Open RAN-ready solutions, along with upgrading existing 4G radios.

Telecom Order Management Market Players:

- Ericsson

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cognizant

- Oracle Corporation

- IBM Corporation

- Pegasystems Inc.

- Fujitsu Limited

- Comarch

- ChikPea

- Neustar, Inc.

- Cerillion

The telecom order management market exhibits intense competition as providers aim to streamline service delivery, reduce operational costs, and enhance customer experiences. Vendors are increasingly deploying cloud-native and AI-powered platforms to manage complex order lifecycles, from service request to activation. The market is marked by strong demand for omnichannel capabilities, real-time tracking, and integration with legacy and next-gen OSS/BSS systems. Competition is further fueled by the rising adoption of 5G and fiber networks, prompting vendors to offer scalable, flexible solutions. Strategic partnerships, geographic expansion, and continuous product innovation define the competitive strategies in this dynamic market landscape. Here are some key players operating in the global telecom order management market:

Recent Developments

- In March 2025, Wipro Limited launched TelcoAI360 to transform operations for telcos with the integration of AI. The platform is aimed at strengthening telcos to come out with differentiated technology solutions at scale and speed, while delivering a better customer experience at a fraction of the cost.

- In February 2025, Bharti Airtel Limited granted a contract to Nokia and Qualcomm, aimed at expanding 5G Wi-Fi solutions and Fixed Wireless Access to provide high-speed internet access to users in India.

- In July 2024, IBM Corporation joined strategic forces with ASMPT Limited to advance bonding methods for chiplet packages for AI. The partnership is aimed at advancing the hybrid bonding and thermocompression technology for chiplet packages.

- Report ID: 1320

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Telecom Order Management Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.