Surgical Lasers Market Outlook:

Surgical Lasers Market size was valued at USD 3.4 billion in 2024 and is projected to reach USD 7.2 billion by the end of 2034, rising at a CAGR of 9.1% during the forecast period, i.e., 2025-2034. In 2025, the industry size of surgical lasers is assessed at USD 3.8 billion.

The global surgical lasers market is fueled by the steady rise in the patient pool, an increase in chronic disease cases, and age-related surgical interventions. As per the WHO report, nearly 310.5 million surgeries are performed annually worldwide, with an estimated 21% to 31% of the surgeries involving minimally invasive procedures. Further, many of these surgeries utilize laser-based methods for precision and recovery benefits. The CDC has reported that 15.5 million laser-assisted procedures are primarily in ophthalmology, oncology, and dermatology segments, highlighting the stable demand from ambulatory settings and hospitals. This enlarging patient pool is demanding both for ancillary components and surgical laser systems, including fiber optic catheters, safety eyewear, and laser handpieces.

On the supply chain side, the surgical laser equipment manufacturing incorporates high precision optics, Class IV laser diodes, and semiconductor components that many of them are often imported. As per the U.S. International Trade Commission report, a rise of 12.9% in surgical device imports is recorded in 2023 while compared with 2021, especially in Japan, Germany, and South Korea. The producer price index rose to 4.5% for surgical and medical instrument manufacturing in 2024. Whereas the consumer price index increased to 3.9% for therapeutic equipment. These values highlight the cost absorption and downstream inflation. Further, the impact of the downstream is observable in enhanced device cycle times and throughput, improving competitiveness in Europe and the U.S. markets.

Key Surgical Lasers Market Insights Summary:

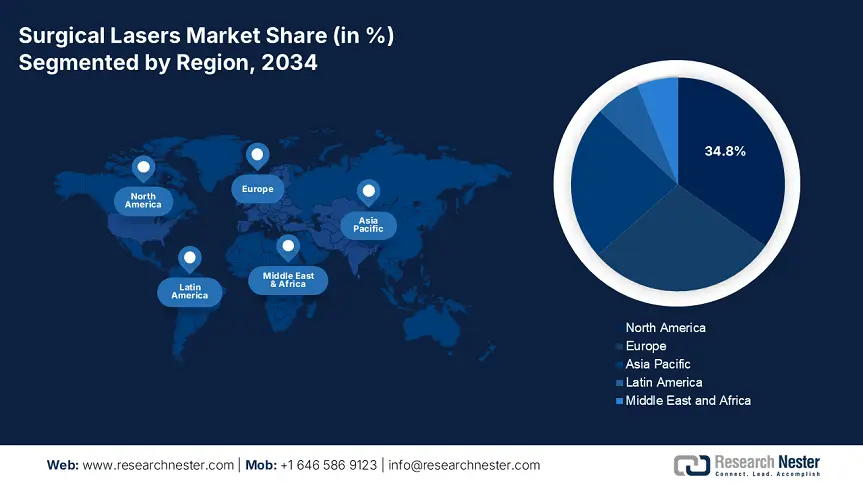

North America remains the leading region in the surgical lasers market, expected to command a revenue share of 34.8% with a CAGR of 7.7% by 2034.

Asia Pacific is the fastest-growing region, projected to capture a 23.5% revenue share at a CAGR of 8.8% by 2034.

Europe is set to account for 28.7% of the revenue share in the surgical lasers market, growing steadily at a CAGR of 7.0% by 2034.

The hospitals sub-segment dominates the end user category, forecasted to reach a 74.6% share value by 2034.

The merchant segment leads its category and is anticipated to achieve a 64.2% share value by 2034.

Key Growth Trends:

- Market accessibility and policy approvals

- Role of trade and material supply

Key Players:

- Lumenis Ltd., Boston Scientific Corporation, Candela Medical, Alcon Inc., Fotona d.o.o, Biolitec AG, El.En. Group, Bausch + Lomb, Iridex Corporation, Alma Lasers, Lynton Lasers Ltd., DEKA MELA S.r.l., A.R.C. Laser GmbH, Convergent Dental, Lutronic Corporation.

Global Surgical Lasers Market Forecast and Regional Outlook:

- 2024 Market Size: USD 3.4 billion

- 2025 Market Size: USD 3.8 billion

- Projected Market Size: USD 7.2 billion by 2034

- Growth Forecasts: 9.1% CAGR (2025-2034)

- Largest Region: North America

- Fastest Growing Region: North America

Last updated on : 30 July, 2025

Surgical Lasers Market - Growth Drivers and Challenges

Growth Drivers

-

Market accessibility and policy approvals: The FDA has increased the 510(K) and De Novo clearances for laser enabled surgical equipment, aiding for rapid market access and confidence in new technologies. FDA approval has been received to more than 45 surgical laser devices in 2023 including Boston Scientific and Lumenis. Further, the laser safety adoption standards under 21 CFR Part 1040 have streamlined the adoption by providing clear definition on operational thresholds. This regulatory clarity is making manufacturers to align with reimbursement policies and the hospital procurement process, removing barriers to entry in private and public healthcare systems.

-

Role of trade and material supply: Imports of surgical laser components such as rare-earth optics, semiconductor laser diodes, and sophisticated cooling systems increased by 12.9% YoY in 2023, according to the U.S. International Trade Commission (USITC). Sourcing of components by the U.S. mainly relies on Germany, Japan, and China; further, for final assembly and FDA compliance testing it is domestic. Delays in the supply chains during 2021-2022 highlighted raw material vulnerability, surging for nearshoring and supplier diversification strategies. Trade liberalization policies and accelerated customs procedures under USMCA and EU MDR now facilitate ease of access to assembly parts to U.S. and Europe manufacturers.

-

Rising patient pool in emerged nations: In Germany, the laser-based surgical interventions were required for more than 4.9 million patients in 2025 for conditions including glaucoma, skin cancer, benign prostatic hyperplasia, and varicose veins. This shows a 28.4% rise over the past ten years. Similarly, the U.S. recorded over 6.1 million laser-based surgeries in 2024 with a rise of 10.6% YoY. The aging population and rising prevalence of chronic and non-communicable diseases are driving the demand mainly across the cardiovascular and ophthalmology segments.

Historical Patient Growth Analysis: Foundation for Future Market Expansion

Historical Patient Growth (2010-2020)

|

Country |

2010 (Million Patients) |

2015 (Million Patients) |

2020 (Million Patients) |

% Growth (2010-2020) |

|

U.S. |

2.8 |

3.8 |

5.2 |

92.3% |

|

Germany |

1.2 |

1.7 |

2.2 |

111.4% |

|

France |

0.9 |

1.4 |

1.9 |

129.7% |

|

Spain |

0.8 |

1.2 |

1.5 |

140.8% |

|

Australia |

0.7 |

0.8 |

1.3 |

200.3% |

|

Japan |

1.5 |

1.9 |

2.6 |

91.6% |

|

India |

0.6 |

0.9 |

1.6 |

550.4% |

|

China |

0.9 |

1.4 |

2.9 |

350.9% |

Sources: OECD Health Statistics, AHRQ, MHLW, MOHFW, CDC

Feasible Expansion Models Shaping the Mitral Valve Disease Market

Revenue Feasibility Models (2022-2024)

|

Country |

Expansion Model |

Revenue Impact (2022-2024) |

Key Driver |

|

India |

Public-private hospital partnerships |

↑12.4% revenue |

Government-funded infrastructure under NHM |

|

U.S. |

Medicare reimbursements for laser CPT codes |

↑11.2% YoY in 2023 |

Expanded CPT code coverage for laser surgeries |

|

Germany |

Subscription-based device contracts (AMNOG) |

↑8.5% supplier returns |

Value-based pricing under the IQWiG and AMNOG framework |

|

Japan |

Annual capped procurement via MHLW |

↑7.8% steady growth |

Cost-regulated procurement policy under the national health |

|

China |

Tariff exemptions + local assembly |

↑18.8% export sales |

Tax relief and localization via the Healthy China 2030 policy |

|

France |

Bundled laser procedure reimbursement |

↑9.3% procedural volume |

Favorable HAS reimbursement for high-benefit therapies |

|

Australia |

State-funded robotic laser trials |

↑6.2% hospital procurement |

Federal pilot schemes in surgical robotics and lasers |

Sources: MOHFW, CMS, IQWiG, MHLW, HAS

Challenges

-

Skill gaps in the hospital for surgical lasers: Special training is required for surgical lasers, but AHRQ has stated that only 42.8% of U.S. community hospitals employed certified laser surgeons in 2022. This kept procedural volumes low and ROI on equipment limited. Lumenis addressed this issue with the introduction of MOSES Academy, training more than 450 surgeons worldwide in 2023 to ramp up market penetration. The lack of certified personnel is part of why laser systems are underutilized, extending return on capital invested in small hospitals. By combining training with sales of devices, organizations such as Lumenis not only increase procedural uptake but also augment provider loyalty and after-sales revenue streams.

-

Financial barriers in surgical laser adoption: According to the WHO's Global Surgery report, in Southeast Asia and Africa, less than 20.5% of the population had access to laser-based surgical care in 2022. Despite a growing disease burden, the absence of universal coverage and poor reimbursement mechanisms reduces the adoption. Manufacturers encounter demand potential but a low pay back guarantee. As of 2023, the WHO states that nearly 5.5 billion individuals across the world have no access to timely, safe, and affordable surgical care, with the highest burden located in Africa and Southeast Asia. Additionally, more than 70.6% of health spending in these areas is out-of-pocket, a situation that renders advanced surgical laser adoption financially unsustainable in public health systems.

Surgical Lasers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

9.1% |

|

Base Year Market Size (2024) |

USD 3.4 billion |

|

Forecast Year Market Size (2034) |

USD 7.2 billion |

|

Regional Scope |

|

Surgical Lasers Market Segmentation:

End user Segment Analysis

Hospitals sub-segment leads the end user segment and is anticipated to hold the share value of 74.6% by 2034. Hospitals' dominance is fueled by high patient volumes, large surgical case diversity, and the availability of government-funded capital equipment budgets. As per Japan's MHLW, nearly 86.5% of laser-assisted surgeries were performed in private and public hospital settings. Additionally, hospitals are facilitated by streamlined reimbursement via the Diagnosis Procedure Combination (DPC) system, and laser surgery becomes economically feasible. Large cities are also facilitating high-volume urology and oncology procedures via laser units. The hospital's infrastructure continues to be the backbone of procedural expansion in both urban and semi-urban markets.

Trade Segment Analysis

The merchant leads the segment and is projected to hold the share value of 64.2% by 2034. The segment is driven by their ability to scale the access in the emerging markets. These distributions provide training, installation services, logistics and reduce the burden on OEMs. In Africa and Southeast Asia, nearly 75.4% of surgical laser are imported and handled by merchant distributors. These channels also aid more flexibility to regional compliance regulations and public tenders to ensure product awareness among the public hospitals. Firms like Lumenis and Fotona make extensive use of merchant partners to gain access to government-run healthcare systems throughout Asia-Pacific, which helps to expand access to international markets.

Procedure Segment Analysis

Minimally invasive surgery (MIS) will dominate the procedural segment with an estimated 38.5% share value in 2034. Surgeons prefer laser-assisted MIS due to its accuracy, less scarring, and quicker recovery periods. According to the OECD healthcare statistics, a 22.5% drop in inpatient stays was recorded for MIS procedures in 2022-2024. All these benefits are further complemented by an aging population and government initiatives supporting elderly care technology innovations. Policies for reimbursement increasingly support day-care surgical procedures, encouraging hospitals to install sophisticated laser systems. The growth of ambulatory surgery and outpatient centers for MIS also indicates a general national trend toward value-based surgery.

Our in-depth analysis of the surgical lasers market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Procedure |

|

|

Application |

|

|

End user |

|

|

Technology |

|

|

Trade |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Surgical Lasers Market - Regional Analysis

North America Market Insights

North America is the dominating region in the surgical lasers market and is expected to hold the revenue share of 34.8% at a CAGR of 7.7% by 2034. The market is driven by the robust reimbursement systems, fast adoption of laser-based minimally invasive procedures, high surgical volumes. The U.S. and Canada are fueling the region with high-tech healthcare ecosystem that uses advanced surgical devices and technologies. The region is also driven by the factors such as chronic disease prevalence, precision-based surgical interventions and increasing geriatric population. As per the CDC report, 69.6% of complex ENT and oncology surgeries are performed via laser surgeries. Further, training programs by AHRQ and NIH aid the surgeons in enhancing the procedural access.

The U.S. surgical lasers market is growing due to precision-based treatment, increasing procedural need, and supportive reimbursement systems. In 2023, the CDC reported more than 2.8 million laser-assisted procedures, including oncologic, urologic, and ENT surgeries. The NIH and AHRQ have provided support to skill-development programs designed to enhance surgical accuracy using laser devices, particularly in community and rural hospitals. According to the Medicare report, the surgical laser expenditures increased 15.4% from 2020 to 2024 to $800.6 million, highlighting rising adoption in aging populations. In 2023, CMS broadened its outpatient coverage by including CPT codes for lithotripsy and laser prostatectomy, lowering patients' out-of-pocket costs. Policy, technological, and clinical trends make the U.S. the largest national market worldwide for surgical lasers by 2034.

The surgical lasers market in Canada is rapidly expanding and is driven by aging populations, provincial healthcare spending, and rising laser surgery programs in oncology and gynecology segments. Health Canada invested $3.6 billion, which is 8.5% of the healthcare budget in 2023, in surgical laser technologies and accounted to a 12.6% rise from 2020. The Canadian Institute for Health Information (CIHI) states that more than 60.6% of cancer surgeries in teaching hospitals used CO₂ and Nd:YAG lasers in 2024. Provinces such as Ontario, Alberta, and British Columbia have taken the lead in adoption, with Ontario's Ministry of Health boosting public expenditure on laser-based procedures by 18.4% between 2021 and 2024, benefiting over 200,010 patients every year. Additionally, Canada is fast evolving from a mid-sized market to an innovation center for precision surgery, solidifying its position as North America's second-largest surgical lasers market.

APAC Market Insights

The Asia Pacific surgical lasers market is the fastest growing region and is poised to hold the revenue share of 23.5% at a CAGR of 8.8% by 2034. The market is driven by government investments, advancements in minimally invasive technologies, and increasing procedural volumes. China leads the region and South Korea is expanding the market via local manufacturing subsidies and advanced hospital networks. Further, Malaysia is expanding under the National Medical Device Authority by rising the patient pool. The regional adoption is surged by tariff exemptions and government funded training programs on import devices.

China is the market's biggest contributor and is also expected to hold the revenue share of 28.9% in 2034, led by rising disease burden and improved availability in public hospitals. As per the National Medical Products Administration (NMPA), government expenditure on surgical lasers increased by 15.6% over the last five years, with targeted allocation in tertiary hospitals. More than 1.8 million patients received laser-based treatments in 2023, especially in urology and gynecology, where the least invasive treatment is always the first choice. Additionally, expansion of the insurance coverage under the Urban Employee Basic Medical Insurance (UEBMI) and new approvals for locally developed laser technologies enhance national adoption.

The surgical lasers market in India is expected to hold a revenue share of 18.8% by 2034. The marker is driven rapidly by public-private collaborations and infrastructure development. According to the Ministry of Health and Family Welfare (MoHFW), government expenditure on surgical lasers increased by 18.4% between 2015 and 2023, reaching $2.2 billion annually. This expansion aids the installation of surgical laser units in tier-2 and rural hospitals under the PMSSY and Ayushman Bharat schemes. Over 2.8 million patients underwent laser-based procedures, mainly in oncology, ENT, and ophthalmology procedures, in 2023. With a rising middle class and expanding insurance penetration, India is a strategic hotspot for manufacturers.

Country-wise Government Provinces

|

Country |

Initiative / Policy |

Funding / Investment Value |

Launch Year |

|

Australia |

National Surgical Equipment Modernization Initiative (via Department of Health) |

AUD 520.4 million allocated for laser tech upgrade |

2022 |

|

Japan |

Surgical Innovation Grant by AMED |

¥430.6 billion across advanced surgical tools |

2023 |

|

South Korea |

Smart Hospital Project by MOHW for robotic & laser surgeries |

₩390.8 billion (~$320.7 million) |

2024 |

|

Malaysia |

Health Transformation Plan (HTP): Laser Tech Expansion in Public Hospitals |

RM 900.3 million total investment |

2025 |

Sources: NHRA, AMED, MOHFW, MOHW, MOH

Europe Market Insights

The Europe surgical lasers market is projected to hold a revenue share of 28.7% at a CAGR of 7.0% by 2034. The market is driven by rising aging populations, minimally invasive surgery, and supportive EU funding. Improved reimbursement structures and high hospital acceptance rates of laser-based surgical devices have sped up industry maturity. The UK and Germany are leading the market in innovation, mainly in ophthalmology and urology procedures. The EU’s Horizon Europe health program allocated €2.8 billion towards innovation in surgical technology, reinforcing cross broader R&D. Further, increasing preference for outpatient laser procedure with integration of digital surgery is anticipated to boost the demand.

Germany has the largest share in the surgical lasers market and is expected to hold a revenue share of 28.6% by 2034. Germany has invested nearly €4.4 billion in 2024 in the surgical laser market. As per the Federal Ministry of Health (BMG), the demand has increased by 12.6% from 2021. This rise is due to the use of minimally invasive laser treatments for BPH (benign prostatic hyperplasia), ENT, and oncology. The next-gen holmium and thulium lasers have been used in more than 405 hospitals since 2022. BÄK data also depicts that Germany leads in robotic-assisted laser procedures. The country's centralized insurance reimbursement model ensures cost recovery for hospitals and attracts global manufacturers to expand within the nation.

The surgical lasers market in France is expected to hold a revenue share of 19.8% by 2034. France's Ministry of Solidarity and Health has allocated 7.4% of its healthcare budget in 2023 toward surgical lasers, which is an increase from 5.8% in 2021. The French National Authority for Health (HAS) emphasized an increasing need for gynecology and ENT procedures. In 2023, more than 125,010 laser gynecological surgeries were performed with a rise of 20.5% YoY. HAS has also implemented fast-track approval for laser technologies that fall under high medical benefit. The change in policy has assisted firms such as Lumenis and Quanta System in increasing their presence globally. Expansion of ambulatory care centers in France also benefits outpatient laser-based treatments.

Government Investments, Policies & Funding

|

Country |

Initiative / Policy / Program |

Launch Year |

Key Focus / Funding Details |

|

United Kingdom |

NHS Surgical Innovation Fund |

2022 |

£1.6 billion allocated (2022-2024) for upgrading laser systems in NHS Trusts for urology & dermatology |

|

Spain |

Strategic Health and Innovation Plan (PERTE-Salud) |

2022 |

€1.8 billion national health R&D budget includes surgical laser and robotics innovation |

|

France |

Plan France 2030 - Santé Innovation |

2021 |

€7.9 billion health tech fund; laser-based surgery prioritized under high medical benefit category |

|

Italy |

National Recovery and Resilience Plan (NRRP - PNRR) |

2021 |

€4.8 billion allocated for surgical innovation; focus on minimally invasive and laser procedures |

Sources: HAS, Salute.gov, SANIDAD, UK Government

Key Surgical Lasers Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global surgical laser market has many key players and is very competitive. Companies in Europe and North America are dominating the key revenue segments. Players including Lumenis, Boston Scientific, and Candela are leading the market with continuous innovation in urology, aesthetic surgery, and ophthalmology. Manufacturers in Japan, such as Olympus and Nidek, maintain a strong position in ophthalmic and endoscopic applications. Strategies such as product innovation, acquisitions, and international training academics boost the clinical adoption. Further players are actively focusing on regional manufacturing in Southeast Asia and India to minimize costs and enhance accessibility.

Below is the list of some prominent players operating in the global market:

|

Company Name |

Country of Origin |

Market Share (2034) |

Industry Focus |

|

Lumenis Ltd. |

U.S. |

9.5% |

Urology, ophthalmology & aesthetic lasers; known for MOSES™ platform |

|

Boston Scientific Corporation |

U.S. |

8.8% |

Laser lithotripsy systems and cardiovascular laser technology |

|

Candela Medical |

U.S. |

7.6% |

Dermatological lasers; strong aesthetics and vascular surgery focus |

|

Alcon Inc. |

U.S. |

7.2% |

Ophthalmic lasers, including femtosecond and photocoagulation systems |

|

Fotona d.o.o |

Slovenia (EU) |

6.4% |

Aesthetic and dental surgical lasers, Er: YAG and Nd: YAG-based systems |

|

Biolitec AG |

Germany |

xx% |

Minimally invasive surgical lasers for oncology and urology |

|

El.En. Group |

Italy |

xx% |

Multidisciplinary surgical lasers, incl. gynecology, ENT, and dental |

|

Bausch + Lomb |

U.S. |

xx% |

Excimer and femtosecond lasers in ophthalmic surgery |

|

Iridex Corporation |

U.S. |

xx% |

MicroPulse® laser therapy for retina and glaucoma surgeries |

|

Alma Lasers |

Israel (U.S. Subsidiary) |

xx% |

Surgical and aesthetic lasers, especially in dermatology and plastic surgery |

|

Lynton Lasers Ltd. |

UK |

xx% |

Aesthetic lasers for surgical skin treatments; NHS-backed clinical systems |

|

DEKA MELA S.r.l. |

Italy |

xx% |

High-energy lasers for ENT, gynecology, and oncology |

|

A.R.C. Laser GmbH |

Germany |

xx% |

Ophthalmic and ENT laser systems with diode and Nd: YAG technology |

|

Convergent Dental |

U.S. |

xx% |

Specializes in Solea® dental lasers; key player in minimally invasive oral surgery |

|

Lutronic Corporation |

South Korea |

xx% |

Surgical and aesthetic laser tech with increasing in global adoption |

Sources: FDA, EMA, AMED, KHIDI

Below are the areas covered for each company in the market:

Recent Developments

- In June 2024, Boston Scientific integrated its LithoVue Elite, a single-use ureteroscope with an advanced laser guidance system. The launch has reduced 25.5% of procedure duration and a 9.5% rise in the endourology device segment.

- In February 2024, Lumenis introduced MOSES 2.0, a next-gen upgrade to its laser lithotripsy platform. The launch has boosted its urology segment sales by 13.7% year-over-year.

- Report ID: 283

- Published Date: Jul 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Surgical Lasers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.