Surface Acoustic Wave Filters Market Outlook:

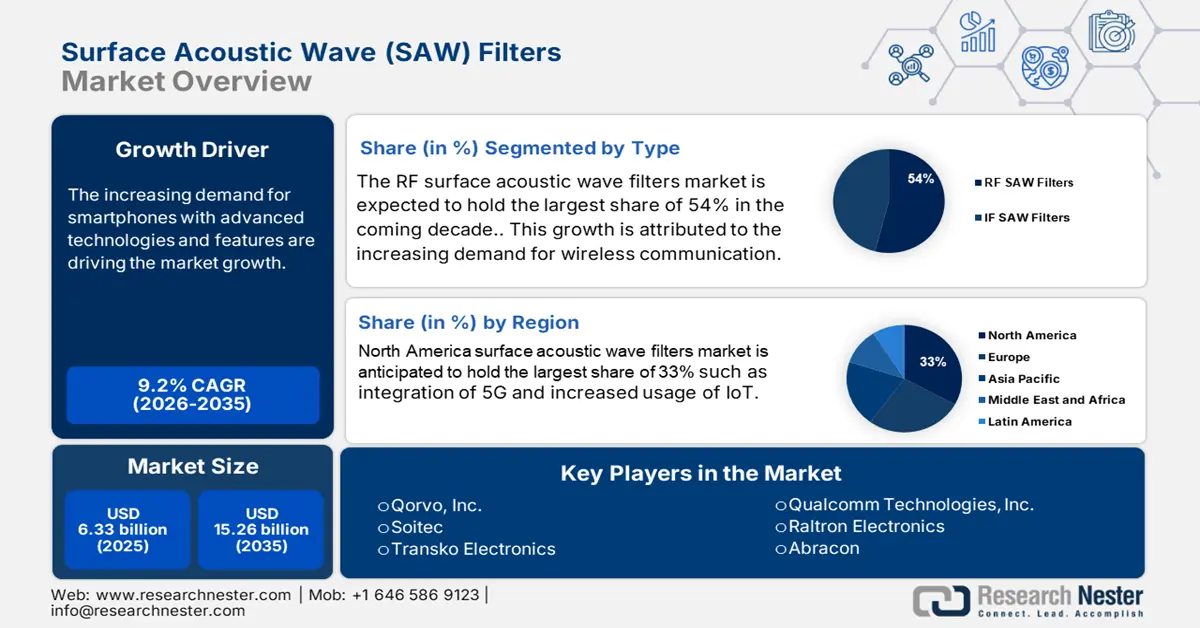

Surface Acoustic Wave Filters Market size was valued at USD 6.33 billion in 2025 and is expected to reach USD 15.26 billion by 2035, expanding at around 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of surface acoustic wave filters is evaluated at USD 6.85 billion.

The market's growth can be attributed to the rising demand for smartphones. SAW filters have remained a vital component of modern smartphones. In a report published by the World Economic Forum, there were almost 8.6 billion mobile device subscriptions present globally in 2021. A large variety of radio frequency bands (LTE bands) with frequencies ranging from 600 MHz to 2700 MHz have been supported by smartphones in recent years. Manufacturers are packing smartphones in most LTE frequency bands so that they can be compatible with networks around the world.

As a result of technological progress in the field of silicon processing and packaging, manufacturers have been able to reduce device size significantly. Filters are now more efficient and effective than in previous generations, given the development of SAW technology. High-frequency stability over a wide temperature range exists within the existing generations of SAW filters.

Key Surface Acoustic Wave (SAW) Filters Market Insights Summary:

Regional Highlights:

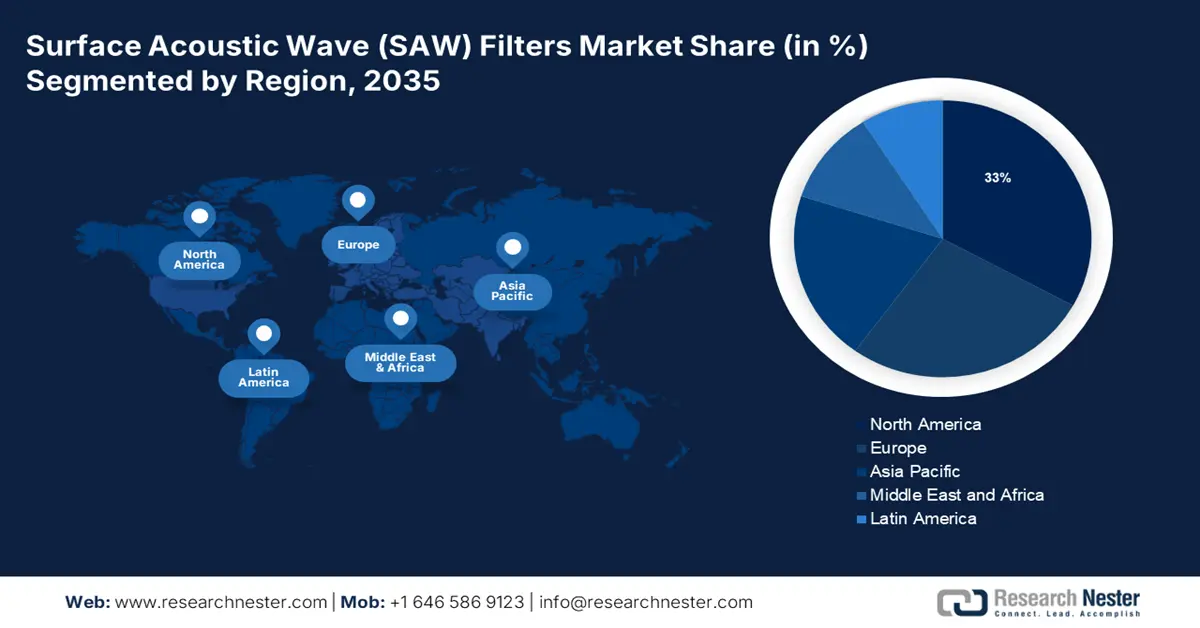

- The North America surface acoustic wave (saw) filters market will hold over 33% share by 2035, attributed to the rapid deployment of SAW filters in aerospace and 5G tech.

- The Asia Pacific market will secure 27% share by 2035, fueled by the well-established electronics and telecom industries.

Segment Insights:

- The rf saw filters segment in the surface acoustic wave filters market is forecasted to hold a 54% share by 2035, driven by increasing adoption in SATCOM devices for signal stability.

- The telecommunications segment in the surface acoustic wave filters market is projected to achieve a 36% share by 2035, attributed to the rising use of SAW filters for efficient signal transmission.

Key Growth Trends:

- Rising implementation of wireless systems in SAW filters

- Rising adoption of 5G network

Major Challenges:

- Relatively high insertion loss

Key Players: Qorvo, Inc, Qualcomm Technologies, Inc., Raltron Electronics, Soitec, Transko Electronics, TDK Corporation, Murata Manufacturing, Fujitsu Limited, Sony Semiconductor Solutions Corporation, Toshiba Corporation..

Global Surface Acoustic Wave (SAW) Filters Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.33 billion

- 2026 Market Size: USD 6.85 billion

- Projected Market Size: USD 15.26 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, China, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 11 September, 2025

Surface Acoustic Wave Filters Market Growth Drivers and Challenges:

Growth Drivers

- Rising implementation of wireless systems in SAW filters: Semiconductor manufacturers are concentrating on producing affordable, secure, and high-performing SAW filters. Mobile phones and wireless connectivity have grown to be mainstream consumer products. SAW filters are typically utilized for filtering RF signals in the lower frequency range, up to various gigahertz. For instance, according to the Wireless Infrastructure Association in March 2023, the wireless and mobile industry in the U.S. spent USD 11 billion on fabricating additional capacity. These factors are propelling the growth of the market during the assessed period.

- Rising adoption of 5G network: Several chip makers are attracted to the growing development of telecommunication infrastructure in developing economies. One of the most recent technological developments in telecommunications is the deployment of a next-generation 5G network. Surface acoustic wave filters render high-performance frequency selection, effectively filtering and selecting signals from other frequency bands. This procedure helps ensure smooth communication between devices while suppressing interference. It has been estimated that the global 5G connections number reached 2 billion in 2024 and is projected to reach 7.7 billion by 2028.

- Expansion of the Internet of Things: According to the European Commission in 2021, almost 48% of large enterprises and 26% of small enterprises used the Internet of Things. SAW sensors have gained great attention in various IoT applications. The novel technology of the embedded transducer approach allows the SAW device to transmit signals at higher speeds than commercially used devices.

- SAW applications in biosensing applications: SAW-based sensors have become popular for monitoring cell mechanics. These techniques are not only cost-efficient and versatile but also render an in-depth analysis of detected materials. According to the National Institutes of Health in 2023, surface acoustic wave biosensors have gained attention as efficacious solutions to conduct blood measurements in less than 3 minutes.

Challenges

- SAW filter is complex to manufacture: SAW filter manufacturers face challenges that require high specialization, reliable technology, and various integration tools due to the intricacy of these advanced devices. Development is a difficult process that demands specialized equipment. Therefore, one of the main factors that could hinder market growth is the complexity involved in the manufacturing of SAW filters. Also, the lower switching speed due to the complexity of the control algorithm's design affects the overall performance.

- Relatively high insertion loss: The insertion loss is the power loss when the signal passes through the filter. Also, there is a high recurring unit cost associated with the device acting as a growth-impeding factor.

Surface Acoustic Wave Filters Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 6.33 billion |

|

Forecast Year Market Size (2035) |

USD 15.26 billion |

|

Regional Scope |

|

Surface Acoustic Wave Filters Market Segmentation:

Type Segment Analysis

The RF surface acoustic wave filters market is expected to hold the largest share of 54% in the coming decade. This segment increases as RF SAW is the most advanced type of filter that helps to provide a smooth latency signal for each SATCOM device. In addition, new opportunities for electronic communication of SATCOM are being created through the use of cost-effective and low-consumption acoustic wave filters. According to the United Nations Office for Outer Space Affairs in 2022, 8,261 satellites were orbiting the Earth. The rising usage of RF SAW filters in SATCOM communication is acting as a catalyst for the segment’s growth.

Vertical Segment Analysis

The telecommunications segment in the surface acoustic wave filters market is projected to account for a share of 36%. There has been increased demand for the SAW filters as they are helpful in efficiently splitting and transmitting signals. According to the IEEE Communication Society in 2022, global spending on telecom services and Pay TV services reached USD 1,478 billion in 2022. Other than this, SAW filters are also used in consumer electronics items such as satellite radios, television receivers, radios, etc.

Our in-depth analysis of the global surface acoustic wave (SAW) filters market includes the following segments:

|

Type |

|

|

Enterprise Size |

|

|

Frequency Range |

|

|

Industry Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Surface Acoustic Wave Filters Market Regional Analysis:

North America Market Insights

North America surface acoustic wave filters market is anticipated to hold the largest share of 33%. The growth is due to the rapid deployment of SAW filtering in amplification and jamming systems in the aerospace and defence sectors. Additionally, North America is one of the earliest adopters of 5G technologies and requires sophisticated SAW filters to achieve optimal performance. It has been estimated that by the end of 2023, North America 5G connections totaled 197 million. As more 5G networks are put in place, there will be a growing need for SAW filters. Additionally, the Internet of Things (IoT) is a key factor driving the SAW filter market in the region. In the coming years, demand for RF filters in this region is expected to grow significantly as Internet of Things devices are put into more homes, businesses, and industries.

Asia Pacific Market Insights

The SAW filters market in the Asia Pacific is poised to grow significantly with a share of 27%. The boom has been driven by the well-established electronics, telecommunications, and chip industries in this region. For instance, in India, according to the Press Information Bureau, the country’s electronics sector has witnessed rapid growth and reached USD 155 billion in 2023. Surface acoustic wave filters are widely used to eradicate unwanted frequencies from electronic circuits, propelling the market growth.

Surface Acoustic Wave Filters Market Players:

- Qorvo, Inc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Qualcomm Technologies, Inc

- Raltron Electronics

- Soitec

- Transko Electronics

- TAI-SAW Technology Co., Ltd

- Vectron International

- Murata Manufacturing Co., Ltd

- Transko Electronics

- Raltron Electronics Corporation

The competitive landscape of the Market is rapidly evolving as established key players, telecom giants, and new entrants are investing in novel technologies. Key players in the market are focused on developing new technologies and products that cater to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global surface acoustic wave (SAW) filters market:

Recent Developments

- In May 2024, Nisshinbo Micro Devices Inc. released NSNJ2023 and NSNJ2024 dual surface acoustic wave filter products usable in a multi-band land mobile radio system. The device is also useful in other general-purpose radio equipment.

- In June 2023, Qorvo delivered 1st C-band BAW band pass filter and switch/LNA module for 5G small cell radios. Qorvo®, a leading global provider of connectivity and power solutions, made these announcements today.

- Report ID: 5427

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Surface Acoustic Wave (SAW) Filters Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.