Subdermal Contraceptive Implants Market Outlook:

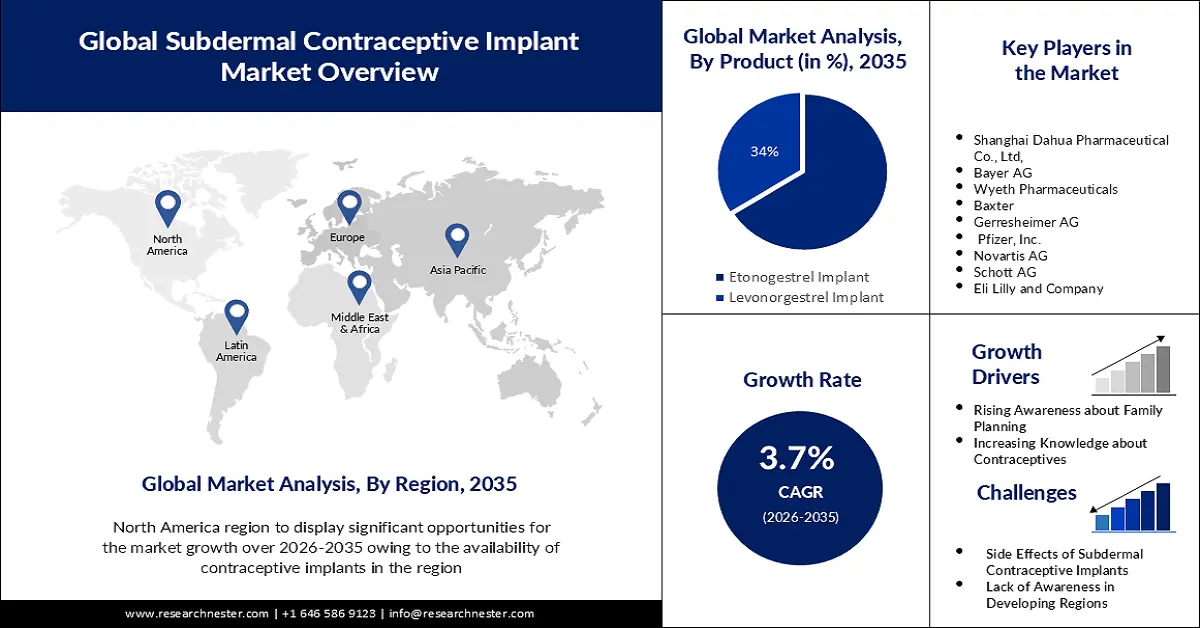

Subdermal Contraceptive Implants Market size was over USD 1.11 billion in 2025 and is anticipated to cross USD 1.6 billion by 2035, growing at more than 3.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of subdermal contraceptive implants is assessed at USD 1.15 billion.

The reason behind the growth is impelled by the rising count of unintended pregnancies. Subdermal contraceptive implants is an effective method to avoid unwanted pregnancies for women and couples, as it can stop pregnancies for three to five years. For instance, globally, there are more than 120 million unplanned pregnancies per year, or close to half of all pregnancies.

The rising governmental initiative to utilize contraceptive procedures are believed to fuel the market growth. For instance, the World Health Organization (WHO) is supporting nations to better their contraceptive policies and practices and also taking part in the development of new contraceptive methods.

Key Subdermal Contraceptive Implants Market Insights Summary:

Regional Insights:

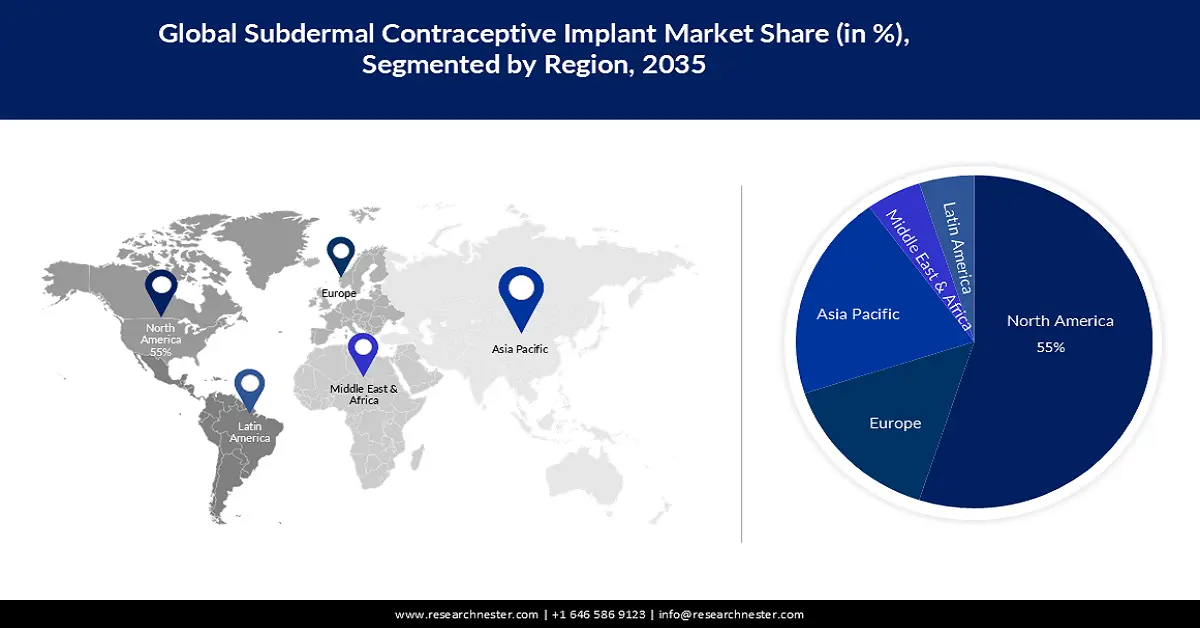

- North America is predicted to hold the largest share of 55% by 2035, impelled by the widespread availability of contraceptive implants such as Nexplanon.

- APAC is expected to be the second largest region by 2035, driven by rising government initiatives to enhance access to contraceptive methods.

Segment Insights:

- The etonogestrel implant segment is projected to account for 66% share by 2035, propelled by its high contraceptive efficacy and FDA approval for up to three years.

- The hospital segment is expected to secure a significant share by 2035, driven by the need for clinical settings for implant insertion and specialized removal procedures.

Key Growth Trends:

- Rising Awareness about Family Planning

- Increasing Knowledge about Contraceptives

Major Challenges:

- Side Effects of Subdermal Contraceptive Implants

- Lack of Awareness in Developing Regions

Key Players: Shanghai Dahua Pharmaceutical Co., Ltd, Bayer AG, Wyeth Pharmaceuticals, Baxter, Gerresheimer AG, Pfizer, Inc., Novartis AG, Schott AG, Eli Lilly and Company.

Global Subdermal Contraceptive Implants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.11 billion

- 2026 Market Size: USD 1.15 billion

- Projected Market Size: USD 1.6 billion by 2035

- Growth Forecasts: 3.7%

Key Regional Dynamics:

- Largest Region: North America (55% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Indonesia, Vietnam, Mexico

Last updated on : 25 November, 2025

Subdermal Contraceptive Implants Market - Growth Drivers and Challenges

Growth Drivers

- Rising Awareness about Family Planning – As a result, the demand for subdermal contraceptive implants is expected to rise as they have a huge potential to help in family planning, and are one of the most practical, accessible, and increasingly accepted forms of family planning in the world. Globally, more than 60% percent of married women between the ages of 15 and 49 practice family planning.

- Increasing Knowledge about Contraceptives- Educational interventions across the globe are helping to increase the knowledge of available contraceptive methods, which has led to an increase in the adoption of subdermal contraceptive implants as an acceptable means of contraception for adolescent girls and young women.

Challenges

-

Side Effects of Subdermal Contraceptive Implants- There are a few side effects that some people experience after receiving implants which include menstrual irregularities, headaches, weight gain, acne, dizziness, mood swings, nausea, lower abdominal pain, hair loss, loss of libido, pain at the implant site, neuropathy, and follicular cysts.

Additionally, implanon (etonogestrel) a contraceptive used to prevent pregnancy can cause serious eye symptoms, serious heart symptoms, and severe headache, confusion, slurred speech, arm or leg weakness, trouble walking, loss of coordination. Furthermore, it should not be used at the time of pregnancy as it can lead to a certain serious pregnancy issue (ectopic pregnancy).

- Lack of Awareness in Developing Regions

- Lack of Skilled Professionals to Insert and Remove these Implants

Subdermal Contraceptive Implants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.7% |

|

Base Year Market Size (2025) |

USD 1.11 billion |

|

Forecast Year Market Size (2035) |

USD 1.6 billion |

|

Regional Scope |

|

Subdermal Contraceptive Implants Market Segmentation:

Product Segment Analysis

The etonogestrel implant segment is estimated to hold 66% share of the global subdermal contraceptive implants market during the forecast period. Etonogestrel implant is a hormonal birth control method that comes in the form of a flexible plastic matchstick-sized rod. Additionally, the U.S. Food and Drug Administration has given the etonogestrel subdermal implant approval for contraception for up to three years as a highly effective contraceptive option for women. Moreover, the etonogestrel implant has a failure rate of less than 1%, making it more efficient than female sterilization.

Application Segment Analysis

Subdermal contraceptive implants market from the hospital segment is set to garner a notable share shortly. Subdermal contraceptive implant procedure is usually performed within the hospital premises whereby the gynecologist places the implant in the non-dominant arm, typically, in the consultation room by using a local anesthetic. Besides this, sometimes there may be a need for specialized procedures, including hospital surgery if it gets difficult to remove the implant, or it cannot be found.

Type Segment Analysis

Subdermal contraceptive implants market from the biodegradable segment is set to garner significant share by the year 2035. Levonorgestrel (LNG) biodegradable subcutaneous implants have emerged as the most promising long-term contraceptive methods as they release a contraceptive steroid for a predetermined amount of time before dissolving. Besides this, a subdermal biodegradable contraceptive implant is used to provide secure and reliable contraception, as it is a low-cost, biodegradable implant system in the form of a subdermal pellet, is extremely adaptable, and does not need to be surgically removed.

Our in-depth analysis of the global subdermal contraceptive implants market includes the following segments:

|

Product |

|

|

Application |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Subdermal Contraceptive Implants Market - Regional Analysis

North American Market Insights

Subdermal contraceptive implants market in North America is predicted to account for the largest share of 55% by 2035 impelled by the availability of contraceptive implants. Nexplanon which resembles a matchstick in size and is a tiny, thin rod is the implant that is offered in the US. Besides this, Canada has now authorized the use of Nexplanon to give patients in the country an essential and long-overdue expansion of their options for contraception. For instance, Women in the US had access to over 50% of the contraceptive products available globally, as compared to approximately 34% for Canadian women.

APAC Market Insights

The APAC subdermal contraceptive implants market is estimated to be the second largest, during the forecast timeframe led by rising government’s initiatives to improve access to contraceptive methods. The Indian government has made important strides towards enhancing sexual and reproductive health at the national, local, and rural levels by launching various initiatives such as Mission Parivar Vikas, which will greatly expand access to family planning and contraceptives. For instance, lately, India's adoption of the Sustainable Development Goals (SDG) indicator over 3 intends to ensure that everyone has access to sexual and reproductive health care services by 2030 by meeting three-fourths of family planning needs with contemporary contraceptive methods.

Subdermal Contraceptive Implants Market Players:

- Merck & Co., Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Shanghai Dahua Pharmaceutical Co., Ltd,

- Bayer AG

- Wyeth Pharmaceuticals

- Baxter

- Gerresheimer AG

- Theramex

- Contraline, Inc.

- Pfizer, Inc.

- Novartis AG

- Schott AG

- Eli Lilly and Company

- Sandoz International GmbH

- Teva Pharmaceutical Industries Ltd.

Recent Developments

- Shanghai Dahua Pharmaceutical Co., Ltd, along with DKT WomanCare announced to reduce the price of, a two-rod contraceptive implant Levoplant that was recently approved to enhance women's reproductive health autonomy. Furthermore, it will now cost qualified buyers around USD 6 which will aid in increasing access to a high-quality contraceptive for those who need it the most and will make it easier for people who require access to quality contraception.

- Contraline, Inc. announced to investment of over USD 7 million for the creation of the first injectable hydrogel-based implanted male contraceptives to create a long-acting, reversible male contraceptive that gives more individuals more choices for family planning and changes how people think about contraception.

- Teva Pharmaceutical Industries Ltd. introduced a Generic Version of NuvaRing intended for use by women of reproductive age that combines estrogen and progestin to prevent conception. Furthermore, the product is an essential addition to Teva's generic product line which must be worn for three weeks.

- Report ID: 5300

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.