Structural Health Monitoring Market Outlook:

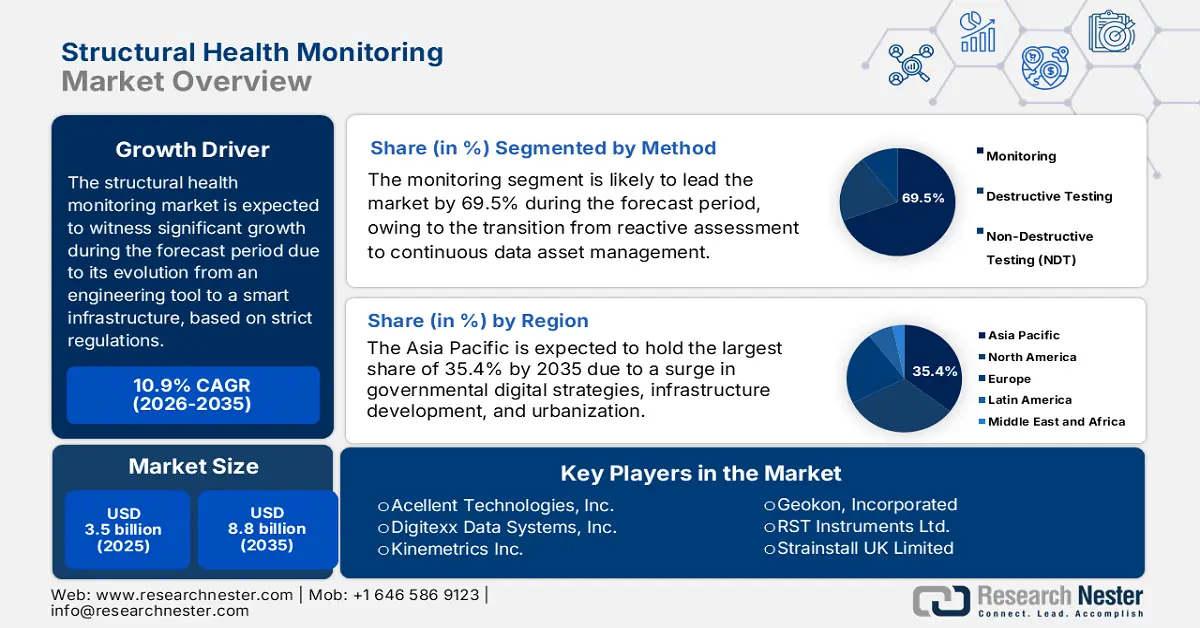

Structural Health Monitoring Market size was over USD 3.5 billion in 2025 and is estimated to reach USD 8.8 billion by the end of 2035, expanding at a CAGR of 10.9% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of structural health monitoring is estimated at USD 3.8 billion.

The international structural health monitoring market is currently undergoing a crucial transformation, evolving from a specialized engineering tool to a standard component of smart infrastructure and Industry 4.0 strategies. This particular shift is readily driven by the effective convergence of rapid maturation of digital technologies, strict regulations, and aging global infrastructure. According to an article published by the United Nations Organization in 2025, digitalized technologies have progressed rapidly than any other advancement and successfully reached 50% of the developing world’s population within 20 years. Besides, there has been increased focus on shifting to a green economy that is projected to create 24 million new employment opportunities by the end of 2030, thereby denoting an optimistic outlook for the overall market.

Furthermore, the convergence of digital twins, sudden shift to the Internet of Things (IoT)-driven and wireless systems, predictive insights and artificial intelligence-based analytics, integrated multimodal sensing, and growth in platform-specific and SaaS models are also uplifting the structural health monitoring market globally. As per an article published by the NIELIT Government in May 2022, there has been a surge in internet-connected devices by 12.5 billion, which has surpassed the number of human beings, accounting for 7 billion. In addition, the number is gradually increasing by 26 billion to 50 billion, which is creating a positive impact on the market’s continuous growth. Besides, as stated in an article published by the OECD Organization in September 2025, 70% of nations utilize AI to optimize internal governmental processes, while 33% use it to improve policy implementation and design, thereby making it suitable for the market’s development.

Key Structural Health Monitoring Market Insights Summary:

Regional Insights:

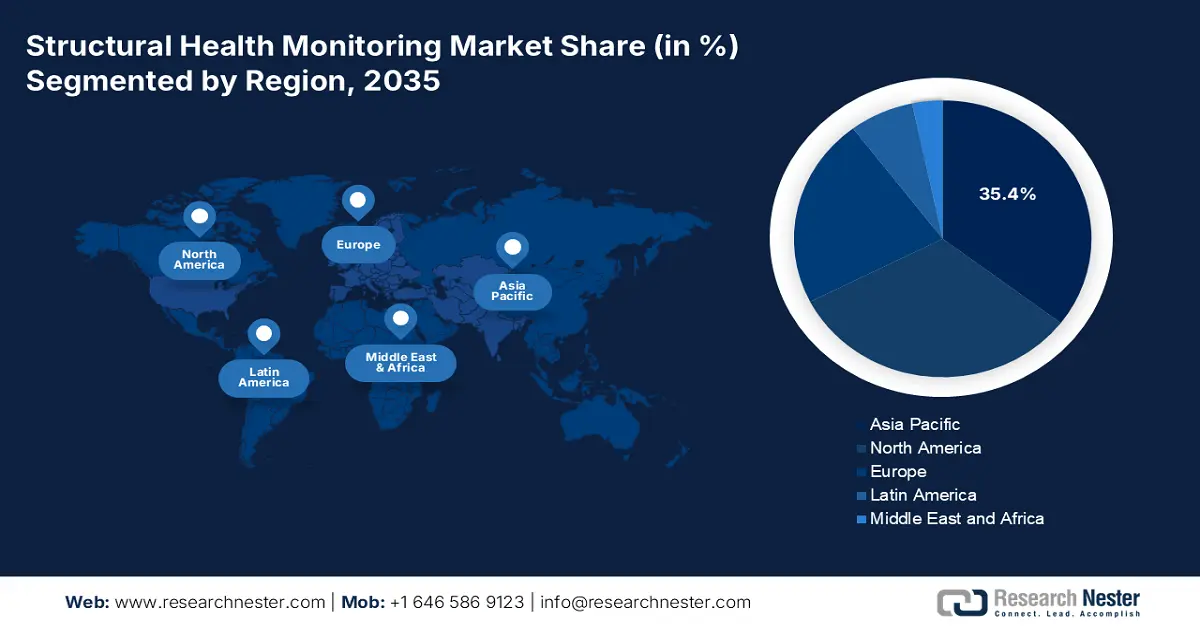

- By 2035, Asia Pacific is anticipated to command a 35.4% share in the structural health monitoring market, underpinned by expansive urbanization and government-led digital infrastructure mandates.

- Europe is poised to emerge as the fastest-growing region during 2026–2035, bolstered by its strategic digital transition initiatives and reinforced infrastructure safety regulations.

Segment Insights:

- The monitoring segment is projected to secure a 69.5% share in the structural health monitoring market by 2035, reinforced by the shift toward continuous, data-driven asset management.

- The wired systems sub-segment is expected to attain the second-largest share during 2026–2035, supported by its reliability, high bandwidth performance, and suitability for mission-critical environments.

Key Growth Trends:

- Green building standards and government regulations

- Increase in aging infrastructures

Major Challenges:

- Lack of interoperability and standardization

- Skill shortage, cybersecurity risks, and data overload

Key Players: Siemens AG (Germany), Robert Bosch GmbH (Germany), General Electric Company (U.S.), Honeywell International Inc. (U.S.), Campbell Scientific, Inc. (U.S.), National Instruments Corporation (U.S.), Nova Metrix LLC (U.S.), COWI A/S (Denmark), Hottinger Brüel & Kjær (HBK) (Germany), Acellent Technologies, Inc. (U.S.), Digitexx Data Systems, Inc. (U.S.), Kinemetrics Inc. (U.S.), Geokon, Incorporated (U.S.), RST Instruments Ltd. (Canada), Strainstall UK Limited (U.K.), SGS S.A. (Switzerland), Pure Technologies (Xylem Inc.) (U.S.), Advitam Inc. (France), Feac Engineering Pty Ltd (Australia).

Global Structural Health Monitoring Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.5 billion

- 2026 Market Size: USD 3.8 billion

- Projected Market Size: USD 8.8 billion by 2035

- Growth Forecasts: 10.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.4% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Brazil, China, Norway, United Kingdom

- Emerging Countries: China, India, Singapore, South Korea, Japan

Last updated on : 5 December, 2025

Structural Health Monitoring Market - Growth Drivers and Challenges

Growth Drivers

- Green building standards and government regulations: The aspects of safety regulations, upgraded building codes, and green certification standards have readily incentivized the integration of monitoring systems for performance validation, sustainability, and safety. According to an article published by the World Economic Forum in June 2024, the collaboration between BOSTON Consulting Group with China and Beyond has resulted in identifying 11 tactical transition levers that can unlock more than 80% of abatement potential and ensure a USD 1.8 trillion market growth opportunity. Moreover, buildings are responsible for 37% of international carbon dioxide emissions, along with 34% of the Earth’s species, thus denoting the increasing demand for green buildings for the structural health monitoring market’s growth.

- Increase in aging infrastructures: The deteriorating state of buildings, pipelines, dams, and bridges, particularly in Europe and North America, is also considered a primary driver for the structural health monitoring market. This has readily compelled international governments to generously invest in monitoring solutions for optimizing repair planning and ensuring risk mitigation by legislation, such as the U.S. Infrastructure Investment and Jobs Act. For instance, as per an article published by the ITA in January 2024, different states in India have planned to develop infrastructure, and this can be initiated by targeting a USD 5 trillion economy through an investment of USD 30 billion by the government to focus on smart city strategies. These particular projects are expected to provide opportunities for the safety and security industry, thus denoting an optimistic outlook for the market.

- Advancement in enabling technologies: The declining expense of sensors, powerful AI software, strong wireless connectivity, and ubiquitous cloud computing have made sophisticated structural health monitoring systems more cost-effective, dependable, and accessible for comprehensive applications. As per an article published by the National Bureau of Economic Research in 2025, the cost of basic cloud computing services reduced by 55% to 70%. For instance, the cloud storage products of Amazon fell at an average yearly rate of 12% to 25%. Moreover, the aspect of traffic at cloud data centers, which is compiled by Cisco Systems, indicated advancements by 62%. Therefore, with such low cloud computing operations, there is a huge growth opportunity for the structural health monitoring market across different nations.

Challenges

- Lack of interoperability and standardization: The structural health monitoring market is highly plagued by the absence of data and universal technical standards, which has created an effective friction in system design, scalability, and deployment. Besides, data acquisition systems and sensors from various manufacturers frequently utilize software interfaces, data formats, and proprietary communication protocols. This has resulted in vendor lock-in that readily limits an owner’s capability to implement best-in-class components and effectively complicates data aggregation from disparate systems across a portfolio of assets. Moreover, the resultant data silos have hindered the development of organizational predictive analytics as well as digital twins, thereby creating a negative impact on the market’s growth.

- Skill shortage, cybersecurity risks, and data overload: The promise of ongoing monitoring can rapidly emerge as a liability of data overload, which causes a gap in the structural health monitoring market’s growth. Different systems generate massive volumes of raw data without offering actionable and clear insights, resulting in alert fatigue, wherein critical warnings are overlooked. Besides, extracting value needs innovative data science, along with structured engineering expertise, which is considered an expensive and rare combination, leading to a significant shortage in skills and talent. Meanwhile, increased focus on connectivity of severe infrastructure to corporate IT networks, as well as cloud, has introduced critical cybersecurity vulnerabilities, thus negatively impacting the market’s development.

Structural Health Monitoring Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.9% |

|

Base Year Market Size (2025) |

USD 3.5 billion |

|

Forecast Year Market Size (2035) |

USD 8.8 billion |

|

Regional Scope |

|

Structural Health Monitoring Market Segmentation:

Method Segment Analysis

The monitoring segment, which is part of the method, is anticipated to garner the largest share of 69.5% in the structural health monitoring market by the end of 2035. The segment’s exposure in the market is highly anticipated to ensure a fundamental shift from periodic and reactive assessment to ongoing and data-based asset management. This particular method comprises the permanent installation of sensor networks that offer frequent or real-time data on a structure’s condition. In addition, its overwhelming market is highly propelled by the increasing demand for operational risk mitigation and predictive maintenance. Besides, the aspect of economic imperative, insurer requirements, and regulations are readily compelling owners to move beyond sporadic non-destructive testing (NDT), thereby creating a positive impact on the overall segment’s growth.

Technology Segment Analysis

The wired systems sub-segment, a part of the technology segment, is projected to hold the second-largest share in the structural health monitoring market during the forecast period. The sub-segment’s development is highly fueled by the testament to its high-stakes application, precision, and unmatched reliability. Besides, in environments wherein the aspect of data integrity of non-negotiable, including aerospace testing, offshore oil platforms, large-span bridges, and nuclear facilities, wired systems offer a secure connection immune, high bandwidth, and stability to radio frequency interference. Additionally, these also provide power delivery, diminish concerns regarding battery life, and ensure maintenance logistics for embedded sensors, thereby making it suitable for boosting the sub-segment’s exposure in the structural health monitoring market.

Connectivity Segment Analysis

Based on the connectivity, the wired connectivity segment is predicted to account for the third-largest share in the structural health monitoring market by the end of the stipulated timeline. The segment’s development is highly fueled by its strong data transmission, accuracy, and high reliability, which makes it the most preferred option for severe infrastructure projects, despite the presence of high installation complexity and costs. Besides, according to an article published by the PIB Government in December 2024, there has been a surge in Internet subscribers to 96.6 crore from 25.1 crore, denoting a growth by 285%. This denotes an increased utilization of the Internet as a wired connection for developing infrastructures, thus proliferating the segment’s upliftment within the market scenario.

Our in-depth analysis of the structural health monitoring market includes the following segments:

|

Segment |

Subsegments |

|

Method |

|

|

Technology |

|

|

Connectivity |

|

|

Offering |

|

|

End user |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Structural Health Monitoring Market - Regional Analysis

APAC Market Insights

The Asia Pacific is anticipated to hold the highest share of 35.4% in the structural health monitoring market by the end of 2035. The market’s growth in the region is significantly driven by unprecedented infrastructure development, proactive government digitalization mandates, and increased urbanization. Moreover, India’s Smart Cities Mission, along with National Infrastructure Pipeline, and China’s Digital China, as well as new infrastructure strategies, are also creating a sustained demand for the market in the region. According to an article published by the UN-HABITAT Organization in 2025, 54% of the worldwide urban population, which is over 2.2 billion people, reside in the region. In addition, by the end of 2050, the regional urban population is projected to increase by 50%, accounting for an additional 1.2 billion people, thus creating a huge growth opportunity for the overall market.

India, in the structural health monitoring market, is growing significantly due to the confluence of huge public infrastructure investment, a robust policy push for disaster-based construction, and urgent urban digitalization. As per an article published by the IBEF Organization in October 2025, the country intends to boost its infrastructure and reach the USD 5 trillion target by the end of 2025. Regarding this, the demand for cement is predicted to remain strong, with a 7% to 8% growth rate within 2 years. Besides, as of March 2024, the Prime Minister unveiled connectivity projects, amounting to USD 18 billion, which is also uplifting the market in the country. Moreover, in terms of the NIP project, almost Rs. 25,00,000 crore (USD 292 billion) has been readily invested for 3,500 projects in different industries, based on which there is a huge growing scope for the overall market.

India’s Growth Index Industries (2025)

|

Industry Type |

Growth Index |

|

Coal |

192.0 |

|

Crude Oil |

75.4 |

|

Natural Gas |

75.9 |

|

Refinery Products |

139.7 |

|

Fertilizers |

133.5 |

|

Steel |

214.2 |

|

Cement |

197.4 |

|

Electricity |

208.6 |

|

Overall |

164.9 |

Source: IBEF Organization

China, in the structural health monitoring market, is also growing, owing to increased digitalization, expansion in huge legacy infrastructure and quality assurance, mitigating geological and seismic hazards, increased focus on smart city and digital twin city megaprojects, and ensuring industrial upgradation with the Made in China 2025 approach. As per a report published by the NUS in April 2022, RMB17.5 trillion (an estimated USD 2.4 trillion) is projected to be invested in the country’s 5G infrastructure by the end of 2025 from private and public capital. Moreover, the country at present boasts accessibility to 1.3 million 5G base stations, which cover 60% of the global stations. Besides, the Cyberspace Administration of China has declared a suitable plan for IPv6 and has already occupied 50% of the nation’s internet traffic as of 2023, and is poised to gain 70% by the end of 2025 across overall social and economic industries.

Europe Market Insights

Europe in the structural health monitoring market is projected to emerge as the fastest-growing region during the forecast duration. The market’s development in the region is highly propelled by the robust push for strategic digitalized transition and infrastructure safety, both of which are significantly supported by regional funding mechanisms, such as the Digital Europe Programme. As stated in an article published by the CEPSIS Organization in March 2025, the Europe Commission has readily allocated €1.3 billion under the Digital Europe Programme for 2025 and 2027, with the intention of strengthening the region’s technological sovereignty. Besides, the national adoption of the region’s Revised Construction Products Regulation (CPR) has mandated stringent sustainability as well as safety standards, which is also driving the market’s demand in the region.

Germany in the structural health monitoring market is gaining increased traction, owing to the presence of a huge industrial base, a strict regulatory framework, and unparalleled public investment in infrastructure modernization. The Transeuropean Transport Network (TEN-T) modernization program and the federal government’s Digital Strategy plan are considered primary catalysts, mandating the integration of smart monitoring solutions for waterways, railways, and bridges. As per an article published by the HEISE in November 2025, the Bundestag Budget Committee has readily approved EUR 4.4 billion for the Federal Ministry for Digital and State Modernization (BMDS). Moreover, with a core budget of an estimated EUR 956.2 million, there has been an expansion of the federal government’s IT infrastructure, which positively impacts the market’s upliftment in the country.

The UK in the structural health monitoring market is also developing due to the strategic national infrastructure, the levelling up agenda, critical safety mandates, aging asset base, the presence of data as infrastructure policy, digital twin mandate, and effective leadership in energy transition. According to an article published by the UK Government in July 2025, the infrastructure pipeline in the country is poised to provide update regarding 780 planned public and private sector projects. In addition, this particular pipeline has readily outlined £530 billion of programs and projects for the upcoming 10 years, which comprises £285 billion fund only for the public industry. Besides, as per the July 2023 UK Government article, the UK Infrastructure Bank has been successfully established with a capital funding of £22 billion to upgrade and decarbonize the overall economy, thus suitable for boosting the market’s exposure.

North America Market Insights

North America in the structural health monitoring market is expected to witness growth at a considerable rate by the end of the stipulated period. The market’s growth in the region is highly propelled by the presence of strict regulatory mandates, significant federal funding, and an aging infrastructure crisis. As per an article published by the Office of Operations in February 2025, the Infrastructure Investment and Jobs Act (IIJA) emerged as the ultimate law, along with denoting a long-lasting investment in the region’s economy and infrastructure by offering USD 550 billion as of 2022. This fund is regarded as the federal investment in facilities, such as broadband, resilience, water infrastructure, mass transit, bridges, and roads. In addition, this has been directly mandated and funded innovative monitoring technologies for longevity and safety. Therefore, this public investment is readily catalyzing the market’s adoption in the region’s private sector.

The structural health monitoring market in the U.S. is gaining increased exposure, owing to regulatory and safety factors, such as the Environmental Protection Agency’s (EPA) Risk Management Program (RMP) and the Occupational Safety and Health Administration (OSHA). Additionally, the presence of sustainability programs and federal funding is also responsible for the market’s upliftment in the country. For instance, as per an article published by the U.S. Department of Energy in January 2024, there has been an announcement of USD 104 million for energy conservation as well as clean energy projects. This is considered the latest strategy to effectively re-establish the federal government, and this also frequently supports projects by implementing smart monitoring and sensors for optimal process control, along with fugitive emission detection.

The structural health monitoring market in Canada is also growing due to extreme weather adaptation, climate resilience, transit investment, federal green infrastructure, and tactical focus on natural resources and energy transition infrastructure, along with bridge safety and aging core infrastructure. According to an article published by the Government of Canada in September 2025, the country’s government committed to more than USD 180 billion for over 12 years. This has readily benefited the country’s population, from trading ports to public transit, energy systems to broadband networks, and natural spaces to community services. Based on this plan, there has been an additional investment of more than USD 168 billion for more than 100,000 projects, of which 93% are completed. Therefore, with increased focus on introducing such strategies, there is a huge growth opportunity for the market in the country.

Key Structural Health Monitoring Market Players:

- Hexagon AB (Sweden)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens AG (Germany)

- Robert Bosch GmbH (Germany)

- General Electric Company (U.S.)

- Honeywell International Inc. (U.S.)

- Campbell Scientific, Inc. (U.S.)

- National Instruments Corporation (U.S.)

- Nova Metrix LLC (U.S.)

- COWI A/S (Denmark)

- Hottinger Brüel & Kjær (HBK) (Germany)

- Acellent Technologies, Inc. (U.S.)

- Digitexx Data Systems, Inc. (U.S.)

- Kinemetrics Inc. (U.S.)

- Geokon, Incorporated (U.S.)

- RST Instruments Ltd. (Canada)

- Strainstall UK Limited (U.K.)

- SGS S.A. (Switzerland)

- Pure Technologies (Xylem Inc.) (U.S.)

- Advitam Inc. (France)

- Feac Engineering Pty Ltd (Australia)

- Hexagon AB is considered a market leader and offers end-to-end structural health monitoring solutions through its Leica Geosystems and Intergraph divisions. The organization specializes in asset lifecycle management software and high-precision geospatial sensors that tend to integrate sensor data with digital twin platforms. Its strength remains in developing a closed-loop ecosystem from data capture to actionable insight for large-scale industrial and infrastructure assets. Therefore, based on its 2024 sustainability report, the organization has achieved EUR 5.4 billion in revenue, 30% in operating margin, 91% in cash conversion, and has its operations across more than 50 countries.

- Siemens AG has leveraged its in-depth building technology and industrial automation expertise to provide integrated structural health monitoring systems, especially through its Siemens Smart Infrastructure division. The company readily focuses on linking structural sensor data to its very own IoT-driven cloud platform for achieving operational optimization and predictive maintenance.

- Robert Bosch GmbH significantly contributes to the structural health monitoring market primarily through its strong portfolio of MEMS sensors, which are essential components for inertial measurement and vibration in wireless monitoring systems. Along with its cross-domain software suite that permits data analytics and fusion for condition-based monitoring across sectors. Besides, as per its 2024 annual report, the company has achieved €152,269,378 in income from participating interests, along with €455,616 from similar expenses and interests.

- General Electric Company is regarded as the pivotal player, particularly in the aerospace and energy verticals, by applying its renowned Predix software platform to monitor critical structures, such as aircraft engines, power plant components, wind turbine blades, and Bently Nevada asset performance monitoring technology, thus translating vibration and straining data into fleet-wide health predictions.

- Honeywell International Inc. has integrated structural health monitoring into its wide-ranging industrial and building safety ecosystems, providing solutions that effectively connect structural integrity data from sensors to its building management systems, along with forging performance software by ensuring operational safety, efficiency, and compliance for industrial and smart cities.

Here is a list of key players operating in the global structural health monitoring market:

The international structural health monitoring market is highly fragmented and significantly dominated by established industrial giants and specialized sensor firms from Europe and the U.S. Notable players are readily pursuing growth through two strategic initiatives, such as software platform development and vertical integration. Moreover, organizations such as Siemens and Hexagon are acquiring niche sensor and software firms to provide end-to-end solutions from AI-based and data acquisition analytics. Likewise, specialists, including National Instruments and Campbell Scientific, are focusing on interoperable platforms to lock customers through data ecosystem control. Besides, in November 2024, Fujitsu declared that it has successfully developed Policy Twin, which is the newest digital twin technology to readily stimulate the social impact of localized government policies, thus denoting an optimistic outlook for the structural health monitoring market.

Corporate Landscape of the Structural Health Monitoring Market:

Recent Developments

- In September 2025, Digital Twin Consortium notified that Advanced Micro Devices, Inc. (AMD) has successfully joined as a partner and will provide next-generation AI processing capabilities as well as advanced edge computing solutions to boost AI-driven digital twin systems.

- In December 2024, Siemens Smart Infrastructure has readily set higher ambitions to fuel the next level of value creation by announcing its mid-term targets to gain 6% to 9% comparable revenue growth by readily combining digital and real worlds for sustainable infrastructure.

- Report ID: 173

- Published Date: Dec 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Structural Health Monitoring Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.