Stingray Device Market Outlook:

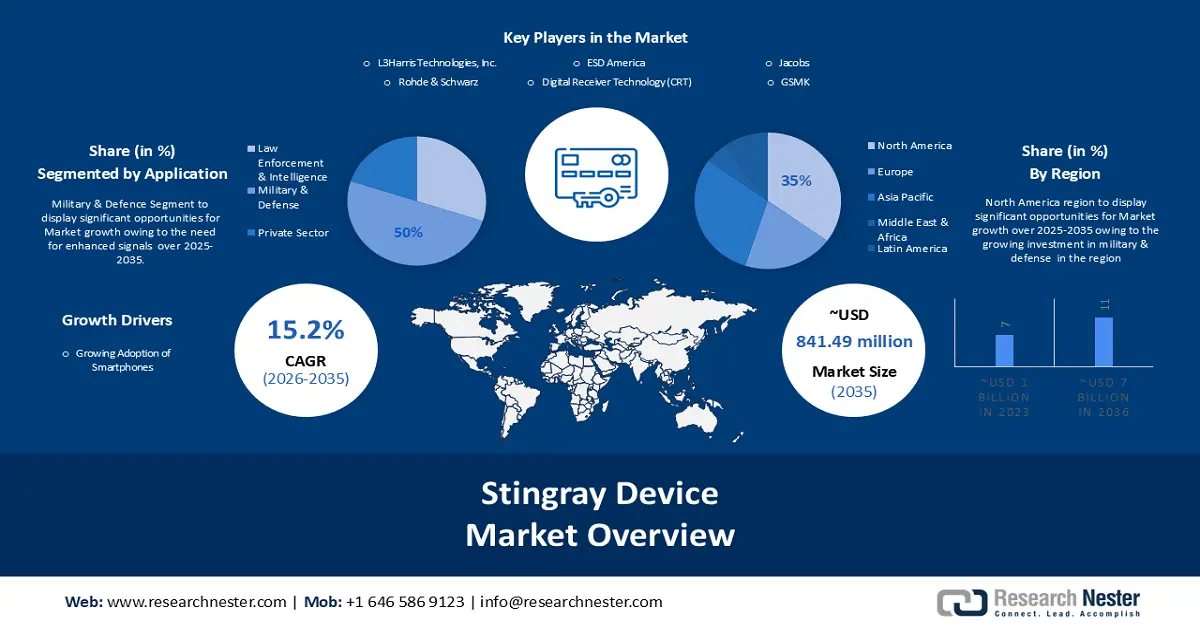

Stingray Device Market size was over USD 204.42 million in 2025 and is poised to exceed USD 841.49 million by 2035, witnessing over 15.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of stingray device is estimated at USD 232.38 million.

This growth of the stingray device market is poised to be dominated by the growing prevalence of crime such as robbery. For instance, in the case of America in 2022, there were over 44,085 handgun-related robberies in the US. Hence, the need for stingray devices is surging significantly.

Furthermore, the development of encryption technologies to safeguard data and communication presents a prospect for stingray device producers to devise inventive methods to surmount encryption obstacles. Hence, there has been growing research and development initiatives taking place in order to increase the efficacy of stingray devices which further aimed at enhancing interception capabilities and encryption countermeasures.

Key Stingray Device Market Insights Summary:

Regional Insights:

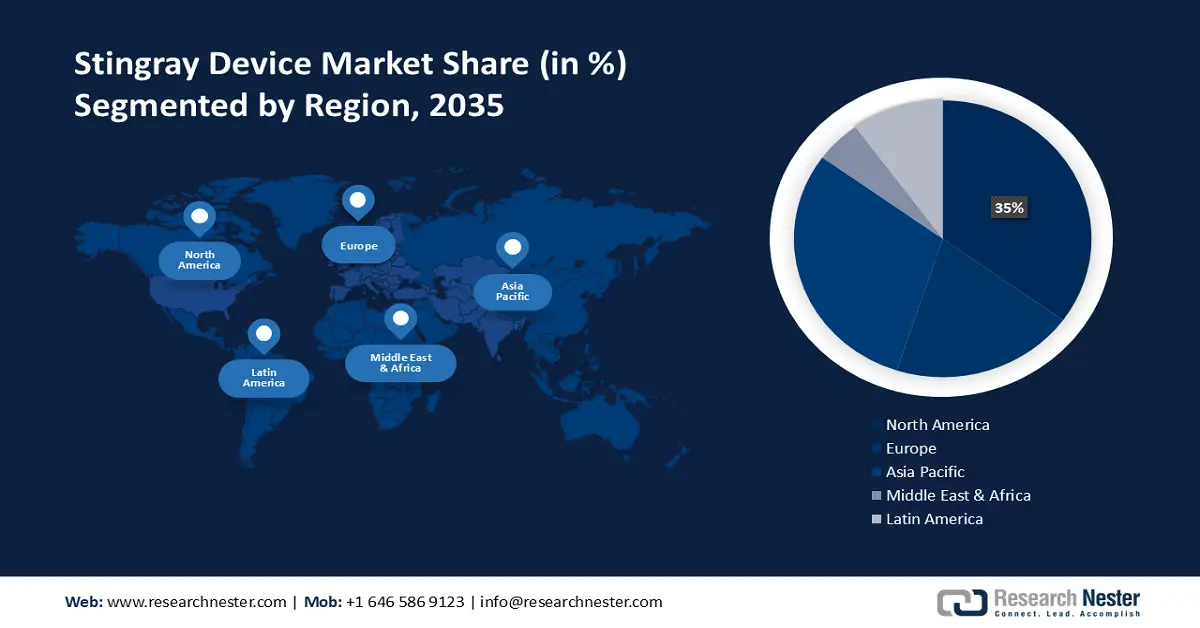

- North America is estimated to account for a 35% share by 2035, owing to growing investment in military & defense.

- asia pacific is projected to experience significant growth in the stingray device market by 2035, fueled by increasing demand for improved surveillance and law enforcement technologies.

Segment Insights:

- The 5G interceptors segment is expected to gather the highest revenue share of about 30% by 2035, impelled by the rollout and proliferation of 5G technology.

- The military & defense segment is poised to generate the largest revenue share of about 50% in the stingray device market by 2035, propelled by the heightened need for advanced signals intelligence (SIGINT) capabilities.

Key Growth Trends:

- Growing Adoption of Smartphones

- Surge in Cyber Treat

Major Challenges:

- Growing Regulatory Challenges

- Surge in Concern for Privacy

Key Players: L3Harris Technologies, Inc., Rohde & Schwarz, ESD America, Digital Receiver Technology (DRT), Rayzone Group, Ltd., NovoQuad Group, Jacobs, Septier Communication LTD, GSMK, PKI Electronic Intelligence.

Global Stingray Device Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 204.42 million

- 2026 Market Size: USD 232.38 million

- Projected Market Size: USD 841.49 million by 2035

- Growth Forecasts: 15.2%

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: - United States, China, Russia, United Kingdom, India

- Emerging Countries: - India, Indonesia, Brazil, Turkey, Saudi Arabia

Last updated on : 27 November, 2025

Stingray Device Market - Growth Drivers and Challenges

Growth Drivers

- Growing Adoption of Smartphones- It was predicted that between 2024 and 2029, there is expected to be a constant rise in the number of smartphone users worldwide, adding about 2 billion people (or over 29 percent). The number of smartphone users is predicted to reach over 7 billion after rising for fifteen years in a row, marking a new peak in 2029. With the rise in the adoption of smartphones, the preference for stingray devices is also growing. This is because most of the communication happens through cell phones.

- Surge in Cyber Treat- Governments are depending increasingly on cyber surveillance to handle certain administrative duties in the fields of civil security, education, welfare, and health. Enterprises that prioritize safeguarding specific data or keeping tabs on staff or customer conduct have also resorted to "cyber-surveillance" and "corporate surveillance." As part of their efforts to publicly condemn behavior they find objectionable, civil society and citizens' organizations may also employ information technologies to keep an eye on the words and actions of government agencies or commercial entities. Hence, for this stingray device could be used. Software-defined radio (SDR) technology provides a versatile and reconfigurable approach to wireless communication for Stingray devices. These devices have become an important weapon for law enforcement agencies in the fight against cybercrime as a result of their ability to mimic a cell tower and intercept mobile conversations.

- Surge in Integration of AI - New opportunities may arise from the merging of stingray devices with artificial intelligence (AI) and advanced analytics technologies. The efficiency and efficacy of law enforcement and intelligence operations may be increased by using stingray devices to give more insightful and actionable intelligence by utilizing AI algorithms and data analytics. This could be achieved since AI could guide the authority in availing real-time data in order to track the moment automatically identified by a stingray. It could also aid in decision-making regarding further steps to be taken on the basis of collected data.

Challenges

- Growing Regulatory Challenges - The application of stingray devices is governed by legal and regulatory frameworks that differ according to the jurisdiction. Certain regions may impose limitations on its implementation as a result of privacy issues, constitutional rights, or stringent usage requirements. Law enforcement agencies may face difficulties in adhering to these restrictions and acquiring the required warrants and approvals, which could restrict the widespread use of Stingray devices.

- Surge in Concern for Privacy - Concerns regarding invasions of privacy and possible civil rights violations are raised by the usage of stingray devices. Monitoring and intercepting communication data might violate people's right to privacy and present moral dilemmas. The launch and acceptance of Stingray devices may face obstacles due to public scrutiny and demands for accountability, transparency, and openness in the use of surveillance technologies.

- Lack of Efficient Investment for the Adoption by Authority

Stingray Device Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15.2% |

|

Base Year Market Size (2025) |

USD 204.42 million |

|

Forecast Year Market Size (2035) |

USD 841.49 million |

|

Regional Scope |

|

Stingray Device Market Segmentation:

Type (IMIS Catchers, GSM Interceptors, CDMA Interceptors, 4G/LTE Interceptors, 5G Interceptors)

The 5G interceptors segment in the stingray device market is expected to gather the highest revenue share of about 30% over the forecast period. The requirement for stingray devices with 5G interceptors increases with the rollout of 5G technology. Between the end of 2021 and the end of 2022, the number of 5G wireless connections worldwide climbed by over 75%, to a maximum of about 2 billion. However, the rapid adoption of 5G technology raises the possibility of cybersecurity breaches. Cyberattacks might grow more common as a result of the increasing number of computers and linked gadgets. In contrast to earlier technologies, 5G offers direct access to the cellular network, which raises the risk of a direct attack. Such security weaknesses may be exploited by attackers to launch complex attacks. Therefore, it is anticipated that as 5G implementation increases, so will the potential concerns. In order to track and intercept conversations across 5G networks, law enforcement, and intelligence agencies are striving to enhance their surveillance capabilities.

Application (Law Enforcement & Intelligence Agencies, Military & Defense, Private Sector)

The military & defense segment in the stingray device market is poised to generate the largest revenue share of about 50% over the forecast period. The need for enhanced signals intelligence (SIGINT) capabilities is what drives the market for Stingray devices in the military and defense sector. Stingrays may be used by military and intelligence agencies to track and intercept enemy communications, providing vital data for military operations and national security. Their deviousness and agility render them valuable resources in various situations involving disobedience. Furthermore, with the rise in terrorism activities the need for stingray devices is growing in military & defense segment. For instance, the most active terrorist group in 2021 was the Taliban, which mostly conducts operations in Afghanistan and was accountable for about 799 incidents. Almost 4,499 people died as a result of the attacks.

Our in-depth analysis of the global stingray device market includes the following segments:

|

Type |

|

|

Application |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Stingray Device Market - Regional Analysis

North American Market Forecast

The North America industry is estimated to account for largest revenue share of 35% by 2035. The major factor influencing the stingray device market growth in this region is growing investment in military & defense. Over 876 billion dollars went toward the military in 2022, placing the United States at the top of the list of nations with the highest military spending. This accounted for around 39% of the approximately 3 trillion U.S. dollars spent on military expenditures globally that year. Additionally, the stingray device market in this region is seeing a rise in the need for lightweight, portable stingray devices. This is explained by the requirement for swift deployment in an emergency and portability when conducting surveillance missions. Additionally, the deployment of the internet of things (IoT) is also growing in this region which is also estimated to enhance the efficiency of stingray devices.

APAC Market Analysis

The stingray device market in Asia Pacific is also projected to have significant growth during the forecast period. The Asia Pacific region's need for stingray equipment is being driven by the growing need for improved surveillance and law enforcement technologies. Given the array of security challenges the region faces, including hacks and organized crime, law enforcement agencies and authorities are attempting to enhance their capacity to monitor and record mobile communications. Furthermore, this region also has a presence of various key players who are focused on advancing the features of this device which is further projected to influence the stingray device market growth.

Stingray Device Market Players:

- L3Harris Technologies, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Rohde & Schwarz

- ESD America

- Digital Receiver Technology (DRT)

- Rayzone Group, Ltd.

- NovoQuad Group

- Jacobs

- Septier Communication LTD

- GSMK

- PKI Electronic Intelligence

Recent Developments

- November 1, 2023: Following the merging of L3 Technologies, L3Harris Technologies is a multinational aerospace and defence technology company that has received contracts for the advancement and development of fire control systems on rocket launch vehicles. The U.S. Army and its allies throughout the world rely heavily on these systems to help them achieve combat superiority.

- December 4, 2023: The first over-the-air (OTA) test system authorized by CTIA Certification to evaluate 5G A-GNSS antenna performance is Rohde & Schwarz's TS8991. This method assesses how well a wireless device's global navigation satellite system (GNSS) receiver is performing. This is important since 5G E911 emergency calls employ Assisted-GNSS.

- Report ID: 5749

- Published Date: Nov 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Stingray Device Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.