Global STATCOM Size, Forecast and Trend Highlights Over 2025-2037

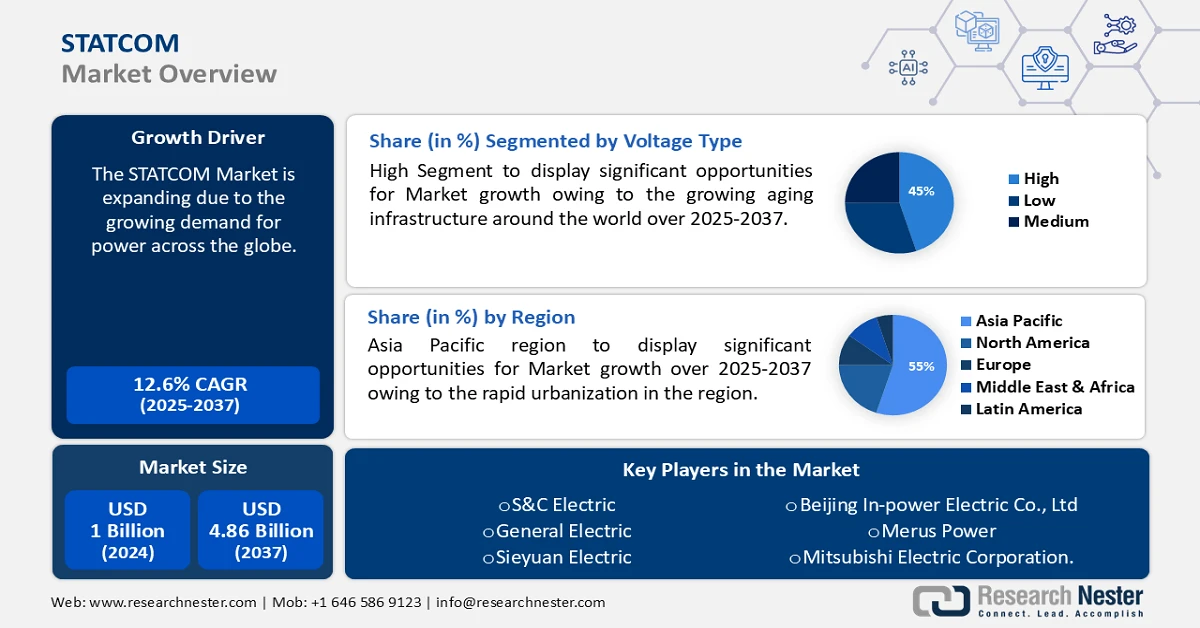

STATCOM Market size was valued at USD 1 billion in 2024 and is expected to secure a valuation of USD 4.86 billion in 2037, expanding at a CAGR of 12.6% during the forecast period, i.e., 2025-2037. In 2025, the industry size of STATCOM s is expected to be USD 1.1 billion.

The STATCOM market is witnessing exponential growth owing to the rising renewable energy sources, creating a need for stable electric grids. Companies are collaborating to enhance the development of renewable energy infrastructure. For instance, in September 2023, GE Vernova and MYTILINEOS Energy & Metals were chosen as primary grid technology suppliers for the Eastern Green Link 1 project to design a 525kV 2GW high-voltage direct current undersea transmission system for connecting East Lothian, Scotland, to County Durham, England. The new link holds great potential to enhance the distribution capabilities of renewable electrical power between Scotland’s wind power zones and demand centers in England. These power grid advancements enable both emission reduction targets and the development of sustainable infrastructure, which protects the power supply from intermittent renewable generation when expanding clean energy infrastructure.

Recent trends toward flexible alternating current transmission systems (FACTS) as fundamental elements of modern power grids are fueling the STATCOM technology market. STATCOM devices are gaining prominence within global utilities as they enable dynamic voltage support and fast-acting reactive power compensation to enhance electrical network performance. The rise in grid disturbance frequency and urgent system recovery needs is increasing the value of STATCOMs as next-generation transmission network components.

Key STATCOM Market Insights Summary:

Regional Insights:

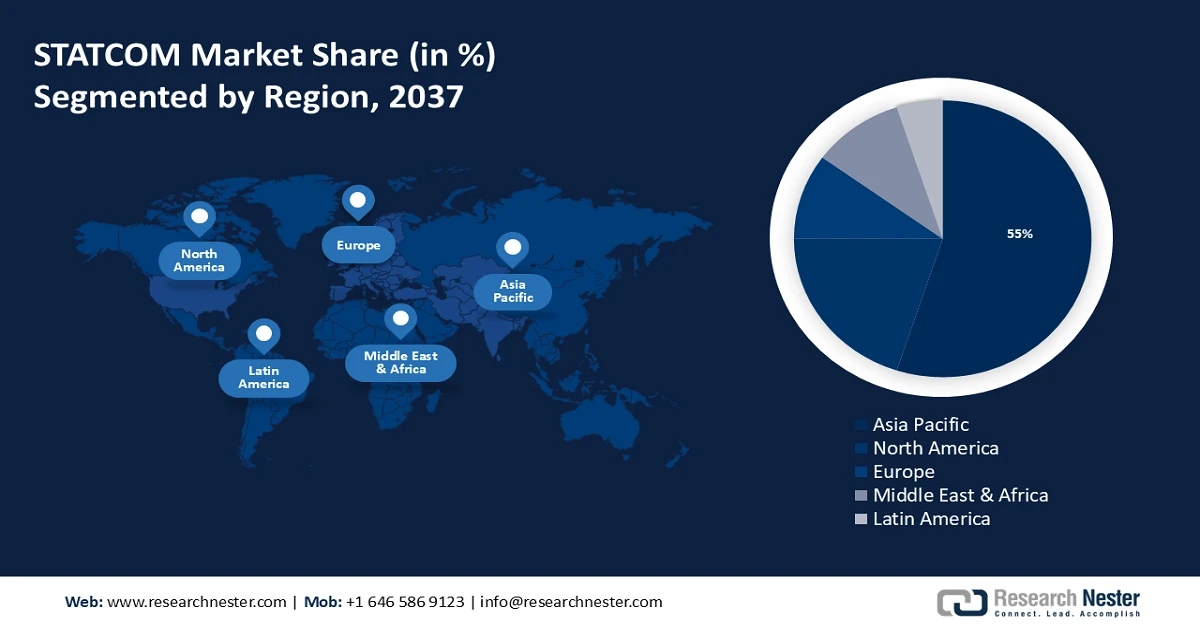

- Asia Pacific is projected to secure a dominant 55% revenue share in the statcom market by 2037, impelled by accelerated renewable energy capacity additions across major solar- and wind-intensive economies.

- North America is anticipated to remain the second-largest regional contributor during the forecast period, supported by sustained deployment of statcom systems to address voltage instability challenges arising from aging grid infrastructure.

Segment Insights:

- The high segment is projected to command a substantial 45% revenue share in the statcom market by 2037, attributed to rising installations of grid stabilization solutions across power-intensive regions.

- The electric utilities segment is expected to capture a notable share during the forecast period, underpinned by increasing reliance on statcom systems for voltage regulation and reactive power compensation amid large-scale renewable integration.

Key Growth Trends:

- Regulatory support and grid codes

- Increasing investments in transmission and distribution

Major Challenges:

- Long payback period

Key Players: ABB Group, Siemens AG, Rongxin Power Electronic Co., Ltd., S&C Electric, General Electric, Sieyuan Electric, Beijing In-power Electric Co., Ltd., Merus Power.

Global STATCOM Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2024 Market Size: USD 1 billion

- 2025 Market Size: USD 1.1 billion

- Projected Market Size: USD 4.86 billion by 2037

- Growth Forecasts: 12.6% CAGR (2025-2037)

Key Regional Dynamics:

- Largest Region: Asia Pacific (55% Share by 2037)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, India, Germany, Japan

- Emerging Countries: Brazil, Vietnam, Saudi Arabia, Australia, Indonesia

Last updated on : 12 May, 2025

STATCOM Sector: Growth Drivers and Challenges

Growth Drivers

-

Regulatory support and grid codes: The STATCOMs are experiencing rapid adoption across the globe, due to the governments’ support and changes in grid code standards. For instance, in October 2024, the Central Electricity Regulatory Commission, through its first amendment of the Indian Electricity Grid Code (IEGC) 2023, implemented strict operational standards that enhance grid stability. These modifications restrict the delivery of infirm power through renewable generation sources and storage systems to span 45 days, with possible extensions upon approval. This amendment requires all generating stations to meet their requirements throughout off-peak hours, and it sets restrictions on the number of scheduling changes during daily and monthly periods. Such regulatory changes are implemented to produce a predictable, stable operation of the grid, which is boosting the demand for advanced reactive power compensation solutions, including STATCOMs.

-

Increasing investments in transmission and distribution: Industrial leaders and country objectives are constantly supporting power sector companies to follow government-declared grid modernization programs, which enable the deployment of advanced technology such as STATCOMs. The deployment of STATCOM throughout worldwide power grid networks is receiving traction owing to the increasing investments by governments that modernize transmission and distribution infrastructure. For instance, in September 2024, India’s Ministry of Power finalized modifications to the National Electricity Plan 2023–2032 to expand transmission infrastructure from 4.85 lakh circuit kilometers (ckm) to 6.48 lakh ckm and boost the transformation capacity from 1,251 GVA to 2,342 GVA by 2032. Such strategic initiatives are opening substantial opportunities for STATCOM technology providers while improving the grid’s readiness to meet future energy requirements and sustainability targets.

Challenges

-

Long payback period: The payback period for STATCOM installations is a challenging factor for STATCOM markets that do not face urgent grid events and have limited renewable energy integration. Power utilities in these areas hold back from installing STATCOM technology as they need to recover their expenses over an extended period, therefore, the technology is facing higher initial outlays when compared to temporary solutions. Power utilities prefer less expensive temporary grid solutions instead of STATCOM systems, as they require substantial capital investment.

STATCOM Market: Key Insights:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

12.6% |

|

Base Year Market Size (2024) |

USD 1 billion |

|

Forecast Year Market Size (2037) |

USD 4.86 billion |

|

Regional Scope |

|

STATCOM Segmentation

Voltage Type (Low, Medium, High)

The high segment in the STATCOM market is estimated to gain a robust revenue share of 45% in the coming years owing to grid stabilization solutions installed in power-demanding regions. Various key players are partnering to deliver advanced high-voltage direct current. For instance, in April 2025, Bharat Heavy Electricals Limited collaborated with Adani Energy Solutions for constructing a 6,000 MW ±800 kV HVDC transmission line to connect Bhadla, Rajasthan, to Fatehpur, Uttar Pradesh. The total investment value is nearly USD 3.0 billion, with an expectation to be completed by 2029. The investment is aimed at improving grid stability as well as supporting renewable energy from Rajasthan's Renewable Energy Zones.

Application (Renewable Energy, Electric Utilities, Photovoltaic Generation)

The electric utilities segment in STATCOM market is set to garner a notable share during the forecast period as electric companies require grid modernization solutions and renewable power integration capabilities. Electric utilities use STATCOM systems to stabilize voltage levels and compensate for reactive power, which serves as a key element for grid stability, given rapidly changing power consumption while operating renewable energy resources. Modern electric utility infrastructure relies on STATCOM devices as the demand for clean power requires advanced power grid solutions for decarbonization initiatives.

Our in-depth analysis of the STATCOM market includes the following segments:

|

Voltage Type |

|

|

Application

|

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

STATCOM Industry - Regional Scope

Asia Pacific Market

The STATCOM market in Asia Pacific is predicted to account for the largest share of 55% by 2037, impelled by the rapid expansion of the renewable energy sector. Countries such as India and China are rapidly building new solar and wind power generation facilities, creating power grid challenges due to their inconsistent nature. STATCOM systems are becoming more widely used as they help control power grid fluctuations while maintaining grid stability and delivering simultaneous improvements in voltage regulation and real-time power quality, enabling effective renewable energy integration.

The STATCOM market in China is experiencing significant growth, as the government maintains a strong commitment to building ultra-high-voltage transmission systems. With the increasing requirement of efficient power transmission from energy-rich western provinces to high-demand urban centers in the east, the UHV networks are becoming increasingly essential. Utility industries are increasingly utilizing the STATCOM systems for voltage stabilization and reactive power stabilization within extended high-throughput transmission pathways.

North America Market Analysis

The North America STATCOM market is estimated to be the second largest, during the forecast timeframe led by aging power grid infrastructure that develops greater susceptibility to instabilities along with voltage fluctuations. Utilities throughout the U.S. and Canada are significantly investing in STATCOM advanced grid stabilization technologies as they ensure stable voltage regulation while sustaining power quality as both electricity usage and power network congestion are rising.

The growth of large-scale renewable energy projects, including wind and solar farms, operates as an essential factor in Texas, along with California and Alberta. The integration of renewable energy sources requires STATCOM technology to stabilize power grids as these systems perform dynamic reactive power regulation and fast-voltage corrections, which ensure reliable renewable power distribution.

The U.S. STATCOM market growth is accelerating owing to the increasing demand for stronger grid resilience during severe weather conditions such as hurricanes, wildfires, and heat waves. Utility companies are investing in advanced voltage control technology, STATCOMs for quick responses, and decreased power disruptions as climate-induced disruptions are pressuring them to protect vulnerable grid areas with aging equipment.

Companies Dominating the STATCOM Landscape

- ABB Group

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens AG

- Rongxin Power Electronic Co., Ltd.

- S&C Electric

- General Electric

- Sieyuan Electric

- Beijing In-power Electric Co., Ltd.

- Merus Power

The STATCOM market is highly competitive, featuring a mix of global power equipment manufacturers and specialized grid technology providers. Key players such as Siemens Energy, General Electric, Mitsubishi Electric, NR Electric, and Bharat Heavy Electricals Limited (BHEL) are focusing on expanding their STATCOM portfolios to address rising grid stability needs. These companies are investing in technological innovations, service capabilities, and strategic collaborations to strengthen their market positions. Here are some key players operating in the global market:

Recent Developments

- In May 2024, GE Vernova collaborated with TECO Electric and Machinery Co. to enhance Taiwan's power grid with advanced STATCOM technology. The project involves installing two ±200 Mvar STATCOM systems at the ZhangGong Step-up Substation and the YongXing Switchyard in Changhua County. This initiative supports Taiwan's sustainable energy goals by facilitating the integration of more renewable energy and enhancing grid stability.

- In March 2023, Mitsubishi Electric received an order for a ±700 MVA STATCOM, the capacity class, from Tohoku Electric Power Network Co. The system will be installed at the Iwate Substation in Morioka, Japan, to stabilize synchronization during bulk power transmission failures. It is expected to be operational by the end of 2031.

- Report ID: 5344

- Published Date: May 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

STATCOM Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.