Global Starch Capsule Market

Part 1 Introduction

• Definition

• Assumptions & Abbreviations

Part 2 Global Market Outlook

Part 3 Market Dynamics

Part 4 Impact of Covid-19 on the Global Market

Part 5 Company Profile

Starch Capsules Market Outlook:

Starch Capsules Market size was valued at USD 390.8 million in 2025 and is projected to reach USD 719.8 million by the end of 2035, rising at a CAGR of 6.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of starch capsules is estimated at USD 415.4 million.

The global starch capsules market is witnessing immense growth fueled by the increasing adoption in pharmaceuticals, nutraceuticals, and dietary supplements. The demand for starch capsules is on the rise due to their vast consumer base, particularly in chronic disease management. The supply chain of starch raw materials to finished goods of capsules is globally integrated but faces various vulnerabilities, mainly in the production of hard empty capsules. As per the WTO report in November 2024, the U.S. imported pharmaceutical capsules from China was USD 49 million, which also includes starch capsules. The market is further driven by enhancing the mechanical stability and dissolution profiles of starch capsules to meet standards set by authorities.

International trade in starch capsules involves the export of raw materials like modified starches and the import of finished capsules for secondary pharmaceutical manufacturing. U.S. exports 42.1 million metric tons of corn to 58 countries, which highlights the availability of corn starch as a crucial raw material for the global market for starch capsules, according to a 2025 report by the U.S. Grains & BioProducts Council. On the other hand, corn starch is widely used in hard empty capsules in various sectors such as pharmaceuticals, nutraceuticals, and dietary supplements, which makes the U.S. market as a critical supplier of starch-based capsules.

Key Starch Capsules Market Insights Summary:

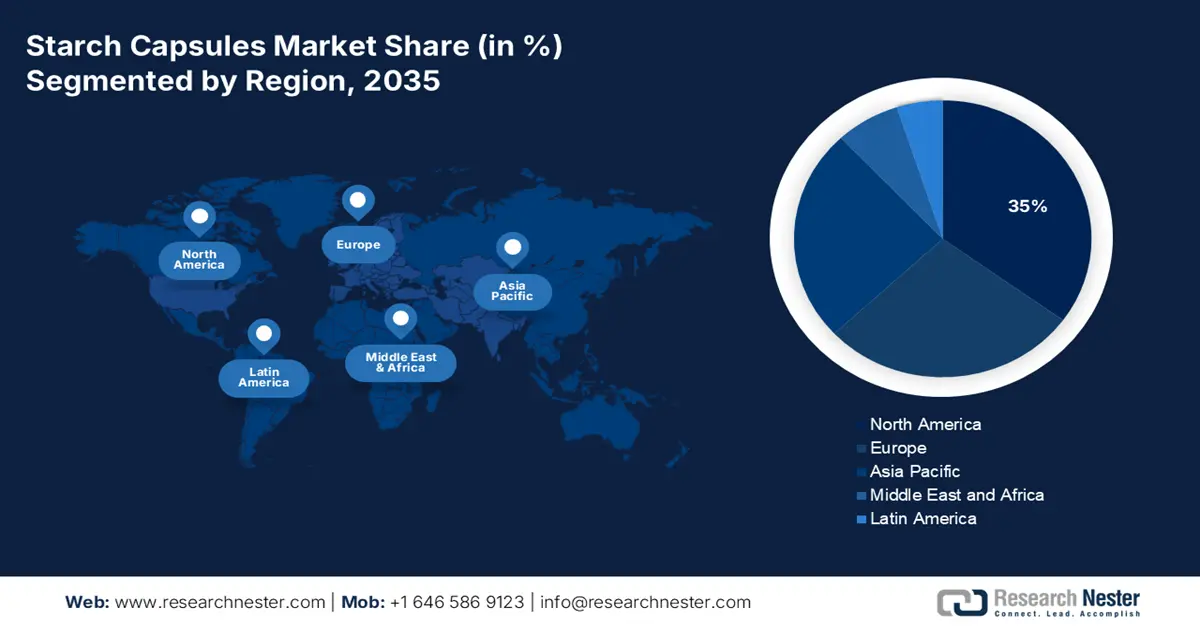

Regional Highlights:

- North America is projected to hold a 35% share by 2035, driven by government healthcare expenditure and strategic market investments in plant-based capsules.

- Asia Pacific is anticipated to grow at the fastest rate with a 27.6% share by 2035, owing to rising chronic disorders and strong demand for starch capsules.

Segment Insights:

- Direct sales is projected to account for 70.1% share by 2035, propelled by supply chain efficiency and cost-effectiveness in bulk purchases for starch capsules.

- The pharmaceutical & nutraceutical companies sub-segment is expected to dominate due to high in-house manufacturing and strategic investment in plant-based capsule R&D.

Key Growth Trends:

- Rising prevalence of chronic diseases

- Sustainability preferences

Major Challenges:

- Sustainability preferences

- Challenges in showing comparative advantage

Key Players: Capsugel (Lonza Group), ACG Associated Capsules, Qualicaps (Mitsubishi Chemical Group), Suheung Capsule, HealthCaps India Ltd., Sunil Healthcare Limited, Lefan Capsule, Shaoxing Kangke Capsule Co., Ltd., Biological Engineering Co., Ltd., Farmacapsulas S.A.S (CapsCanada), Nectar Lifesciences Ltd., Medi-Caps Ltd., Roxlor LLC, Bright Pharma Caps Inc., Shanghai Honest Chemical Co., Ltd., SNAZ PHARMA, Angtai Pharmaceutical Co., Ltd., Natural Capsules Limited, Aenova Group, Captek Softgel International.

Global Starch Capsules Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 390.8 million

- 2026 Market Size: USD 415.4 million

- Projected Market Size: USD 719.8 million by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 3 October, 2025

Starch Capsules Market - Growth Drivers and Challenges

Growth Drivers

- Rising prevalence of chronic diseases: One of the primary drivers for the starch capsules market is the rising burden of chronic diseases such as diabetes. In this regard, the CDC data in February 2024 has depicted that 129 million people in the U.S. are living with chronic disease. Similarly, in May 2024, the CDC data stated that the U.S. reported diabetic cases among 38.4 million individuals, which fueled the demand for delayed-release formulations, directly benefiting the starch capsules industry.

- Sustainability preferences: The eco-friendly necessity of pharmaceutical products is massive, especially to meet the ESG (Environmental, Social, and Governance) commitments. In this regard UN Sustainable Development Group reported that many firms are imposed to ESG controls for biodegradable capsules. Besides, the UN SDGs state that starch capsules are sustainable and reduce the carbon footprint when compared with gelatin. This global shift, both by regulatory frameworks and consumers for eco-friendly therapeutics, is driving growth in the market.

- Strategic company collaborations and innovation: Major pharmaceutical companies are forming strategic alliances with capsule manufacturers to secure supply and co-develop advanced delivery solutions. These collaborations concentrate on boosting stability for biologics and other aspects of capsule performance. Further expansion of the companies such as in December 2024, Lonza Capsules & Health Ingredients has announced its expansion of its manufacturing unit to India and China, focusing to meet the demand and quality standards.

Regulatory Limits of Sodium Octenyl Succinate Starch %

|

Japan |

USA |

EU |

JECFA |

|

|

OSA limits |

— |

≤ 3.0 |

— |

— |

|

Occienyl succinate group |

≤ 3.0 |

— |

≤ 3.0 |

≤ 3.0 |

|

Residual ocenyl succinate |

≤ 0.8 |

— |

≤ 0.3 |

≤ 0.3 |

Source: NLM August 2022

Challenges

- Government price controls: The aspect of reimbursement barriers and government price controls can act as a significant restraint for the starch capsules market to capture optimum manufacturer base. Europe is at the forefront hindering starch capsule profitability imposing strict price controls. Besides WHO in 2023 reported that the AMNOG law imposed for Germany manufacturers-controlled prices limiting the earnings. This has been tough for the suppliers to opt for starch capsule production with such price caps imposed.

- Challenges in showing comparative advantage: It is hard to demonstrate to regulators and payers that there is a material benefit to a starch capsule compared to gelatin. Despite being beneficial for the vegetarian and vegan community, this is often not a recognized clinical outcome. For example, a starch product's clearance was delayed in 2022 when Japan's PMDA requested further stability testing, requiring the manufacturer to show comparable performance under varying humidity levels.

Starch Capsules Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 390.8 million |

|

Forecast Year Market Size (2035) |

USD 719.8 million |

|

Regional Scope |

|

Starch Capsules Market Segmentation:

Distribution Channel Segment Analysis

Direct sales are leading the segment and is poised to hold the highest share value of 70.1% by 2035. Direct sales is dominated by starch capsules, as they are a bulk industrial ingredient. The OEC report in 2023 has stated that U.S. holds over 19.9% of the global pharmaceutical ingredient import share, including starch-based capsules. This segment is the dominant model over fragmented retail distribution for this market because it guarantees supply chain efficiency, improved quality, and cost-effectiveness for large-volume purchases.

End user Segment Analysis

The pharmaceutical & nutraceutical companies sub-segment leads as the major end-user. This is stimulated by high in-house manufacturing of capsule-based drugs and supplements. According to the U.S. Food and Drug Administration (FDA), the number of new drug applications (NDAs) specifying plant-based excipients increased between 2022 and 2024. Further, the SV Healthcare report in 2024 has stated that India’s nutraceutical market is expanding and is poised to reach USD 18 billion by the end of 2025. This indicates a strategic decision by leading companies to respond to consumer demand for vegetarian products, investing heavily in R&D and securing up their leading revenue share through controlled, bulk manufacturing.

Application Segment Analysis

The pharmaceuticals segment is expected to garner the largest share in the starch capsules market by the end of 2035. The dominance of the segment is attributable to the widespread preference over tablets for pediatric and aging populations. In this regard NIH report in 2024 states that new molecular entities require capsule delivery systems in pharmaceuticals. Besides, in 2023 EMA reported that the plant-based capsules obtain faster regulatory approval thus denoting a positive outlook for segment’s dominance.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Source |

|

|

Application |

|

|

Function |

|

|

End user |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Starch Capsules Market - Regional Analysis

North America Market Insights

North America is a key player in the starch capsules market, projected to register a significant share of 35% during the forecast period. The dominance of this region is mainly attributable to the developmental tendency of countries such as the U.S and Canada and the government healthcare expenditure. The U.S. dominates the North America market owing to the increased spending by Medicare for plant-based capsules. Besides, it is stated that Medicaid offers substantial coverage for starch capsule scripts for chronic disease, which is up to 2021. Additionally, the presence of key market players drives market evolution in the region.

U.S. market is driven by its strong consumer base towards plant-based supplements and pharmaceuticals. The federal support is crucial for the market demand. As per the CMS data in June 2025, the Medicare spending in healthcare rose by 8.1% to USD 1,029.8 billion in 2023, including the formulation of starch based capsules in pharmaceuticals and nutraceuticals. The primary trend, which is backed by government funding and improved insurance coverage, is the incorporation of starch capsules into common drug formulations, which guarantees consistent market expansion.

Canada's starch capsules market is rising rapidly and is expected to hold the largest share by 2035. The Québec Life Sciences 2022–2025 strategy allocates USD 211 million to sector-wide innovation, including support for starch-based capsules. This initiative is expected to generate USD 569 million in funding and stimulate nearly USD 2 billion in direct investment, reflecting strong government backing. Furthermore, BioteCanada experiences annual growth in export-focused capsule production, which in turn implies a positive market outlook in the country.

Starch Capsule Clinical Trials

|

Trial Name / ID |

Intervention / Comparator |

Indication |

Status |

Sponsor |

Outcome Measures |

|

N-acetyl Glucosamine Capsule for IBS-D (NCT02504060) |

Starch Placebo vs N-acetyl-D-Glucosamine |

Irritable Bowel Syndrome |

Recruiting |

Dongying Leader Pharmaceutical |

Abdominal pain, stool consistency, quality of life |

|

Starch-entrapped Microspheres for Gut Health (NCT01210625) |

Nutrabiotix Fiber (starch microspheres) |

Constipation / Gut Health |

Completed |

Nutrabiotix Ltd / Academic Partners |

Stool frequency, consistency, gut microbiome |

Source: ClinicalTrials.gov

APAC Market Insights

The Asia Pacific starch capsules market is anticipated to grow at the fastest rate, with a considerable share of 27.6% during the forecast period. The market is appreciably fueled by higher instances of chronic disorders and the huge demand for starch capsules. Asia Pacific hosts a substantial number of emerging nations such as India, China, Japan, South Korea and Malasiya that witness immense adoption for starch-based capsules for disease management. Besides the requirement for sustainable therapeutics is intended to help the region’s growth embracing market progression.

There is an exceptional opportunity for the market in India, driven by both public and private healthcare systems. The industry in India contributes significantly to the global market due to its critical role in various industries, such as food and beverages, pharmaceuticals, and textiles. Various research is conducted related to starch capsules, and one such research from NLM study in November 2024 has depicted that starch capsules exhibit high resistance to simulated gastric fluids and are minimally soluble in simulated intestinal fluids. Further, with the smaller diameter in capsule about 100–150 micrometer, provide better resistance to gastric degradation, supporting prolonged release conducive to diabetic treatment stages requiring controlled MET doses.

China's starch capsule market is growing in accordance with national policies on sustainable drugs. The market is driven by the domestic pharmaceutical industry and the adoption of innovative, high-quality excipients like starch capsules. In April 2023, the NLM released a report indicating that 79% of domestic new drugs submitted their first investigational new drug applications in 2022, compared to 60% in the previous year. As more medications need oral solid dosage forms, the demand for starch-based capsules has increased.

Europe Market Insights

Europe market is driven by rigid regulations and a strong consumer migration towards plant-based and vegan pharma products. The growth is mainly fueled by the European Medicines Agency's (EMA) push towards sustainable and biocompatible excipients, in addition to increasing demand for halal and kosher-compliant medicines. Some of the most important trends are higher investments for R&D of modified starch technologies for improving capsule stability and dissolution profiles. The EU Pharmaceutical Strategy, financed by the European Health Data Space, focuses on increasing the resilience of supply chains for essential medical products, such as advanced capsule materials.

Germany is the largest shareholder in Europe's market by 2035. Germany's leadership is driven by its robust pharmaceutical manufacturing base and proactive government spending. The Germany Trade and Invest data in 2025 has stated that the pharmaceutical industry revenue reached EUR 59.8 billion in 2023 at a CAGR of 6.4%. As manufacturers increasingly use sustainable and plant-derived excipients to meet legal and environmental criteria, this growth increases the demand for novel drug delivery forms, such as starch-based capsules.

France's starch capsule sector is fueled by strong government regulations that are aligned with EU-wide sustainability targets. The French National Authority for Health (HAS) plays a crucial role in aiding the starch capsules by expanding the patient access and increasing integration into reimbursable drug programs. In addition, the backing of European health authorities to new medical technologies fuels the expansion by financing local research on environmentally friendly capsule solutions, solidifying France's status as a regional hub and leader in green drug delivery.

Key Starch Capsules Market Players:

- Capsugel (Lonza Group)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ACG Associated Capsules

- Qualicaps (Mitsubishi Chemical Group)

- Suheung Capsule

- HealthCaps India Ltd.

- Sunil Healthcare Limited

- Lefan Capsule

- Shaoxing Kangke Capsule Co., Ltd.

- Biological Engineering Co., Ltd.

- Farmacapsulas S.A.S (CapsCanada)

- Nectar Lifesciences Ltd.

- Medi-Caps Ltd.

- Roxlor LLC

- Bright Pharma Caps Inc.

- Shanghai Honest Chemical Co., Ltd.

- SNAZ PHARMA

- Angtai Pharmaceutical Co., Ltd.

- Natural Capsules Limited

- Aenova Group

- Captek Softgel International

The starch capsules market comprises key market players that are leveraging vertical integration and regulatory support to enhance their global presence. Major firms are focusing on strategic partnerships, acquisitions, and expansions to accelerate to gain exposure across all nations. For instance, Lonza finalized the acquisition of Capsugel to enhance its product portfolio. Furthermore, the U.S. FDA states that new NDAs now specify plant-based capsules, driving R&D investments in the sector. Hence, such strategies to strengthen their ecosystem will encourage the adoption of innovative therapeutics, thereby widening the market presence.

Below is the list of some prominent players operating in the market:

Recent Developments

- In May 2024, Roquette Pharma Solutions announced the launch of the new LYCAGEL Flex hydroxypropyl pea starch premix for nutraceutical and pharmaceutical softgel capsules.

- In December 2023, Kura Sushi USA launched Ecopon, biodegradable starch-paper capsules for Bikkura Pon prizes, enhancing sustainability and reducing plastic waste.

- In October 2023, Roquette Pharma Solutions completed its acquisition of Qualicaps from the Mitsubishi Chemical Group. This acquisition is focuses mainly on expanding the global footprint of its pharmaceutical business, as well as enriching its offerings of oral dosage solutions.

- Report ID: 2580

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Starch Capsules Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.