Smart Signaling Market Outlook:

Smart Signaling Market size was valued at USD 20.9 billion in 2025 and is expected to reach USD 39.2 billion by 2035, expanding at a CAGR of 6.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of smart signaling is evaluated at USD 884.1 billion.

The growing concerns related to road safety has driven the sector’s expansion. A myriad of factors drives the global smart signaling market’s supply chain. For instance, the U.S. Bureau of Labor Statistics (BLS) reports that in August 2025, the consumer price index for urban consumers increased by 0.4% after seasonal adjustments. Over the past year, it went up by 2.9% without seasonal adjustments, influenced by the broader inflation trends that have influenced the adoption rates of smart signaling technologies.

In terms of major investments, the U.S. Department of Transportation allocated USD 100 million annually from 2022 to 2026 under the aegis of the SMART Grants Program for projects that utilize advanced technology to solve critical pain points of transportation. In terms of trade, the global trends highlight a greater focus on securing defense-critical supply chains, which includes components related to smart signaling systems. In Europe, around USD 7.63 billion has been committed to bolstering the transport infrastructure under the Connecting Europe initiative. The market is set to expand due to the large-scale investments funneled to improve transportation infrastructure in multiple economies.

Key Smart Signaling Market Insights Summary:

Regional Highlights:

- The hardware segment of the smart signaling market is projected to capture a 41.7% revenue share by 2035, propelled by the growing integration of display boards in smart city infrastructure and sustainable urban mobility initiatives.

- The traffic management segment is anticipated to hold the largest market share by 2035, fueled by accelerating urbanization and rising global vehicle ownerships.

Segment Insights:

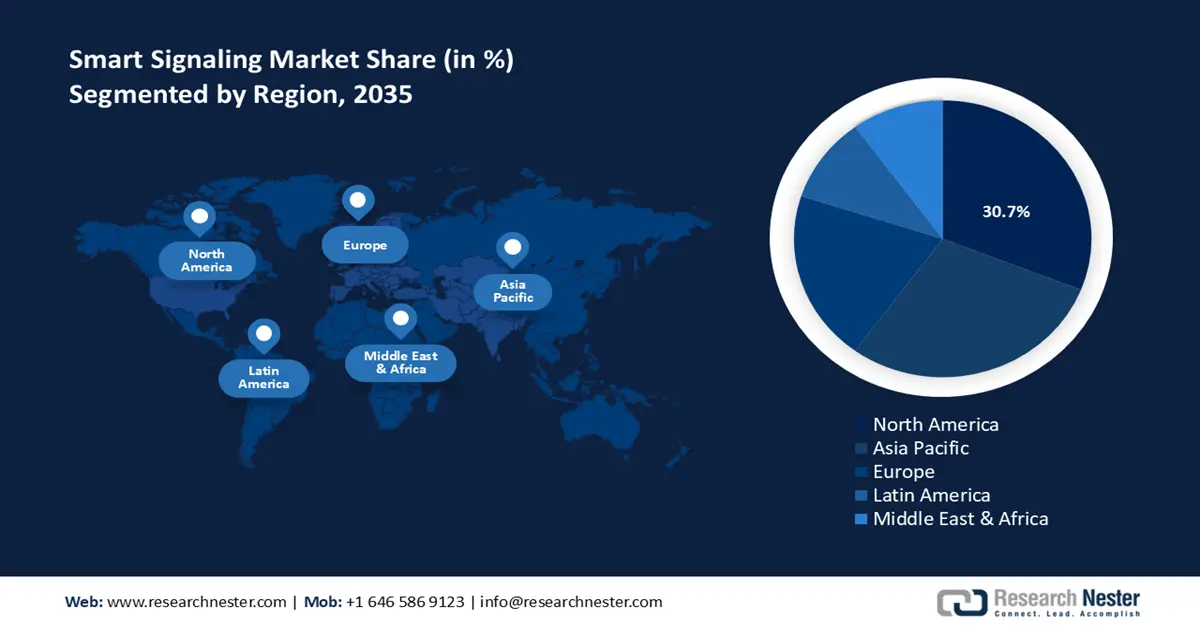

- The North America smart signaling market is projected to secure a 30.7% revenue share by 2035, underpinned by rising investments in smart city infrastructure and supportive regulatory alignment.

- The APAC region is expected to witness the fastest expansion through 2035, spurred by large-scale infrastructure investments and improved governance frameworks across emerging economies.

Key Growth Trends:

- Integration of vehicle-to-infrastructure (V2I) communication in the urban traffic systems

- Enforcement-as-a-Service (EaaS) is repositioning smart signaling from infrastructure to recurring revenue

Major Challenges:

- Obsolescence threat

- High initial costs

Key Players: Siemens Mobility, Schneider Electric, Honeywell International Inc., Hitachi Ltd., Kapsch TrafficCom AG, Cisco Systems, Thales Group, Mitsubishi Electric, LeddarTech, Cubic Corporation, Tata Consultancy Services (TCS), Samsung SDS, PBA Group, Samsara, Geely Auto Group (Volocopter)

Global Smart Signaling Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 20.9 billion

- 2026 Market Size: USD 884.1 billion

- Projected Market Size: USD 39.2 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30.7% Share by 2035)

- Fastest Growing Region: APAC

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Indonesia, Brazil, Mexico, South Korea

Last updated on : 6 October, 2025

Smart Signaling Market - Growth Drivers and Challenges

Growth Drivers

- Integration of vehicle-to-infrastructure (V2I) communication in the urban traffic systems: A major catalyst of the global smart signaling market is the rising demand and sales of connected and autonomous vehicles. Their growth is intrinsically tied with a rising deployment of smart signaling as a foundational technological for a safer vehicle experience. Additionally, vehicle safety has emerged as a major segment promoted throughout the broader automotive industry, keeping pace with the shifting consumer trends demanding safer cars. In terms of regional initiatives, in 2024, the Ministry of Land, Infrastructure, and Transport in South Korea expanded its V2X pilot zones across the cities of Pangyo and Sejong, where smart signals are integrated with the connected vehicle platforms to broadcast signal phase and timing data. To highlight the lucrativeness of the market, similar deployments are underway in the U.S., promising to provide greater opportunities for vendors.

- Enforcement-as-a-Service (EaaS) is repositioning smart signaling from infrastructure to recurring revenue: The gradual shift from outright ownership of traffic enforcements systems to outsourced smart enforcement contracts has positively reinforced the sector’s growth. In recent years, multiple municipalities in Western Europe and North America started the shift. The arrangement bundles smart traffic signals, automated license plate readers, AI-powered violation detection, etc., into subscription-based payment models. Additionally, the shift has led to CAPEX-heavy infrastructure turning to an OPEX model. Moreover, to map the future outlook, the smart signaling vendors with pay-per-enforcement models are slated to displace traditional signal manufacturers in tenders, and companies that do not adapt risk obsolescence.

- Technological advancements: The artificial intelligence (AI), and cloud computing, machine learning and other digital technologies are being increasing integrated into the production of smart signaling solutions. Theses technologies has the ability to enhance the overall characteristics of the final product. Further, the strong presence of tech savvy consumers in the developed countries is likely to propel the sales of advanced signaling solutions. The leading companies are also investing heavily in R&D to introduce next gen solution and double their revenue hares. One of the latest examples of that is HMAX solution introduced in September 2024 by Hitachi Rail, which is powered by NVIDIA AI technology. This all-in-one platform offers AI-powered solutions to improve train operations, signaling, and infrastructure management for transport operators.

Challenges

- Obsolescence threat: An ongoing challenge plaguing the growth of the smart signaling market is the rapid rate of technological advancements and vendors being unable to keep pace. Although, the advent of these advancements assists the market’s growth, but the frequent entry of new technologies poses a risk of the current products becoming obsolete. Additionally, the implementation of 5G networks has added to the cost of investing in new infrastructure. The challenge is particularly prominent on SMEs operating in the market.

- High initial costs: The substantial upfront investment is one of the major restraint factors for the growth of the market. The production of smart signaling solutions requires specialized materials and components. The flucations in the supply chain of theses solutions directly influences the manufacturing costs of smart signaling solutions. Thus, the prices-sensitive markets are anticipated to be the most challenging regions for key players.

Smart Signaling Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 20.9 billion |

|

Forecast Year Market Size (2035) |

USD 39.2 billion |

|

Regional Scope |

|

Smart Signaling Market Segmentation:

Component Segment Analysis

The hardware segment of the market is projected to hold a dominant revenue share of 41.7% throughout the anticipated timeline. A significant driver of the segment is the rising application of display boards in smart city applications and in urban traffic management. Moreover, globally, the push for sustainable transportation solutions, which has aligned with the decarbonization goals embraced by a large number of economies. The future outlook of the segment, and investment opportunities, is slated to be higher in cities that are rapidly becoming more connected. Vendors that are able to seamlessly leverage 5G with LED and OLED displays to offer higher resolutions and longer lifespans are expected to expand their market presence.

Application Segment Analysis

The traffic management segment is estimated to account for the largest market share through 2035. The rapid urbanization has bolstered the demand for next gen signaling solutions across the world. The rising vehicle ownerships is creating a profitable environment for smart signaling solution producers. According to the European Automobile Manufacturers' Association in 2024, global car sales reached 74.6 million vehicles, up by 2.5% from previous year. This reflects a robust need for traffic management solutions, including smart signaling.

End user Segment Analysis

The government segment is set to hold a major market share between 2026 to 2035, owing to traffic and urban mobility management requirements. The municipalities, transport ministries, and regional authorities prime focus on ensuring road safety and reducing congestion is boosting the trade of smart signaling solutions. The World Bank states that it has spent around USD 5.5 billion to improve energy efficiency, including funding for public projects like energy-saving buildings and streetlights. The massive public investments in smart infrastructure are yet another factor contributing to the segmental growth.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Application |

|

|

Deployment Mode |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Signaling Market - Regional Analysis

North America Market Insights

The North America market is projected to hold a dominant revenue share of 30.7% by the end of 2035. The regional market is favorably reinforced by the evolving demographic trends, and the rising investments in smart cities, creating ample opportunities for the deployment of smart signaling solutions. Additionally, a major driver regionally has been the regulatory harmonization between initiatives such as the Green and Inclusive Community Buildings program of Canada and the Smart Cities Program of the U.S. The demographic trends are leaning towards greater urbanization, heightening the demand for smart signaling systems that handle the surging traffic volumes. With sustainable urban planning set to become the backbone of urban infrastructure, the regional market is projected to maintain its revenue share throughout the forecast period.

The U.S. market is projected to maintain its leading share in North America. The market's growth is reinforced by a confluence of multiple factors, ranging from the rapidly evolving consumer behaviors and the impact of federal policies. For instance, the Infrastructure and Jobs act has created a cascading effect in the U.S. market by funneling over USD 100 billion into improving transportation systems. Such large-scale investments have heightened the scope of smart signaling deployments. Furthermore, the consumer behavior in the U.S. has exhibited a willingness for greater adoption of traffic analytics to improve safety. These trends are expected to ensure that the U.S. market remains dominant in North America.

Canada’s market is expected to increase at a high pace due to the country’s efforts to build digitally connected city infrastructure. Smart city projects are speeding up the use of smart signaling solutions. For example, in June 2024, Infrastructure Canada announced that the government committed about USD 222 million over 11 years to the Smart Cities Challenge through the Impact Canada Initiative. This directly represents Canada as the most profitable marketplace for key investors.

Asia Pacific Market Insights

The APAC smart signaling market is poised to maintain the fastest expansion throughout the forecast timeline. The surging investments in infrastructure development and improvements in local governance models have bolstered the scope of smart signaling solutions deployment. Additionally, a vital catalyst is the trade deals which have facilitated a steady flow of capital, bolstering the regional market’s growth. In this context, the APAC market presents a multifaceted growth opportunity, influenced by the top-down policy decisions and bottom-up demand for urban mobility solutions.

The India smart signaling market is estimated to capture high revenue share during the anticipated timeline. The market is shaped by a unique blend of nationwide digitalization along with opportunities arising from state-level fragmentation. The ongoing Smart Cities Mission seeks to overhaul urban infrastructures, driving the demand for smart signaling solutions. Additionally, the public-private partnerships (PPP) of India have supported a greater deployment of smart signaling systems. The PPP committee has appraised around 396 projects to date. The market also benefits from a mobile-first population, that bolsters the adoption rates of digital solutions for urban mobility. These trends are expected to expand the India market growth through 2035.

The China market is foreseen to be influenced by the supportive government polices and funding. The large-scale smart city investments are directly propelling the trade of smart signaling solutions. Further, continuous innovations in the consumer electronics has increased the application of advanced smart signaling solutions. The robust expansion of wireless communication networks is also creating a lucrative environment for smart signaling market players.

Europe Market Insights

The Europe market is anticipated to capture the second-largest revenue share through 2035. The region’s strong focus on sustainable mobility and road safety directly propels the application of smart signaling technologies. The stringent EU transportation and environmental policies also supports the increasing trade of smart signaling solutions. Many municipalities are integrating signaling systems into broader smart city platforms, driving the overall market growth.

The sales of smart signaling systems in Germany are estimated to be driven by its strong automotive sector and advanced urban mobility initiatives. The government-backed digitization programs are also contributing to the increasing adoption of smart signaling technologies. German automakers, along with tech providers are expected to lead innovations in the market.

The U.K. is another leading market for smart signaling in Europe, inflected by government’s supportive initiatives in road safety and net-zero transport goals. In March 2020, the government released its second Road Investment Strategy, covering April 2020 to March 2025. It announced plans to spend USD 34.8 billion to improve the country’s major road network. Thus, the investments under the National Infrastructure Strategy are set to directly advance adoption of adaptive signaling systems across major cities.

Key Smart Signaling Market Players:

- Siemens Mobility

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Schneider Electric

- Honeywell International Inc.

- Hitachi Ltd.

- Kapsch TrafficCom AG

- Cisco Systems

- Thales Group

- Mitsubishi Electric

- LeddarTech

- Cubic Corporation

- Tata Consultancy Services (TCS)

- Samsung SDS

- PBA Group

- Samsara

- Geely Auto Group (Volocopter)

The market is dominated by a mix of established and emerging players, with companies such as Siemens Mobility, Schneider Electric, and Honeywell leading the market. Additionally, the market is in a transitional phase and is estimated to be fully mature by the end of 2035. The competitive landscape of the market is marked by continuous technological advancements, acquisitions, and strategic partnerships, which are accelerating the expansion. The table below highlights the major players in the market.

Recent Developments

- In August 2025, Q-Free unveiled the development of Dynamic Signals. It’s the first of its kind designed with modern cybersecurity standards to keep it secure.

- In July 2025, Fingerprint introduced new Smart Signals and platform upgrades. These identify harmful bots and AI agents, separating them from safe automated traffic.

- Report ID: 3262

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Signaling Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.