Hearing Aids Market Outlook:

Hearing Aids Market size was over USD 9.89 billion in 2025 and is poised to exceed USD 21.15 billion by 2035, witnessing over 7.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hearing aids is estimated at USD 10.59 billion.

The growth of the market can primarily be accounted to the growing unsafe listening practices, such as listening to music at high volume via earphones, gaming, noise pollution and others resulting in the higher cases of deafness across the globe. As per the data released by the World Health Organization (WHO), it was noticed that more than 1 billion adults are projected to be at a permanent avoidable hearing loss on account of unsafe listening practices.

The global hearing aids market trends such as, a higher number of untreated hearing disabilities boosting the demand for hearing rehabilitation, and growing government initiatives to promote the upcoming technological innovation to improve hearing loss are projected to influence the growth of the market positively over the forecast period. For instance, approximately 2.4 billion people are expected to show symptoms of hearing loss, and about 650 million people are projected to be in the need of hearing rehabilitation by the year 2050. Moreover, hearing aids are electronic devices to be worn in or behind the person’s year. Hearing aids are helpful for deaf people since they are designed to transmit sound from the environment into the ear by making it louder. Hence, such factors are projected to hike the growth of the market over the forecast period.

Key Hearing Aids Market Insights Summary:

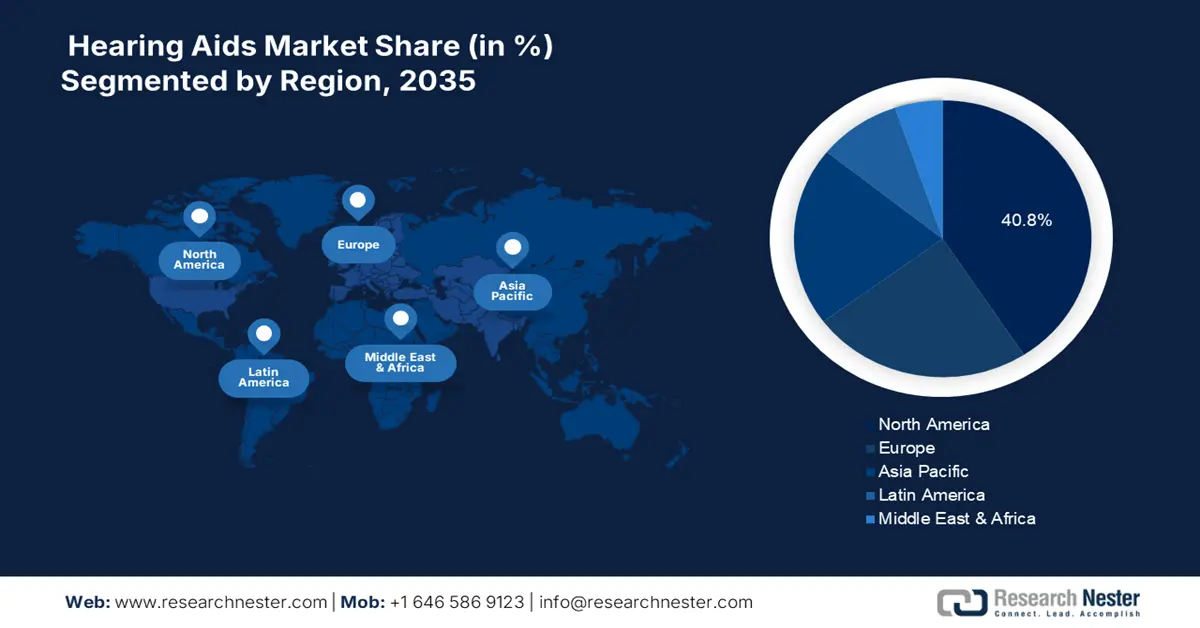

Regional Highlights:

- The North America hearing aids market is predicted to capture 40.8% share by 2035, driven by rising cases of hearing loss, an aging population, technological advancements in hearing aid designs, and a strong healthcare infrastructure.

Segment Insights:

- The sensorineural (hearing loss) segment in the hearing aids market is expected to experience noteworthy growth during 2026-2035, driven by the rising prevalence of sensorineural hearing loss and the aging population.

Key Growth Trends:

- Growing Prevalence of Hearing Loss Globally

- Increasing Geriatric Population with Significant Hearing Disability

Major Challenges:

- Higher Cost Associated with the Hearing Aids

- Lack of Awareness and the Skilled Medical Professionals

Key Players: Foshan Vohom Technology Co., Ltd., Sonova AG, Demant A/S, audifon GmbH & Co. KG, Cochlear Ltd., Lively Hearing Corporation, Rion Co., Ltd., Earlens Corporation, Zhejiang Nurotron Biotechnology Co., Ltd., SeboTek Hearing Systems, LLC.

Global Hearing Aids Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.89 billion

- 2026 Market Size: USD 10.59 billion

- Projected Market Size: USD 21.15 billion by 2035

- Growth Forecasts: 7.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 9 September, 2025

Hearing Aids Market Growth Drivers and Challenges:

Growth Drivers

- Growing Prevalence of Hearing Loss Globally - World Health Organization (WHO) stated that nearly 430 million individuals across the globe live with hearing disabilities, out of which, 34 million of them are children.

- Increasing Geriatric Population with Significant Hearing Disability- World Bank released a set of data demonstrating that the geriatric population reached 747,238,580 in 2021 worldwide.At a certain age, the hearing sensitivities and speech understanding of people fade away. Age-related hearing loss or also known as Presbycusis, is a natural phenomenon that occurs as a person grows old. Hearing loss generally occurs due to the changes in the auditory nerve and inner ear that causes a person to be intolerant to loud sounds. Hence, higher demand for hearing aids emerges in the market on the back of growing geriatrics over the forecast period.

- Rising Adoption of Hearables Hardware - As of 2020, the total number of hearables hardware installed was projected to reach nearly 250 million units which are further forecasted to hit approximately 950 units installed by the year 2024.

- Spiking Penetration of Personal Audio Devices- It is estimated that more than 50% of the global population aged between 10 to 35 is going to be exposed to unsafe degrees of hearing loss on account of the higher utilization of personal audio devices.

Challenges

- Higher Cost Associated with the Hearing Aids

- Hearing aids are developed and designed using mini particles that are expensive, such as speakers, amplifiers, microphones, and others. It also increases the selling price of hearing aids, hence, this factor is estimated to hamper the market growth over the forecast period.

- Lack of Awareness and the Skilled Medical Professionals

- Requirement for Higher Initial Investment

Hearing Aids Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.9% |

|

Base Year Market Size (2025) |

USD 9.89 billion |

|

Forecast Year Market Size (2035) |

USD 21.15 billion |

|

Regional Scope |

|

Hearing Aids Market Segmentation:

Hearing Loss Segment Analysis

The global hearing aids market is segmented and analyzed for demand and supply by hearing loss into conductive and sensorineural, out of which, the sensorineural segment is projected to witness noteworthy growth over the forecast period. The growth of the segment can be accounted to the higher prevalence of sensorineural hearing loss coupled with the higher utilization of electronics and the growing geriatric population across the globe. Based on the data provided by the National Library of Medicine (NLM), it was demonstrated that sudden SNHL accounts for 5-27 per 100,000 individuals each year in the USA alone.

Our in-depth analysis of the global hearing aids market includes the following segments:

|

By Aids Type |

|

|

By Implants |

|

|

By Patients Type |

|

|

By Hearing Loss |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hearing Aids Market Regional Analysis:

North American Market Insights

North America region is poised to dominate around 40.8% market share by 2035, driven by rising cases of hearing loss, an aging population, technological advancements in hearing aid designs, and a strong healthcare infrastructure. For instance, it has been observed that around 45 million Americans live with hearing disabilities, additionally, in every 5 people, 1 person wears a hearing aid. Moreover, the presence of highly developed healthcare infrastructure and the noteworthy penetration of major key players in the region is further expected to hike the growth of the market over the forecast period

Hearing Aids Market Players:

- Foshan Vohom Technology Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sonova AG

- Demant A/S

- audifon GmbH & Co. KG

- Cochlear Ltd.

- Lively Hearing Corporation

- Rion Co., Ltd.

- Earlens Corporation

- Zhejiang Nurotron Biotechnology Co., Ltd.

- SeboTek Hearing Systems, LLC.

Recent Developments

-

Sonova AG, prestigiously known for providing hearing care solutions, introduces its new Lumity platform. The Lumity platform is mainly designed for reducing listening efforts by improving speech understanding. This new innovation is built upon Paradise and Marvel platforms and is expected to power the next series of Phonak hearing instruments.

-

Cochlear Ltd. to unveil the next phase in the development of cochlear implants. The company has collaborated with several leading hearing health experts to release a multi-center, randomized controlled trial (RCT) associated with a cochlear implant.

- Report ID: 4432

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hearing Aids Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.