Smart Coatings Market Outlook:

Smart Coatings Market size was over USD 11.03 billion in 2025 and is anticipated to cross USD 89.58 billion by 2035, witnessing more than 23.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of smart coatings is estimated at USD 13.34 billion.

The smart coatings market is anticipated to witness significant growth during the forecast period owing to the high usage of smart coatings in drone technology. Smart coatings are increasingly used in drones to enhance their performance, durability, and efficiency. Traditional coatings provide basic protection and often fail in extreme environments or require regular maintenance, making smart coating a vital innovation. These materials offer unique properties such as self-healing, UV resistance, anti-corrosion, and conductivity, providing drones with improved functionality.

Smart coatings can respond dynamically to environmental stimuli. For example, self-healing smart coatings can automatically repair microcracks which diminishes the need for manual creation and prolongs the life of drones. In February 2020, Saab AB integrated self-healing coatings into their Skeldar drone platforms to improve durability in hostile environments such as maritime and desert zones. These coatings let drones work in extreme temperatures and corrosive atmospheres which further extends the maintenance cycle and decreases operational downtime.

Key Smart Coatings Market Insights Summary:

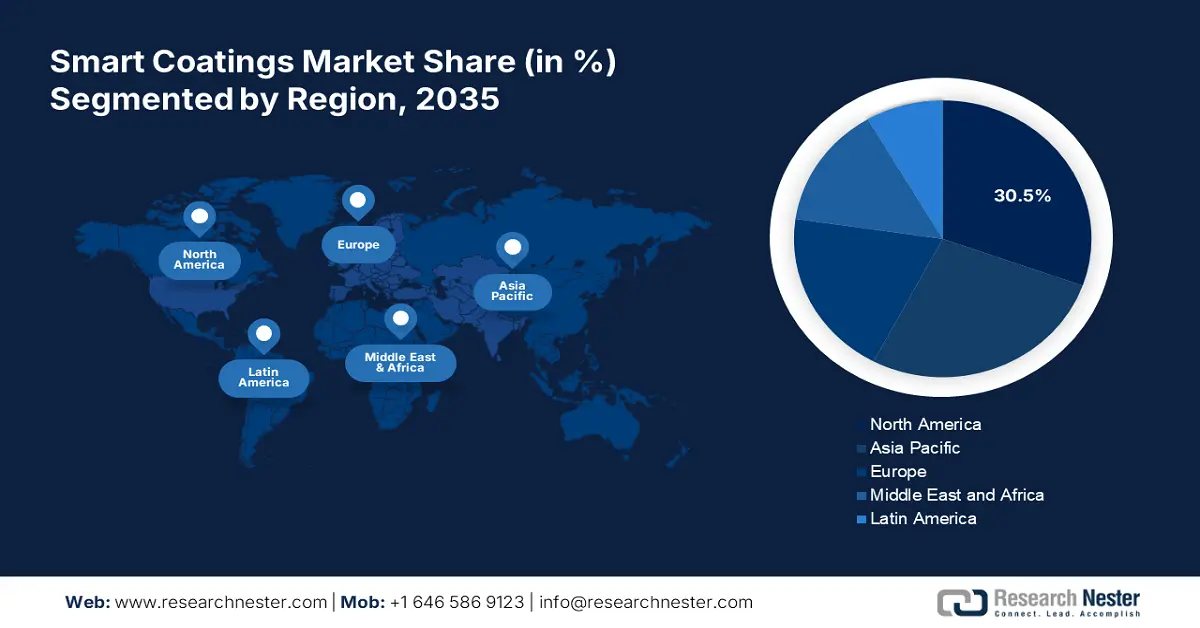

Regional Highlights:

- North America smart coatings market is poised to capture 30.50% share by 2035, driven by the presence of top research institutions, cutting-edge technology companies, and strong industrial sectors at the forefront of developing advanced smart coating technologies.

- Asia Pacific market will grow rapidly by 2035, driven by increasing urbanization and industrialization in China, India, Japan, and Southeast Asia, rising demand across several sectors, and high investments in developing innovative products.

Segment Insights:

- The nano coatings segment in the smart coatings market is expected to achieve a 33.30% share by 2035, driven by nano coatings’ durability and multi-industry resistance properties.

- The anti-corrosion coatings segment in the smart coatings market is expected to hold the largest share by 2035, attributed to advancements in self-healing coatings for aerospace and marine environments.

Key Growth Trends:

- Technological developments

- Increasing demand from theconstruction sector

Major Challenges:

- Environmental problems caused by smart coatings

- Restricted availability of raw materials

Key Players: 3M Company, PPG Industries Inc., Akzo Nobel N.V., Sherwin-Williams Company, AnCatt, Covestro AG, and BASF SE.

Global Smart Coatings Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.03 billion

- 2026 Market Size: USD 13.34 billion

- Projected Market Size: USD 89.58 billion by 2035

- Growth Forecasts: 23.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 8 September, 2025

Smart Coatings Market Growth Drivers and Challenges:

Growth Drivers

- Technological developments: Technology developments and the increasing popularity of smart coating technology are enhancing the demand for smart coatings across several industries. These coatings are designed to respond to environmental conditions or mechanical stress which transforms the performance of materials in ways that are not matched by traditional coatings. Key players are focused on developing technologically advanced products to cater to the rising demand. For example, in September 2021, PPG Industries Inc., a US-based company that generates and distributes coatings, paints, and specialty materials announced the launch of Sigma Sailadvance NX coating, a significant antifouling technology breakthrough.

The smart coating is progressively being used in the infrastructure and automotive sectors owing to its ability to protect surfaces from corrosion, mechanical damage, and UV radiation. In June 2020, Nippon Paint focused on advancing smart coating for defense and industrial drones, targeting applications that need UV resistance and self-cleaning properties to decrease maintenance costs and improve drone longevity. - Increasing demand from the construction sector: As urbanization and infrastructure projects expand worldwide, construction companies gradually seek innovative solutions to improve building longevity, energy efficiency, and aesthetic appeal. Smart coatings provide a range of benefits including anti-corrosion, self-cleaning properties, and energy-efficient functionalities that are well-suited for modern construction needs. According to the Ministry of Statistics and Programable Implementation (MoSPI), the construction industry is projected to increase by 10.7% by the end of 2024. The smart coatings market is likely to expand to cater to the increasing demand from the building sector.

Challenges

- Environmental problems caused by smart coatings: Smart coatings are considered to be destructive to the environment owing to the assessment of gases during synthesis and the use of solvents such as volatile organic compounds (VOCs) that release dangerous peroxides and ozone. These compounds are harmful to the environment as VOCs contribute to the creation of ozone and smog. Moreover, all these compounds are injurious to human health as they can cause nose, eye, and throat irritation, loss of coordination, headaches, and nausea. These factors are predicted to hinder the smart coatings market growth in the coming years.

- Restricted availability of raw materials: Several smart coatings rely on developed materials such as nanomaterials, polymers, and rare earth elements which are either inadequate in supply or subject to economic or geopolitical constraints. A perfect example of this can be dependence on rare earth elements which are critical for producing smart coatings with high-performance features. According to a report in 2022 by the US Geological Survey, worldwide production of rare earth elements touched only 280,000 metric tons which is deficient to meet the increasing demand from industries such as construction, automotive, and aerospace. This shortage has caused supply uncertainties and price volatility impacting manufacturer's ability to enlarge the production of smart coatings.

Smart Coatings Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

23.3% |

|

Base Year Market Size (2025) |

USD 11.03 billion |

|

Forecast Year Market Size (2035) |

USD 89.58 billion |

|

Regional Scope |

|

Smart Coatings Market Segmentation:

Product Type Segment Analysis

Anti-corrosion coatings segment is projected to capture largest smart coatings market share by the end of 2035, due to the advancement of self-healing coatings. These advanced materials can repair themselves when damaged improving durability and decreasing maintenance necessity. This capability is mainly valuable in high-wear applications such as aerospace and automotive industries, where preserving the integrity of materials is critical for performance and safety. For example, Boeing Company positively completed its testing for the MQ-25 stingray drone, by applying corrosion-resistant smart coatings to enhance its performance in the maritime environment.

Technology Segment Analysis

In smart coatings market, nano coatings segment is anticipated to account for revenue share of around 33.3% by 2035, due to exclusive desirable properties that address several functionality and performance needs across various industries. They can offer resistance against abrasion, corrosion, and UV radiation while upholding minimal thickness, making them ideal for applications where weight and space restrictions are critical such as in the automotive, electronics, and aerospace industries. For instance, in June 2024, Onyx Coating, a global leader in the automotive protection and care industry announced the launch of a novel nano coating combination of 10H and N1 that provides unparalleled protection for vehicles along with flawless finish and long-lasting defense against abrasion, corrosion, and UV radiation.

Our in-depth analysis of the smart coatings market includes the following segments:

|

Product Type |

|

|

Technology |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Coatings Market Regional Analysis:

North America Market Insights

North America industry is predicted to dominate majority revenue share of 30.5% by 2035, to the presence of top research institutions, cutting-edge technology companies, and strong industrial sectors at the forefront of developing advanced smart coating technologies. The region’s prominence on high-performance materials and next-generation solutions fuels the demand for smart coatings with characteristics such as anti-corrosion, self-healing, and energy efficiency. In addition, rising demand for low-volatile organic compounds and sustainable solutions catering to stringent regulations and norms is expected to boost smart coatings market growth in the coming years.

The U.S. is a leading hub for advanced coatings such as self-healing and IoT-integrated solutions used across several sectors such as automotive, aerospace, and electronics sectors. In addition to this, the U.S. defense sector invests heavily in coatings with anti-corrosion, anti-reflective, and self-healing properties for asset protection and augment operational efficiency.

Canada’s stringent environmental policies and improving infrastructural development have resulted in growing need for sustainable and durable coating solutions. Builders are focused on opting for smart coatings to meet the energy-saving and emission-reduction goals. Moreover, the rising adoption of smart coatings across the automotive sector and increasing investments in developing advanced products are expected to drive Canada smart coatings market.

Asia Pacific Market Insights

Asia Pacific is expected to register a rapid revenue CAGR throughout the forecast period owing to increasing urbanization and industrialization in China, India, Japan, and Southeast Asia, rising demand for smart coatings across several sectors including, automotive, construction, and manufacturing, and high investments in developing innovative products such as self-healing and stimuli-responsive coatings. Moreover, rising awareness about sustainability and stringent environmental regulations are encouraging consumers to opt for eco-friendly coatings. This is expected to increase the production of these sustainable coatings.

In China, smart coatings are gaining popularity in electronics, automotive, and aerospace applications as these help to improve product durability and reduce operational prices. Several companies are investing in R&D activities to develop smart coatings with self-healing features and advanced corrosion resistance.

The smart coatings market in India is likely to register rapid revenue growth during the forecast period owing to rapid urbanization, rising investments in residential and commercial construction, high usage of advanced coatings in the automotive sector, and increasing focus on developing innovative products. For instance, in July 2024, Shalimar Paints Ltd announced its plan to expand its coatings and paints product portfolio with the launch of several waterproof, anti-corrosive products developed with its cutting-edge technology.

Smart Coatings Market Players:

- 3M Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- PPG Industries Inc.

- Akzo Nobel N.V

- Sherwin-Williams Company

- AnCatt

- Covestro AG

- BASF SE

The smart coatings market is contributing by developing advanced and high-performance smart coatings that address the emerging needs of several industries. Some key players are Akzo Nobel N.V., Nippon Paint Automotive Coatings Co. Ltd, Sherwin-Williams Company, PPG Industries Inc., and so on. As the demand for smart coatings continues to increase worldwide, competition among industry players is projected to remain fierce, driving further innovation and technological developments in the market. These key players are focused on adopting several strategic alliances such as mergers and acquisitions, partnerships, joint ventures, product launches, and license agreements to enhance their product portfolio and sustain their market position. Here are some leading players in the smart coatings market:

Recent Developments

- In September 2023, D.C. United announced a partnership with Sherwin-Williams to align their brand with a paint industry leader.

- In October 2021, Nippon Paint Holdings acquired Cromology to expand its decorative paint business in Europe and the goal is to achieve revenue growth that overtakes the market growth in their operating regions by promoting growth strategies.

- In May 2021, PPG declared that it had completed its acquisition of Wörwag, a global manufacturer of coatings for automotive and industrial applications.

- Report ID: 2530

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Coatings Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.