Seed Treatment Market Outlook:

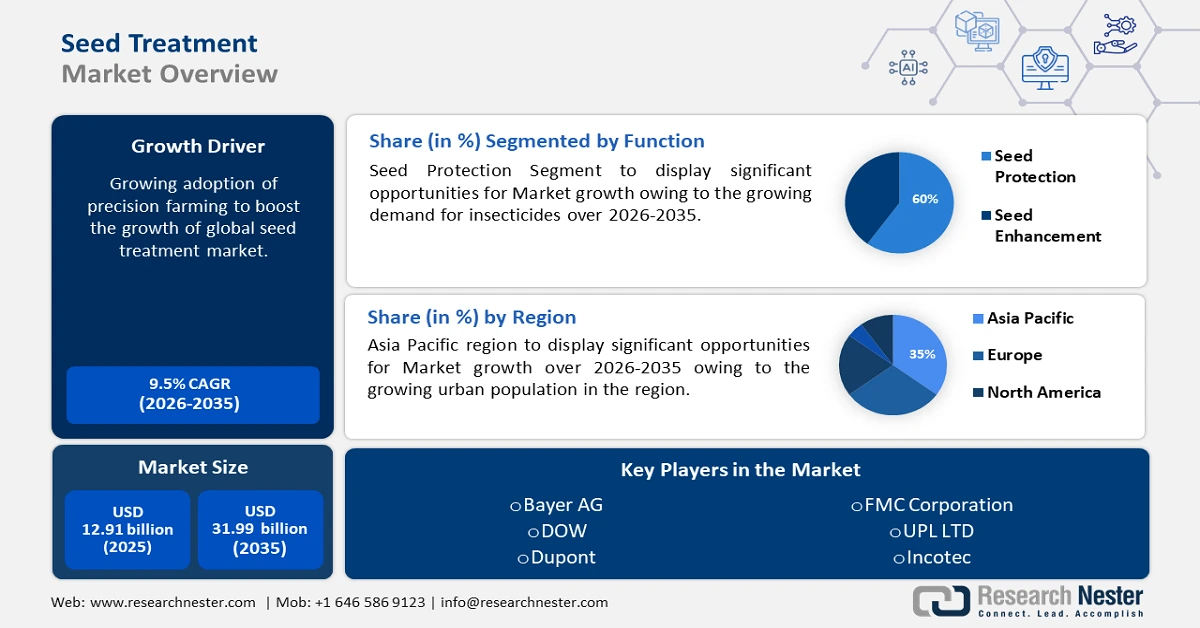

Seed Treatment Market size was over USD 12.91 billion in 2025 and is projected to reach USD 31.99 billion by 2035, growing at around 9.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of seed treatment is assessed at USD 14.01 billion.

The market growth is impelled by growing demand for food security on account of the surging population. For instance, by 2050, farmers are estimated to grow over 55% more food calories, in contrast to the year 2009, in order to satisfy the needs of the global growing population. Furthermore, there have been surging advancements in seed treatment technologies, which include precision seed coating and biotechnology. Additionally, such advancements in seed treatment technologies are set to encourage a rise in efficiency, adoption, and efficacy in the agriculture industry.

Key Seed Treatment Market Insights Summary:

Regional Highlights:

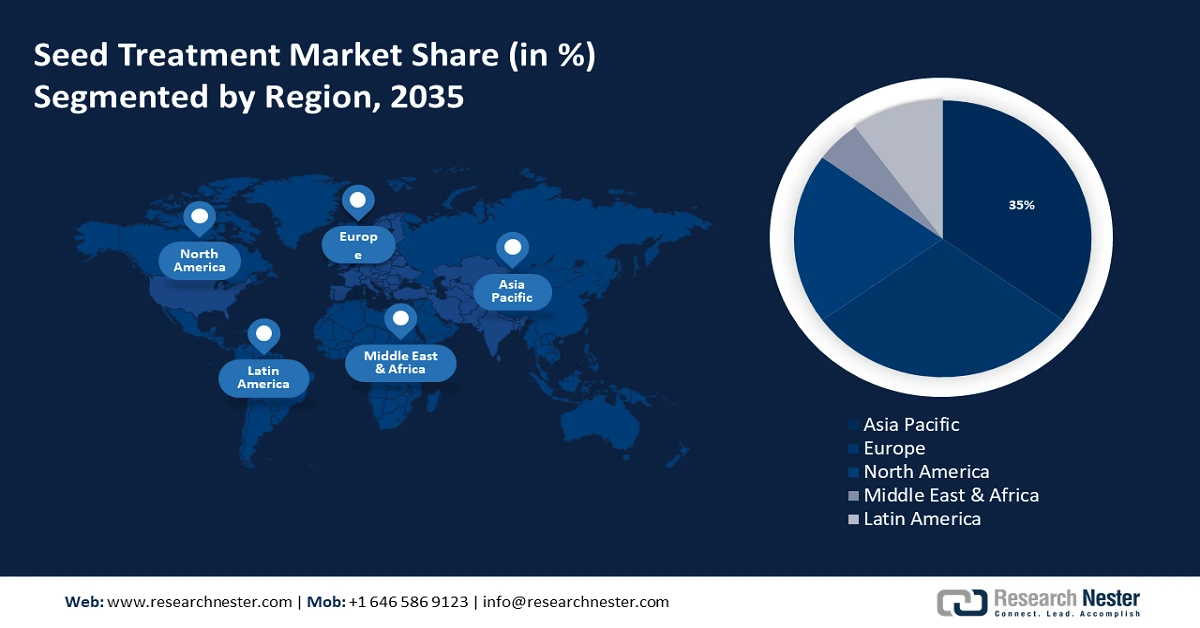

- Asia Pacific seed treatment market will hold around 35% share by 2035, driven by growing urban population and increasing demand for food and bio-based agricultural products.

Segment Insights:

- The seed protection segment in the seed treatment market is forecasted to hold a 60% share by 2035, spurred by increasing demand for insecticides and fungicides to support healthier plant growth.

- The synthetic chemical segment in the seed treatment market market will capture 55% share, fueled by its shorter time to control pest diseases, 2026-2035.

Key Growth Trends:

- Growing Launch of Policy & Regulatory Framework to Reduce Disease

- Growing Adoption of Precision Framing

Major Challenges:

- Growing Launch of Policy & Regulatory Framework to Reduce Disease

- Growing Adoption of Precision Framing

Key Players: Bayer AG, Oerth Bio, Syngenta Crop Protection AG, DOW, Dupont, Nufarm Ltd., FMC Corporation, Arysta Lifescience, UPL Ltd, Incotec.

Global Seed Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.91 billion

- 2026 Market Size: USD 14.01 billion

- Projected Market Size: USD 31.99 billion by 2035

- Growth Forecasts: 9.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Brazil, China, India, Germany

- Emerging Countries: China, India, Brazil, Argentina, Mexico

Last updated on : 8 September, 2025

Seed Treatment Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Launch of Policy & Regulatory Framework to Reduce Disease-Governments across the globe understand the need to enhance the productivity of crops and are hence offering funds in order to support research initiatives to boost the launch of advanced solutions for agriculture. Moreover, they are introducing integrated pest management in order to limit the dependency on chemical pesticides, avoid harmful effects on human health, and protect the environment. Hence, it is estimated to be another major factor in boosting seed treatment market growth. Moreover, various policies and incentives have been implemented by the government to dominate the demand for IPM practices in seed treatment. These initiatives include financial incentives, regulatory frameworks, and educational programs that might further encourage the utilization of environmentally friendly pest control solutions. Furthermore, regulations are launched to ensure that agriculture products meet stringent quality standards and boost consumer confidence in agriculture products.

-

Growing Adoption of Precision Framing-Precision farming is experiencing a surge in its adoption on account of the growing importance of technology. This farming method is considered to be one of the modern approaches that utilize modern technologies, including satellite imagery or field mapping, to gather data regarding the condition of the soil, weather patterns, and crop growth, which is further examined to reach precise decisions regarding planting, fertilizing, and harvesting. This modern approach is expected to increase production while saving farmers money by improving crop efficiency. Hence, it is observing growth in its demand. Further, this approach is also predicted to have great advantages for seed treatment since it could guide the farmer in seed spacing and more.

-

Growing Prevalence of Disease in Crop-On account of growing climate change and global trade, the prevalence of crop diseases and pests has risen significantly. Around the globe, close to 19% to about 39% of crop yield is damaged owing to pests and disease. Hence, this is encouraging farmers to adopt more effective protection solutions. Seed treatments provide a dedicated solution for protecting crops from the outset. Seed treatment is a preventive strategy that enhances the strength of plants from the moment of germination, further reducing the possibility of losses.

Challenges

-

Strict Government Regulations-The seed treatment market is predicted to adhere to the regulations announced by various government bodies, such as the USDA, Health Canada, the European Commission, the Asia Pacific Seed Association (APSA), and more. However, these regulations keep changing with the change in geography, making it difficult for the producer to adhere to them. As a result, the growth of the market for seed treatment might be restricted.

-

Growing Disruption in the Supply Chain of Raw Materials

-

Lack of Awareness Regarding Seed Treatment Among Farmers -Farmers in developing countries lack awareness regarding crop disease and its prevention. Moreover, poor farmers have limited knowledge regarding the schemes offered by the government, hence restraining themselves from adopting modern approaches. Hence, this factor is predicted to hinder the seed treatment market expansion for seed treatment.

Seed Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.5% |

|

Base Year Market Size (2025) |

USD 12.91 billion |

|

Forecast Year Market Size (2035) |

USD 31.99 billion |

|

Regional Scope |

|

Seed Treatment Market Segmentation:

Function Segmwent Analysis

The seed protection segment in the seed treatment market is predicted to hold revenue share of 60% by 2035, propelled by growing demand for insecticides and fungicides. Insecticides safeguard seeds from harmful pests, hence further influencing healthier plant growth, while fungicides deal with fungal pathogeny. Hence, with the growing demand for high-quality seeds, the segment is expected to experience growth.

Application Segment Analysis

The seed dressing segment is projected to generate 50% share in the seed treatment market by 2035, led by growing seed infections, such as foliar infections. Hence, further steps have been taken by several countries to control its spread. For instance, in 2023, the NC State Soybean Extension and Pathology programs organized foliar fungicide trials in all parts of North Carolina. Field studies were conducted in the counties of Sampson, Union, and Yadkin. Seven distinct fungicide formulations were administered at R3 together with a nontreated control as a check. Hence, the segment for seed coating is expected to surge.

Type Segment Analysis

The synthetic chemical segment in the seed treatment market will dominate 55% share by 2035. This is because the time required to control the pest disease is shorter with the use of synthetic chemicals in contrast to biological solutions. Seeds that are treated with resistance-inducing chemicals, including jasmonic acid, salicylic acid, and more, demonstrate long-lasting protection for plants.

Our in-depth analysis of the global seed treatment market includes the following segments:

|

Type |

|

|

Function |

|

|

Application |

|

|

Crop Type |

|

|

Stage of Seed |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Seed Treatment Market Regional Analysis:

APAC Market Insights

The Asia Pacific seed treatment market is expected to account for 35% revenue share by 2035, led by growing urban population. For instance, approximately the globe's 2.2 billion individuals currently dwell in the Asia region. Furthermore, it is predicted that this population in Asia's urban region might rise by 50%. This indicates that more than 1.2 billion individuals will be added. As a result, the demand for food is also growing. Further, the production of pesticides is also growing in this region, which might additionally boost the market growth. Moreover, Asia Pacific is witnessing growth in organic agricultural practices in the coming years. Hence, this influences the demand for bio-based agricultural products, influencing the market expansion.

European Market Insights

The Europe seed treatment market is predicted to have notable growth during the forecast period, driven by growing awareness among farmers regarding the benefits of seed treatment in this region. Further, the demand for corn in this region is growing significantly to meet the demand for biofuels. In addition, this demand for biofuels is because the government in this region is launching strict regulations to reduce the emission of CO2.

Seed Treatment Market Players:

- Bayer AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Oerth Bio

- Syngenta Crop Protection AG

- DOW

- Dupont

- Nufarm Ltd.

- FMC Corporation

- Arysta Lifescience

- UPL Ltd

- Incotec

Recent Developments

- January 19, 2023: Bayer and Oerth Bio, the agricultural biotech company made an announcement of a new collaboration to develop high sustainable products PROTAC for crop protection. This novel and unique product is predicted to be a game-changer for the agriculture sector to reduce the environmental impact of the chemical.

- May 17, 2022: Syngenta Crop Protection’s Seedcare launched a novel technology VICTRATO, offering a powerful combination of nematode and disease control for to boost crop quality and output while maintaining the long-term health of their soil.

- Report ID: 1413

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Seed Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.