Metal Recycling Market Outlook:

Metal Recycling Market size was valued at USD 629.28 billion in 2025 and is expected to reach USD 1.14 trillion by 2035, expanding at around 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of metal recycling is assessed at USD 663.83 billion.

The market growth is owing to increasing need for metals in various applications and the increasing scarcity of rare earth metals. According to calculations, in the next five years, over 70% of respondents in the automotive sector will see a shortage of metal. Conversely, the chemical and infrastructure sectors will see shortages of roughly 77% and 81%, respectively.

In addition, reprocessing of metal waste has been more popular over the past 20 years due to decreased greenhouse gas emissions and efficient energy management, both of which are significant factors anticipated to propel the market expansion. For instance, the net greenhouse gas emissions from human activities increased by 43% between 1990 and 2020. Emissions of carbon dioxide, which account for about three-fourths of all emissions, increased by 51% during that period.

Key Metal Recycling Market Insights Summary:

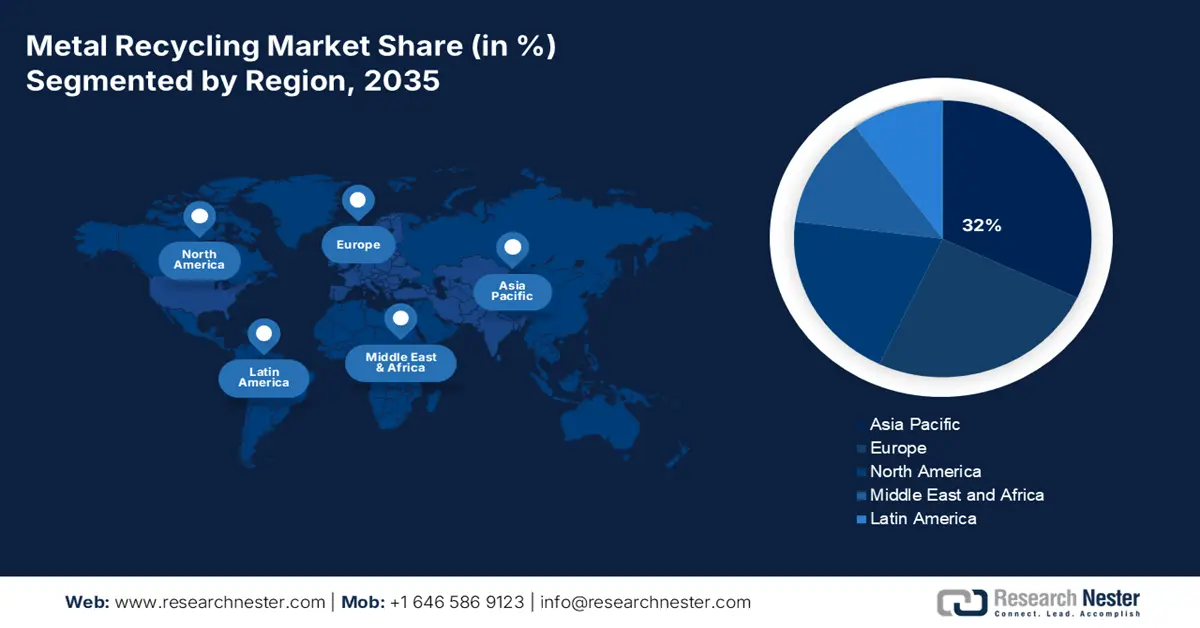

Regional Highlights:

- Asia Pacific metal recycling market will dominate over 32% share by 2035, driven by high steel and aluminum production and government emphasis on waste management.

- Europe market will capture a 25% share by 2035, driven by strict government energy rules and funding for recycling technologies.

Segment Insights:

- The aluminium segment in the metal recycling market is forecasted to capture a 39% share by 2035, driven by its energy efficiency and reduced greenhouse gas emissions.

- The automotive segment in the metal recycling market is expected to achieve a 35% share by 2035, influenced by the growing automobile sector and the need for cost-effective recycling of raw materials.

Key Growth Trends:

- Increase in Urbanization and Industrialization to Boost Market Growth

- Favourable Government Initiatives

Major Challenges:

- Issue of Safety

- It is projected that an unorganised flow of waste metals and a dearth of collection zones will impede market expansion.

Key Players: ArcelorMittal S.A., Norsk Hydro ASA, Kimmel Iron & Metal Co., Inc., Schnitzer Steel Industries, Inc., OmniSource Corporation, Nucor Corporation, Aurubis AG.

Global Metal Recycling Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 629.28 billion

- 2026 Market Size: USD 663.83 billion

- Projected Market Size: USD 1.14 trillion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 8 September, 2025

Metal Recycling Market Growth Drivers and Challenges:

Growth Drivers

- Increase in Urbanization and Industrialization to Boost Market Growth- The market is anticipated to expand as a result of the increase in construction activities occurring in several areas, including Asia-Pacific and Europe. The market for metal recycling is growing in demand due to the rapid economic growth brought about by increased industrialization and urbanisation. Consequently, increased government and consumer spending on housing and infrastructure as a result of growing urbanisation boosts market growth. Furthermore, recycling metals boosts employment in the sector and the national economy. For example, an industry in the US that brings in USD 236 billion a year employs more than a million people.

- Favourable Government Initiatives- Global government programmes that promote and encourage metal recycling have a big effect on the market as a whole. For instance, by establishing challenging goals and encouraging sustainable production and consumption methods, the circular economy package of the European Union seeks to enhance the recycling and reuse of commodities, including metal. All things considered, government initiatives for recycling metal are vital for encouraging environmentally friendly production and consumption methods, cutting waste and its negative effects on the environment, and propelling the world market for recycled metal.

- Aggregating Demand from Many End-Use Sectors to Increase the Market for Metal- The global metal recycling market is expanding as a result of end-use industries including manufacturing, construction, and automotive using metal more and more. Because metal is just as good as virgin metal in terms of quality, cost, and environmental impact. The end-use industries are switching from employing virgin metal to recycled metal because of the previously cited reasons. One of the biggest steel companies in the world uses metal in its manufacturing process and has promised to employ 50% more recycled material by 2030.

Challenges

- Issue of Safety- The problem of safety is one of the main obstacles in commercial metal recycling. Managing substantial quantities of metal may be exceedingly hazardous, therefore it's critical for businesses to implement appropriate safety measures to safeguard both their employees and the environment. Strict safety protocols, such as frequent training and safety audits, are also in place to ensure that staff members are adequately prepared to manage the hazards inherent in this line of work.

- It is projected that an unorganised flow of waste metals and a dearth of collection zones will impede market expansion.

- The main obstacle to market expansion is a rise in import duties on steel.

Metal Recycling Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 629.28 billion |

|

Forecast Year Market Size (2035) |

USD 1.14 trillion |

|

Regional Scope |

|

Metal Recycling Market Segmentation:

Product Segment Analysis

The aluminium segment share in the metal recycling market is expected to surpass 39% by 2035. Recycling aluminium is becoming more popular than recycling other metals since it is less harmful to the environment because it uses less energy and emits fewer greenhouse gases. Reusing aluminium helps lower greenhouse gas emissions since it uses 95% less energy than making new aluminium from raw materials. Additional recycling of aluminium is economical since it uses less energy, which lowers production costs. Furthermore, because aluminium is used in so many different industries, including packaging, transportation, and building, demand for metal is rising. Aluminium recycling makes it possible to satisfy this need without using up natural resources.

Industry Segment Analysis

The automotive segment is predicted to hold about 35% metal recycling market share during the forecast period, impacted by the expanding automobile sector. Many raw materials are needed in the manufacturing of modern cars, including metals like copper, aluminium, and steel. Recycling used metal scraps contributes to resource conservation by lowering the need for virgin raw materials. Because recycling waste metal uses less energy than creating new metals from raw materials, it is a cost-effective method.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Type |

|

|

Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Metal Recycling Market Regional Analysis:

APAC Market Insights

Metal recycling market in the Asia Pacific region is attributed to hold largest share of about 32% by the end of 2035. Being one of the world's top manufacturers of steel and aluminum, the region is responsible for the market expansion. In April 2020, China produced over 85 million metric tons of steel, and in the same month in 2021, that amount rose to about 98 million metric tons. In addition, rising government emphasis on effective waste management and the expanding demand for products will fuel the market revenue. The National Policy, which the Indian government drafted in 2019, along with the country's increasing steel demand are anticipated to boost ferrous processing domestically.

European Market Insights

Europe metal recycling market is expected to hold 25% of the revenue share during the forecast period. The market growth is due to strict government rules regarding energy use in the region and the growing use of recycled for the production of secondary metals. To cut waste and greenhouse gas emissions, for example, the German government keeps funding recycling and circular economy initiatives. The government started a USD 5 billion investment programme in 2021 to aid in the advancement of new recycling technologies and their transfer.

Metal Recycling Market Players:

- SIMS Metal Management Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SUEZ SA

- ArcelorMittal S.A.

- Norsk Hydro ASA

- Kimmel Iron & Metal Co., Inc.

- Schnitzer Steel Industries, Inc.

- OmniSource Corporation

- Nucor Corporation

- Aurubis AG

Commercial Metal Company

Recent Developments

- ArcelorMittal today announces plans to roll out a new sustainability programme across Europe, aiming to secure Responsible Steel site certification for all its ArcelorMittal Europe - Flat Products sites. The 12-month programme will enable each site to prove that our production processes meet rigorously defined standards across a broad range of social, environmental and governance criteria.

- Nucor Corporation announced a capital investment that will add vacuum degassing to its engineered bar capabilities at its bar mill in Darlington, South Carolina. Adding this capability will enable the mill to produce engineered bar products meeting some of the most stringent quality specifications in the industry. The vacuum degassing system is expected to begin operations in late 2020.

- Report ID: 3339

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Metal Recycling Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.