Sales Intelligence Market Outlook:

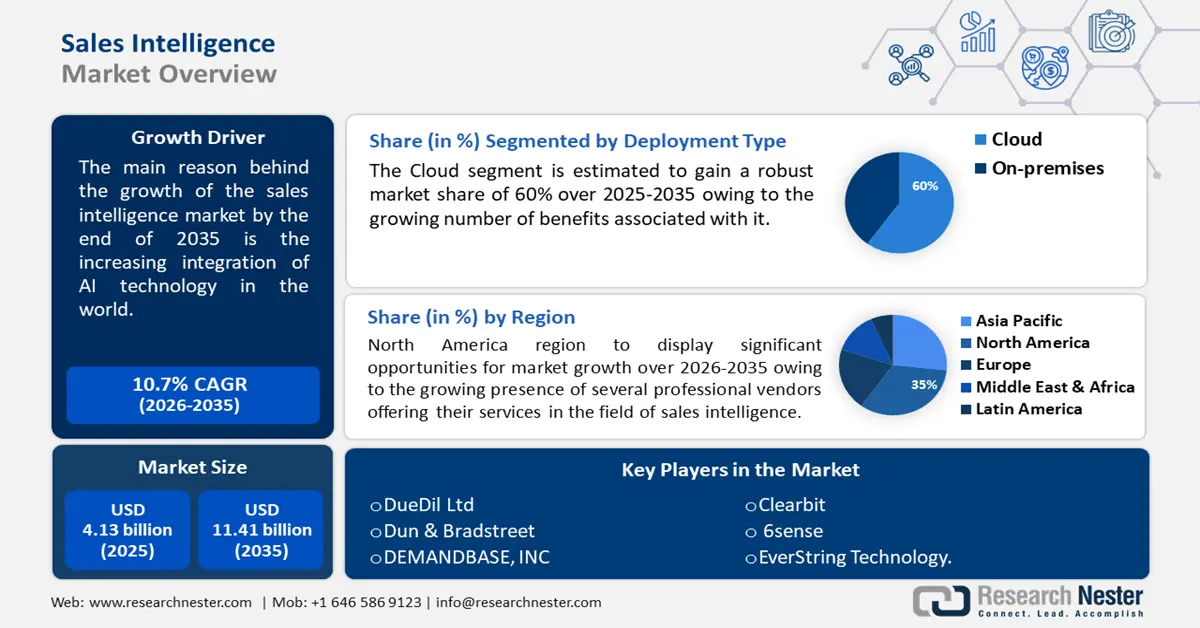

Sales Intelligence Market size was over USD 4.13 billion in 2025 and is poised to exceed USD 11.41 billion by 2035, witnessing over 10.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sales intelligence is estimated at USD 4.53 billion.

The growth of the market is poised to be dominated by the rising number of companies globally. In 2023, there are about 333 million companies all across the world. As a result, the market demand for sales intelligence is also predicted to grow to enhance the company's growth

Sales intelligence provides perceptions into the behavior of customers in addition to the market, competitors, and potential for expansion. It creates actionable insights by combining data from internal and external sources, which may be utilized to find potential new leads and develop successful sales tactics. Therefore, with its utilization companies might procure profits, resulting in the success of the business.

Furthermore, the amount of funding allotted for the expansion and development of sophisticated, automated technology and equipment to handle large volumes of structured and unstructured data has increased as a result of an increasing amount of strategic market collaborations. Consequently, this factor is also projected to influence sales intelligence market growth.

Key Sales Intelligence Market Insights Summary:

Regional Highlights:

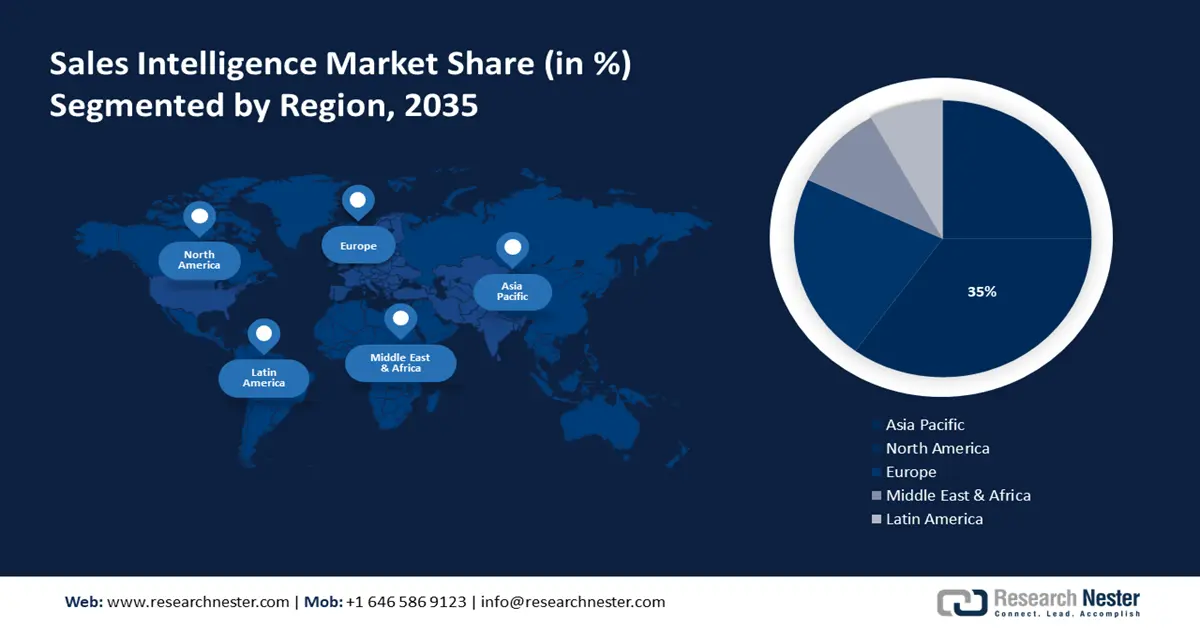

- North America sales intelligence market will secure over 35% share, driven by the increasing presence of professional vendors and a growing retail sector, where data plays a key role in shaping consumer behavior, forecast period 2026–2035.

- Asia Pacific market will register significant CAGR, fueled by the rise of AI startups and increased investment in sales intelligence technologies across the region, forecast period 2026–2035.

Segment Insights:

- The large enterprise segment in the sales intelligence market is projected to capture a 70% share by 2035, driven by the rising number of large enterprises adopting sales intelligence solutions.

- The cloud segment in the sales intelligence market is forecasted to capture a 60% share by 2035, driven by the elimination of firewall limitations and scalable storage capacity.

Key Growth Trends:

- Surge in deployment of AI

- Surge in online shopping trend

Major Challenges:

- Implementation of standard regulations

- Surge in risk of data breaches is slated to hamper the market growth in the forecast timeframe

Key Players: HG Insights, 6sense, Clearbit, DEMANDBASE, INC., Dun & Bradstreet, DueDil Ltd, EverString Technology, FullContact, GRYPHONNETWORKS CORPORATION, Insideview.

Global Sales Intelligence Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.13 billion

- 2026 Market Size: USD 4.53 billion

- Projected Market Size: USD 11.41 billion by 2035

- Growth Forecasts: 10.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, Germany, China, India

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 16 September, 2025

Sales Intelligence Market Growth Drivers and Challenges:

Growth Drivers

- Surge in deployment of AI - Over 64% of B2B sales organizations will be employing technology that integrates workflow, data, and analytics to make decisions that are data-driven by 2026 as opposed to intuition-based. Additionally, studies reveal that sales teams only spend roughly 29 percent of their time interacting with clients. The remainder of the time is devoted to routine chores that have nothing particularly related to the sales cycle, such as data entry, meetings, prospecting, and setting up more meetings.

Hence, the integration of AI in sales intelligence is predicted to rise. AI in sales may be utilized to automate tedious processes, detect chances for cross-selling and upselling, manage and predict client behavior, and increase forecasting accuracy. AI in sales aims to increase productivity and effectiveness while cutting expenses - Surge in online shopping trend - The reason for the enormous global growth of e-commerce is that consumers are no longer restricted to one physical store or even a hundred in a mall. Currently, they can shop at any store they choose, since a variety of sales intelligence market places provide access to a wide range of options and brands. Another reason why customers prefer eCommerce is that it allows them to compare prices from different retailers and get the best offers.

However, this also creates competition among various online businesses. Hence, the demand for sales intelligence is predicted to rise. Businesses may divide their consumer base depending on a range of factors, including preferences, purchase patterns, and demographics, due to e-commerce business intelligence. Organizations may improve the efficacy and relevance of their sales endeavors by customizing their messaging, offers, and sales methods to target groups based on their understanding of client segments. - Escalating the number of internet users found globally - With the growing number of internet users, the amount of intent data is also growing. In essence, business-to-business (B2B) intent data is an assortment of signals indicating a company's possible interest in acquiring a good or service.

Website visits, material downloads, social media interactions, webinar registrations, and other activities may all be regarded as these indications. One can target the ads by tracking and analyzing these signals to learn more about a company's purchase intent. Therefore, the adoption of sales intelligence market is also estimated to rise.

Challenges

- Implementation of standard regulations - One of the biggest obstacles to sales intelligence market is the standard regulations. Most of the private information that sales intelligence companies gather, store, and review has to do with contact details, work responsibilities, and business relationships. This data is frequently used to create comprehensive assessments of people and organizations, in addition to educating and counseling sales and marketing teams.

- Surge in risk of data breaches is slated to hamper the market growth in the forecast timeframe

- Surge in complexity in sales intelligence is anticipated to pose limitations on the sales intelligence market expansion in the upcoming future.

Sales Intelligence Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.7% |

|

Base Year Market Size (2025) |

USD 4.13 billion |

|

Forecast Year Market Size (2035) |

USD 11.41 billion |

|

Regional Scope |

|

Sales Intelligence Market Segmentation:

Deployment Type

In sales intelligence market, cloud segment is likely to dominate over 60% share by 2035. This high percentage may be explained by the fact that firewall limitations that may hinder users from accessing on-premise solutions are removed by cloud solutions.

Overhead and maintenance expenses are eliminated with cloud-based Software as a Service solution. Additionally, the nearly limitless storage capacity offered by cloud object storage services mitigates the limitations on locally installed hardware's scalability and storage volume.

Organization Size

In sales intelligence market, large enterprise segment is predicted to account for around 70% revenue share by 2035.. The major element projected to influence the segment growth is the rising number of large enterprises. In 2021, the number of major enterprises with 250 or more employees globally was predicted to be over 351,519.

The size of infrastructure is growing significantly which is why the number of large businesses is growing along with the rise in loyal customers. Hence, to further sustain those loyal customers and gain newer these organizations keep exploring various means.

Moreover, this large proportion may also be attributed to growing rates of data deterioration and greater competition among major companies in several industry sectors. Additionally, large companies tend to be more technically skilled than small and medium-sized businesses, which facilitates the adoption of sales intelligence solutions to accelerate sales cycles and increase productivity.

Our in-depth analysis of the global sales intelligence market includes the following segments:

|

Component |

|

|

Deployment Type |

|

|

Organization Size |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sales Intelligence Market Regional Analysis:

North American Market Insights

The North American sales intelligence market is set to capture the largest revenue share of about 35% over the review period. The major element to influence the market growth in this region is the growing presence of several professional vendors offering their services in the field of sales intelligence. Additionally, the retail business is also expanding in this region. As of 2023, there were over 2,992,526 retail trade companies in the US, up about 2% from 2022.

Also, in the retail sector in this region, data is driving creativity and providing a fresh perspective on understanding and predicting client requirements. The sales team may gather more data from beacons, wearables, PoS terminals, CRMs, and other databases by deploying sales intelligence across different regions in the retail industry.

APAC Market Insights

The Asia Pacific sales intelligence market is estimated to have significant growth during the forecast period. This expansion is set to be dominated by rising AI startups in this region. This is because AI and advanced computing are quickly centered in the APAC area.

Businesses from Taiwan, South Korea, India, Japan, Singapore, and other countries have established a regional innovation hub that is driving artificial intelligence (AI) advancements to previously unthinkable levels. Hence, several AI startups are growing in this region which might further boost the market growth. Furthermore, the key market players in this region are investing significantly in sales intelligence. Hence, this factor is also projected to encourage sales intelligence market expansion in this region

Sales Intelligence Market Players:

- HG Insights

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- 6sense

- Clearbit

- DEMANDBASE, INC.

- Dun & Bradstreet

- DueDil Ltd

- EverString Technology

- FullContact

- GRYPHONNETWORKS CORPORATION

- Insideview

Recent Developments

- HG Insights has upgraded its flagship Platform. Business executives require actionable information from Platform 2.0 to fully comprehend their markets, make informed decisions, and proceed confidently and precisely to market (GTM).

- 6sense declared the launch of revenue AI for sales. This new platform was created to enhance the daily lives of sellers by making it easier to find prospects and accounts that are in-market for items, to plan a seller's day with high-impact activities, and to uncover deeper data on buyers and marketing tools.

- Report ID: 5667

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sales Intelligence Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.