Reverse Factoring Market Outlook:

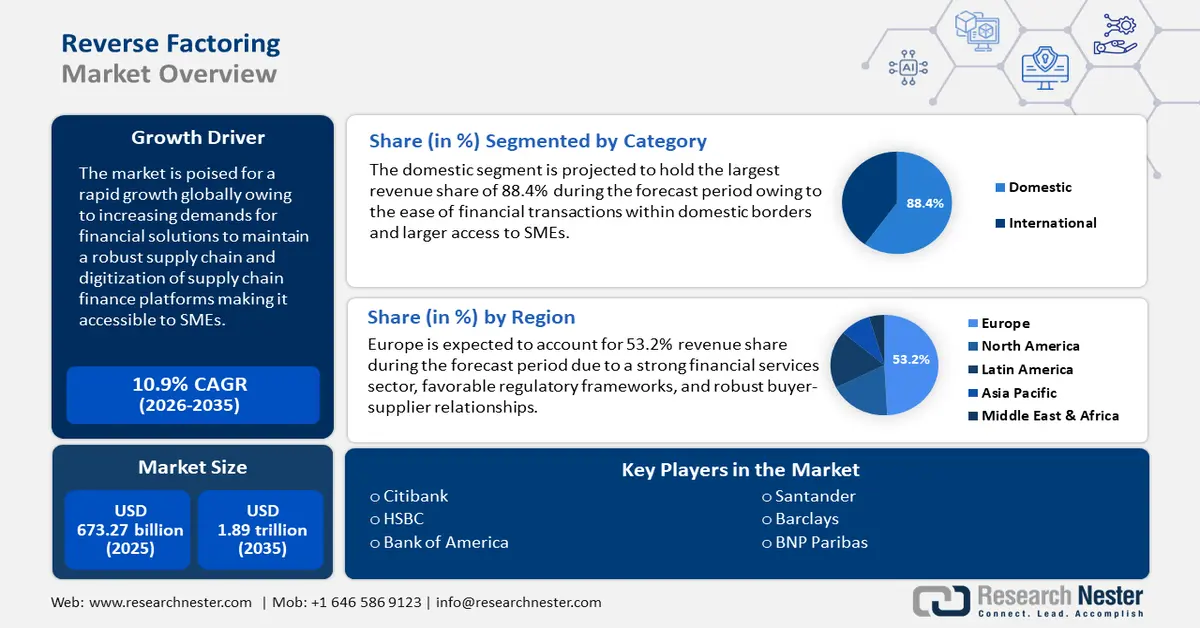

Reverse Factoring Market size was over USD 673.27 billion in 2025 and is poised to exceed USD 1.89 trillion by 2035, witnessing over 10.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of reverse factoring is estimated at USD 739.32 billion.

Reverse factoring is a financial arrangement where a large buyer helps suppliers clear financial dues earlier than the agreed-upon payment terms. Industries such as manufacturing, retail, construction, automotive, etc., are the primary users of reverse factoring to streamline capital management. In March 2023, the World Economic Forum (WEF) stated reverse factoring to be vital for small and medium-sized industries operating with limited capital and facilitating industries to strengthen their supply chains. WEF report highlights supply chain finance (SCF) i.e., reverse factoring can play a role in lowering emissions. In 2022, the global SCF award was earned by Henkel for implementing a successful SCF program.

The rising complexity of global supply chains has increased the need for efficient and reliable financing solutions. Reverse factoring helps mitigate the risk of bad debt by transferring the credit risk to the financial institution. In July 2024, a Forbes report stated that PUMA was close to achieving its environmental, sustainability, and governance goals by applying reverse factoring. PUMA collaborates with its banking partners such as HSBC, BNP Paribas, Standard Chartered, and the International Finance Corporation (IFC) on its Nexus digital platform to pay suppliers within 5 days and reduce the manual work involved. The positive growth of PUMA bodes well for the reverse factoring market as more global players adapt the SCF program to strengthen their supply chains.

Key Reverse Factoring Market Insights Summary:

Regional Highlights:

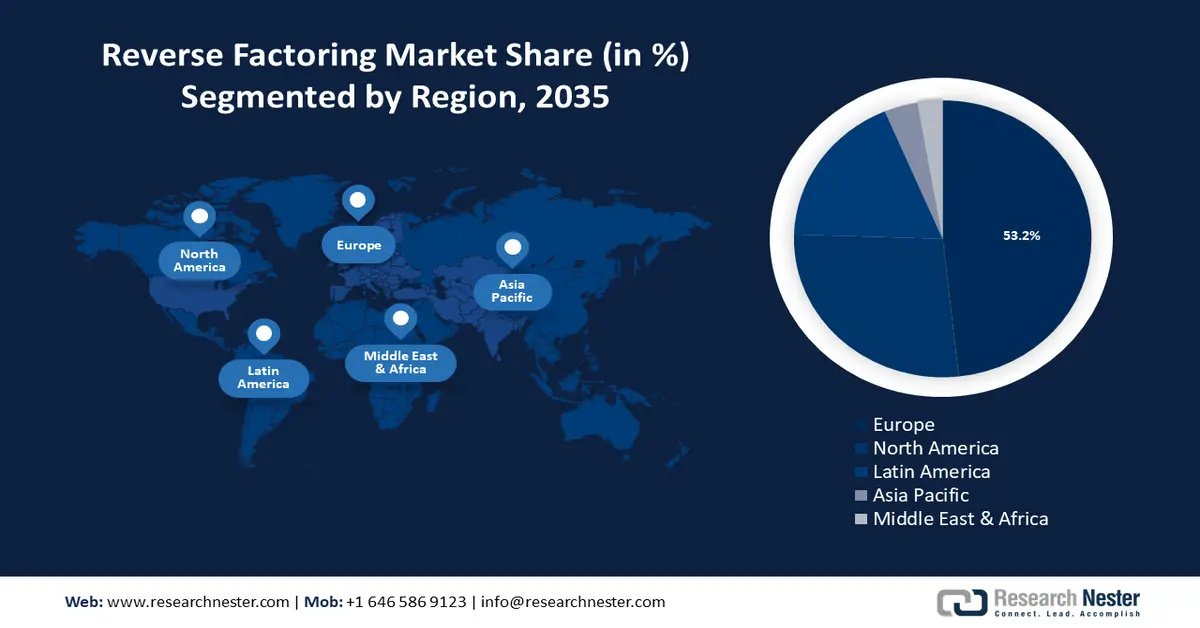

- Europe reverse factoring market is anticipated to capture 53.20% share by 2035, driven by a well-established financial services sector and increasing fintech adoption for reverse factoring.

- North America market grows rapidly CAGR during 2026-2035, driven by businesses optimizing cash flow management and adopting fintech reverse factoring solutions.

Segment Insights:

- The domestic segment in the reverse factoring market is anticipated to achieve an 88.40% share by 2035, attributed to simpler regulations, lower costs, and digitization of supply chain finance.

- The non-banking financial institutions segment in the reverse factoring market is expected to experience considerable growth over 2026-2035, fueled by flexibility in niche financial services and tailored offerings.

Key Growth Trends:

- Increased focus on SME support

- Risk management amid supply chain disruptions

Major Challenges:

- Regulatory burdens

- Overreliance on buyer financial health

Key Players: Citibank, HSBC, Bank of America, Prime Revenue, Deutsche Bank, Santander, BNP Paribas, Caixabank, Barclays.

Global Reverse Factoring Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 673.27 billion

- 2026 Market Size: USD 739.32 billion

- Projected Market Size: USD 1.89 trillion by 2035

- Growth Forecasts: 10.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (53.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Brazil, Mexico, Russia

Last updated on : 18 September, 2025

Reverse Factoring Market Growth Drivers and Challenges:

Growth Drivers

-

Increased focus on SME support: Reverse factoring or SCF can help small and medium-sized enterprise (SME) suppliers improve their cash flow and liquidity. SMEs can face impediments in accessing affordable credit that can cause disruptions to operations. Reverse factoring stabilizes the financial health of SMEs and strengthens the supply chain by ensuring that the smaller players can meet production demands. The positive correlation between reverse factoring and the strengthening of SMEs is a key factor in reverse factoring market growth. In December 2022, Endesa announced the circular reverse factoring solution with Caixabank, BBVA, and Santander. The Iberia Supplier Improvement Program by Endesa is designed to help SMEs by improving their financing conditions between 35% to 50%.

-

Risk management amid supply chain disruptions: The COVID-19 pandemic exposed loopholes in global supply chains, leading to disruptions. To combat supply chain disruptions, companies are seeking to adopt reverse factoring. By ensuring early payment through a third party, suppliers are less prone to hiccups, which ensures the smooth running of the supply chain. Additionally, reverse factoring can improve cash flow, increase revenue, and reduce costs, thus, helping buyers and suppliers. In April 2021, EXIM extended its supply chain financing guarantee program and modified it to make it more accessible to suppliers. EXIM’s program helped small business exporters withstand the challenges of the COVID-19 pandemic.

-

Fintech innovations and rising digitalization: Digital platforms enable streamlining of the entire reverse factoring process, from payments to invoice submissions. This reduces the workload and administrative costs, improving buyer and supplier efficiency in turn. Digital platforms also enable wider access for SMEs by simplifying the application process by eliminating extensive documentation requirements. Additionally, fintech innovations also drive market revenue such as blockchain technology that can be used to provide secure and transparent transactions. In January 2024, Global Payment, Inc. formed SecurCapital Corp. to address supply-chain finance requirements of mid-tier logistics companies by utilizing the benefits of blockchain.

Challenges

-

Regulatory burdens: Regulatory hurdles can be significant impediments to reverse factoring market growth. Stringent regulations such as Know Your Customer (KYC) and anti-money laundering requirements, along with tax regulations can add to the costs. Additionally, consumer protection laws can limit the fees and interest rates that can be charged. There can also be multiple layers of jurisdictions depending on the region and the variations can create constraints for financial institutions. Inconsistent regulations can slow down reverse factoring and increase operational costs.

-

Overreliance on buyer financial health: Reverse factoring solutions are increasingly dependent on the financial stability of the buyer. In case a buyer faces financial difficulties then suppliers may still receive early payments but eventually, the financer may limit or withdraw services. This creates a risky ecosystem for suppliers as their access to timely payments can become uncertain if buyer finances are compromised. This can be particularly challenging in volatile sectors or during global economic slowdowns. For instance, the construction company Carillion collapsed due to irregularities in reverse factoring payments to the third party as Santander UK stopped paying automatic payment of invoices to suppliers.

Reverse Factoring Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.9% |

|

Base Year Market Size (2025) |

USD 673.27 billion |

|

Forecast Year Market Size (2035) |

USD 1.89 trillion |

|

Regional Scope |

|

Reverse Factoring Market Segmentation:

Category Segment Analysis

The domestic segment accounts for the highest reverse factoring market share of 88.4% during the forecast period. The segment’s growth is due to reduced complexities compared to international trade regulations and ease of financial transactions. Domestic transactions also facilitate building relationships between buyers and suppliers within the country. Additionally, the reduced costs compared to cross-border transactions boost the segment’s growth. Institutions in this segment are seeking to digitize their platforms to attract more domestic businesses by offering ease of transactions. For instance, in May 2023, Indian Bank launched supply chain finance in its digital platforms and will provide short-term working capital finance to vendors of corporates in the country.

The international segment in the reverse factoring market is projected to witness a rapid increase in revenue share during the forecast period owing to the rising globalization of business. This segment accounts for transactions beyond national borders which increases regulations and complexity, and hence the third party offering SCF must have robust frameworks so that the cash flow is not hindered. The segment’s growth is driven by the rapid expansion of global supply chains that require reliable financing solutions for international transactions. Institutions within this segment are investing in digital platforms to manage cross-border transactions, improve accessibility, and streamline the process. For instance, in August 2019, Standard Chartered and SAP Ariba partnered to make SCP solutions accessible throughout Asia Pacific via the Ariba Network.

Financial Institution Segment Analysis

The bank segment in the reverse factoring market is projected to account for a significant revenue share during the forecast period due to an increase in businesses adopting SCF solutions. Commercial banks play the role of third parties in a buyer and supplier trade agreement and facilitate transactions by paying the supplier early to maintain a steady supply chain. The segment growth is attributed to the higher level of trust that banks enjoy over non-traditional financial institutions due to regulatory oversights. Banks facilitate domestic as well as international reverse factoring making them a viable financial option for numerous local or global market players. Additionally, the segment is growing owing to risk management, digitization of finance platforms, and integration of trade finance solutions such as letters of credit and export credit insurance.

The non-banking financial institutions (NBFIs) segment is estimated to witness considerable growth during the forecast period owing to the rising number of businesses adopting SCF financial solutions. Additionally, NBFIs offer a wider range of services than traditional banks and operate in niche areas of finance. For instance, NBFIs can specialize in specific industries such as healthcare, manufacturing, and IT. The flexibility offered by NBFCs allows them to cater to more businesses, increasing the market reach.

Our in-depth analysis of the reverse factoring market includes the following segments:

|

Category |

|

|

Financial Institution |

|

|

End-use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Reverse Factoring Market Regional Analysis:

Europe Market Insights

Europe industry is estimated to dominate majority revenue share of 53.2% by 2035. The rapid market growth is attributed to the well-established financial services sector with a multitude of banks and financial institutions offering reverse factoring services to MNCs and SMEs. The robust business activity in various sectors in Europe contributes favorably to creating an SCF ecosystem. For instance, in July 2021, Santander launched a reverse factoring operation under the European Guarantee Fund (EGF) to improve access to finance for SME suppliers.

Germany is projected to hold a dominant share in the reverse factoring market during the forecast period owing to the robust industrial base and reliance on complex supply chains requiring financial solutions. Another key factor of growth is the push for Industry 4.0 to digitize various sectors which is hastening the adoption of fintech solutions that streamline reverse factoring processes. Additionally, artificial intelligence (AI) and machine learning (ML) integration on web-based SCF portals is improving data analytics, benefiting businesses. For instance, SCF platform CRX in Germany has implemented AI and ML integrated analytics in their services.

France is gaining momentum in the reverse factoring market and is estimated to register an upward trajectory during the forecast period. The growth is attributed to the rising demand for SCF solutions in sectors such as retail, aerospace, manufacturing, etc. Businesses in France are seeking solutions to support their supplier networks and strengthen their supply chains. Government support for SMEs is also expected to boost market growth. In December 2020, the government launched the France Num loan guarantee to finance the digitization of very small enterprises (VSE) and small and medium-sized enterprises (SMEs). The scheme was further extended to December 2023. The robust trade regulatory framework in Europe is key to market growth in France due to the ease of business within Europe.

North America Market Insights

North America reverse factoring market is poised to witness rapid growth during the forecast period due to increasing drive of businesses to optimize cash flow management. Many businesses in the region have adopted reverse factoring financial solutions to maintain a robust supply infrastructure domestically and internationally. Additionally, the region has the presence of several multinational companies in various sectors that source supplies from around the world, leading to greater scalable opportunities for the reverse factoring market by offering fintech solutions.

In the U.S., the reverse factoring market is poised for impressive growth during the forecast period driven by the diverse industrial sector in the country which demands seamless finance solutions to maintain the supply chains. Banks and NBFIs in the U.S. are integrating digitization of their financial platforms to streamline the cash flow process. Rising awareness of blockchain technology is also improving accessibility for all kinds of businesses. For instance, in August 2021, Mitsubishi Corporation of the U.S. purchased metal commodities worth USD 43 million from Peru, and the purchases were made over multiple transactions using Skuchain’s currency-agnostic blockchain.

In Canada, the reverse factoring market is estimated to flourish owing to the presence of robust manufacturing, retail, and natural resources sectors fuelling the demand to maintain supply chains through financial solutions. Due to economic disruptions during the pandemic, there is a greater emphasis on cash flow management, prompting businesses to turn to reverse factoring. The government is making a push to improve the access of companies in Canada to global SCF platforms boosting the market’s rise. In 2020, Taulia announced that its SCF services will be administered via an automated system that can integrate with the ERP systems of the clients making it easier for suppliers to sign up and start using their program.

Reverse Factoring Market Players:

- Citibank

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- JP Morgan Chase & Co.

- HSBC

- Bank of America

- Taulia

- PrimeRevenue

- Deutsche Bank

- Crédit Agricole

- C2FO

- Santander

- BNP Paribas

- Barclays

- Standard Chartered

- Caixabank

- ING Group

Some of the key players in the reverse factoring market are:

Recent Developments

- In March 2024, Crédit Agricole and Worldline announced a joint venture for digital payment services for merchants in France after authorization from the European Commission.

- In January 2024, Yes Bank announced the deployment of SmartFin powered by Veefin’s supply chain finance solution. SmartFin will be an advanced digital supply chain finance (SCF) platform.

- In August 2023, the SCF Financial Public chain launch event was organized in Singapore. The event offered new platforms in the fintech sector for investors, partners, and blockchain startups.

- In June 2023, Rakbank selected Newgen’s Trade and Supply Chain Finance solution to digitize and optimize its end-to-end business finance process.

- Report ID: 6452

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Reverse Factoring Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.