Reservoir Analysis Market Outlook:

Reservoir Analysis Market size was estimated at USD 10.45 billion in 2025 and is expected to surpass USD 18.89 billion by the end of 2035, rising at a CAGR of 6.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of reservoir analysis is assessed at USD 11.08 billion.

Growing public investment in water and energy infrastructure is driving demand for reservoir analysis services. This demand is fueled by government-funded projects that require specialized site characterization, subsurface modelling, and long-lead procurement. The Infrastructure Investment and Jobs Act of the U.S. commits more than $50 billion to drinking, wastewater, and stormwater upgrades. The Bureau of Reclamation's allocation from the recently passed Bipartisan Infrastructure Law also includes approximately $8.3 billion for water service projects. Moreover, the Department of Energy also has large capital flows through new programs (federal infrastructure funding is 97 billion to the DOE). These allocations create reliable fiscal pipelines for reservoir surveying, monitoring systems, and specialist engineering services.

From a trade and supply-chain perspective for reservoir analysis, imported and domestic instrumentation, pumps, valves, and control hardware are documented in U.S. machinery trade schedules and propelling increases in machinery import values. The World Bank estimates annual capital needs of $131-$140 billion to meet water and sanitation SDGs, while the EPA assessment shows that U.S. drinking-water systems face about $625 billion in needs for pipes, treatment, and storage. These numbers justify continued purchasing of raw materials, assembly-line equipment, and component cross-border trade required for project implementation.

Key Reservoir Analysis Market Insights Summary:

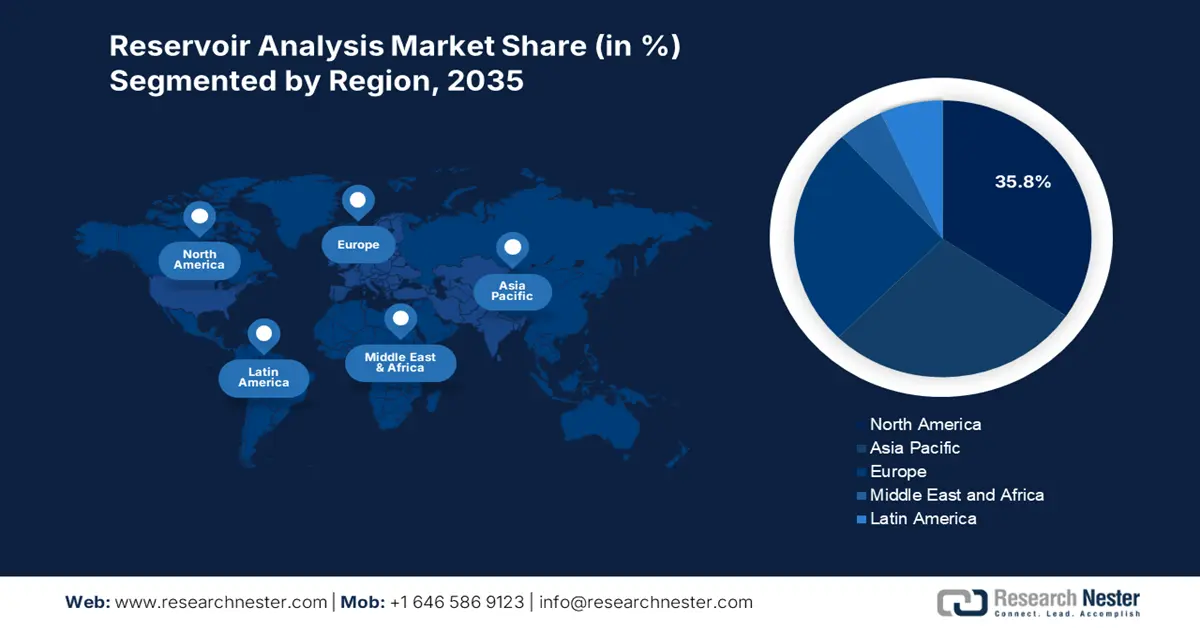

Regional Highlights:

- The North America reservoir analysis market is projected to command 35.8% share by 2035, supported by expanding shale gas and tight oil exploration.

- By 2035, the Asia Pacific region is estimated to secure a 29.1% share, bolstered by rising oil & gas exploration activities and energy security initiatives.

Segment Insights:

- By 2035, the conventional reservoir segment in the reservoir analysis market is projected to capture 55.7% share, propelled by mature extraction technologies.

- The reservoir simulation segment is anticipated to reach a 32.3% share by 2035, fueled by increased investment in digital oilfield technologies and AI-powered predictive analytics.

Key Growth Trends:

- Rising global oil & gas demand

- Shale gas and tight oil exploration

Major Challenges:

- High operational costs

- Lack of skilled workforce

Key Players: Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International plc, CGG S.A., Core Laboratories N.V., Expro Group, SGS SA, ALS Limited, Geoservices (Schlumberger subsidiary), Paradigm Group B.V., Reservoir Group (a Hunting PLC company), Korea National Oil Corporation (KNOC), Oil and Natural Gas Corporation (ONGC), Petroliam Nasional Berhad (Petronas).

Global Reservoir Analysis Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.45 billion

- 2026 Market Size: USD 11.08 billion

- Projected Market Size: USD 18.89 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: USA, China, Saudi Arabia, Russia, Canada

- Emerging Countries: India, Brazil, UAE, Australia, Norway

Last updated on : 2 September, 2025

Reservoir Analysis Market - Growth Drivers and Challenges

Growth Drivers

- Rising global oil & gas demand: The constantly increasing worldwide demand for oil and gas continues to drive the exploration of reservoirs. The US Energy Information Administration (EIA) estimates that global consumption of liquid fuels would grow from 99.5 million barrels per day in 2022 to more than 105 million barrels per day by 2026, pressuring exploration and production (E&P) companies to invest in sophisticated reservoir analysis to maximize recovery rates, fine-tune production planning, and determine economic viability with uncertain crude prices, which is contributing to market growth in upstream oilfield services.

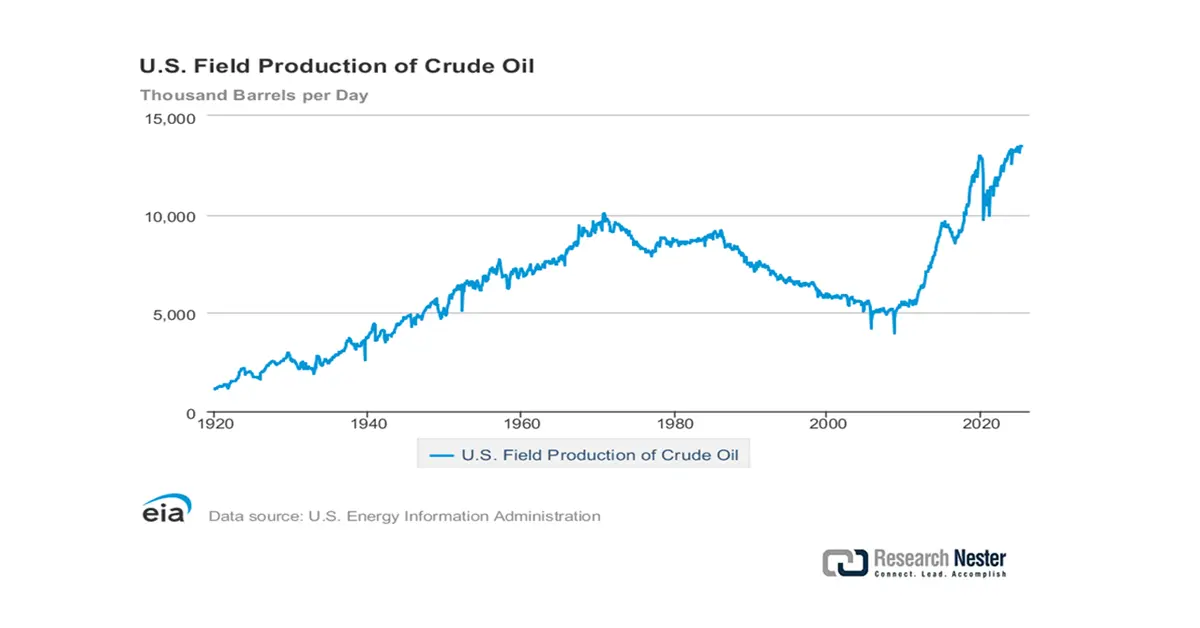

- Shale gas and tight oil exploration: Demand for reservoir analysis has risen because of the burgeoning shale gas and tight oil exploration in North America, China, and Argentina. The U.S. Energy Information Administration (EIA), in an estimation for 2023, stated that the United States produced roughly 3.04 billion barrels (about 8.32 million barrels per day) of crude oil directly from tight-oil resources. This accounted for about 64% of total U.S. crude oil production for the year 2023. Reservoir analysis technologies allow for accurate characterization of unconventional reservoirs, which improves the design of hydraulic fracturing in terms of formation, well placement, and enhanced oil recovery design, enabling operators to maximize extraction of hydrocarbons while investing more confidently because of the return on investment, also in a cost-effective manner, making shale expansion a major market driver around the world.

- Increasing investment in unconventional resources: Development of non-conventional resources such as shale gas, tight oil, and coalbed methane is increasing interest in advanced analysis of reservoir capacity and performance. Non-conventional reservoir development comes with specific challenges, particularly complex geology and limited permeabilities that require sophisticated analytical techniques to develop an accurate profile of the reservoir. Hydraulic fracturing and horizontal drilling both rely heavily on reservoir data to plan and implement a project. The United States, China, and Argentina are global leaders in non-conventional resource exploration and development. This leadership is accelerating the adoption of specialized analytical technologies, pushing them into mainstream use across the sector. These advanced technologies enhance recovery efficacy, improve operational efficiency, and significantly reduce environmental and safety risks through superior reservoir analysis.

Crude Oil Production

The growth of the crude oil production market directly fuels expansion in the reservoir analysis sector, as increasing extraction, particularly from complex unconventional reserves like shale or deepwater fields, requires precise subsurface evaluation to maximize recovery and economic viability. Rising production demands advanced analytical technologies for effective reservoir characterization, modeling, and real-time monitoring to optimize well placement, enhance operational efficiency, and reduce drilling and environmental risks. Consequently, as oil producers target harder-to-reach resources or strive to extend the life of mature fields, investment in sophisticated reservoir analysis becomes indispensable, making this market a critical enabler of sustainable and profitable production growth.

U.S. Field Production of Crude Oil

(Source: EIA)

Challenges

- High operational costs: Reservoir analysis requires sophisticated methodologies, including seismic imaging, coring, and well logging, resulting in a high operational cost. According to the U.S. Energy Information Administration (EIA, 2023), advanced well logging and subsurface analysis significantly increase upfront drilling costs. This financial burden disproportionately restricts small operators in emerging markets, who often lack the excess capital required to invest in such essential yet costly technological evaluations, potentially limiting their competitiveness and operational scalability. Reservoir studies conducted offshore or in deepwater environments require unique equipment and skill sets, which substantially increase per-project costs, thus limiting clear opportunities for developing markets in price-sensitive regions.

- Lack of skilled workforce: The global reservoir analysis market faces a significant constraint due to a shortage of qualified professionals, including geophysicists, petrophysicists, and reservoir engineers. According to the Society of Petroleum Engineers (SPE, 2022), there is a 21% global gap in the advanced subsurface talent pool, directly impeding project timelines and execution efficiency. This talent shortage is particularly acute in mature regions like North America, where an aging workforce is retiring without sufficient replacement by younger professionals, despite growing opportunities in energy innovation and subsurface analytics. Without urgent intervention to attract and train new talent, the industry should anticipate prolonged development center delays, deferred investment decisions, and constrained project scalability especially in price-sensitive operational environments.

Reservoir Analysis Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 10.45 billion |

|

Forecast Year Market Size (2035) |

USD 18.89 billion |

|

Regional Scope |

|

Reservoir Analysis Market Segmentation:

Reservoir Type Segment Analysis

The conventional reservoir segment is projected to capture the largest market share, reaching 55.7% by 2035. This dominance is driven by mature extraction technologies, lower production costs, and consequently, stronger profit margins. As supported by the U.S. Energy Information Administration (EIA), conventional reservoirs continue to significantly contribute to global oil production due to their established infrastructure, proven extraction methods, developed expertise, and reduced financial risk. This ongoing reliance is further promoting investment in advanced black oil reservoir modeling, enabling operators to optimize reservoir management, enhance recovery rates, and extend the productive life of these mature or brownfield assets.

Service Type Segment Analysis

The reservoir simulation segment is anticipated to constitute the most significant growth by 2035, with 32.3% market share, mainly due to the increased investment in digital oilfield technologies and AI-powered predictive analytics, which are driving demand. The Society of Petroleum Engineers (SPE) highlights the importance of simulation to improve hydrocarbon recovery, well performance, and decrease exploration and development risks. Improved modeling provides benefits in responsible and income-generating production through proactive decision-making, lower operational expenses, and increased remaining field life, which improves long-term market conditions for reservoir analysis software and services.

Application Segment Analysis

The offshore segment is anticipated to constitute the most significant growth by 2035, with 28.9% market share, mainly due to the growth of deepwater drilling projects and increasing investments in offshore exploration. Governments around the world are, and have been continuously, supporting offshore energy development in order to diversify energy resources. The United States Bureau of Ocean Energy Management (BOEM) has abundant offshore data on leasing, which indicates growth in this segment.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Sub- Segments |

|

Reservoir Type |

|

|

Service Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Reservoir Analysis Market - Regional Analysis

North America Market Insights

By 2035, the North American market is expected to hold 35.8% of the market share due to shale gas and tight oil exploration. High drilling activity in the Permian and Bakken formations is driving market demand. According to the U.S. Energy Information Administration (EIA), crude oil production averaged 12.4 million b/d in 2023, and also driving reservoir evaluation services. In addition, ongoing investment in enhanced oil recovery (EOR) projects and continued development in the offshore Gulf of Mexico will also help the North American reservoir analysis market in the forecast period.

The U.S. is the leading country in the North America reservoir analysis market, accounting for more than 81% of revenue share in 2025. The Bureau of Land Management reported that drilling permits were approved for FY2023, which supports strong market demand. In addition, the significant growth overall in the North America reservoir analysis market is due to the expanding knowledge surrounding 3D seismic, geomechanics, and particularly petrophysical logging methods for shale and unconventional reservoirs. Companies such as Halliburton, Schlumberger, and Baker Hughes have continued investment in digital reservoir modeling and artificial intelligence-driven production optimization for better recovery factors as well as to reduce operational costs.

Asia Pacific Market Insights

The Asia Pacific market is expected to hold 29.1% of the market share due to increasing oil & gas exploration activities and energy security initiatives. An increase in offshore drilling projects, especially in countries like China, India, and Australia, has contributed to this growth. Global energy investment is expected to surpass USD 3 trillion for the first time in 2024, USD 2 trillion of which will go to clean energy technologies and infrastructure. Upgrades to the seismic services, core analysis, and data integration solutions will also drive growth in the market. Key players are extending the availability of their services in the region to meet the need for geological complexities.

China is the largest market in the Asia Pacific reservoir analysis market. The upstream investment growth and shale gas development are planned to stimulate the usage of advanced reservoir characterization methods. According to data from CNPC and the IEA, China has set a target of producing 281 bcm of natural gas by 2030, which will be driven by reservoir characterization methods. The development of new projects in basins of Sichuan, Tarim, and Ordos will be key triggers of future petrophysical and seismic analysis service demand. Moreover, collaborative agreements with international service providers to enhance the extraction progress of unconventional resources will continue to strengthen the growth of the reservoir analysis market in China.

Europe Market Insights

The European market is expected to hold 26.8% of the market share due to the redevelopment of mature oilfields, North Sea enhanced oil recovery (EOR) projects, and the use of digital twins to create advanced representations of reservoir models. AI and machine learning are allowing reservoir modeling to become readily available and provide less friction for exploration and resource management. Major players are moving toward tying seismic imaging with data interpretation in real-time to create an integrated way to maximize the reservoir in a more efficient way. This evolution of technology aligns with Europe's goal of adopting sustainable energy practices and lessening carbon emissions.

Key Reservoir Analysis Market Players:

- Schlumberger Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Halliburton Company

- Baker Hughes Company

- Weatherford International plc

- CGG S.A.

- Core Laboratories N.V.

- Expro Group

- SGS SA

- ALS Limited

- Geoservices (Schlumberger subsidiary)

- Paradigm Group B.V.

- Reservoir Group (a Hunting PLC company)

- Korea National Oil Corporation (KNOC)

- Oil and Natural Gas Corporation (ONGC)

- Petroliam Nasional Berhad (Petronas)

The global reservoir analysis market is highly consolidated. The largest operators are the major U.S. oilfield service firms, like Schlumberger, Halliburton, and Baker Hughes, which, collectively, hold over 50% of the market share. The European firms CGG and Core Laboratories provide complementary services within their respective regions, through the application of sophisticated technologies for seismic and core interpretation. Many strategic initiatives can be seen through acquisitions aimed towards adding more services to their organic offerings, advancements in digital reservoir modeling capabilities, and implementation of robust AI-based interpretation systems to improve efficiency and reduce operational risk. Companies in Australia, South Korea, India, and Malaysia are seeking to invest in their indigenous exploration and integrated analysis services to reduce dependence on international companies and build local upstream capabilities in line with the current energy transition policies being adopted and the evolving energy landscape.

Some of the key players operating in the market are listed below:

Recent Developments

- In February 2025, Schlumberger (SLB) announced its AI-enabled real-time reservoir monitoring suite. The platform is being deployed at its field operations in the Gulf of Mexico offshore fields to optimize interventions and increase field recovery factors by 2-4%. Adoption of the platform is increasing quickly, as the penetration of digital reservoir engineering in SLB-managed offshore assets surpassed 25% (up from ~10% in 2022).

- In June 2024, Baker Hughes launched its elevated chemical EOR suite that provided up to 8% OOIP incremental recovery in field trials in the Permian and North Sea at 1.5× over the previous chemistries. By Q3 2024, Baker Hughes will partner with two of the largest oil operators for deployment, in a US reservoir engineering market expected to grow from USD 2.48 billion (2023) to USD 3.56 billion by 2029.

- Report ID: 1360

- Published Date: Sep 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Reservoir Analysis Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.