Battery Energy Storage Market Outlook:

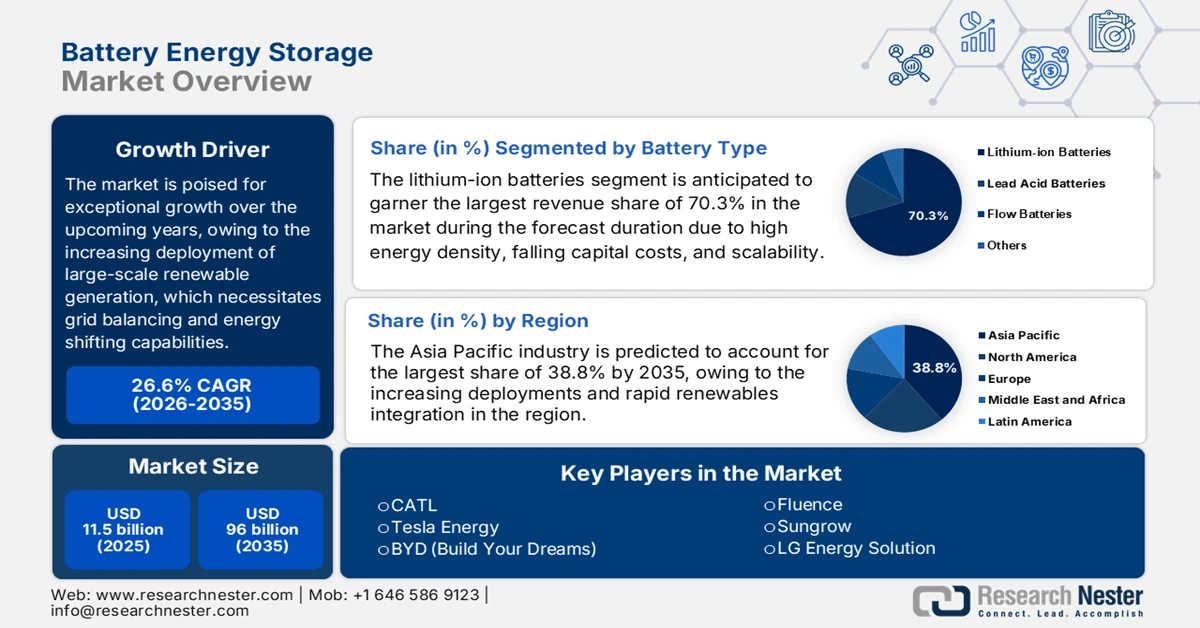

Battery Energy Storage Market size is projected to reach USD 11.5 billion in 2025 and is expected to grow to USD 96 billion by 2035, rising at a CAGR of 26.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of battery energy storage is estimated at USD 14.5 billion.

The battery energy storage market is poised for exceptional growth over the upcoming years, owing to the increasing deployment of large-scale renewable generation, which necessitates grid balancing and energy shifting capabilities. The U.S. federal planning analyses project rapid expansion of storage capacity to accommodate variable wind and solar generation, with policies channeling significant public investment and incentives toward energy storage deployment and supply chain resilience. In this context, in May 2024, the U.S. Department of Energy’s Office of Electricity announced that it has awarded USD 15 million to three projects demonstrating long-duration energy storage technologies, with each project receiving around USD 5 million in federal funding. Selected projects include hybrid lithium-ion, vanadium redox flow, and community-scale storage systems to validate cost, reliability, and field performance while integrating renewable energy sources, hence strengthening domestic manufacturing of energy storage solutions.

Furthermore, the trade aspect also drives continued growth in the market. Over the recent years until 2024, U.S. imports of lithium-ion energy storage batteries grew, which represented a rise from 17% to 84% of total battery imports, wherein China is supplying 69% of finished lithium-ion batteries and 33% of parts for non-lead-acid batteries in 2024. Moreover, the U.S. exports also increased, particularly to Mexico, where exports of non-lead-acid battery parts increased from USD 43 million in 2023 to USD 1.9 billion in 2024, reflecting growing domestic production. Meanwhile, the domestic battery manufacturing output expanded, with inflation-adjusted gross output increasing 359% in a span of five years, reaching record levels in 2024. The supply chain continues to focus growth on downstream assembly modules and packs, whereas the upstream material processing remains partially dependent on imports, though planned U.S. cell assembly investments aim to meet projected domestic demand through 2035.

U.S. Lithium-Ion Battery Manufacturing: Production, Employment, and Investment Trends (2024-2025)

|

Category |

Details |

Implication |

|

U.S. Market Price (Li-Ion Batteries) |

Approximately 90% higher than China's imports without subsidies |

Domestic subsidies & tariffs reduce cost gap → encourages local production & competitiveness |

|

Domestic Manufacturing Output |

Increased 359% (2020–2024) |

Strong growth in domestic production → opportunity for suppliers & integrators |

|

Employment |

54,400 in 2024 |

Highest ever → growing workforce supports scale-up & R&D |

|

Non-Lead-Acid Battery Shipments |

USD 16.6 billion in 2022 (up from USD 0.7 billion in 2013) |

Shift to lithium-ion → larger market share, export potential |

|

Lead-Acid Battery Shipments |

USD 2.2 billion in 2022 (down from USD 5.3 billion in 2013) |

Declining market → opportunity to reallocate resources to advanced batteries |

|

Projected Cell Assembly Capacity |

Increasing through 2035 |

Onshoring potential → meet EV and grid storage demand |

|

Component Supply Capacity (Anode, Cathode, Foil, Separators) |

Lagging behind cell assembly |

Investment gap → opportunity for component manufacturers |

|

Policy Support |

IIJA & FY2022 Reconciliation Act |

Stimulates domestic production and investment → reduces reliance on imports. |

Source: Congress.gov

Key Battery Energy Storage Market Insights Summary:

Regional Highlights:

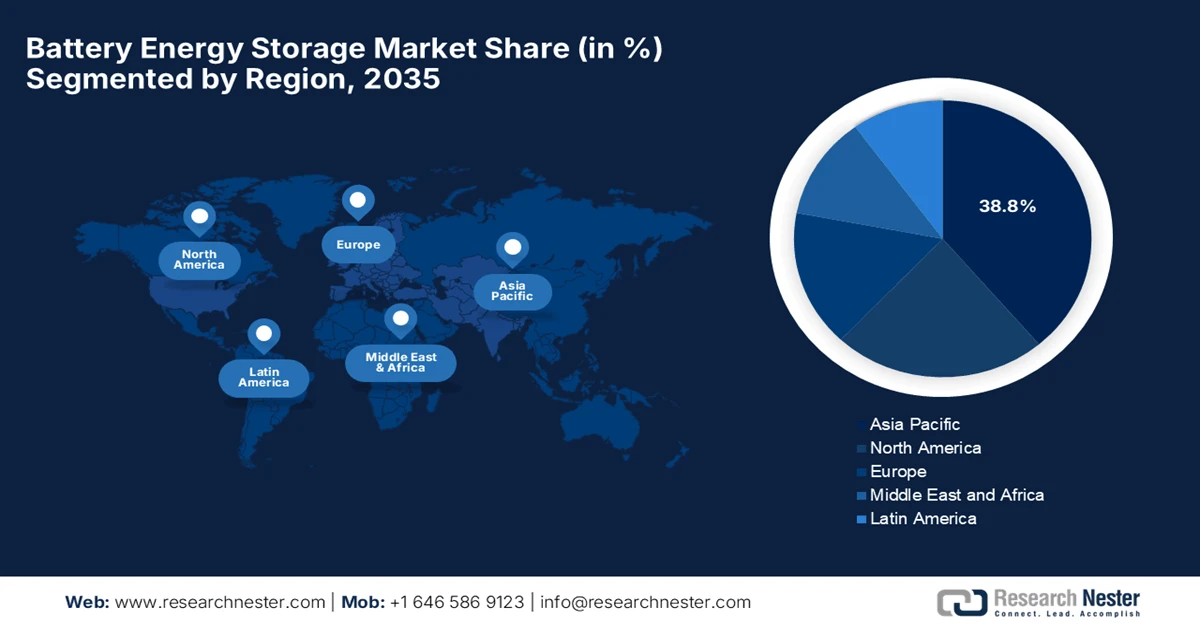

- Asia Pacific is projected to account for a dominant 38.8% revenue share by 2035 in the battery energy storage market, underpinned by increasing deployments and rapid integration of renewable energy sources

- North America is anticipated to expand at a considerable pace through 2026–2035, supported by grid modernization initiatives and renewable integration infrastructure reinforced by favorable policy frameworks

Segment Insights:

- The lithium-ion batteries segment is expected to capture a leading 70.3% revenue share by 2035 in the battery energy storage market, benefiting from high energy density, declining capital costs, extended cycle life, and scalability across grid, commercial, and residential BESS

- The utility-owned segment is forecast to hold a considerable share by 2035, aligned with rising grid flexibility requirements and regulatory support focused on strengthening resilient grid infrastructure

Key Growth Trends:

- Rapid expansion of renewable energy

- Grid modernization and reliability needs

Major Challenges:

- High capital costs

- Battery technology limitations

Key Players: CATL, Tesla Energy, BYD (Build Your Dreams), Fluence, Sungrow, LG Energy Solution, EVE Energy.

Global Battery Energy Storage Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.5 billion

- 2026 Market Size: USD 14.5 billion

- Projected Market Size: USD 96 billion by 2035

- Growth Forecasts: 26.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.8% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Australia, Brazil, Canada, Spain

Last updated on : 21 January, 2026

Battery Energy Storage Market - Growth Drivers and Challenges

Growth Drivers

- Rapid expansion of renewable energy: The fundamental driver for the battery energy storage market is the increasing deployment of solar and wind power across almost all nations. Solar only produces during daylight, and battery storage is needed to store excess energy and release it when demand is high or generation is low. In this context, ENGIE in January 2026 announced that it was awarded its first hybrid solar-plus-storage project in India by combining 200 MW of solar PV with a 100 MW/600 MWh battery energy storage system that is capable of supplying up to six hours of stored renewable energy. This project, awarded under SECI’s national tender, supports the country’s goal of round-the-clock clean power by storing excess solar output and releasing it when generation is low or demand is high. The commissioning is expected in 2028, and the project strengthens grid resilience and ENGIE’s role in expanding renewable and flexible energy solutions.

- Grid modernization and reliability needs: Utilities and grid operators are continuously making investments in modern, flexible power systems to handle demand fluctuations, frequency regulation, peak load management, and blackouts. Battery energy storage systems help meet these grid flexibility and resilience requirements, driving consistent adoption in the market. In February 2025, Sarawak Energy reported that it had commissioned Malaysia’s first-ever utility-scale 60 MW/82 MWh battery energy storage system at the Sejingkat Power Plant in Kuching, providing essential grid services as voltage and frequency regulation, primary spinning reserve, and peak demand management. Besides this, BESS enhances grid reliability and resilience, supports integration of intermittent renewable energy, and helps meet rising electricity demand across Sarawak, hence denoting a positive market outlook.

- Supportive government policies & incentives: Most of the countries have introduced policy frameworks, subsidies, tax credits, and clean energy mandates that encourage investment in the market. Testifying this, the U.S. Residential Clean Energy Credit allowed homeowners to claim 30% of the costs for installing qualified clean energy property, including battery storage systems (≥3 kWh), which began in 2023, on their primary residence through 31 December 2025. The credit covered both the equipment and installation costs, thereby reducing upfront investment and encouraging the adoption of renewable energy and storage technologies. Therefore, such policies provide a direct financial incentive to expand residential battery storage and other clean energy solutions, increasing adoption in this field. Furthermore, global energy storage projects also create encouraging opportunities for cost savings, energy efficiency, and long-term clean energy investments.

Key Battery Energy Storage Projects 2025 and Market Opportunities

|

Company / Project |

Location |

Capacity (MW / MWh) |

Market Opportunity |

|

Statkraft - Zerbst Solar Hybrid |

Germany |

46.4 MW solar + 16 MW / 57 MWh storage |

Enhances grid stability, enables higher solar integration, and increases the profitability of solar assets |

|

Schneider Electric - Boost Pro |

Europe |

0.2-2 MWh (scalable) |

Supports commercial/industrial energy management, reduces peak demand charges, and enables flexible renewable use |

|

Hokkaido Sapporo Battery Energy Storage LLC |

Japan |

10 MW / 30 MWh |

Stabilizes the grid, optimizes surplus renewable energy, supports renewable expansion, and carbon neutrality goals |

Source: Company Official Press Releases

Challenges

- High capital costs: The battery energy storage systems necessitate huge investments in terms of battery cells, inverters, power electronics, and installation. The operational expenses in the market are considerably low, whereas the initial capital outlay can deter utilities, commercial operators, and residential users, particularly in emerging markets. Similarly, the aspect of large-scale projects often requires financing structures, subsidies, or long-term contracts to ensure economic viability. On the other hand, despite declining lithium-ion costs, BESS is costly when compared to conventional peaking power or fossil fuel-based storage alternatives. Therefore, developers must balance system sizing, technology selection, and project lifespan to ensure cost-effectiveness, which can limit constant deployment and adoption in price-sensitive regions.

- Battery technology limitations: The BESS technologies, primarily lithium-ion, face limitations in terms of energy density, cycle life, thermal stability, and degradation over time. Also, the aspect of high energy demands or prolonged discharge periods can accelerate performance decline, negatively impacting system efficiency and reliability. The alternative chemistries, such as flow batteries or solid-state solutions, are still in early commercial stages, representing high costs and limited manufacturing capacity. In addition, factors such as thermal management, fire safety, and recycling challenges also pose technological barriers in the battery energy storage market. As a result, developers must carefully match battery chemistry with application requirements, and ongoing R&D is highly essential to overcoming limitations in the in industrial use.

Battery Energy Storage Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

26.6% |

|

Base Year Market Size (2025) |

USD 11.5 billion |

|

Forecast Year Market Size (2035) |

USD 96 billion |

|

Regional Scope |

|

Battery Energy Storage Market Segmentation:

Battery Type Segment Analysis

The lithium-ion batteries segment is anticipated to garner the largest revenue share of 70.3% in the battery energy storage market during the forecast duration. The dominance of the segment is mainly propelled by high energy density, falling capital costs, long cycle life, and scalability for grid, commercial, and residential BESS. In September 2025, VARTA, a Clarios brand, announced that it had launched a new lithium-ion battery portfolio for leisure vehicles and marine use, which offers fast charging, long cycle life, reduced weight, and high usable energy for off-grid applications. It also mentioned that these batteries feature smart monitoring through a Bluetooth app and CI-BUS integration, rugged IP67 protection, and optional heating for reliable performance in harsh and cold environments. In addition, the product is available in six variants from 50 Ah to 200 Ah, and they deliver up to 80% depth of discharge, recharge in two to three hours, and weigh about 55% less than when compared to AGM lead-acid batteries.

Ownership Segment Analysis

By the conclusion of 2035, the utility-owned segment is likely to grow with a considerable share in the market. The grid flexibility needs and supportive regulatory environments that promote resilient grid infrastructure are the key factors driving this leadership. In September 2025 Department of Environment, Great Lakes, and Energy reported that Michigan is advancing clean energy leadership by expanding utility-scale battery storage to make its electric grid cleaner, more reliable, and more resilient. It also notes that the 100 MW Tibbits energy storage facility in Coldwater, which is developed by Jupiter Power and Consumers Energy, is the state’s first operational utility-scale battery project, storing excess energy during low demand and supplying it back to the grid when needed. Additionally, supporting Michigan’s 2023 clean electricity law and community development, the project strengthens grid reliability, stabilizes electricity costs, and delivers significant economic benefits.

Application Segment Analysis

The renewable energy integration segment based on application is anticipated to gain a significant revenue share in the battery energy storage market during the discussed tenure. The governments across most nations are encouraging high renewables penetration, co locating storage with solar and wind projects becomes key to firm intermittent generation and improve dispatchability, driving revenue share in this application. This trend is also reinforced by national renewable energy targets, grid decarbonization mandates, and incentive programs that explicitly support hybrid renewable-plus-storage projects. Moreover, utilities and system operators mostly rely on storage to provide ancillary services such as frequency regulation and ramping support. As renewable capacity additions accelerate globally, battery storage integrated with clean generation assets is becoming a core revenue-generating component of modern power systems, hence denoting a wider segment scope.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Battery Type |

|

|

Ownership |

|

|

Application |

|

|

Capacity Range |

|

|

Connection Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Battery Energy Storage Market - Regional Analysis

APAC Market Insights

The Asia Pacific battery energy storage market is expected to garner the largest revenue share of 38.8% by the end of 2035. The region’s dominance in this field is mainly propelled by increasing deployments and rapid renewables integration. In this context, Japan Petroleum Exploration Co., Ltd. (JAPEX) in October 2025 announced that it had commenced construction of the JAPEX Tomakomai battery energy storage system, which is a grid-scale battery facility located at its Hokkaido District Office in Tomakomai City. The firm also notes that this project aims to stabilize the power grid by compensating for output fluctuations from renewable energy sources such as solar and wind, with commercial operations planned for autumn 2027. Furthermore, it is selected under Japan’s FY2024 Renewable Energy Expansion and Grid-Scale Energy Storage System Support Program, wherein the Tomakomai BESS represents JAPEX’s first extra-high voltage battery system and supports its strategy to expand revenue opportunities in the energy storage business.

China battery energy storage market is progressing at a notable pace on account of large-scale deployments that are best aligned with national energy transition strategies. Storage is used to support high renewable penetration and enhance grid dispatch capabilities, reflecting the country’s focus on strengthening power system flexibility. In January 2026, HiTHIUM reported that its Chongqing manufacturing base was recognized by the World Economic Forum as the world’s first lighthouse factory for energy storage batteries. The company also notes that this facility is the first mass-production site for kAh long-duration energy storage batteries, that leverages intelligent manufacturing, AI, and AIoT technologies to ensure high-quality, near-zero-defect production and enhance grid-scale renewable energy integration. Further with mass production of the ∞Cell 1175Ah LDES batteries and deployment of ∞Power 6.25MWh 4h BESS systems, the plant positions HiTHIUM to lead large-scale, safe, and efficient energy storage solutions across the globe.

India battery energy storage market is also gaining momentum as the country is readily expanding solar and wind capacity to meet the heightened electricity demand. Simultaneously, the government-backed initiatives are positioning storage as a tool to improve renewable reliability, support a consistent power supply, and address grid balancing challenges in this evolving power system. In September 2025, the Ministry of Electronics & IT reported that the Union Minister inaugurated TDK Corporation’s lithium-ion battery manufacturing plant in Sohna, Haryana. It also stated that the facility is designed to produce 20 crore (200 million) battery packs on a yearly basis, thereby meeting nearly 40% of India’s domestic requirement for batteries used in mobile phones, laptops, wearables, and hearables. Also, this milestone is a significant step toward Atmanirbhar Bharat, creating around 5,000 direct jobs, strengthening the country’s electronics manufacturing ecosystem, and positioning India as a growing hub for advanced electronics production.

North America Market Insights

The North America battery energy storage market is expected to grow at a considerable rate, mainly driven by the grid modernization and renewable integration infrastructure, with strong growth supported by supportive policies. In January 2026, PowerBank Corporation announced a 5 MW hybrid solar and battery energy storage project in New York, which is called the NY-Holland Glnwd project. Besides, the system will store surplus renewable energy from solar generation to balance supply and demand by also enabling community solar participation, where local residents can benefit from reduced electricity costs without installing equipment. In addition, this project supports New York’s Climate Leadership and Community Protection Act goals and builds on PowerBank’s extensive regional renewable energy development experience, contributing to the state’s growing clean energy infrastructure.

The U.S. battery energy storage market is growing on account of increased adoption, which is driven by policy support, utility procurement programs, and the expansion of solar and wind generation. Storage systems are being integrated into wholesale power markets in the country to provide services such as frequency regulation and capacity support, thereby strengthening overall grid flexibility. In this regard, the U.S. Department of Energy announced in December 2024 a USD 28.7 million investment under the Grid Resilience and Innovation Partnerships (GRIP) Program to deploy a utility-scale battery energy storage system in Florida. The system will provide backup power to critical community facilities, including nursing homes and community centers, improve grid resilience against extreme weather, and save an estimated USD 160,000 on a yearly basis in fuel costs for municipal utility customers. Furthermore, this project advances the Biden-Harris Administration’s agenda to modernize the grid, enhance reliability, and ensure equitable energy access through clean energy and resilient infrastructure investments.

Canada battery energy storage market is positively influenced by its clean energy transition and emphasis on decarbonizing provincial power systems. There has been a strong presence of lithium-ion technology in Ontario & Alberta, coupled with increasing large-scale projects, which are highlighting opportunities in data centers and industrial sectors. The Canada Energy Regulator in July 2025 reported that the country’s grid-connected energy storage capacity of over 1 MW could more than double by the end of 2030, growing from 552 MW in 2024 to 1,149 MW based on projects under construction, and potentially reaching 2,768 MW if all approved projects are completed. It also stated that battery energy storage systems are the fastest-growing and most widely deployed technology, thereby complementing variable renewable energy sources such as wind and solar while enhancing grid reliability and power quality. Additionally, the government funding, such as the Smart Renewables and electrification pathways program, is supporting utilities and system operators in modernizing grids and integrating renewables.

Canada Energy Storage Overview: Technology, Capacity & Deployment Status (2025-2030)

|

Storage Type |

Status in Canada |

Typical Capacity / Duration |

Key Features |

|

Battery Energy Storage (BESS) |

Under construction & proposed |

1-411 MW, 0.5-6 hours |

Fastest-growing, scalable, mainly lithium-ion, supports renewables integration. |

|

Pumped Storage Hydropower (PSH) |

Active (Sir Adam Beck) |

174 MW |

Uses water stored at height to generate electricity; the longest-standing and largest storage type. |

|

Compressed Air Energy Storage (CAES) |

Active (Goderich) |

1.75 MW |

Stores air in underground structures; adiabatic type captures heat for efficient energy release |

Source: Canada Energy Regulator

Europe Market Insights

Europe battery energy storage market has acquired a prominent position, especially driven by decarbonization goals, cross-border power integration, and the need for system flexibility. Storage solutions are supporting the transition away from fossil fuels by enabling higher renewable penetration and improving the responsiveness of interconnected electricity industries. In this context, Canadian Solar in November 2025 announced that its subsidiary e-STORAGE secured a 20.7 MW / 56 MWh battery energy storage project in Lower Saxony, Germany, under a 20-year long-term service agreement. Besides, this project was developed by Kyon Energy and will deploy e-STORAGE’s proprietary SolBank platform, wherein the shipments are starting in March 2026, and commissioning will follow later the same year. Simultaneously, this initiative supports Germany’s grid flexibility and renewable integration by leveraging e-STORAGE’s automated facilities and 10 GWh annual BESS capacity.

Germany battery energy storage market reflects its advanced energy transition, with storage supporting decentralized energy systems and high renewable generation. The country’s market also benefits from batteries that are integrated with solar installations and smart energy management systems to enhance grid stability and self-consumption. In November 2025, LEAG Clean Power and Fluence announced the GigaBattery Jänschwalde 1000 project, which is Europe’s largest battery energy storage system, with a capacity of 1 GW / 4 GWh in Germany. It was powered by Fluence’s Smartstack platform, whereas the project will provide essential grid services, enhance renewable integration, and support the country’s energy transition. Furthermore, this flagship collaboration demonstrates the prominent role of gigascale storage facilities in stabilizing the grid and advancing regional clean energy infrastructure, hence making it suitable for overall market growth.

The UK battery energy storage market is shaped mainly by the government targets and increasing investments in this sector. Developers in the country are capitalizing on capacity additions and large projects, where revenue streams are evolving beyond simple frequency response. In December 2025, RWE announced its largest UK battery energy storage project, which is the Pembroke Battery Storage in South Wales, with a capacity of 350 MW and 700 MWh. It is scheduled for construction in early 2026 and commissioning in 2028, wherein the facility will support the Pembroke Net Zero Centre, enhance grid stability, and integrate renewable energy. Moreover, the project also includes biodiversity measures and reflects RWE’s commitment to expanding battery storage as a key driver of the country’s clean energy transition. Hence, this development strengthens the country’s market by increasing grid flexibility and helping stabilize electricity supply during peak demand periods.

Key Battery Energy Storage Market Players:

- CATL (Contemporary Amperex Technology Co., Limited) (China)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Tesla Energy (U.S.)

- BYD (Build Your Dreams) (China)

- Fluence (U.S./Germany)

- Sungrow (China)

- LG Energy Solution (South Korea)

- EVE Energy (China)

- Panasonic Corporation (Japan)

- Samsung SDI (South Korea)

- Siemens Energy (Germany)

- AES Energy Storage (U.S.)

- Saft (France)

- NEC Energy Solutions (Japan)

- Enphase Energy (U.S.)

- ESS Inc. (U.S.)

- Primus Power (U.S.)

- Redflow (Australia)

- Sonnen GmbH (Germany)

- Powin Energy (U.S.)

- CATL is identified as the world’s largest battery manufacturer, which is dominating the energy storage and EV battery sectors that has advanced lithium-ion technology. The company is mainly focused on large-scale battery production, R&D in long-duration storage, and worldwide partnerships with automakers and utility providers. Besides, CATL’s vertical integration from raw materials to battery cells and modules gives it cost and scale advantages, whereas its investments in next-generation chemistries, recycling, and energy management systems strengthen its position globally.

- Tesla Energy is yet another central player in this field, which combines battery innovation with software-driven energy management, leveraging its expertise in lithium-ion technology from EV production. Besides, its flagship product, the Megapack, targets mainly the utility-scale energy storage, whereas the Powerwall and Powerpack serve commercial and residential sectors. In addition, Tesla focuses on scalable deployments, integrated solar-plus-storage solutions, and AI-based energy optimization, thereby enabling flexible grid services such as peak shaving, load shifting, and renewable smoothing.

- BYD is a major battery and renewable energy solutions provider that is offering modular and scalable BESS systems for industrial, utility, and residential applications. The company is best known for its strong vertical integration, battery manufacturing, energy storage systems, and electric vehicles, in turn enabling economies of scale and cost efficiency. BYD opted for expansion into overseas markets, partnerships with utilities, and development of hybrid storage technologies, which is positioning BYD as a key player in both China’s renewable energy sector and global energy storage growth.

- Fluence is a leading energy storage integrator which is specializing in utility-scale and commercial energy storage projects. The company has been formed as a joint venture between Siemens and AES, and it provides turnkey solutions combining battery systems, software, and analytics, enabling grid services such as frequency regulation, renewable integration, and capacity management. In addition, Fluence is focused on digital energy management platforms, long-duration storage, and global expansion, which allows it to capture emerging opportunities in developing energy industries.

- Sungrow is a top renewable energy technology company that is offering inverters and energy storage solutions. The company’s BESS systems are increasingly deployed for utility-scale, commercial, and residential applications, having a strong presence in the Asia Pacific, Europe, and the Americas. Moreover, Sungrow emphasizes integrated solutions combining storage hardware, software, and advanced energy management systems, and makes continued investments in high-efficiency lithium-ion chemistries and grid stabilization technologies, supporting both renewable penetration and enhancing energy reliability for utilities and commercial customers as well.

Below is the list of some prominent players operating in the global market:

The global battery energy storage market is extremely competitive, which is dominated by China-based giants such as CATL, BYD, and EVE Energy, which leverage large-scale manufacturing and cost advantages. The U.S. and Europe-based players, such as Tesla Energy, Fluence, Siemens Energy, and Saft, differentiate themselves through system integration, software platforms, and turnkey solutions. In November 2025, Northland Power announced that it had acquired two late-stage BESS projects in Poland totaling 300 MW / 1.2 GWh, which marks a strategic expansion in its core industry. These Mieczysławów (200 MW / 800 MWh) and Kamionka (100 MW / 400 MWh) projects, each with a four-hour duration, will support Poland’s transition from coal to renewables and generate revenue through long-term capacity contracts and energy market participation. It is scheduled for construction in 2026 at an estimated cost of €200 million (USD 230 million). These projects reinforce Northland’s commitment to advancing reliable, lower-carbon energy systems in Europe.

Corporate Landscape of the Battery Energy Storage Market:

Recent Developments

- In November 2025, Adani Group announced its entry into the battery energy storage systems sector with a landmark 1126 MW / 3530 MWh project at Khavda, making it India’s largest BESS deployment. The project is featuring over 700 lithium-ion battery containers and energy management systems, will enable clean electricity, support peak load management, and reduce solar curtailment.

- In October 2025, Sumitomo Corporation and its partners secured financing for Uzbekistan’s largest solar and battery energy storage project by combining 1,000 MW of solar power with 1,336 MWh of BESS. It is located in the Samarkand and Bukhara regions, and the project will supply electricity to the state-owned National Electric Grid of Uzbekistan under a long-term power purchase agreement.

- In June 2025, Cummins India Limited announced that it had launched battery energy storage systems to support India’s clean energy transition, enhance grid reliability, and optimize energy use across industries like manufacturing, data centers, and commercial realty. It is built with lithium ferrophosphate batteries and advanced thermal management; the systems offer scalable, safe, and efficient energy storage solutions.

- Report ID: 3048

- Published Date: Jan 21, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Battery Energy Storage Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.