Pupillometer Market Outlook:

Pupillometer Market size was over USD 464.64 million in 2025 and is projected to reach USD 914.02 million by 2035, growing at around 7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of pupillometer is evaluated at USD 493.91 million.

The surging trajectory in the pupillometer market is predominantly driven by the advancements in neurodiagnostic equipment and growing understanding of the pupillary light reflex as a biomarker. For instance, in February 2024, Philips introduced the Azurion neuro biplane system at ECR2024. The technology aided in the improvement and expediency of minimally invasive neurovascular patient diagnosis and therapy. Furthermore, enhanced use in intensive care, specifically for neurological examination, testifies to the device's utility in offering quantifiable and objective information on pupillary response. For instance, in March 2024, Northwestern Medicine neurosurgeon is the first neurosurgeon in the U.S. to employ a novel neurosurgical drill, the Hubly Drill. It is an auto-stopping cranial drill to save a patient in the intensive care unit.

Moreover, the increasing incidence of neurological disorders and a worldwide aging population have increased the demand for non-invasive diagnostic instruments that will help diagnose early and continue to check up. For instance, in March 2024, the WHO stated that neurological diseases afflict more than 1 in 3 persons. In addition to that, according to a significant study published in The Lancet Neurology, over 3 billion individuals globally lived with a neurological disorder in 2021. In addition, people have become more conscious of their eye health and methods of treatment, hence, will spur the demand for pupillometer devices in the long run.

Key Pupillometer Market Insights Summary:

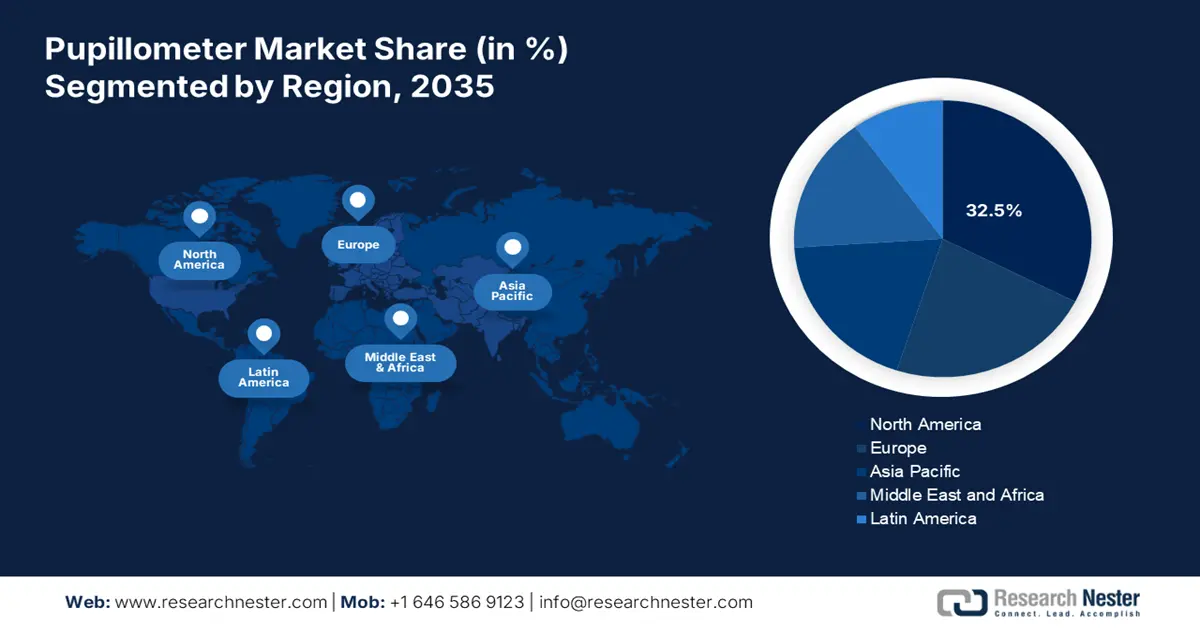

Regional Highlights:

- North America dominates the Pupillometer Market with a 32.5% share, driven by the adoption of pupillometers for clinical trials, research, and medical diagnostics, bolstering its leadership through advanced healthcare applications by 2035.

- The Asia Pacific region is projected to experience the fastest growth in the Pupillometer Market from 2026 to 2035, driven by the growing usefulness of pupillometers in diagnosing and treating eye disorders.

Segment Insights:

- The Ophthalmology segment is forecasted to dominate with substantial CAGR growth by 2035, propelled by pupillometry’s role in pre- and post-operative assessment to reduce complications.

- The Video Segment is expected to achieve a 59.2% share by 2035, fueled by its precise and dynamic visualization capabilities in medical applications.

Key Growth Trends:

- Expanding research into pupillary dynamics

- AI & ML integration into methodologies

Major Challenges:

- Variability in measurement

- Cost and accessibility

- Key Players: Luneau Technology Group, NIDEK CO., LTD., SCHWIND eye-tech-solutions, US Ophthalmic, Konan Medical, and more.

Global Pupillometer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 464.64 million

- 2026 Market Size: USD 493.91 million

- Projected Market Size: USD 914.02 million by 2035

- Growth Forecasts: 7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Pupillometer Market Growth Drivers and Challenges:

Growth Drivers

- Expanding research into pupillary dynamics: The pupillometer market witnessed noteworthy growth due to research into pupil dynamics as it unearths new areas of applications and clarifies existing concepts of diagnosis in. For instance, in March 2024, at the AD/PD 2024 conference, CND Life Sciences introduced its NerValence pathology detection system. Such advancements not only establish the clinic usability but also unlock new opportunities for novel modalities of diagnosis and therapy. Therefore, such innovations into the better patient care and effective treatment modalities boost the market growth.

- AI & ML integration into methodologies: The incorporation of AI & ML into pupillometer technology is transforming pupillary analysis from a basic measurement to a high-tech diagnostic tool, hence boosting pupillometer market growth. For instance, in February 2023, Remidio's Medios DR AI, which is utilized with its portable retinal cameras, was approved by CDSCO. These technologies can detect subtle trends and patterns in pupillary dynamics not visible to the naked eye and allow for earlier detection of neurological and systemic disease. The adoption of such technology is propelled in an increasing range of clinical as well as research situations and thereby cementing its status as a front-line market expansion driver.

Challenges

- Variability in measurement: Despite technological advancements, variation in measurement protocol and analysis variation can cause differences in values reported for the pupils, hampering the pupillometer market growth. The inherent state susceptibility of pupillary light reflex to emotional state or cognitive loading further provides yet other sources of variance. Without a standardized procedure for managing these confounding factors, interstudy and intersite comparisons of measurements made with the pupillometer are fraught with challenges. Such heterogeneity then compromises the validity and reproducibility of measurements made with the pupillometer, making them unsuitable to all circumstances and hindering good clinical guidelines development.

- Cost and accessibility: The primary stumbling block to the availability of high-technology pupillometer hardware are easy approach and costs. The high technology built into contemporary pupillometers, ranging from advanced sensors to image-processing software and artificial intelligence algorithms to machine learning analytics, adds to relative costs. The factoring in of costs lowers the relative feasibility of using such instruments for application in smaller clinics, rural health centers, and less-industrialized countries where typically there is tighter budgets on health care. Therefore, objective pupillary measurement is not available to broad segments of the world's population, continuing existing health care disparities.

Pupillometer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7% |

|

Base Year Market Size (2025) |

USD 464.64 million |

|

Forecast Year Market Size (2035) |

USD 914.02 million |

|

Regional Scope |

|

Pupillometer Market Segmentation:

Type (Video, Digital)

Video segment is projected to account for more than 59.2% pupillometer market share by the end of 2035, mainly due to the capability of delivering precise and dynamic visualization of data, which is the cornerstone of precise pupillary analysis. For instance, in July 2021, the NPi-300 is a next-generation automated pupillometer from NeurOptics. It improves pupillary assessment to help doctors and their patients detect cerebral injury, guide treatment, and determine prognosis. In addition, video-based systems commonly include sophisticated image-processing software to enable high-resolution measurement of pupillary diameter, velocity, and latency for best diagnostic specificity. The conducive features offered by video-based pupillometers thereby underpins market leadership.

Application (Ophthalmology, Neurology, Oncology)

The ophthalmology segment is anticipated to dominate the pupillometer market throughout the projected timeframe owing to the evaluation of most ophthalmic diseases, such as glaucoma, cataract, and neurological disease of the visual pathway. In addition, pupillometry facilitates pre- and post-operative assessment of ophthalmic patients, in order to obtain the best visual outcome and reduce complications. For instance, in August 2024, the Topcon IS-6500 Instrument Stand was developed for maximum efficiency, ergonomic comfort, and a seamless patient experience. This digital stand combines state-of-the-art technology with a stylish design, with a digital touch-screen control panel for easy navigation and customization.

Our in-depth analysis of the global pupillometer market includes the following segments:

|

Type |

|

|

Mobility |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pupillometer Market Regional Analysis:

North America Market Statistics

By 2035, North America pupillometer market is set to capture over 32.5% revenue share. Pupillometers provide objective measures of pupillary reactions, which help in the assessment and tracking of these situations. The region is also a center for clinical trials and medical research. Moreover, the pupillometers are frequently used in research projects by research institutions in the region to examine treatment outcomes, assess therapeutic approaches, and look into neurological diseases.

In the U.S. pupillometer market is likely to unveil lucrative growth opportunities owing to the technology advancements and the increasing demand for precise diagnostic tools. For example, Essilor Instruments USA unveiled the AKR800NV Auto Kerato-Refractometer in October 2022. Free measurements including automatic peripheral keratometry, white-to-white measuring, and retro-illumination imaging were made available with the AKR800NV. The advanced features of the AKR800NV, such as night vision testing and accommodation evaluation, help eye care professionals conduct comprehensive eye examinations for media-opacity screening and contact lens fitting.

Canada pupillometer market is exponentially increasing its footprints owing to the legislative ecosystem that focuses on disseminating eye care awareness amongst its population. For instance, in November 2024, Vision Health Partners in Canada applaud parliament's adoption of the National Strategy for Eye Care Act, Bill C-284 in order to guarantee that all Canadians will have access to necessary eye health services. This legislation lays out a thorough framework for creating a national strategy to enhance eye care and rehabilitation services, invest in research to provide treatments and cures, increase accessibility, and promote eye health education across the country.

Asia Pacific Market Analysis

The pupillometer market in Asia Pacific is likely to witness fastest growth during the stipulated timeframe attributable to the growing usefulness in diagnosing and treating a wide range of eye disorders prevailing within the region. Traditionally, pupillometers measured pupillary responses using visible light but new breakthroughs have changed the ecosystem in delivering the effectiveness in eye care. Nonetheless, infrared pupillometry is becoming the norm for contemporary gadgets within the region.

In India pupillometer market is likely to witnessing robust growth owing to the integration of pupillometer into apt eye surgeries of patients. In addition to helping with contact lens fitting and selection, pupillometry is utilized in pre-operative evaluations for refractive operations like PRK or LASIK eye surgery. For instance, in March 2025, the Center for Sight introduced AI-driven planning using the fastest and safest LASIK surgery technique in the world, powered by AMARIS 1050RS. Hence, the owing to these reasons, demand for pupillometer is bolstered in the country.

China pupillometer market is likely to flourish at a fast pace during the stipulated timeline due to the presence of pharmaceutical giants and their investments towards the ophthalmic field. For instance, in July 2024, TowardPi Secures 27.6 million USD in Series D Funding as its technology leads ophthalmic equipment innovation. Through the vertical integration of clinical demands, creative system functionalities, and high-performance upstream components, the company has made advancements in a number of high-end ophthalmic equipment categories.

Key Pupillometer Market Players:

- NeurOptics, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Reichert Technologies

- Johnson & Johnson Vision

- Brightlamp, Inc.

- Adaptica

- Essilor Instruments USA

- HAAG-STREIT GROUP

- Luneau Technology Group

- NIDEK CO., LTD.

- SCHWIND eye-tech-solutions

- US Ophthalmic

- Konan Medical

- Eli Lilly and Company

The competitive landscape in the pupillometer market is influenced by both new and established competitors. These players use strategic moves including collaborations, mergers and acquisitions, and creative product releases. Additionally, it is anticipated that rising R&D expenditures will intensify market rivalry. For instance, in September 2024, Johnson & Johnson has introduced the new research TECNIS PureSee intraocular lens (IOL). It has a purely refractive design and is intended for people with presbyopia. The goal of the device is to provide cataract patients who want to repair their vision at various distances, including functional near vision, distance vision, and intermediate vision.

Here's the list of some key players:

Recent Developments

- In November 2024, Nihon Kohden announced the purchase of a 71.4% share in NeuroAdvanced Corp. By fusing Ad-Tech's specialist intracranial electrodes with Nihon Kohden's well-established expertise in EEG systems, the firm is better equipped to handle complicated neurological diseases.

- In May 2023, Essilor Luxottica and the European Academy of Optometry and Optics (EAOO) announced that they would continue to work together as platinum sponsors of the prestigious event Eye care in the changing world. This strategic alliance demonstrated Essilor Luxottica's dedication to offering steadfast assistance to eye care specialists.

- Report ID: 7336

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pupillometer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.