Protein Degeneration Therapy Market Outlook:

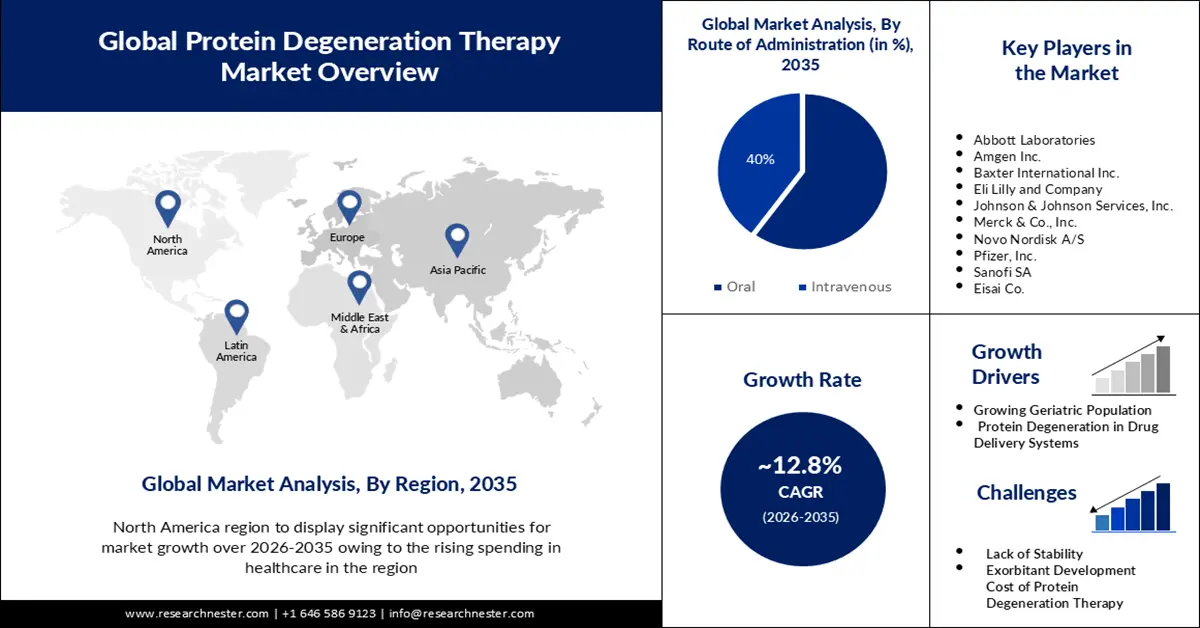

Protein Degeneration Therapy Market size was valued at USD 156.34 billion in 2025 and is likely to cross USD 521.39 billion by 2035, expanding at more than 12.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of protein degeneration therapy is estimated at USD 174.35 billion.

The reason behind the growth is due to the growing burden of cancer across the globe which is one of the leading causes of death driven by smoking, and other significant factors. For instance, in 2040, there will be more than 29 million cases of cancer worldwide owing to population growth and aging. Moreover, targeted protein degradation has increased the number of druggable proteins available for use in cancer treatments and is a strategy to destroy cancer-causing proteins.

The growing advancements in protein degeneration therapy are believed to fuel protein degeneration therapy market growth. For instance, the successful endogenous protein degradation tool known as proteolysis targeting chimeric (PROTAC) technology was created in recent years which has demonstrated promising outcomes in clinical trials for the treatment of breast and prostate cancer.

Key Protein Degeneration Therapy Market Insights Summary:

Regional Highlights:

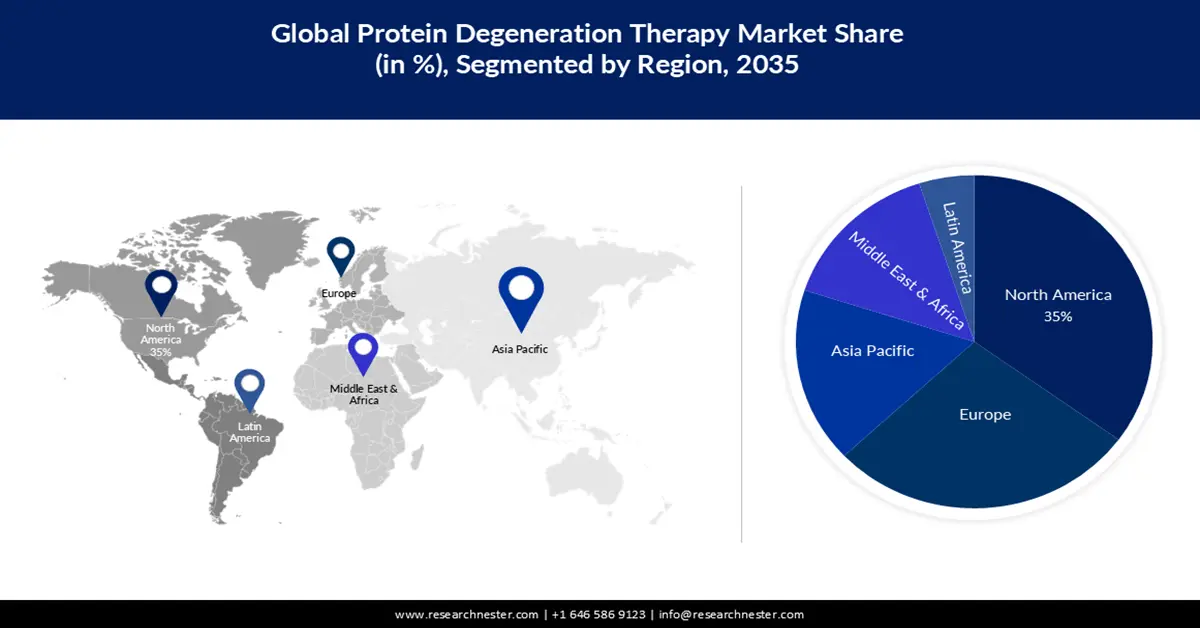

- By 2035, North America in the Protein Degeneration Therapy Market is projected to command a 35% share, underpinned by escalating healthcare expenditure that is accelerating adoption of advanced protein-based therapies.

- Europe is expected to remain the second-largest regional contributor by 2035, sustained by rising emphasis on quality health and growing preference for personalized wellness solutions.

Segment Insights:

- By 2035, the oral segment in the Protein Degeneration Therapy Market is anticipated to hold a 60% share, supported by increasing acceptance of convenient and non-invasive administration methods.

- The neurology segment is set to attain a notable share by 2035, reinforced by the mounting burden of neurological disorders and the therapeutic need to eliminate pathogenic protein deposits.

Key Growth Trends:

- Growing Geriatric Population

- Increasing Availability of Protein Degraders

Major Challenges:

- Lack of Stability

Key Players: Baxter International Inc., Eli Lilly and Company, Johnson & Johnson Services, Inc., Merck & Co., Inc., Novo Nordisk A/S, Pfizer, Inc.

Global Protein Degeneration Therapy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 156.34 billion

- 2026 Market Size: USD 174.35 billion

- Projected Market Size: USD 521.39 billion by 2035

- Growth Forecasts: 12.8%

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 20 November, 2025

Protein Degeneration Therapy Market - Growth Drivers and Challenges

Growth Drivers

-

Growing Geriatric Population - The molecular etiology of several age-related disorders has been closely linked to degenerative protein changes or DPMs such as in age-related macular degeneration, or AMD which is one of the main causes of blindness in the globe. According to estimates, the proportion of the population aged 60 and up rose over 1 billion, and this figure is expected to increase by more than 2 billion by 2050.

-

Increasing Availability of Protein Degraders- Many degraders based on the PROTAC principle have already progressed to clinical testing which is being used in pharmaceuticals to selectively downregulate a target protein.

-

Protein Degeneration in Drug Delivery Systems- In the drug development process, the use of tiny compounds to cause targeted protein breakdown is rising, and the research on targeted protein degradation is also creating new avenues for the quickly expanding field of medication. Moreover, targeted protein degradation is gaining popularity because it is a relatively new method of drug development backed by growing clinical validation. For instance, the overall value of venture financing deals involving targeted protein degrader medicines (TPDs) increased by more than 1500% between 2017 and 2022.

Challenges

-

Lack of Stability- Only a small range of concentration, temperature, ionic strength, and acidity conditions are stable for proteins and peptides therefore it is difficult to ensure the stability of protein formulations which is crucial as any alterations in protein integrity might lead to a reduction in therapeutic efficacy and can trigger immunogenic reactions in patients. Moreover, in the pharmaceutical industry, protein stability is especially important during the process of expression and purification.

-

Exorbitant Development Cost of Protein Degeneration Therapy Owing to the Complexity and Requirement of advanced technologies

-

Stringent rules and regulations can increase the overall time and cost which is expected to limit the introduction of new treatments

Protein Degeneration Therapy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.8% |

|

Base Year Market Size (2025) |

USD 156.34 billion |

|

Forecast Year Market Size (2035) |

USD 521.39 billion |

|

Regional Scope |

|

Protein Degeneration Therapy Market Segmentation:

Route of Administration Segment Analysis

The oral segment in the protein degeneration therapy market is estimated to gain a robust revenue share of 60% in the coming years. Owing to its ease of use, non-invasive drug delivery methods have drawn a lot of attention in the field of biomedicine. Oral protein degeneration therapies are developed so that patients can take them conveniently and easily.

Oral administration improves convenience and patient compliance and offers a simple, non-invasive method that lessens patient discomfort. Oral administration makes it possible for medications to be released more gradually since for many protein degeneration treatments, careful dosage is necessary. Moreover, this route of administration also encourages scalability and cost-effectiveness, may be easily scaled up for mass production, and may become more widely accepted by providing them to a broader range of patients.

Application Segment Analysis

The neurology segment in the protein degeneration therapy market is set to garner a notable share shortly. The number of neurological disorders-related deaths and disabilities is becoming more widely acknowledged as a global public health concern since more than 6 million people worldwide lose their lives to neurological illnesses each year. The need for efficient therapies is growing as neurological disorders are becoming more common. Moreover, recognized genetic pathways or substantial protein deposits that cause cell death are used to describe neurodegenerative diseases. The goal of protein degeneration therapy is to remove the aberrant protein deposits while also slowing down the disease and trying to specifically remove these harmful proteins.

Our in-depth analysis of the global protein degeneration therapy market includes the following segments:

|

Product Type |

|

|

Route of Administration |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Protein Degeneration Therapy Market - Regional Analysis

North American Market Insights

North America industry is anticipated to hold largest revenue share of 35% by 2035. For instance, in 2021, U.S. health spending climbed by over 2% to reach around USD 4 trillion. Particularly, 2022 saw a faster-than-expected 4% increase in healthcare spending in the United States. As a result, the market for therapeutic proteins has experienced unprecedented growth, and new approaches to treating diseases have been made possible by protein-based therapies in the region.

European Market Insights

The Europe protein degeneration therapy market is estimated to be the second largest, during the forecast timeframe led by growing awareness about quality health. The European Union's actions have resulted in a heightened consciousness regarding the significance of optimal health and overall well-being, leading to the growing desire for personalized approaches to address several health-related concerns.

Protein Degeneration Therapy Market Players:

- F. Hoffmann-La Roche AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abbott Laboratories

- Amgen Inc.

- Baxter International Inc.

- Eli Lilly and Company

- Johnson & Johnson Services, Inc.

- Merck & Co., Inc.

- Novo Nordisk A/S

- Pfizer, Inc.

- Sanofi SA

Recent Developments

- Amgen Inc. teamed up with Generate Biomedicines to identify and develop protein therapies for five targets, help multi-specific drug design even more, and create prospective lead compounds with predictable manufacturability and clinical behavior. In addition, by combining Amgen's biologics drug discovery expertise with Generate's AI platform, they can further shorten drug discovery timelines and could generate over USD 1 billion for the Flagship Pioneering spinout.

- Eli Lilly and Company collaborated with Lycia Therapeutics, Inc. to address critical unmet medical needs in Lilly's therapeutic areas of focus, such as immunology and pain, and use cutting-edge new technology to tackle difficult illness areas such as immunology and pain. Further, this collaboration will enable the development of many therapeutic modalities, including antibodies and small compounds.

- Report ID: 3968

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Protein Degeneration Therapy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.