Private LTE Market Outlook:

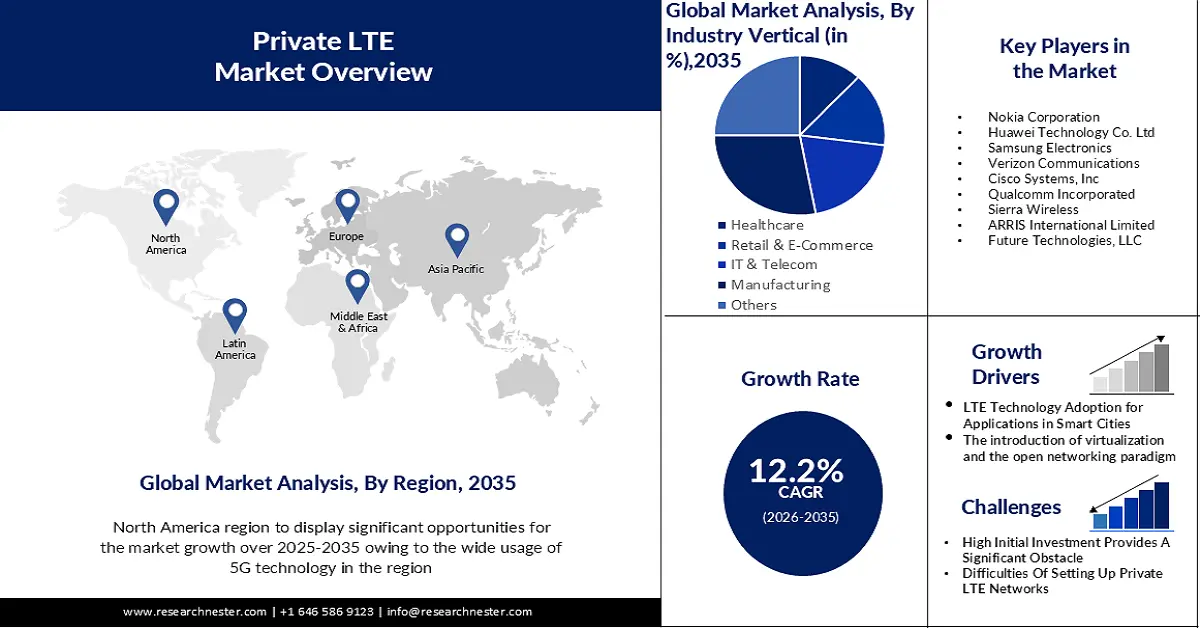

Private LTE Market size was over USD 7.9 billion in 2025 and is anticipated to cross USD 24.98 billion by 2035, growing at more than 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of private LTE is assessed at USD 8.77 billion.

The rise in smartphone use worldwide is anticipated to be a significant demand generator for the expansion of the private LTE network industry. As of 2024, there are 6.93 billion smartphone users worldwide, or 85.68% of the global population, who own a smartphone.

The main factors driving the growth of the private LTE market include features such as high capacity, high speed, high security, consistent performance, low latency rate, greater range, and interoperability. Furthermore, as society evolves, more people are embracing isolated networks, which is anticipated to play a significant role in the spread of private LTE throughout the world market.

Key Private LTE Market Insights Summary:

Regional Highlights:

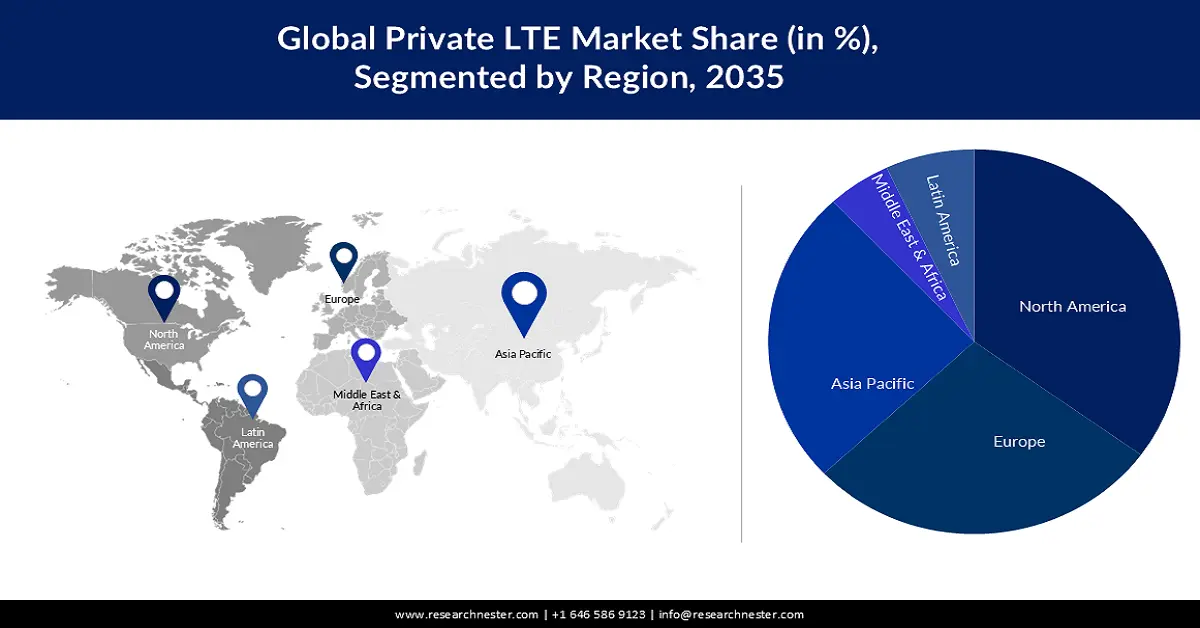

- North America private LTE market will secure over 35% share by 2035, driven by increased 5G and AI adoption and demand for wireless connectivity.

- Europe market will achieve a 30% share by 2035, driven by digital transformation and investment in private LTE infrastructure.

Segment Insights:

- The frequency division duplexing segment segment in the private lte market is expected to hold a 65% share by 2035, attributed to the superior performance of FDD technology for symmetric traffic signals in wireless networks.

- The manufacturing segment segment in the private lte market is projected to hold a 28% share by 2035, driven by automation in manufacturing plants using network technologies and large investments to improve coverage and performance.

Key Growth Trends:

- LTE Technology Adoption for Applications in Smart Cities

- The introduction of virtualization and the open networking paradigm

Major Challenges:

- LTE Technology Adoption for Applications in Smart Cities

- The introduction of virtualization and the open networking paradigm

Key Players: Nokia Corporation, Huawei Technology Co. Ltd, Samsung Electronics, Verizon Communications, Cisco Systems, Inc., Qualcomm Incorporated, Sierra Wireless, ARRIS International Limited, Future Technologies, LLC.

Global Private LTE Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.9 billion

- 2026 Market Size: USD 8.77 billion

- Projected Market Size: USD 24.98 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 16 September, 2025

Private LTE Market Growth Drivers and Challenges:

Growth Drivers

- LTE Technology Adoption for Applications in Smart Cities- A smart city gathers data using a variety of electronic, Internet of Things-based devices and sensors. Insights from this data are utilized to manage assets, services, and resources efficiently. Smart city initiatives have been implemented in numerous emerging nations, including Brazil, India, and China, to advance sustainable and cutting-edge infrastructure development. For instance, the Ministry of Housing and Urban Affairs developed the Smart City Mission in India to create 100 smart cities nationwide. Smart video security, smart waste management, smart lighting, smart metering, and smart parking are just a few of the needs that advanced ICT services could aid with. IoT modules have become a crucial component of the infrastructure for smart cities because they lessen the burden that traffic and environmental problems place on the city. A strong network solution is needed for ongoing operations and defense against weak security breaches. Since private LTE networks are among the finest because they provide mobility, spectrum alternatives, network security, configurable quality of service (QoS), ecosystem and interoperability, and high-to-low rate scaling, it is anticipated that these networks will be widely used in these smart cities.

- The introduction of virtualization and the open networking paradigm- The adoption of the open networking paradigm may spur innovation in how private LTE networks operate. Vendors can now offer virtualized and cloud-based solutions for radio-based stations and mobile core networks thanks to developments in cloud and virtualization technologies. The advent of virtualization and cloud computing has made open networking possible. Network infrastructure enablers, ISVs, cloud service providers, MNOs, Sis, channel partners, and MSPs are all part of the ecosystem around the private LTE market. It is anticipated that the robust cooperation amongst various ecosystem participants would propel the expansion of the private LTE industry.

- The Emergence of Commercial and Industrial IoT- Businesses in a variety of industrial verticals are always working to leverage IoT more to automate procedures and boost productivity. Therefore, the private LTE market would see development prospects from the use of IoT and related technologies. With the introduction of Industry 4.0, producers want to use private LTE networks to increase security. Sensitive data can also remain local thanks to private LTE's separate network and specialized radio equipment. Because the spectrum is readily available, the network is also well-suited for industrial applications based on Quality of Service (QoS) and is simple to build.

Challenges

- Interference between frequency bands- There are choices for licensed, shared, and unlicensed spectrum under fragmented spectrum regimes. The need for private networks may rise in response to increased spectrum availability, but there may also be problems with complexity and scalability. The first business users to be able to deploy private LTE networks will be GAA Tier 3 users. Managing this band's licensing is the main obstacle. Network designers must consider several spectrum ranges when designing their services. In many regions of the world, the spectrum is available in a severely fragmented band.

- The high initial investment provides a significant obstacle to the industry's growth.

- The difficulties of setting up private LTE networks and the limitations imposed by the need for a license to establish a private LTE network are impediments to the expansion of private LTE.

Private LTE Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 7.9 billion |

|

Forecast Year Market Size (2035) |

USD 24.98 billion |

|

Regional Scope |

|

Private LTE Market Segmentation:

Industry Vertical Segment Analysis

Based on the industry vertical, the manufacturing segment in the private LTE market is attributed to holding the largest market share of about 28% during the forecast period. Automated systems in manufacturing plants carry out regular tasks using network technologies including GPS, Wi-Fi, and hardwired connections. But these possibilities for connectivity aren't. To keep its hold on the market, AT&T Inc. has spent more than USD 800 million in wired and wireless networks in Kentucky during the last three years. The telecom behemoth expects that these planned expenditures will enhance the coverage, speed, dependability, and overall performance of IoT devices for businesses and consumers. To enable IoT devices and robotic equipment to operate on various frequencies, private LTE places the manufacturing plant's network on a different frequency band.

Technology Segment Analysis

Based on technology, the frequency division duplexing segment in the private LTE market is attributed to hold the largest revenue share of about 65% during the forecast period. With frequency division multiplexing (FDD), transmitting and receiving signals take place on different frequency bands, preventing interference between the two. FDD is thought to be a superior choice over TDD for symmetric traffic signals, like a voice in broadband wireless networks because the signals don't interfere. Many wireless systems, such as millimeter wave (MMW) and microwave (MW) communications as well as certain 4G/LTE networks, use frequency division multiplexing (FDD). A faster mobile broadband communication network is created using LTE-FDD.

Our in-depth analysis of the global private LTE market includes the following segments:

|

Component |

|

|

Technology |

|

|

Deployment |

|

|

Frequency Band |

|

|

Industry Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Private LTE Market Regional Analysis:

North American Market Insights

Private LTE market in the North American region is predicted to hold the largest revenue share of about 35% during the forecast period. The private LTE market growth in this region is because 5G networks are widely used in the area and because artificial intelligence (AI) and other smart connected gadgets are becoming increasingly popular. In North America, there will be close to 406 million 5G subscriptions by 2028. In North America, there were 166 million 5G subscriptions in 2022. Furthermore, as businesses move toward digitization, there is a growing need for wireless networks. These factors, along with the availability of unlicensed and shared spectrum in private LTE networks, present opportunities for service providers to offer the newest technological advancements in high-speed internet service.

European Market Insights

Private LTE market in the European region is projected to hold the second-largest revenue share of about 30% share during the projected period. Strong economic growth and continuous telecom sector development are pushing businesses to make significant investments in private LTE to maintain expansion and boost efficiency. The need for private LTE is increasing in Europe as a result of this significant move toward digital transformation and an increase in cloud deployment.

Private LTE Market Players:

- LM Ericsson

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nokia Corporation

- Huawei Technology Co. Ltd

- Samsung Electronics

- Verizon Communications

- Cisco Systems, Inc

- Qualcomm Incorporated

- Sierra Wireless

- ARRIS International Limited

- Future Technologies, LLC

Recent Developments

- To provide loT Accelerator Device Connect, Ericsson and Thales worked together to create the first generic eSIMs for businesses that were ready for a connection. In June 2020, Ericsson plans to generally release standalone 5G radio software with edge cloud infrastructure services.

- To supply high-capacity equipment, such as 5G massive MIMO to support all frequency bands, Nokia and Ice announced a five-year agreement. Under this agreement, the business will deploy 3,900 new base stations and update about 3,200 existing base stations.

- Report ID: 5656

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Private LTE Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.