Portable Generator Market Outlook:

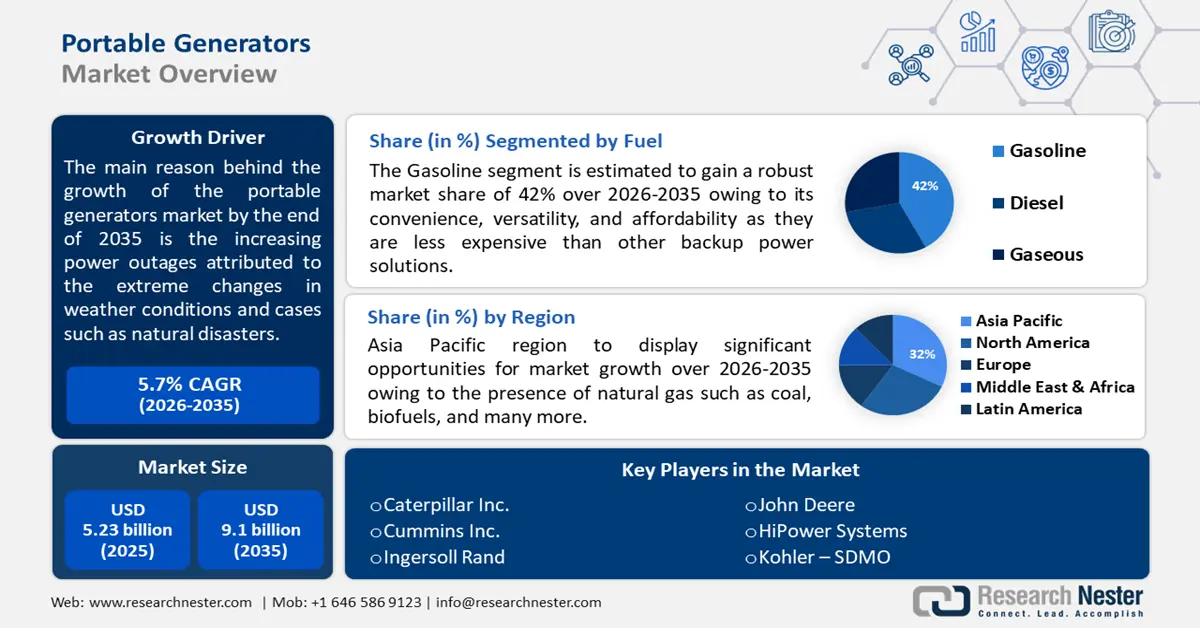

Portable Generator Market size was valued at USD 5.23 billion in 2025 and is likely to cross USD 9.1 billion by 2035, expanding at more than 5.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of portable generator is estimated at USD 5.5 billion.

The market growth is credited to increasing power outages attributed to the extreme changes in weather conditions and cases such as natural disasters, and many more. According to a report by the National Centers for Environmental Information in 2024, the U.S. has experienced an average of about 18 billion USD in climate disasters each year, with about 18 climate disasters in 2022 causing a total of more than 175.2 billion USD in damage and resulting in 474 fatalities.

Key Portable Generator Market Insights Summary:

Regional Highlights:

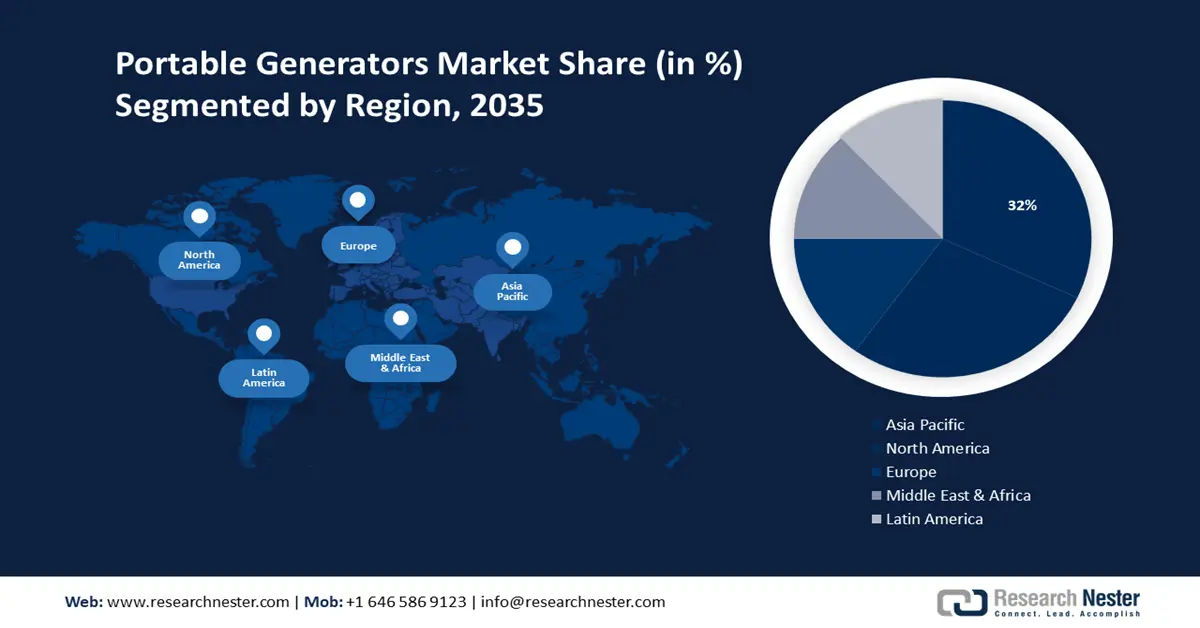

- Asia Pacific portable generator market is poised to capture 32% share by 2035, driven by availability of natural gas and rapid industrial growth.

- North America market projects lucrative growth during the forecast timeline, driven by rising demand for clean energy and government initiatives.

Segment Insights:

- The gasoline segment in the portable generator market is projected to achieve a 42% share by 2035, propelled by its convenience, versatility, and affordability.

- The residential segment in the portable generator market is projected to experience significant growth during 2026-2035, driven by an increase in residential areas along with the necessity for reducing environmental footprint.

Key Growth Trends:

- Demand for uninterrupted power supply

- Rising investments in power infrastructure

Major Challenges:

- Complexity of installation and maintenance

- High Manufacturing costs

Key Players: Generac Power Systems, American Honda Motor Corp., Caterpillar Inc., Cummins Inc., Ingersoll Rand, John Deere, HiPower Systems, Kohler-SDMO, Wacker Neuson.

Global Portable Generator Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.23 billion

- 2026 Market Size: USD 5.5 billion

- Projected Market Size: USD 9.1 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, India

- Emerging Countries: China, India, Indonesia, Brazil, Mexico

Last updated on : 8 September, 2025

Portable Generator Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Industrialization- The electricity demand is propelling due to increased industrialization, which has led to a situation where the generators are in a constant state of upgrade or improvement. According to a report in 2021, the US economic growth has been mainly concentrated in a few places, such as 6% of the US accounts for about two-thirds of the GDP output, they have greatly increased the growth rate of the generator market size expansion in the forecasted years.

- Demand for uninterrupted power supply- The unavailability of electricity can hamper several operations of SMEs (Small and Medium Enterprises) along with commercial places. A reliable power supply is required from several sources such as wind, solar, and many more which work with renewable resources. According to a report by the Center for Climate and Energy Solutions, renewable energy made up about 19.8& of electricity generation in 2020, coupled with hydro and wind making up the majority of it. This is expected to increase to 35% by 2030, and most of this increase is set to be from wind and solar.

- Rising investments in power infrastructure- The increasing investments in power infrastructure, and power generation in the form of building new power plants, upgrading the existing ones, and the need for maintaining the new infrastructure leads to huge demands for generators. According to a report by IEA in 2023, a total of about 2.8 trillion USD was invested in energy in 2023, out of this, 1.7 trillion USD is for clean energy.

- Increasing energy demand- The surge in energy demand that is driven by several factors such as economic development, population growth, and many more, has led to an increase in the demand for generators. Portable generators are highly essential for meeting the increasing energy demands which has led to an increase in their production, this in turn results in the increasing availability and demand for spare parts, repairs, and maintenance services which are essential to ensure their operation continuously. According to a report in 2024, due to the increasing population, the global energy demand increased to 69.22% in 2022 led by the increasing world population from 47.67% in 1990.

Challenges

- Complexity of installation and maintenance- For optimal alignment and stability, portable generator systems need to be carefully designed, engineered, and installed. Along with this, regular maintenance is also required to maximize energy production and for the maintenance of structures in excellent shape. For certain users, this can be costly and time-consuming.

- High Manufacturing costs- Revenues from the portable generator market may be constrained by rising manufacturing costs and mounting safety concerns. The demand for these generators is also being hampered by a variety of technical and functional limitations, including the inability to power a large number of devices, the production of huge amounts of carbon monoxide, noisy gasoline engines, and gasoline consumption. Because of this, it is inappropriate in the event of unexpected power outages, requiring operator involvement and somewhat restricting product usage.

Portable Generator Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 5.23 billion |

|

Forecast Year Market Size (2035) |

USD 9.1 billion |

|

Regional Scope |

|

Portable Generator Market Segmentation:

Fuel

Gasoline segment is likely to hold more than 42% portable generator market share by 2035. The segment growth is propelled by its convenience, versatility, and affordability, as there is a high demand for gasoline generators because they are less expensive than other backup power solutions, making it a better option on budget for consumers.

Moreover, gasoline generators are widely used in several applications in homes and businesses during power outages. According to a report by the U.S. Energy Information Administration in 2024, the global production of liquid fluids is expected to cross 1.9 billion b/d by 2025. Additionally, the demand for natural gas portable generators is also increasing owing to their reliability, fuel efficiency, and low emissions. They also offer a clear burning fuel which produces less pollutants.

End User

The residential segment in the portable generator market is projected to record significant growth till 2035, due to increase in residential areas along with the necessity for reducing the environmental footprint and becoming more sustainable in our practices. According to a report by the World Bank in 2023, it is slated that about 50% of the population lives in urban areas & by 2045 the global urban population is predicted to surpass 6 billion.

Moreover, usage of generators that produce lower emissions coupled with the usage of less energy helps to fulfill such objectives, and the generators that use green energy, renewable and alternative fuels can also fulfill the goal of being more environmentally conscious.

Our in-depth analysis of the portable generator market includes the following segments:

|

Fuel |

|

|

End User |

|

|

Product |

|

|

Phase |

|

|

Power |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Portable Generator Market Regional Analysis:

APAC Market Insights

Asia Pacific portable generator market is expected to account for around 32% revenue share by 2035. The market expansion in the region is driven by presence of natural gas such as coal, biofuels, and many more. According to a report, in 2023 APAC holds about 43% of the global coal reserves. Furthermore, a large part of the Asia Pacific region has favorable geographical conditions for the development of the portable generator sector. In addition, the Asia Pacific region has witnessed rapid industrial and economic growth in recent years, leading to increasing demands for power generation.

There is a high presence of renewable energy power stations in Japan which reduces the risk of outages. According to a report by the Energy Information Administration in 2024, renewable generation in Japan increased to 26% in 2022 from 21% in 2018. There is a high production of steel in China which makes a huge landscape for the portable generator market growth. According to a report in 2024, there has been an increase in the exports of steel products by 30% from Chinese steel companies.

North America Market Insights

North American portable generator market is likely to showcase lucrative growth rate through 2035, owing to growing demand for accessible and reliable powers in the energy & power sector, on account of the rise in population, which is shifting more towards the usage of clean energy. According to a report by the U.S. Energy Information Administration, in 2022 the usage of natural gas was about 33% of the whole energy consumption.

In the United States there have been rising government initiatives in the form of investment and campaigns to spread awareness regarding the usage of renewable energy. According to a survey conducted in 2023, it was revealed that more than 66% of U.S. adults prioritize using an alternative energy source like solar, hydrogen, and wind power. Moreover, Canada is predicted to have the presence of key players in the field of power generation and electricity demand which is further encouraging collaboration with the energy & power sector. According to a report in 2023, the energy consumption in Canada increased to 8585 petajoules from 2022 tp 2021.

Portable Generator Market Players:

- Briggs and Stratton

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Generac Power Systems

- American Honda Motor Corp.

- Caterpillar Inc.

- Cummins Inc.

- Ingersoll Rand

- John Deere

- HiPower Systems

- Kohler – SDMO

- Wacker Neuson

Most of these companies are continuously collaborating, expanding, making agreements, and joining ventures for the growth of this sector and are estimated to be the major key players in this landscape.

Recent Developments

- Generac Power Systems- recently Mean Green along with Generac Power Systems company, introduced the World’s Largest Electric Zero Turn Mower – EVO 96, powered by a lithium battery of 44kWh.

- Cummins Inc.- foreseeing and constantly working for a zero-emission future, announced Accelera by Cummins, a new unit that would specifically focus on zero-emission solutions to accelerate towards a sustainable future.

- Report ID: 3236

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Portable Generator Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.