Smart Diagnostic and Monitoring Medical Device Market Outlook:

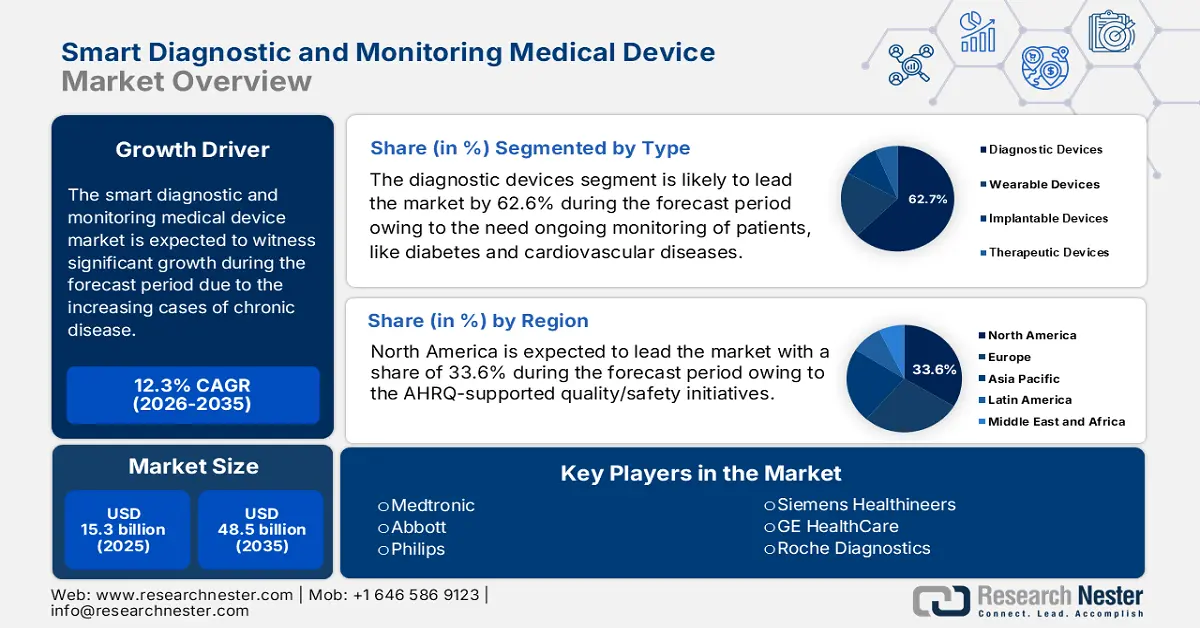

Smart Diagnostic and Monitoring Medical Device Market size was valued at USD 15.3 billion in 2025 and is projected to reach USD 48.5 billion by the end of 2035, rising at a CAGR of 12.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of smart diagnostic and monitoring medical device is estimated at USD 17.1 billion.

The smart diagnostic and monitoring medical device market is growing at a tremendous pace and is stimulated by the increasing cases of chronic disease burden and aging populations that need to be constantly monitored and managed. According to the CDC data in April 2025, almost 76% of the population in the U.S. is reported to have 1 chronic disease, with the young population having 59.5%, midlife having 78.4%, and adults having 93.0%. Public health statistics reveal that chronic illness in developed markets is generating expected demand for remote monitoring, post-acute surveillance, and continuous glucose monitoring.

The trade value of medical instruments reached USD 167 billion, including smart diagnostic devices. Over the past five years, the growth rate of this category has been 6% as stated in the OEC 2023 report. The leading exporters of medical instruments and devices are the U.S., exporting products worth $34.8 billion globally. Trade flows and pricing dynamics impact the R&D planning and procurement. Further, the industry’s upstream exposure to semiconductors and specialty chemicals makes trade policy and tariffs more sensitive. The market is further driven by the manufacturer's strategy, collaborations, and acquisitions.

Key Smart Diagnostic and Monitoring Medical Device Market Insights Summary:

Regional Highlights:

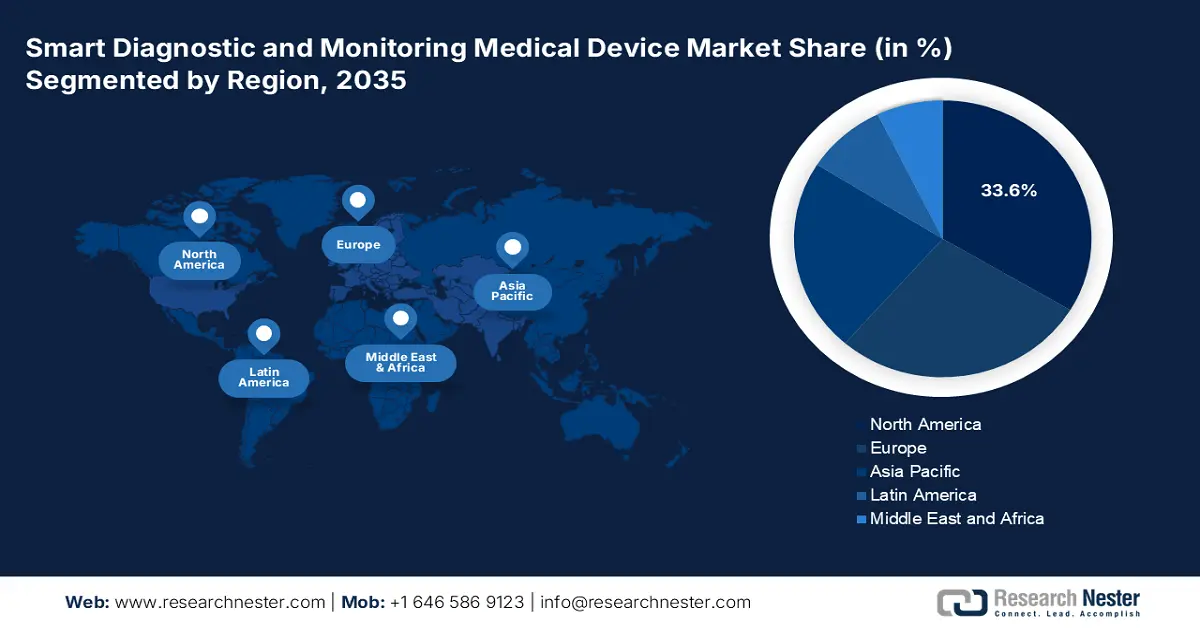

- North America in the smart diagnostic and monitoring medical device market is projected to secure a 33.6% share by 2035, attributed to the rising chronic disease burden, supportive reimbursement policies, and increased AI-driven diagnostics R&D.

- Asia Pacific is anticipated to record substantial growth by 2035, supported by national digital-health programs and rapid adoption of IoT- and AI-integrated hospital systems.

Segment Insights:

- The diagnostic devices segment in the smart diagnostic and monitoring medical device market is projected to account for 62.6% share by 2035, propelled by the rising prevalence of chronic diseases and the growing adoption of AI-enabled monitoring technologies.

- The MRI-compatible monitoring devices segment is anticipated to secure a notable share by 2035, fueled by technological advancements that enable safe operation within MRI environments.

Key Growth Trends:

- Rising disease burden

- AI and analytics value-stack

Major Challenges:

- Regulatory barriers and market entry lag

Key Players: Medtronic, Abbott, Philips, Siemens Healthineers, GE HealthCare, Roche Diagnostics, Boston Scientific, Dexcom, Masimo, ResMed, Edwards Lifesciences, Lunit, i-SENS, Molbio Diagnostics, Medical Innovation Ventures (Mediven), Omron Healthcare, Nihon Kohden, Sysmex, Terumo, Fukuda Denshi

Global Smart Diagnostic and Monitoring Medical Device Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.3 billion

- 2026 Market Size: USD 17.1 billion

- Projected Market Size: USD 48.5 billion by 2035

- Growth Forecasts: 12.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Australia, Brazil

Last updated on : 2 September, 2025

Smart Diagnostic and Monitoring Medical Device Market - Growth Drivers and Challenges

Growth Drivers

-

Rising disease burden: The largest demand driver for continuous and remote monitoring devices is based on the rising chronic disease and aging populations. As per the CDC report in October 2024, nearly 6 in 10 people in the U.S. live with a chronic condition, resulting in the demand for long-term monitoring in cardiology, respiratory care, and diabetes. The government favors ambulatory management and early detection to reduce hospitalizations, providing a demand for innovative devices. Manufacturers align with the chronic care pathways and provide reduced admission rates to unlock payer uptake.

-

AI and analytics value-stack: AI-enabled analytics in health devices convert the streaming device data into actionable triage and risk scores, increasing clinical value and payer willingness to reimburse. Manufacturers are actively embedding validated analytics to justify the premium pricing and subscription models. Further, NIH and EU research funding for AI diagnostics accelerates clinical validation pathways that support payer value cases. As per the NLM report in July 2025, nearly 1016 FDA-approved AI-enabled devices are developed in the U.S., marking a remarkable growth in the market.

-

Patient affordability and reducing out-of-pocket burden: According to the Health System Tracker article released in August 2025, the out-of-pocket spending for physician and clinical services in the U.S. is estimated to be $245 per capita. Despite reimbursement, high out-of-pocket costs surge the adoption of home monitoring in developing markets. These financial burdens emphasize the importance of tiered pricing and subsidized programs to enhance the adherence of smart diagnostic device use. Further, the subscription models, evidence-based tiered pricing, and public-private procurement can mitigate affordability challenges.

FDA-Approved AI-Enabled Medical Devices: An Overview, 2024

|

Category |

Number of Devices |

% of Total |

Notes |

|

Total FDA-approved AI-enabled devices |

903 |

100% |

Most launched in last decade |

|

By Specialty |

|

||

|

Radiology |

692 |

76.6% |

Dominant specialty |

|

Cardiovascular |

91 |

10.1% |

- |

|

Neurology |

29 |

3.2% |

- |

|

By Device Type |

|

||

|

Software only |

664 |

73.5% |

- |

|

Implantable |

6 |

0.7% |

- |

Source: NLM, April 2025

Geographical Origin of AI enabled Medical Devices, 2024

|

Origin

|

No. of AI-enabled medical devices (%) |

||

|

All (N = 903) |

Available for clinical use (n = 860) |

Recalled (n = 43) |

|

|

U.S. |

434 (48.1) |

409 (47.6) |

25 (58.1) |

|

Canada |

33 (3.7) |

33 (3.8) |

0 |

|

Europe |

183 (20.3) |

175 (20.3) |

8 (18.6) |

|

Asia |

154 (17.1) |

147 (17.1) |

7 (16.3) |

|

Other |

99 (11) |

96 (11.2) |

3 (7.0) |

Source: NLM

Challenges

-

Regulatory barriers and market entry lag: Regulatory complexity is the major burden on diagnostic devices. According to the WHO, fragmented medical device regulations slow down the innovation adoption in low- and middle-income nations. For instance, Japan's new digital health device regulations of 2022 lag in certain smart monitoring approvals, which restricts timely access. Firms such as Philips countered this by establishing a robust regulatory-focused team, accelerating the implementation in several jurisdictions. Strategic alliances with regulators as well as pilot reimbursement programs have helped to avoid delays by assisting entry.

Smart Diagnostic and Monitoring Medical Device Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.3% |

|

Base Year Market Size (2025) |

USD 15.3 billion |

|

Forecast Year Market Size (2035) |

USD 48.5 billion |

|

Regional Scope |

|

Smart Diagnostic and Monitoring Medical Device Market Segmentation:

Type Segment Analysis

Diagnostic devices dominate the type segment in the smart diagnostic and monitoring medical device market and are expected to capture the share value of 62.6% by 2035. The segment is fueled by growth in chronic diseases that need ongoing monitoring of patients, like diabetes and cardiovascular diseases. Improved wearable sensors, implantable technology, and AI-enabled analytics enable precise measurements of health in real-time, enhancing patient care and minimizing healthcare expenses. According to the Jan 2022 Juniper research report, the U.S. and China are at the forefront of adopting cutting-edge technologies like IoMT devices, with 21% and 41% connected devices.

Device Compatibility Segment Analysis

The MRI-compatible monitoring devices lead the segment is poised to hold a considerable share value by 2035. The segment is driven by the advancements in technologies allowing devices to operate safely in the strong magnetic fields of MRIs without risking patient life. The growing use of MRI in chronic disease and neurology cases is reinforcing this trend. According to the NLM report in October 2023, over 40 million MRI scans were performed annually in the U.S. as of 2022, reflecting steady demand for compatible monitoring devices in clinical workflows.

End user Segment Analysis

Home care settings will lead the end user segment by 2035. The decentralization drives the dominance of home care use of smart diagnostic devices, including glucose monitors, blood pressure monitors, and pulse oximeters. Elderly population, patient preference for home-based care, and cost containment strategies surge the adoption of the latest technologies. COVID-19 has significantly increased the demand for remote patient monitoring. Further, the government initiatives and reimbursement coverage further sustain this sub-segment's prominence in the developed markets.

Our in-depth analysis of the smart diagnostic and monitoring medical device market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Application |

|

|

End user |

|

|

Technology |

|

|

Service |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Diagnostic and Monitoring Medical Device Market - Regional Analysis

North America Market Insights

The smart diagnostic and monitoring medical device market dominates the North America region and is expected to hold a share of 33.6% by 2035. This dominance is due to the rising chronic disease burden, payer-backed RPM/RTM reimbursement, and AHRQ-supported quality/safety initiatives. Hospitals scale interoperable platforms (HHS/ONC) linking EMR, analytics, and device data, while NIH grants surge AI diagnostics and sensor R&D. According to the Office of Industry and Competitiveness Analysis report released in September 2023, the export of electro-diagnostic patient monitoring systems increased by $622 million (65.9%) to $1.57 billion in 2022, reflecting major growth in North America's smart diagnostic and monitoring medical devices market.

The U.S. smart diagnostic and monitoring device market in North America is driven due to the rising chronic disease, surging for continuous monitoring and episodic at its core, to value-based care. As per the CMS report in April 2025, Remote Physiologic Monitoring CPT codes such as 99453, 99454, 99457, 99458, and Remote Therapeutic Monitoring 98975–98977/98980–98981, aiding in device data capture, transmission, and clinical management reimbursement. On the other hand, AHRQ enhances patient safety, quality measurement, and digital tool adoption in ambulatory and inpatient environments, and NIH aids AI/ML diagnostics, wearable sensors, and digital biomarkers.

Trade Data on Medical Devices and Instruments in 2023

|

Country |

TradeFlow |

Product Description |

Trade Value 1000USD |

|

U.S. |

Export |

Medical Diagnostic Test instruments and apparatus |

64,346.28 |

|

Canada |

Export |

Medical Diagnostic Test instruments and apparatus |

3,271.83 |

|

U.S. |

Import |

Instruments and appliances used in medical |

19,524,852.48 |

|

Canada |

Import |

Instruments and appliances used in medical |

1,706,884.72 |

Source: WITS, 2023

APAC Market Insights

Asia Pacific is the fastest-growing region in the smart diagnostic and monitoring device market and is projected to hold a considerable share by 2035. The region is driven by the rapid aging, chronic disease burden, and national digital-health programs that expand remote and in-hospital monitoring. Smart hospitals in the region contributes to the regional market growth by incorporating the latest technologies such as IoT, robotics and AI to improve the operations in the healthcare sector. Further strategic partnerships and collaborations improves the telehealth expansion for rural access. For example, in January 2022, Advantech in Vietnam signed an agreement with Thai Hoa General Hospital located in Vietnam’s Ninh Thuan province for integrating advanced medical technologies to support doctors and medical staff and improve efficiency.

China holds the largest share in the smart diagnostic and monitoring medical device market in the Asia Pacific and is expected to hold a substantial share by 2035. The country is influenced by the prevalence of chronic diseases as well as robust government investment in digital health. Additionally, according to the evidence in the NLM article in July 2024, almost 53% of the devices that are connected have vulnerabilities, and there have been several regulatory reforms in place to prevent such an incident. Recently, in 2022, in China, regulatory guidelines have been issued for the classification and designation of artificial intelligence medical software.

Europe Market Insights

Europe is dominating the smart diagnostic and monitoring medical device market and is propelled by the aging population, growth of chronic diseases (cardiovascular, diabetes, COPD), and country-level digital-health initiatives that spur remote monitoring, hospital-at-home, and integrated diagnosis. Interoperability (FHIR/HL7), cybersecurity, and SaMD lifecycle management are in high demand by hospitals and health systems to address regulatory requirements. The EU4Health 2025 Work Programme allocates more than €39 million specifically to the digital strand, including funding provided to digital diagnostics such as AI-based diagnostic devices, health data integration, and digital medical devices.

Germany is Europe's largest smart diagnostic and monitoring medical device market and is expected to retain a significant share by 2035. According to the NLM report in September 2022, Germany's statutory health insurance system covered digital health applications (DiGAs), many of which are smart diagnostic and monitoring medical devices, and earned revenues that exceeded €73 million. Strong hospital uptake driven by university/university-clinic networks, DiGA/digital health ecosystem, and digital therapeutics channels; statutory health insurance (GKV) pilots and reimbursement channels promote adoption.

Key Smart Diagnostic and Monitoring Medical Device Market Players:

- Medtronic

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abbott

- Philips

- Siemens Healthineers

- GE HealthCare

- Roche Diagnostics

- Boston Scientific

- Dexcom

- Masimo

- ResMed

- Edwards Lifesciences

- Lunit

- i-SENS

- Molbio Diagnostics

- Medical Innovation Ventures (Mediven)

- Omron Healthcare

- Nihon Kohden

- Sysmex

- Terumo

- Fukuda Denshi

The smart diagnostic and monitoring market is highly competitive, characterized by a platform ecosystem, payer-aligned outcomes, and clinical-grade data quality. Abbott, Philips, Siemens Healthineers, GE HealthCare, Roche, and Medtronic use broad portfolios as key players. Other industry leaders drive adoption through home-based monitoring, subscription models, and AI-based analytics. Strategic initiatives such as FDA/CE pathways for software updates, AI partnerships, EMR interoperability, and M&A for algorithm/IP acquisition. Companies in Japan defend shares via reliability, combined diagnostics, and telemonitoring. Meanwhile, Malaysia, India, and Korea entrants with networked POCT, affordable, and AI triage solutions.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In February 2025, MediBuddy partners with ELECOM to launch advanced smart health IoT devices in India, expanding access to innovative, preventive healthcare for millions. This launch aims to improve health outcomes and health management more conveniently.

- In April 2024, Philips and smartQare partnered to automate and simplify patient monitoring in and out of the hospital. This process is executed with the wearable biosensors backed by industry-leading monitoring platforms help to reduce clinical workload and length of patient hospital stay.

- Report ID: 471

- Published Date: Sep 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Diagnostic and Monitoring Medical Device Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.