Car Accessories Market Outlook:

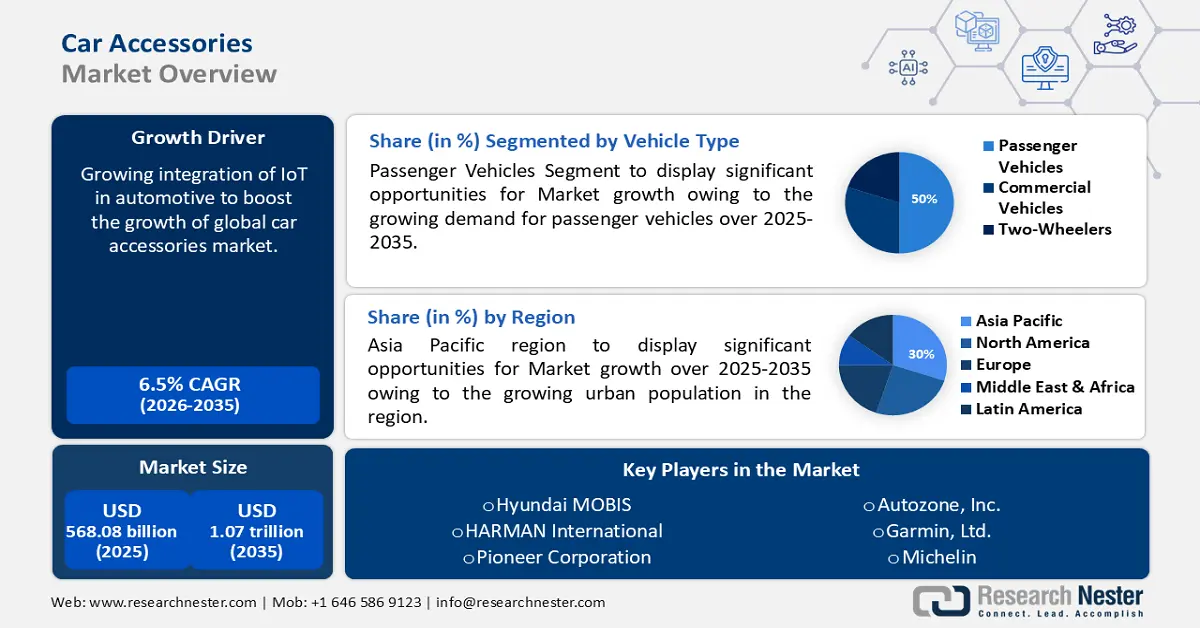

Car Accessories Market size was over USD 568.08 billion in 2025 and is anticipated to cross USD 1.07 trillion by 2035, witnessing more than 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of car accessories is assessed at USD 601.31 billion.

This growth in the market is set to be encouraged by the growing young population. In 2022, over 2 billion adolescents and youth were recorded who were between the ages of 10 and 24. Further, this young population has a huge demand for customized vehicles since their preference for aesthetic appeal in automotive is growing.

Furthermore, there has been surging competition between car manufacturers, which is why they are offering attractive accessories in order to satisfy customers changing preferences and obtain competitive advantages. Therefore, this factor is predicted to dominate the expansion of the market for car accessories over the years to come.

Key Car Accessories Market Insights Summary:

Regional Highlights:

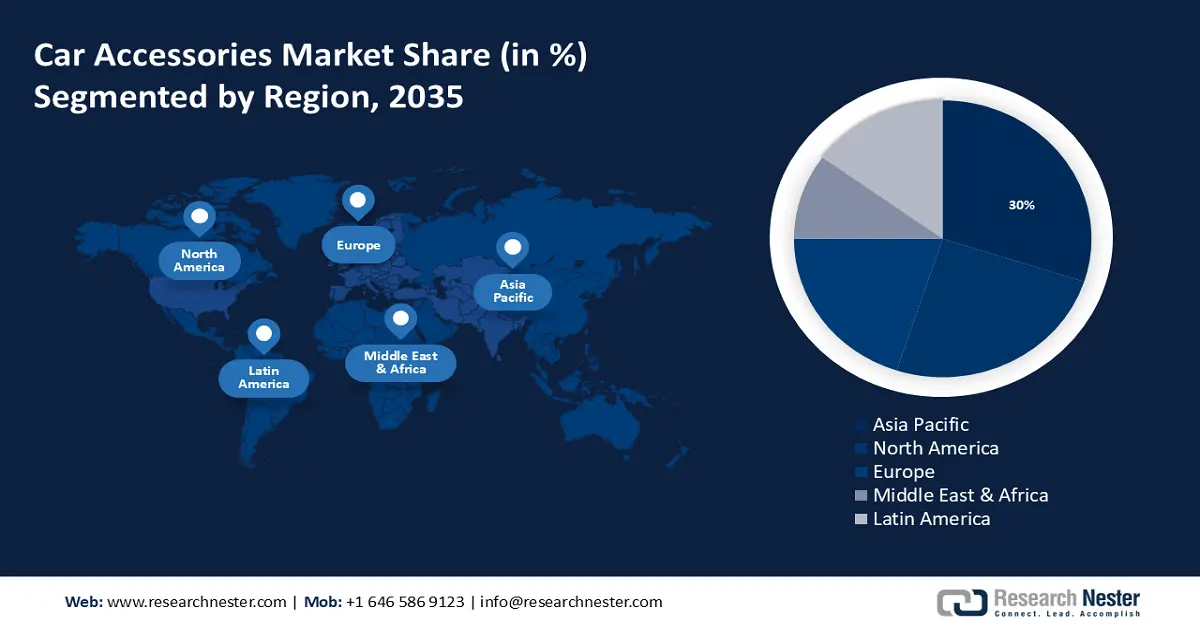

- Asia Pacific car accessories market achieves a 30% share by 2035, driven by growing urbanization and rising demand for commercial vehicles.

Segment Insights:

- The exterior car accessories segment in the car accessories market is forecasted to witness strong growth through 2035, driven by consumer interest in enhancing vehicle aesthetics through external products.

- The aftermarket segment in the car accessories market is expected to achieve a 55% share by 2035, fueled by the affordability of aftermarket accessories compared to OEM parts.

Key Growth Trends:

- Growing Integration of IoT in Automotive

- Rising Demand for Electric Vehicles

Major Challenges:

- Lack of High-Quality Interior Products

- Competitiveness in Price

Key Players: Luxoft, Hyundai MOBIS, HARMAN International, Pioneer Corporation, Garmin Ltd., Autozone, Inc., Michelin, Bridgestone Corporation, Uno Minda, Hella GmbH & Co. KGaA.

Global Car Accessories Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 568.08 billion

- 2026 Market Size: USD 601.31 billion

- Projected Market Size: USD 1.07 trillion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 17 September, 2025

Car Accessories Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Integration of IoT in Automotive-The demand for IoT in automotive is surging significantly with the growing customer expectation for enhanced technology in their vehicles. As a result, huge investments have been made in IoT for automobiles across the world. For instance, by 2025, approximately USD 739 billion is predicted to be invested in automotive IoT. Further, this integration of IoT is set to be influenced by the growing need for smart infrastructure to not only improve the appearance but also to protect the vehicle from accidents. However, along with preventing accidents, IoT also enables in-vehicle infotainment systems, which allow drivers and passengers to stream music, navigate, make hand-free calls, and more throughout the journey. Hence, with the growing demand for IoT, the car accessories market is estimated to rise over the coming years. These automotive IoT components refer to cloud-connected IoT devices, including cameras, GPS trackers, sensors, and telematics solutions, which are deployed in automobiles to collect real-time data and further offer a smarter driving experience.

- Rising Demand for Electric Vehicles-The growing adoption of electric vehicles is predicted to pose an opportunity to boost the growth of the car accessories market. This is because electric vehicles require a number of accessories. These accessories include an EV charger, lighting, a thermal cooling system, and other components that are installed as per the demand of owners of electric vehicles.

- Surging Need to Secure a Car-The prevalence of car theft is growing around the world. This has further boosted the need for safety features in automobiles. However, economic or low-variant compact cars, which are still the most preferred vehicles among the middle-class population, consist of manual locking systems, which is why the prevalence of theft has increased. Therefore, to safeguard cars from theft, owners of automobiles are adopting anti-theft locking systems in the cars. Consequently, this is expected to boost the growth of the car accessories market during the forecast period.

Challenges

- Lack of High-Quality Interior Products-There are a number of suppliers in the market who offer car accessories of low quality. In contrast to the branded car accessories, these low-quality accessories are offered at competitive prices. Hence, even though brands are providing inferior-quality accessories with a promising look, consumers are still preferring the low-quality accessories. As a result, this lack of awareness regarding genuine accessories among consumers is projected to hinder the growth of the car accessories market during the coming years.

- Competitiveness in Price

- Growing Economic Uncertainty

Car Accessories Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 568.08 billion |

|

Forecast Year Market Size (2035) |

USD 1.07 trillion |

|

Regional Scope |

|

Car Accessories Market Segmentation:

Vehicle Type Segment Analysis

The passenger vehicles segment is predicted to gather the highest share in the car accessories market of over 50% over the forecast period. This growth of the market is set to be dominated by growing demand for passenger vehicles. For instance, in 2022, over 56 million passenger cars in the globe were sold, which is the highest. This growth in the sale of passenger cars is set to be influenced by the rising disposable income of the people. Moreover, the demand for autonomous vehicles is also surging significantly which might also boost the segment growth. Furthermore, the demand for connectivity of automobiles is high among young drivers. As a result, with the growing penetration of the internet, the deployment of advanced accessories in passenger vehicles is growing. Therefore, the demand for passenger car accessories is predicted to rise.

Application Segment Analysis

The exterior car accessories market is estimated to hold 60% of the revenue share over the coming years. Exterior car accessories include all those products which are utilized to enhance the appearance of the automobile. These external car products consist of rear mudguards, plastic car door guards, stainless-steel car bumper guards, tire inflators, front mudguards, decals and stickers, wraps, and others.

Sales Channel Segment Analysis

The aftermarket segment is expected to account for 55% share of the car accessories market by 2035. The aftermarket accessories segment has observed an extraordinary surge in popularity in recent years. One of the major factors to boosts the demand for aftermarket accessories is that they offer affordable accessories in contrast to the original equipment manufacturer (OEM) substitute. Accessories offered by OEMs are often priced at a premium, hence making them unaffordable for consumers who are budget-conscious. Hence, as aftermarket accessories, provide a cost-effective alternative without negotiating the quality or performance of the accessories, its demand is growing.

Our in-depth analysis of the global car accessories market includes the following segments:

|

Vehicle Type |

|

|

Application |

|

|

Product Type |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Car Accessories Market Regional Analysis:

APAC Market Insights

The Asia Pacific car accessories market is set to gather the highest revenue share of over 30% during the forecast period. This growth of the market is set to be dominated by a growing urban population. For instance, over 2.2 billion population of the world, currently reside in Asia. Moreover, by 2050, this urban population is predicted to rise by 50% in Asia, which means that an additional 1.2 billion people will be added. This urbanization has further boosted demand for commercial vehicles and off-highway trucks since the need for transportation also increases. As a result, the market growth for car accessories is predicted to observe growth. Moreover, there has been a growing shift in the infotainment system from simple audio to the touchscreen that holds up a number of features, including Apple CarPlay, Android Auto, Telematics, and more. Hence, this driving the demand for car accessories market and is estimated to be highest in countries such as India and China.

North American Market Insights

The North America car accessories market is predicted to observe robust growth over the coming years. This growth is poised to be encouraged by the presence of major players in the field of car manufacturing. Additionally, the standard of living of the people in this region has improved significantly, which is why their demand for luxury vehicles is also boosting. As a result, since luxury cars demand the deployment of advanced accessories the market in this region is predicted to experience a surge over the coming years.

Car Accessories Market Players:

- Luxoft

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hyundai MOBIS

- HARMAN International

- Pioneer Corporation

- Garmin Ltd.

- Autozone, Inc.

- Michelin

- Bridgestone Corporation

- Uno Minda

- Hella GmbH & Co. KGaA

Recent Developments

- Luxoft and Hyundai MOBIS made an announcement that they are collaborating for the Infotainment Domain Controller. These two companies will enable to offer more compelling solutions in the complicated automotive domain controller market due to this collaboration.

- A wholly-owned subsidiary of Samsung Electronics Co., Ltd., HARMAN focused on connected technologies for automotive, enterprise, and consumer markets, has made anannouncement that its Digital Transformation Solutions (DTS) business unit is collaborating with Microsoft. This collaboration is predicted to enable HARMAN to combine with Microsoft Azure private multi-access edge compute (PMEC).

- Report ID: 5997

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Car Accessories Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.