p-Hydroxycinnamic Acid Market Outlook:

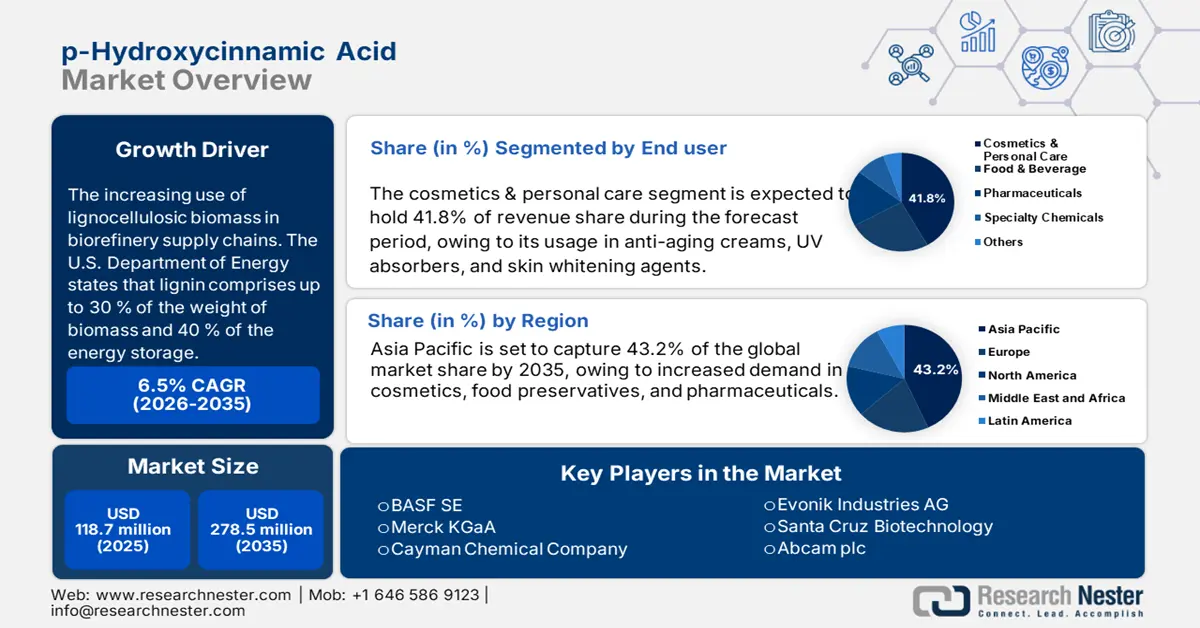

p-Hydroxycinnamic Acid Market size was estimated at USD 118.7 million in 2025 and is expected to surpass USD 278.5 million by the end of 2035, rising at a CAGR of 6.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of p-hydroxycinnamic acid is assessed at USD 126.3 million.

The primary catalyst for the p-hydroxycinnamic acid market is the increasing use of lignocellulosic biomass in biorefinery supply chains. The U.S. Department of Energy states that lignin comprises up to 30 % of the weight of biomass and 40 % of the energy storage; therefore, there is enough supply of lignin for all of the aromatics that can be produced from pHCA. Alkaline pretreatment waste streams are now yielding hydroxycinnamic acids, and pilot studies producing tens to hundreds of grams per liter demonstrate that further expansion of production could be possible. Historically, the DOE has invested RDD funding into membrane fractionation and catalytic separation approaches since 2020, now with the potential to commercialize.

The market for raw material supply is fundamentally based on agricultural residues that utilize biorefinery facilities and are processed as biorefineries. There is documentation from U.S. integrated facilities demonstrating the fractionation of lignin streams with pHCA precursor recovery on-site. Expansion of manufacturing capacity is occurring through adaptive laboratory evolution methods; e.g., Pseudomonas strain can tolerate 20 g/L pHCA and can be used to modify fermenters to produce higher yields. HTS codes for pHCA currently do not allow for the isolation of pHCA specifically, nor can documentation on any formal export or import volumes be found. It appears that RDD revenue support is still available from sector funding to develop pilot-scale assembly line processes for lignin use or valorization.

Key p-Hydroxycinnamic Acid Market Insights Summary:

Regional Highlights:

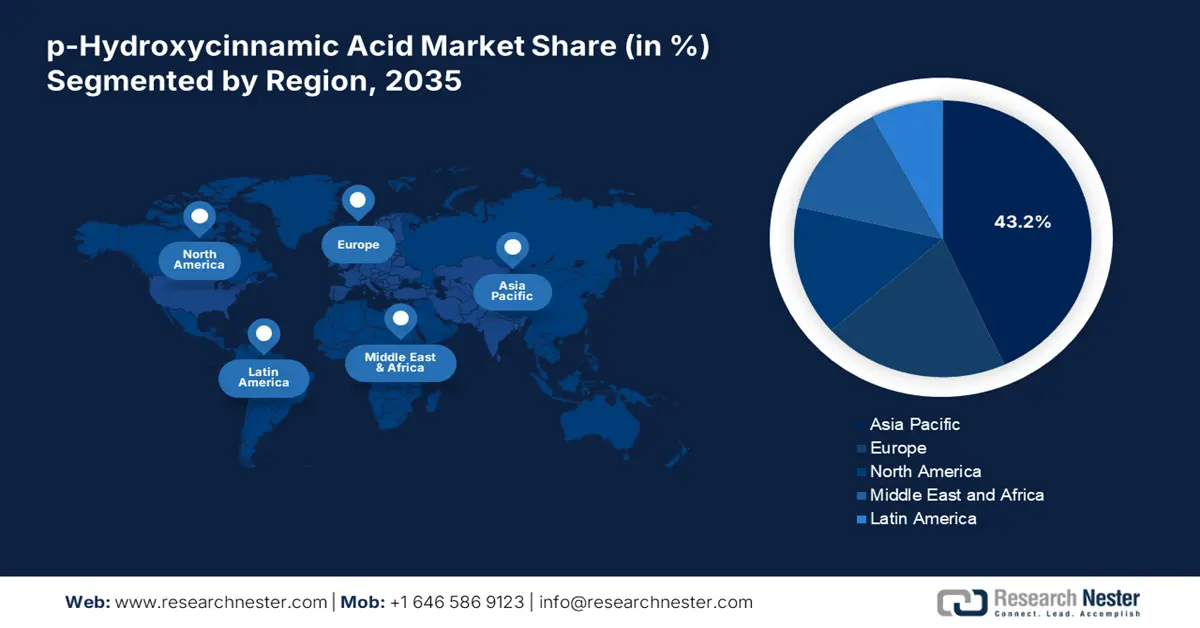

- The Asia Pacific p-Hydroxycinnamic acid market is anticipated to command a 43.2% share by 2035, impelled by increasing consumption across cosmetics, food preservatives, and pharmaceutical applications supported by strong R&D investments and chemical production growth in China and India.

- The European market is projected to expand steadily through 2026–2035, owing to rising demand for natural antioxidants in cosmetics and nutraceuticals and the EU’s emphasis on sustainable sourcing under the REACH regulation and Green Deal policies.

Segment Insights:

- The cosmetics and personal care segment of the p-Hydroxycinnamic acid market is projected to capture a 41.8% share by 2035, propelled by its growing incorporation in anti-aging creams, UV absorbers, and skin-whitening agents owing to its antioxidant and photoprotective properties.

- The synthetic segment is expected to hold a 39.3% share by 2035, driven by cost-efficient production methods and the robust availability of bulk synthetic supply chains meeting industrial purity requirements.

Key Growth Trends:

- Growth in the functional food and nutraceuticals market

- Rising demand in cosmetics and personal care products

Major Challenges:

- High production costs due to low-yield bioprocessing

- Lack of standardization in quality and purity grades

Key Players: BASF SE, Merck KGaA, Cayman Chemical Company, Tokyo Chemical Industry Co., Ltd. (TCI), Evonik Industries AG, Sigma-Aldrich (part of Merck Group), Santa Cruz Biotechnology, Abcam plc, Alfa Aesar (Thermo Fisher Scientific), Combi-Blocks Inc., Carbosynth Ltd (now part of Biosynth), Toronto Research Chemicals, Matrix Scientific, Haihang Industry Co., Ltd., Wako Pure Chemical Industries (FUJIFILM)

Global p-Hydroxycinnamic Acid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 118.7 million

- 2026 Market Size: USD 126.3 million

- Projected Market Size: USD 278.5 million by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, United States, Germany, Japan

- Emerging Countries: South Korea, Brazil, France, Indonesia, Mexico

Last updated on : 30 September, 2025

p-Hydroxycinnamic Acid Market - Growth Drivers and Challenges

Growth Drivers

- Growth in the functional food and nutraceuticals market: p-HCA has a wide range of applications as a functional additive in dietary supplements about its inherent antioxidant and anti-diabetic properties. Demand is driven by consumer behavior; a 2022 International Food Information Council (IFIC) survey found that 60% of U.S. residents seek health benefits from their food, with nearly half specifically looking for antioxidants. This fuels R&D for p-HCA-rich supplements derived from clean sources like cinnamon and oats to meet demand for scientifically-backed, natural wellness products.

- The growing adoption of sustainable feedstocks for the production of p-hydroxycinnamic acid: The transition towards sustainable and renewable feedstocks is driving the market for p-hydroxycinnamic acid (p-HCA). Lignin, a significant element of lignocellulosic biomass, is receiving increased focus as a cost-efficient and plentiful raw material for the synthesis of p-HCA. With support from initiatives by the U.S. Department of Energy’s Bioenergy Technologies Office (BETO), companies such as LignoTech are at the forefront of developing lignin valorization technologies, advancing pilot projects aimed at transforming biomass into valuable derivatives of p-HCA, thereby promoting more environmentally friendly chemical manufacturing.

- Rising demand in cosmetics and personal care products: The growth of the cosmetics and personal care industry is significantly influencing the p-Hydroxycinnamic Acid market, as the compound is valued for its antioxidant, UV-protective, and anti-inflammatory properties. Its application in sunscreens, anti-aging formulations, and hair care products aligns with the increasing consumer preference for bio-based and multifunctional ingredients. As awareness of skin health and sun protection continues to rise, manufacturers are leveraging p-Hydroxycinnamic Acid to enhance product efficacy and meet clean-label requirements. This trend is creating substantial opportunities for market growth, particularly in regions with strong demand for premium personal care solutions.

p-Hydroxycinnamic Acid Market: Trade Analysis

p-hydroxycinnamic acid, being a plant-derived compound, benefits directly from the expanding cross-border movement of bio-based chemicals that cater to industries such as pharmaceuticals, cosmetics, and food additives. Increased international trade reduces supply bottlenecks, ensures cost competitiveness, and supports the scaling of green chemistry practices. Moreover, regulatory support and consumer demand for eco-friendly ingredients further accelerate the adoption of traded bio-based fine chemicals, thereby stimulating the demand for p-hydroxycinnamic acid in multiple high-value applications.

Country-wise Trade Analysis for Bio-based Fine Chemicals (2023)

|

Region |

Trade Value (USD Mn) |

Percentage (%) |

|

Netherland |

169 |

21.3 |

|

Thailand |

147 |

18.5 |

|

China |

137 |

17.3 |

|

Belgium |

69.1 |

8.73 |

|

Spain |

65.4 |

8.26 |

|

France |

51.2 |

6.47 |

|

Germany |

37.7 |

4.76 |

|

U.S. |

29.8 |

3.76 |

|

UK |

9.47 |

1.2 |

|

Japan |

7.52 |

0.95 |

|

India |

6.14 |

0.78 |

Source: OEC

Challenges

- High production costs due to low-yield bioprocessing: The cost of biotechnological synthesis of p-HCA with engineered microbes remains high due to low fermentation yields and inefficient conversions. For example, typical yields in microbes are less than 2 g/L, compared to >10 g/L for commercial viability. Additionally, high levels of energy input and purification costs also limit the feasibility of larger applications in cosmetics and pharmaceuticals. Even with lower energy inputs, biobased fine chemicals are produced at costs that are 26-41% higher than petrochemicals, according to the National Renewable Energy Laboratory (NREL), which limits their market potential.

- Lack of standardization in quality and purity grades: Pure p-HCA is not recognized as a standard by any governing body. Despite p-HCA being pure grade > 98%, the pharmaceutical industry uses purity of ≥ 90%, whilst cosmetics and other use at least ≥ 90% (and frequently ≥ 95%; even food use typically >= 90%). p-HCA is not standardized, so manufacturers' projects may be different between the same batch of p-HCA, and this ultimately can impact capacity for global trade. In 2023, the European Chemicals Agency (ECHA) found that, based on REACH,>35% of p-HCA exports from Asia to the EU failed to meet their purity and/or safety levels, and this led to more delayed product approvals and greater overall bottlenecks in product regulations.

p-Hydroxycinnamic Acid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 118.7 million |

|

Forecast Year Market Size (2035) |

USD 278.5 million |

|

Regional Scope |

|

p-Hydroxycinnamic Acid Market Segmentation:

End user Segment Analysis

The cosmetics and personal care segment is predicted to gain the largest market share of 41.8% during the projected period by 2035. p-HCA is more frequently appearing in anti-aging creams, UV absorbers, and skin whitening agents, given its antioxidant, anti-inflammatory, and photoprotective properties. The growth of personal care spending globally and clean label prospects add to this story. The U.S. FDA has also considered p-HCA to be a Generally Recognized as Safe (GRAS) compound for topical use and confirms its suitability for use in personal care products.

Source Segment Analysis

The synthetic segment is anticipated to constitute the most significant growth by 2035, with 39.3% market share, mainly due to the efficient, cost-effective manufacturing, which meets the industrial purity needs regardless of bias sustainability. The availability of bulk volumes and affordable pricing due to the existing synthetic supply chain supports users of p-HCA in cosmetics and UV absorbers. Although the U.S. Department of Energy (DOE) is actively promoting the need for biomass-marketed versions of aromatic compounds, it indicates that synthetic is the preferred pathway since it is well established, efficient, and a widely known practice.

UV-Absorbers Segment Analysis

The UV-absorber subsegment of the p-hydroxycinnamic acid (p-HCA) market is propelled by the growing demand for natural, efficient, and transparent UV-blocking agents in personal care items. Derivatives of p-HCA, including p-coumaric acid, are employed for their capacity to absorb ultraviolet A (UVA) radiation, rendering them appropriate for application in sunscreens and cosmetics. Their integration aids in shielding the skin from detrimental UV rays, thereby fostering the creation of safer and more effective personal care products.

Our in-depth analysis of the p-hydroxycinnamic acid market includes the following segments:

| Segment | Sub-Segments |

|

Source |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

p-Hydroxycinnamic Acid Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia Pacific market is expected to hold 43.2% of the market share due to increased demand in cosmetics, food preservatives, and pharmaceuticals. The market is anticipated to grow at a CAGR of 7.9% (2026 to 2035). Favorable trends include high R&D investments and growth in chemical production in China and India.

China is the largest in the Asia Pacific p-HCA market, projected to grow at a CAGR of 7.8%. China has significant advantages with strong capabilities in chemical synthesis, government support of cosmetic exports, and a large pharmaceutical base. China’s Ministry of Industry and Information Technology (MIIT) has reported substantial growth in the chemical industry. In 2022, the sector saw strong expansion in both investment and exports, with organic chemical exports reaching USD 80.7 billion, a 17% year-on-year increase, while inorganic chemical exports rose 68% from 2021 to USD 39.4 billion.

India's p-HCA market is also rapidly growing due to demand from nutraceuticals and UV-absorbing cosmetics. The Government Production Linked Incentive (PLI) schemes actively promote domestic manufacturing in the specialty chemicals and pharmaceutical sectors. This, coupled with strong Foreign Direct Investment (FDI), fuels growth. The specialty chemicals sector in India demonstrated robust expansion, with an 11.8% year-on-year growth recorded in FY2023.

Europe Market Insights

The European market is growing due to rising demand for natural antioxidants being used as cosmetics, nutraceuticals to support health, and food preservatives, along with the EU's sustainable chemicals strategy (sustainable sourcing). The growth prospects for bio-derived phenolic acids are particularly favorable. The opportunities should continue to grow as governments enforce regulations like the REACH regulation and the Green Deal policies.

Germany's p-hydroxycinnamic acid (p-HCA) market is expected to grow at a CAGR of 6.5% during 2026-2035. The substantial pharmaceutical, cosmetics, and personal care industries, the support of the Federal Ministry for Economic Affairs and Climate Action (BMWK), and supportive regulations for bio-based chemicals (including the German Bioeconomy Strategy 2030) enhance the chances for sustainable sourcing of p-HCA and other bio-sourced phenolic compounds.

France's p-HCA market is expected to grow at a significant rate during the forecast period. The French Ministry for Ecological Transition is encouraging the adoption of plant-based ingredients in the personal care and food sectors, enhancing both demand for p-HCA and value to consumers. Research collaborations with France Chimie and the CNRS aim to advance the eco-sustainable extraction of aromatic compounds, as well as improve the understanding of home-grown bio-sustainable solutions for bio-derived materials, like p-hydroxycinnamic acid.

North America Market Insights

The North American market is expected to hold 15.2% of the market share from 2026 to 2035. Growth is fueled by demand in cosmetics, food preservatives, and pharmaceutical formulations. Investment in biobased chemicals or natural sources, together with supportive regulatory frameworks such as the FDA's and USDA's support for natural ingredients, favors the adoption of natural ingredients. Imports from the Asia-Pacific are also influencing regional supply.

The U.S. market is expected to grow at a significant rate during the forecast period. Demand will be primarily driven by increased usage of p-HCA in anti-aging and UV-absorbing formulations in COSMETICS. The FDA’s recent approval of p-HCA as a safe ingredient for food applications has also furthered the market demand for p-HCA. Domestic U.S. production of p-HCA is limited, with the nation relying heavily on imports. China is the largest single supplier, providing over 30% of U.S. imports of key p-HCA precursor chemicals, according to U.S. International Trade Commission data.

U.S.’s p-Hydroxycinnamic Acid - Exports and Imports (2025)

|

Exporting Country |

Value (USD Million) |

Importing Country |

Value (USD Million) |

|

Canada |

2.25B |

Ireland |

4.78B |

|

Italy |

2.18B |

India |

1.75B |

|

Germany |

2.07B |

Canada |

1.57B |

|

Mexico |

1.82B |

Belgium |

1.57B |

|

China |

1.52B |

Germany |

1.53B |

Source: OEC

By the year 2035, it is anticipated that Canada will account for roughly 15-20% of the p-hydroxycinnamic acid market in North America. This growth is expected to be propelled by an increasing demand for clean-label products, bioactive compounds in functional foods, and natural ingredients in cosmetic formulations. Support from regulatory bodies such as Health Canada, along with heightened research into plant-based sources, may encourage local production.

Key p-Hydroxycinnamic Acid Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck KGaA

- Cayman Chemical Company

- Tokyo Chemical Industry Co., Ltd. (TCI)

- Evonik Industries AG

- Sigma-Aldrich (part of Merck Group)

- Santa Cruz Biotechnology

- Abcam plc

- Alfa Aesar (Thermo Fisher Scientific)

- Combi-Blocks Inc.

- Carbosynth Ltd (now part of Biosynth)

- Toronto Research Chemicals

- Matrix Scientific

- Haihang Industry Co., Ltd.

- Wako Pure Chemical Industries (FUJIFILM)

The global p-hydroxycinnamic acid market is moderately fragmented, and many leading players in this opportunity-rich market are using strategic R&D focus-related investments and partnerships for product portfolio expansion. Many of these firms and others are utilizing modern approaches like green synthesis, expanding capacity, and/or custom contract manufacturing to stay competitive in the marketplace. The Japanese companies are establishing their precision synthesis expertise for electronic devices and biomedical applications. By contrast, firms from North America and firms from Europe are focusing on regulation compliance while building application-specific innovation.

Some of the key players operating in the market are listed below:

Recent Developments

- In 2022, Hangzhou Viablife Biotech offered a fermentation-derived p‑coumaric acid product as a natural preservative for food and cosmetics. Although launched before 2024, demand increased rapidly across Asia-Pacific SMEs for the p‑coumaric acid product by 2024-2025. This development led to significant growth of the regional market for preservatives and will facilitate projections of a 44% Asia-Pacific market share in the p‑coumaric acid segment by 2035.

- In 2021, Conagen officially published its bio-based p‑coumaric acid preservatives for natural cosmetic and food use. By Q4 2023, sales volumes increased by 26% as consumer demand continued to rise for clean-label products, which I project will lead to a 2-3% point increase in North American market share by Q1 2024. All of this indicates that Conagen will enhance its presence in the biobased specialty chemicals segment.

- Report ID: 4355

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

p-Hydroxycinnamic Acid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.