Organic Fertilizers Market Outlook:

Organic Fertilizers Market size was over USD 14 billion in 2025 and is estimated to reach USD 26.1 billion by the end of 2035, expanding at a CAGR of 7.2% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of organic fertilizers is estimated at USD 15 billion.

The worldwide organic fertilizers market is currently undergoing a profound transition by evolving from a niche segment into a centralized pillar of sustainable and modernized agriculture. This shift is merely driven by customer preference, along with an aggressive convergence of strict government policies, which is a critical demand for soil preservation and compels economic imperatives for farmers. According to an article published by Earth Organization in September 2023, the organic fertilizer sector is projected to account for USD 27.4 billion, along with an 11.3% growth rate by the end of 2030. Besides, in Europe, there is a separate 30% budget allocation for its very own Common Agricultural Policy (CAP) rural growth program to support and promote organic farming. Likewise, in North America, 82% of families purchase organic food regularly, with annual organic food sales reaching almost USD 40 billion.

Moreover, precision-based organics, the presence of circular economy models, biostimulant and microbial blends, advancements in formulation, and consumer and branding education are other factors that are propelling the organic fertilizers market growth. As per an article published by the GAP Organization in May 2025, as international agricultural systems witness increased pressure to ensure continuous production with few resources, precision agriculture is emerging as the ultimate pathway to gain sustainable productivity to cater to target 2% yearly growth rate by the end of 2050. In addition, over 50% of farms in the Midwest states use this particular technology, which is readily contributing to the market’s upliftment. Besides, as per the October 2025 EWG article, there have been 14.9 million acres of ongoing corn in Wisconsin, Minnesota, Iowa, and Illinois, thereby representing 20% of the overall 73.5 million harvested cropland, which is contributing to the market’s growth.

Continuous Harvested Crop and Corn Acres Analysis in the U.S. (2025)

|

State Name |

Continuous Corn Acres (Millions) |

Harvested Cropland Acres (Millions) |

Continuous Corn and Share of Harvested Cropland |

|

Illinois |

3.2 |

21.6 |

15% |

|

Iowa |

5.8 |

23.5 |

25% |

|

Minnesota |

2.9 |

19.7 |

15% |

|

Wisconsin |

3.1 |

8.8 |

36% |

|

Total |

15 |

73.5 |

20% |

Source: EWG Organization

Key Organic Fertilizers Market Insights Summary:

Regional Insights:

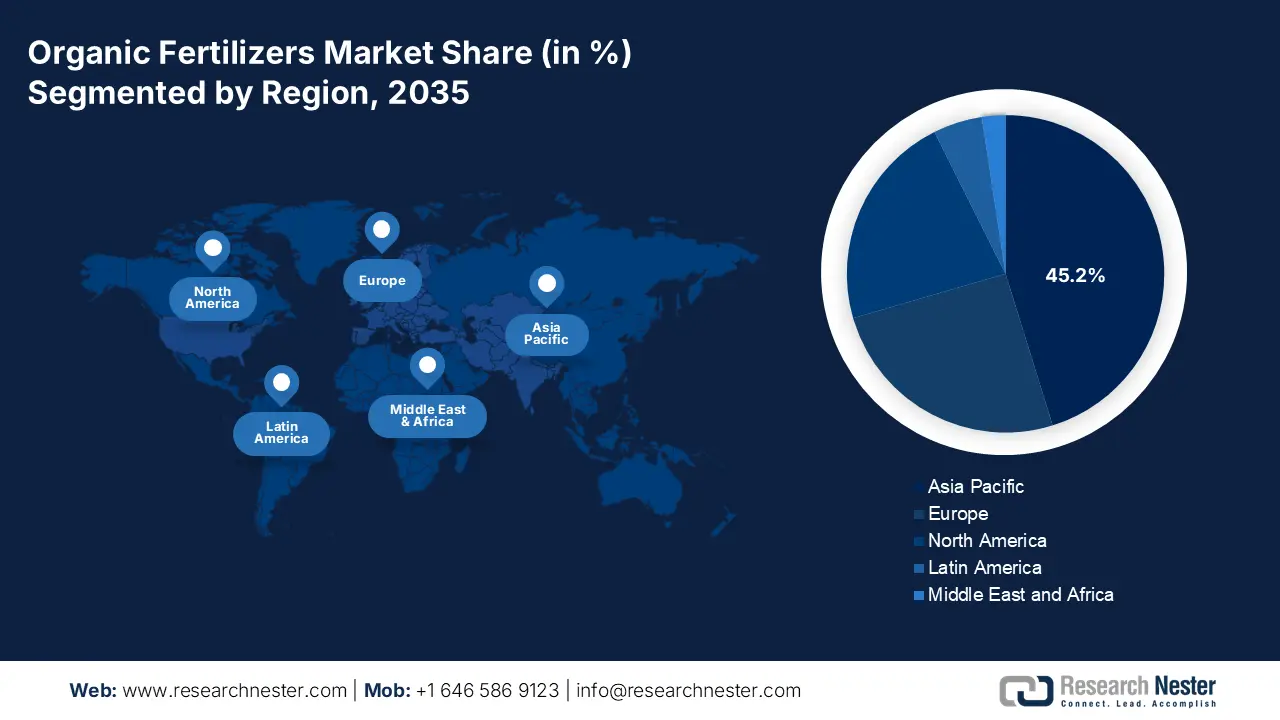

- Across 2026–2035, the Asia Pacific region is projected to command a 45.2% share of the organic fertilizers market by 2035, supported by mounting food-security pressures and stringent policies addressing environmental degradation.

- By 2035, North America is expected to emerge as the fastest-growing region, propelled by stringent regulatory frameworks, evolving consumer preferences, and advanced agricultural innovations.

Segment Insights:

- By 2035, the conventional (non-certified organic) sub-segment is anticipated to retain a 70.8% share of the organic fertilizers market, strengthened by its broad adoption among traditional farmers seeking agronomic and economic benefits.

- By the end of the forecast timeline, the dry segment is projected to secure the second-highest share, supported by its gradual nutrient-release capability that enhances soil structure and biological activity.

Key Growth Trends:

- Escalation in customer demand for organic food

- Soil health degradation and climatic changes

Major Challenges:

- Lack of standardization and variable product efficiency

- Technical knowledge barrier and limited farmer awareness

Key Players: The ScottsMiracle-Gro Company (U.S.), BASF SE (Germany), Dow Inc. (U.S.), Syngenta Group (Switzerland), Groupe Roullier (France), Coromandel International Limited (India), K+S Aktiengesellschaft (Germany), OCP Group (Morocco), Haifa Group (Israel), SQM S.A. (Chile), ICL Group Ltd. (Israel), COMPO EXPERT GmbH (Germany), Krishak Bharati Cooperative Limited (KRIBHCO) (India), National Fertilizers Limited (India), Sumitomo Chemical Co., Ltd. (Japan), Nufarm Ltd. (Australia), CJ CheilJedang (South Korea), Plant Food Company, Inc. (U.S.), Agripower (Australia).

Global Organic Fertilizers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14 billion

- 2026 Market Size: USD 15 billion

- Projected Market Size: USD 26.1 billion by 2035

- Growth Forecasts: 7.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45.2% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, India, Germany, Japan

- Emerging Countries: Brazil, Indonesia, Vietnam, Mexico, Australia

Last updated on : 27 November, 2025

Organic Fertilizers Market - Growth Drivers and Challenges

Growth Drivers

- Escalation in customer demand for organic food: The international organic food sector is continuing to outpace traditional food development, leading to a strong pull-through effect that needs the overall supply chain, such as fertilizers, to be certified organic. For instance, as per an article published by Invest India in October 2023, 187 countries in the country practice organic agriculture, and organic food in the overall country is cultivated within 2.6 million hectares. In addition, the share of land utilized for organic farming in the country is 1.5%, and over the past 10 years, there has been an increase in organic agriculture by 145.1%, further comprising 4.4 million organic farmers. Moreover, the country produced 2.9 million certified organic products, including vegetables, dry fruits, pulses, cotton, cereals and millets, fiber, oil seeds, and sugarcane, thus suitable for boosting the organic fertilizers market.

- Soil health degradation and climatic changes: The demand for climate-resilient agriculture, loss of organic carbon, and widespread soil degradation are pressuring reevaluation of farming practices. Based on this, the organic fertilizers market is significantly recognized as essential for restoring soil structure, long-lasting productivity, and water retention. As stated in an article published by the UNESCO Organization in August 2024, 90% of the planet’s land surface is projected to be degraded by the end of 2050. Besides, 75% of healthy soils are already degraded, which directly impacted 3.2 billion. Meanwhile, as per an article published by Earth Organization in June 2024, scientists have warned that 24 billion tons of fertile soil are being steadily lost, majorly due to unsustainability, which has further increased the market’s demand.

- Input cost volatility and economic viability: The volatile and rising cost of synthetic fertilizers, along with increasing evidence of the long-lasting yield stability and cost advantages of organic soil management, are significantly making the organic fertilizers market extremely economically attractive for farmers. As stated in an article published by NLM in October 2024, the mineral fertilizer utilization and a sudden shift to diversified crop rotations can diminish energy consumption by an estimated 21,000 MJ/ha for more than 6 years. Likewise, the adoption of no-tilled systems instead of ploughing has decreased energy utilization by 12,000 MJ/ha. Besides, organic farming provides €4000/ha increased contribution margin in comparison to traditional methods in tillage and fertilization.

Challenges

- Lack of standardization and variable product efficiency: A fundamental challenge in the organic fertilizers market is the inconsistent performance and lack of universal quality standards. Besides, the nutrient content in organic products can also vary dramatically between manufacturers and batches, since these are derived from biological sources subject to natural variation. This particular contrasts sharply with synthetic fertilizers, which provide guaranteed and precise nutrient profiles. In addition, the slow-release nature of nutrients in different organic products, while advantageous for soil health, results in unpredictable nutrient availability, which potentially impacts crop yields. Moreover, the administrative certification and framework differ across different regions, which has resulted in market confusion, thus negatively impacting the overall organic fertilizers market.

- Technical knowledge barrier and limited farmer awareness: The shift from traditional to organic nutrient management needs a systematic and in-depth shift in agronomic practices, along with a significant knowledge gap. Besides, many farmers are experts in applying synthetic fertilizer, but there is an absence of technical training to effectively utilize organic alternative options. Moreover, organic fertilizers are not only a one-to-one substitution; instead, they demand various timing, placement, and frequent complementary practices, such as cover cropping. Without generous expansion services, clear data and hands-on training demonstrate local success and return on investment (ROI). Therefore, farmers are significantly reluctant to integrate their perseverance as a complicated and risky practice.

Organic Fertilizers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.2% |

|

Base Year Market Size (2025) |

USD 14 billion |

|

Forecast Year Market Size (2035) |

USD 26.1 billion |

|

Regional Scope |

|

Organic Fertilizers Market Segmentation:

Certification Segment Analysis

The conventional (non-certified organic) sub-segment, which is part of the certification segment, is anticipated to hold the highest share of 70.8% in the organic fertilizers market by the end of 2035. The sub-segment’s upliftment is attributed to the comprehensive adoption of organic fertilizers by traditional farmers, not seeking organic certification, but are increasingly implementing these to optimize soil health and diminish their dependency on synthetic chemicals. This is frequently motivated by agronomic and economic advantages, in comparison to market or regulatory demands. For instance, a traditional wheat or corn farmer may utilize manure or compost to reduce erosion, enhance water retention, and rebuild soil organic matter. This eventually diminishes irrigation expenses and improves yield resilience while continuing to make as of synthetic pesticides as per demand.

Form Segment Analysis

The dry segment, which is part of the form, is projected to cater to the second-highest share in the organic fertilizers market by the end of the stipulated timeline. The segment’s growth is highly driven by its ability to improve soil health and ensure plant growth by offering nutrients slowly, boosting biological activity, and enhancing soil structure. According to an article published by NLM in February 2024, Citrullus lanatus, which is well-known as watermelon, is considered an organic fertilizer that can grow to almost 5 m to 6 m. In addition, it requires a temperature ranging between 21 degrees Celsius to 32 degrees Celsius. Besides, the international watermelon production has reached 101.6 million tons, with China readily ranking at the top position, accounting for 59.9% of the overall population. Likewise, the watermelon production in the U.S. is common in California, Texas, Georgia, and Florida, constituting for 75% of the population, thereby suitable for boosting the segment’s exposure.

Application Segment Analysis

Based on the application, the broadcasting segment is predicted to account for the third-highest share in the organic fertilizers market by the end of 2035. The segment’s development is highly propelled by its compatibility with large-scale farming, cost-effectiveness, and operational simplicity. In addition, this involves uniformly spreading dry, frequently granular, organic fertilizers, such as pelletized products, manure, and compost products, which are usually used with a spreader that is readily attached to a tractor. This particular method is exceptionally efficient for covering massive areas of pastures, cereals, and row crops, wherein precision is less severe than soil enrichment. Moreover, the nature of organic fertilizers, along with their primary function, which frequently improves the overall soil structure and health, thereby denoting an optimistic approach for the segment’s growth.

Our in-depth analysis of the organic fertilizers market includes the following segments:

|

Segment |

Subsegments |

|

Certification |

|

|

Form |

|

|

Application |

|

|

Source |

|

|

Crop Type |

|

|

Product Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Organic Fertilizers Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the organic fertilizers market is anticipated to hold the largest share of 45.2% by the end of 2035. The market’s upliftment is highly attributed to the dual pressure of food security due to the critical environmental degradation and the massive population caused by chemical overuse. Additionally, strict governmental policies, including China’s Zero-Growth in Fertilizer Use action plan and India’s PMPRF scheme promoting organic nutrients, are also driving the market in the region. According to an article published by the FAO Organization in October 2024, an estimated 23% of the population in the region experienced food insecurity as of 2022, along with increased rates of malnutrition. Besides, the region plays a pivotal role in the international agri-food system, employing 793 million of the 1.2 billion people in the agricultural industry, and effectively contributes to feeding the 8 billion population globally, thus denoting a huge growth for the organic fertilizers market.

China in the organic fertilizers market is growing significantly, owing to the state-mandated transition towards agricultural sustainability by implementing the Ministry of Agriculture and Rural Affairs' Zero-Growth Action Plan for Chemical Fertilizers and Pesticides by the end of 2025. As stated in the 2022 Climate and Clean Air Coalition Organization report, the livestock production in the country has readily increased, with a surge in overall milk, egg, and meat production by 12.0, 10.0, and 6.0. Meanwhile, more than 70% of farms, such as livestock production and crop production, are specialized crop production systems, which are extremely suitable for the organic fertilizers market in the country. Besides, with an increase in bio-fertilizer and specialty segment, along with regulatory pressure to diminish chemical utilization is suitable for uplifting the market in the country.

India in the organic fertilizers market is also growing due to the confluence of a critical soil health crisis and federal policies. In addition, the government’s PM Programme for Restoration, Management, and Health (PM-PRANAM) has been significantly designed to incentivize different states to promote integrated and balanced nutrient management. As per a data report published by the PIB Government in August 2025, the agriculture industry contributes to 16% of the country’s GDP and readily supports more than 46% of the population. The budget estimate for the Department of Fertilizers was revised between 2024 and 2025, amounting to ₹1,91,836.2 crore from ₹1,68,130.8 crore, which has been possible through supplementary demands for grants passed by parliament, thereby bolstering the market’s expansion.

North America Market Insights

North America in the organic fertilizers market is expected to emerge as the fastest-growing region during the forecast duration. The market’s development in the region is highly fueled by the sophisticated customer demand, strict regulatory frameworks, and innovative agricultural practices. In addition, the strong demand for organic food, with the U.S. market continuously outperforming the traditional segment, is also propelling the market in the region. According to an article published by the U.S. Government Accountability Office in January 2024, 27% of ranches or farms utilize precision agricultural practices to effectively manage livestock or crops. Besides, the USDA, along with the National Science Foundation (NSF), has offered nearly USD 200 million for precision agriculture research and development funding, which has created an optimistic outlook for the overall market in the region.

The U.S. in the organic fertilizers market is gaining increased traction, owing to the presence of a well-established organic food industry, increasing environmental consciousness among growers, and a surge in the demand for manure-based and bulk compost products. Additionally, specialty horticulturalists and crop growers are driving the need for processed and high-value organic fertilizers, such as liquid fish emulsion and blood meal. As per a data report published by the Natural Resources Conservation Service (NRCS) in 2023, the organization offers USD 850 million for forestry and climate-smart agriculture mitigation activities through different administrative programs. Moreover, the organization obligated 99.8% of the available 2023 Inflation Reduction Act financial assistance grants to farmers, forest landowners, and ranchers across the region, thus suitable for implementing conservation practices.

Fund Provision in the U.S. by the NRCS and the Inflation Reduction Act (2023)

|

Program Name |

2023 Available Fund (USD Million) |

Overall Inflation Reduction Act Requests |

Conservation of the Landscape |

|

Environmental Quality Incentives Program (EQIP) |

250 |

Almost 8,000 applications (USD 405 million) |

2,812 landowners received climate-focused contracts on 762,698 acres of land |

|

Agricultural Conservation Easement Program (ACEP) |

100 |

More than 250 applications (USD 180 million) |

27 landowners received an ACEP Agricultural Land Easement climate-focused contracts on 53,476 acres of grasslands. |

|

Regional Conservation Partnership Program (RCPP) |

250 |

Over USD 2 billion requested |

More than USD 1 billion is being invested to advance partner-driven solutions to conservation on agricultural land through 81 projects |

|

Conservation Stewardship Program (CSP) |

250 |

More than 3,000 applications (USD 230 million) |

2,406 landowners received climate-focused contracts on 3,312,492 acres of land |

Source: Natural Resources Conservation Service (NRCS)

Canada in the organic fertilizers market is also developing due to the existence of federal policy alignment, shift in consumer and agricultural paradigms, and provincial initiatives. For instance, as stated in the October 2024 article, the Government of Canada readily initiated a commitment of USD 62.9 million for more than 3 years, which commenced between 2024 and 2025. This investment is suitable for Agriculture and Agri-Food Canada to renew and extend the program, and generously cater to the localized food infrastructure. Moreover, the USD 250 million cost-shared Resilient Agricultural Landscape Program has also been designed to utilize an ecological goods and services payment strategy to support on-farm adoption of management practices, including restoring and maintaining grasslands, along with wetlands, which is creating a positive outlook on the overall organic fertilizers market in the country.

Europe Market Insights

Europe in the organic fertilizers market is forecasted to experience steady growth by the end of the stipulated duration. The market’s growth in the region is extremely propelled by the regional Green Deal and its cornerstone policies, including the Biodiversity and Farm to Fork Strategies. These particular regulations have mandated an effective shift towards sustainable agriculture, such as adopting ambitious targets to diminish fertilizer and chemical pesticide utilization. According to a report published by the Europe Journal of Agriculture and Food Sciences in February 2024, the region has successfully set the objective of 25% organic by the end of 2030. Based on this goal, the organic agriculture in the region currently accounts for 9.6% of the region’s agriculture. Additionally, over the past two years, there has been a significant growth in organic agriculture hectares, increasing by 6.7%, which is expected to result in a 17.5% uplift by the end of 2030.

The organic fertilizers market in Germany is gaining increased exposure, owing to the existence of a massive agricultural industry, the highest organic food market sector, and strict national regulations that have exceeded regional mandates. Besides, the Federal Soil Protection Act and the German Sustainable Development Strategy have created a regulatory setting that tends to penalize poor soil health and reward practices that develop soil organic matter. According to a data report published by the AMI Organization in July 2022, the organic share of milk alternatives ranged between 62.4% to 64.2%, followed by 26.6% to 32.0% for meat alternatives. In addition, the share is 15.2% to 16.7% for eggs, along with 11.2% to 15.4% for flour, thereby denoting an increased exposure of the organic food industry in the country, which is positively impacting the overall market’s development.

The organic fertilizers market in Poland is also growing due to massive inflows of regional cohesion and Common Agricultural Policy (CAP) funds for greening and modernizing the agricultural industry, significant potential for expansion, and a low initial base of organic farmland. Meanwhile, the country’s Green Deal approach, along with the National Action Plan for the Sustainable Use of Pesticides, aggressively encourage the integration of organic practices. As stated in the 2022 EKOCONNECT report, the overall area of the country accounts for 312,705 km², along with €13,640 in gross domestic product (GDP), 1,317,000 farms, of which 2.4% caters to fishing, forestry, and agriculture. In addition, 14,682,000 hectares of land have been readily utilized for agricultural areas, with 11.1 ha constituted for agricultural farms, based on which 9.4% of the overall population is employed in this field, thus suitable for the market’s exposure.

Key Organic Fertilizers Market Players:

- Yara International ASA (Norway)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The ScottsMiracle-Gro Company (U.S.)

- BASF SE (Germany)

- Dow Inc. (U.S.)

- Syngenta Group (Switzerland)

- Groupe Roullier (France)

- Coromandel International Limited (India)

- K+S Aktiengesellschaft (Germany)

- OCP Group (Morocco)

- Haifa Group (Israel)

- SQM S.A. (Chile)

- ICL Group Ltd. (Israel)

- COMPO EXPERT GmbH (Germany)

- Krishak Bharati Cooperative Limited (KRIBHCO) (India)

- National Fertilizers Limited (India)

- Sumitomo Chemical Co., Ltd. (Japan)

- Nufarm Ltd. (Australia)

- CJ CheilJedang (South Korea)

- Plant Food Company, Inc. (U.S.)

- Agripower (Australia)

- Yara International ASA is one of the international leaders in crop nutrition, which has leveraged its expanded agronomic expertise to create and upscale high-efficiency organic as well as mineral-based fertilizer solutions. The organization is heavily investing in the shift to a circular bio-economy, thus developing organic fertilizers from recycled nutrient streams to progress sustainable agriculture. Therefore, as per its 2024 annual report, the organization generated MUSD 13,934 in revenue, MUSD 686 in operating income, MUSD 1,889 in EBITDA, and MUSD 15 in net income.

- The ScottsMiracle-Gro Company is regarded as a dominating force in the consumer garden and lawn segment, which has driven mass-market adoption of organic fertilizers through its strong retail distribution and trusted brands. The company’s contribution remains in creating organic gardening, which is accessible to homeowners, while its brand acquisition, such as Botanicare, has extended its reach into customized and high-value organic plant nutrition.

- BASF SE readily contributes to the organic fertilizers market through its innovative research in soil microbiology as well as sustainable solutions, creating advanced biostimulants and bio-fertilizers under brands, including Innoculate. The chemical giant has integrated these organic products into its wide-ranging portfolio, thereby assisting farmers in optimizing nutrient utilization and soil health efficiency as part of integrated crop management systems. Based on these developments, and as stated in its 2024 annual report, the company generated €65.3 billion in sales, €7.9 billion in EBITDA, along with 5.1% in ROCE.

- Dow Inc. has historically focused on petrochemicals, but currently contributes to the market’s material science by creating polymer-based and encapsulation technologies that are intended to be utilized to enhance the controlled-release properties of organic fertilizers. This advancement assists in optimizing the efficacy and diminishing the environmental footprint of organic nutrient delivery systems.

- Syngenta Group significantly addresses sustainability and soil health by adopting organic fertilizers and biostimulants into its implemented crop solutions approach by promoting them as notable components for regenerative agriculture. Through its international footprint as well as direct engagement with farmers, the company has accelerated the adoption of these organic inputs to develop soil resilience and optimize crop yields.

Here is a list of key players operating in the global organic fertilizers market:

The international organic fertilizers market is highly fragmented, which is further characterized by the coexistence of different agricultural giants and specialized niche players. Notable organizations, such as BASF and Yara, have leveraged extended research and development and worldwide networks to adopt organic solutions into their comprehensive sustainability portfolios. Additionally, the acquisition of specialized bio-fertilizer firms to rapidly achieve market and technology accessibility is also a notable strategic approach for the market’s upliftment. Besides, in March 2025, Nitricity Inc. declared an investment of USD 10 million in project funding from a tactical mixture of capital providers, such as Trellis Climate and Elemental Impact, to develop the next-generation organic fertilizer infrastructure in Delhi. The purpose is to achieve commercial-scale volumes, which is suitable for boosting the organic fertilizers market globally.

Corporate Landscape of the Organic Fertilizers Market:

Recent Developments

- In February 2025, PhosAgro Group readily increased its supplies of mineral fertilizers to countries in Africa, exceeding 730,000 tonnes, which denoted an upsurge by 33% since 2023. The top importers of products comprised 60% in Cameroon, 45% in Morocco, 80% in Mozambique, and 10% in South Africa.

- In October 2024, Argus introduced the world’s first-ever prices for specialty and sustainable fertilizers, which include organics and organo-minerals, low-carbon fertilizers, secondary and macronutrients, and water-soluble fertilizers.

- In May 2024, Fresh Del Monte Produce Inc., along with Vellsam Materias Bioactivas, notified their partnership to maximize pineapple residues by way of biofertilizers. Both these organizations announced this collaboration by inaugurating the biofertilizer plant in Kenya, which marked the initial step in the partnership’s biofertilizer production endeavor.

- Report ID: 446

- Published Date: Nov 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Organic Fertilizers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.