Oilfield Casing Spools Market Outlook:

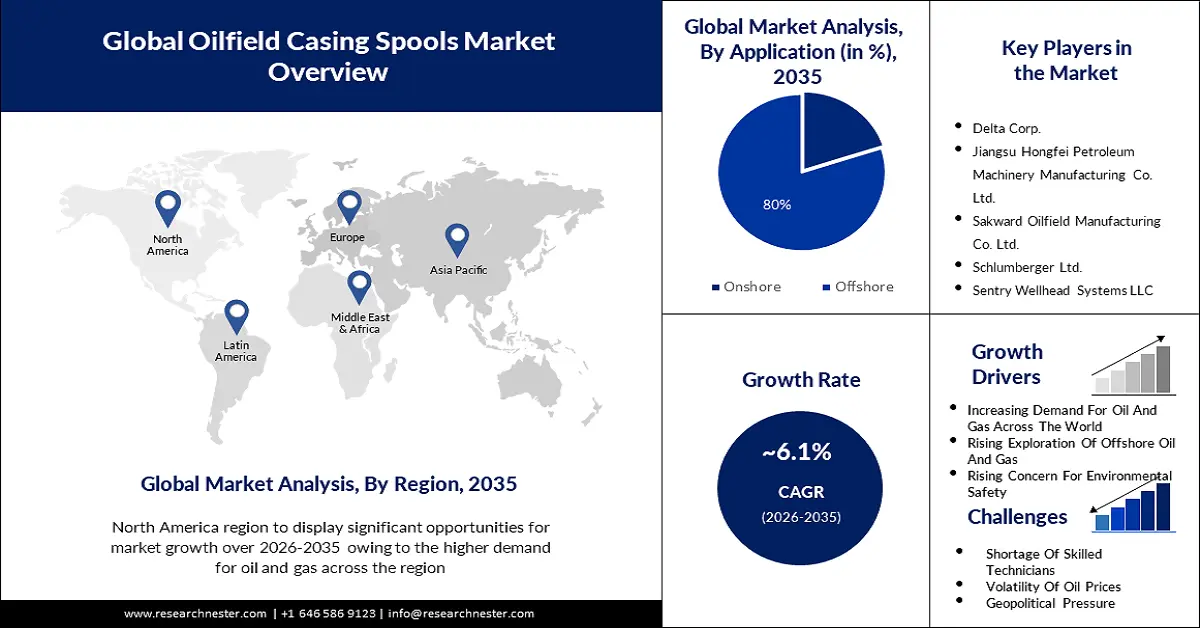

Oilfield Casing Spools Market size was over USD 734.16 million in 2025 and is anticipated to cross USD 1.33 billion by 2035, growing at more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of oilfield casing spools is assessed at USD 774.47 million.

The primary reason behind this massive growth of the market is the increasing exploration of oil and gas fields across the world. The biggest international producers of oil are the United States, Saudi Arabia, and Russia. These three countries generated roughly 40 million barrels of oil daily in 2022. That is 43% of the entire global production for a total of 43.29 million barrels daily. The oil and gas industry is in conversion. In most organizations, decision-makers are concentrated on quickly reshaping exploration portfolios into short-cycle and low-carbon strength scopes, mainly through divestment and M&A activity.

Another reason behind the massive growth of the oilfield casing spools market is the increasing connectivity of world oil and gas fields through pipelines. For instance, the planned Trans-Saharan pipeline will carry gas from Nigeria to Algeria via Niger. If the project is fulfilled, the new pipeline will link to the existing Trans-Mediterranean, Maghreb-Europe, Medgaz, and Galsi pipelines that deliver Europe from conveyance hubs on Algeria’s Mediterranean coast. The Trans-Saharan pipeline would be over 2,500 miles long. It could deliver as much as 30 billion cubic meters of Nigerian gas to Europe annually--similar to about two-thirds of Germany’s 2021 imports.

Key Oilfield Casing Spools Market Insights Summary:

Regional Highlights:

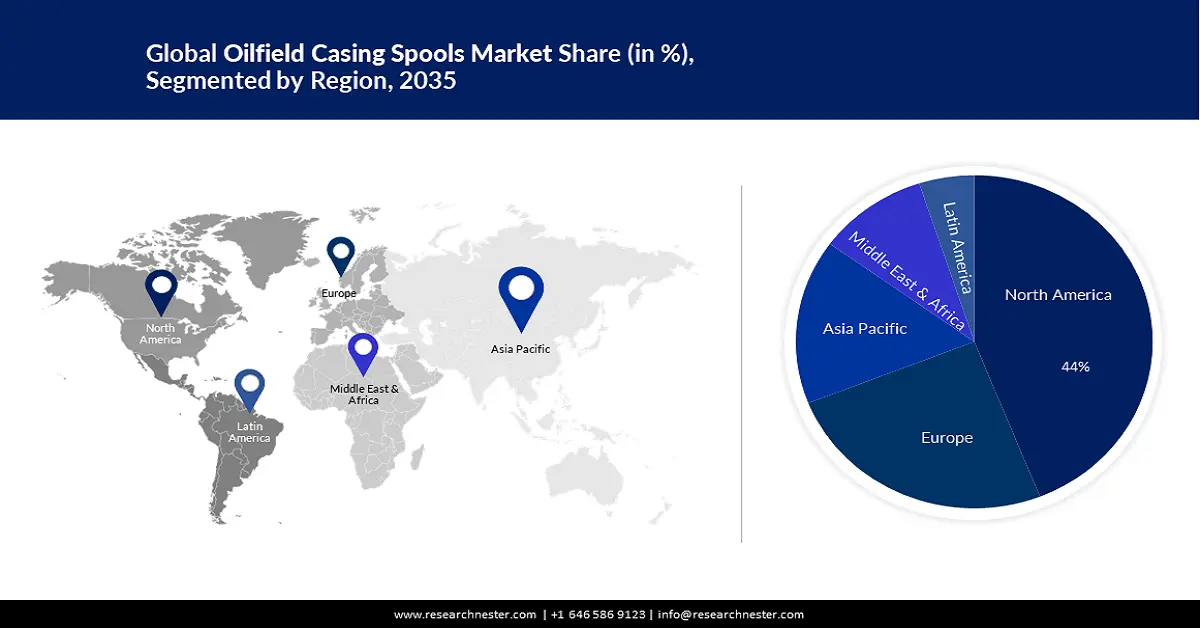

- North America oilfield casing spools market is expected to capture 44% share by 2035, attributed to increasing energy infrastructure investment.

- Europe market will hold the second largest share by 2035, driven by increasing offshore oil and gas production.

Segment Insights:

- The stainless steel (type) segment in the oilfield casing spools market is projected to secure a 85% share by 2035, driven by rising use in oilfields to avoid leaks and enhance durability.

- The offshore segment in the oilfield casing spools market is expected to hold an 80% share by 2035, driven by increasing offshore oil and gas production and numerous upcoming projects.

Key Growth Trends:

- Increasing Use of Green Fuels in Industries

- Shortage of Fossil Fuels

Major Challenges:

- Increasing Inflation in Oil Prices

- Lack of Skillful Technicians

Key Players: Delta Corp., Jiangsu HongFei Petroleum Machinery Manufacturing Co. Ltd., Sakward Oilfield Manufacturing Co. Ltd., Schlumberger Ltd., Sentry Wellhead Systems LLC, Shaanxi FYPE Rigid Machinery Co. Ltd., UZTEL SA, Worldwide Oilfield Machine Inc., Yantai Jereh Oilfield Services Group Co. Ltd., Sentry Wellhead Systems, Japan Petroleum Exploration Co., Ltd., Japan Drilling Co., Ltd., JGC Holdings Corporation, Kawasaki Kisen Kaisha, Ltd., Mitsubishi Gas Chemical Company.

Global Oilfield Casing Spools Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 734.16 million

- 2026 Market Size: USD 774.47 million

- Projected Market Size: USD 1.33 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Russia, United Arab Emirates, Canada

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

Oilfield Casing Spools Market Growth Drivers and Challenges:

Growth Factors

-

Increasing Use of Green Fuels in Industries - Within the industrial sector, manufacturing accounts for the largest share of yearly industrial energy utilization, usually followed by mining, construction, and agriculture. Mining comprises the extraction of minerals, and nonmineral products like stone and gravel, coal, oil, and natural gas. Agriculture comprises farming, fishing, and forestry. Manufacturing is the physical, mechanical, or chemical conversion of components or substances into new products. The U.S. Energy Information Administration (EIA) makes projections for energy utilization by these four major industrial activities in the Annual Energy Outlook (AEO), comprising the types and amounts of energy utilized by industry and manufacturers. Natural gas is noticed in both related formations, meaning it is created and generated with oil, and non-related reservoirs. Gas can either be dry (pure methane) or wet (is placed in other hydrocarbons like butane). Although wet gas must be handled to eliminate the other hydrocarbons and other aftereffects before it can be carried, it can raise producers' profits because they can sell those eliminated products.

- Shortage of Fossil Fuels - The gradual elimination of fossil fuel subsidies is a basic component of successful clean energy transitions, as underscored in the Glasgow Climate Pact. However, the recent international energy crisis has also underlined the political difficulties of doing so. Russia’s infringement of Ukraine caused the crisis, but 2022’s subsidy jump carries some wider lessons on the requirement for organized and people-focused transitions.

- Increasing Consumption of Natural Gas - Past international supply crises have typically been restricted to oil, but fast-moving natural gas markets are in difficulties as well. An increasing and more pliable liquified natural gas (LNG) market has offered intentional competition for gas supply, a condition that wasn’t feasible when gas was delivered by pipeline or LNG under permanent contracts. Europe and Asia are contesting for a similar LNG supply, driving prices up in both markets and expanding the recent tight market to the United States. In a sense, natural gas is the prey of its success: deflection coal-fired power production for economic or environmental factors has been an essential source of gas requirement.

Challenges

- Increasing Inflation in Oil Prices - Oil prices have since increased acutely to approximately USD 100 per barrel following tough economic recovery post-lockdowns. As the economy rises so does the oil need. Fur, rising geopolitical tensions between Russia and Ukraine and in the Middle East are fueling supply fears. This is leading to increasing inflation and problems with economic restoration. An international shift towards renewability may in time change the low price elasticity of oil requirements. But while the energy shift persists apace it's significant to comprehend how supply and requirement factors influence the price of oil and thus the broader economy. Black, Brown, endemic, and low-income communities are unevenly influenced since these groups are inclined to live in neighborhoods with more pollution. In Greeley, Colorado, residents of a mainly Latino and migrant community are trying to close an oil and gas process situated two blocks from a public school in the US.

- Lack of Skillful Technicians

- Problem with Oilfield Casing Tools

Oilfield Casing Spools Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 734.16 million |

|

Forecast Year Market Size (2035) |

USD 1.33 billion |

|

Regional Scope |

|

Oilfield Casing Spools Market Segmentation:

Application Segment Analysis

The offshore segment in the oilfield casing spools market will increase the most during the forecast period and will hold almost 80% of the revenue share. This growth will be noticed due to the increasing number of oil and gas production in offshore fields across the world. Globally, during the prospect period 2021-2025, an amount of 355 key crude and natural gas offshore projects are projected to begin operations in 48 countries. Among these, 130 show the number of strategized offshore projects with detected growth strategies and 225 show the number of early-stage declared offshore projects that are enduring speculative studies and that are yet to be accepted for development. In terms of the number of strategized offshore oil and gas projects, Brazil drives among countries with 17 projects, tracked by China with 14 projects. The UK drives in terms of declared offshore projects with 33, tracked by Norway with 19 projects. Among regions, Africa and Asia are projected to drive international offshore capital expenses. Global crude, condensate, and natural gas generation from active and structured offshore reserves are projected to rise from 46.0 million barrels of oil per day (mmboed) in 2019. The generation from both declared and structured offshore oil and gas projects is projected to rise by 2025.

Type Segment Analysis

The stainless-steel segment will dominate the oilfield casing spools market during the forecast period with almost 85% of the revenue share. This growth of the segment will be noticed primarily due to the increasing use of stainless steel casing spools in oilfields across the world to avoid the danger of leaks and spills. The oil and gas industry is a shifting industry with updated needs. To match these requirements, stainless steel grows to maximize industrial operations by confirming durable and trustworthy execution. The work of stainless steel in petroleum refining is extensive. Stainless steel comprises 10.5% chromium which develops a passive layer of chromium oxide outcoming in effective corrosion opposition.

Our in-depth analysis of the global oilfield casing spools market includes the following segments:

|

Type |

|

|

Working Pressure |

|

|

Application |

|

|

Casing Size |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oilfield Casing Spools Market Regional Analysis:

North American Market Insights

North America industry is estimated to account for largest revenue share of 44% by 2035. This growth will be noticed due to the increasing growth of energy infrastructure in this region. During the last five years, U.S. oil and gas infrastructure growth continued at a quick pace, and a lot have questioned whether the trend can go on. Moreover, the investment space in the American energy infrastructure is projected to increase to an accumulated USD 197 billion by 2029. As hackers pose gradually sophisticated hazards to critical infrastructure and the influences of climate change proceed to raise the prevalence and concentration of weather events, the American energy infrastructure requires a serious overhaul to both raise resiliency and promote the transition to cleaner energy resources.

European Market Insights

The oilfield casing spools market in the European region will also increase massively during the forecast period and will hold the second position during the forecast period. This growth will be noticed because of the increasing offshore oil and natural gas production in the European region. Turkey has also delighted success in this domain and currently started building the underwater pipeline network that will link the offshore Sakarya gas field with the onshore gas processing aptitude in the northern Black Sea domain of Zonguldak. Gas generation is projected to start in the first quarter of 2023, with height generation of over 3,5 bcm yearly.

Oilfield Casing Spools Market Players:

- Delta Corp.

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Jiangsu HongFei Petroleum Machinery Manufacturing Co. Ltd.

- Sakward Oilfield Manufacturing Co. Ltd.

- Schlumberger Ltd.

- Sentry Wellhead Systems LLC

- Shaanxi FYPE Rigid Machinery Co. Ltd.

- UZTEL SA

- Worldwide Oilfield Machine Inc.

- Yantai Jereh Oilfield Services Group Co. Ltd.

- Sentry Wellhead Systems

- Japan Petroleum Exploration Co., Ltd.

- Japan Drilling Co., Ltd.

- JGC Holdings Corporation

- Kawasaki Kisen Kaisha, Ltd.

Recent Developments

- January 10, 2024: SLB declared an investment and technology collaboration deal with Geminus AI that will give SLB exclusive availability to utilize the first physics-advanced artificial intelligence (AI) model builder for oil and gas operations. The Geminus model builder combines physics-depended techniques with process data to generate highly precise AI models that can be utilized at scale, far quicker, and at much less cost than conventional AI techniques.

- January 11, 2024: SLB and Nabors Industries declared cooperation to scale the agreement with programmed drilling solutions for oil and gas operators and drilling contractors. The deal will allow customers to smoothly unify the organizations’ drilling automation applications and rig operating systems to provide modified well construction execution and effectiveness.

- Report ID: 5611

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oilfield Casing Spools Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.