North America Commercial and Residential Electric Boilers Market Overview

Electric boilers are mainly used for water and space heating purposes by most small commercial buildings, manufacturers, and various industries. These boilers typically convert electrical electric energy into thermal or heat energy. Electric boilers are comparatively high efficient in terms of converting power to heat energy.

Electric boilers are getting popular due to their simple design and ease of installation. Additionally, electric boiler requires high current flow to operate that is why three-phase electricity supply is an ideal selection for electric boilers. These boilers offer a numerous advantages such as safer operation; emit no pollutants, and prevention from gas or oil leaking which may create a blaze or explosion. Further, clean and quiet operation of electric boilers is the major reason which is driving the adoption of electric boilers in North America region.

Market Size and Forecast

The North America commercial electric boilers market is expected to expand at a CAGR of 2.8 % to reach at USD 303.1 Million by the end of forecast period i.e. 2017-2024. Additionally, The North America residential electric boilers market is expected to expand at a CAGR of 3.4 % during the forecast period. Factors such as increasing demand for highly efficient electric boiler products in U.S. and Canada are anticipated to drive the growth of residential and commercial electric boiler market during the forecast period.

United States in North America is anticipated to hold the 78.8% market share in terms of revenue by the end of 2024. The region’s dominance is due to the advancement in technology and increasing environmental concerns amongst the population. Further, presence of numerous government regulations to curb carbon emission is also a major factor which is likely to drive the growth of U.S. commercial electric boiler market at Y-O-Y of 4.0% in 2024 as compared to previous years.

CLICK TO DOWNLOAD SAMPLE REPORT

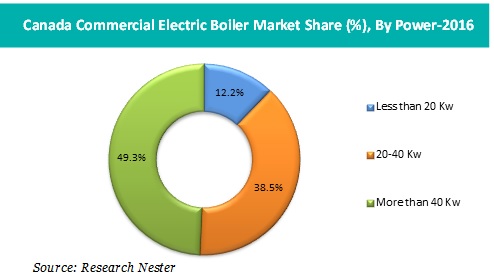

In addition to this, residential electric boiler market is segmented on the basis of power. Further, 20-40 Kw North America residential electric boiler market is anticipated to reach USD 59.0 Million by the end of 2024. Further, continuous government efforts to increase the adoption of high efficiency boiler are anticipated to impel the growth of electric boiler during the forecast period in North America region.

Market Segmentation:

Our in-depth analysis of the North America commercial electric boilers market includes the following segments:

By Power

- Less than 20 Kw

- 20-40 Kw

- More than 40 Kw

By Building Type

- Office Building

- Warehouse

- Retail

- Education

- Lodging

- Health

- Others

By Country

- U.S. Market size, Y-O-Y growth & Opportunity Analysis

- New England Market size, Y-O-Y growth & Opportunity Analysis

- Mid Atlantic Market size, Y-O-Y growth & Opportunity Analysis

- East North Central Market size, Y-O-Y growth & Opportunity Analysis

- West North Central Market size, Y-O-Y growth & Opportunity Analysis

- South Atlantic Market size, Y-O-Y growth & Opportunity Analysis

- East South Central Market size, Y-O-Y growth & Opportunity Analysis

- West South Central Market size, Y-O-Y growth & Opportunity Analysis

- Mountain Market size, Y-O-Y growth & Opportunity Analysis

- Pacific

- Canada Market size, Y-O-Y growth & Opportunity Analysis

Growth Drivers and Challenges

In North America, the adoption of high efficient functioning technologies is increasing owing to a number of factors such as increasing awareness amongst the population towards environment. Further, government initiatives to reduce carbon emission and increasing environmental concerns are escalating the growth of North America residential and commercial electric boiler market in North America region.

Electric boilers have efficiency level of up to 99.8% and minimum noise levels. Moreover, these boilers consume less power. These factors are anticipated to increase the penetration of electric boilers in North America residential and commercial boiler market. Moreover, increasing adoption of high efficiency boiler to replace the old and inefficient cast iron boilers in North America is anticipated to augment the growth of North America residential and commercial electric boiler market in the upcoming years.

In recent years, cast iron boilers demand has witnessed substantial decrease. Factors such as low efficiency, almost impossible internal repairs are contributing to the demand for advanced and efficient boilers such as condensing boilers and electric boilers.

However, high cost of advanced residential and commercial electric boiler is anticipated to hamper the growth of North America residential and commercial electric boiler market over the forecast period. Similarly, high repair cost of electric boilers is also anticipated to dampen the growth of the electric boiler market.

Top Featured Companies Dominating The Market

- A. O. Smith Corporation

- Company Overview

- Key Product Offerings

- Business Strategy

- SWOT Analysis

- Financials

- Slant/Fin Corporation

- Hubbell Electric Heater Company

- Bosch Thermotechnology Ltd.

- Sussman Electric Boilers

- Chromalox Inc.

- LAARS Heating Systems Co.

- Heat Innovations Inc.

- Fulton Companies

- P.M. Lattner Manufacturing Co.

- Report ID: 595

- Published Date: Feb 13, 2023

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

North America Commercial and Residential Electric Boilers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert