Point of Sale (POS) Market Outlook:

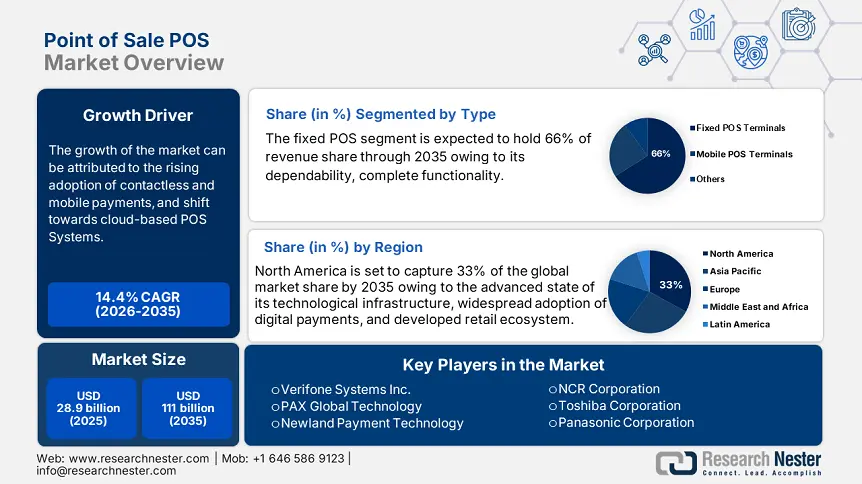

Point of Sale Market size was valued at USD 28.9 billion in 2025 and is projected to reach USD 111 billion by the end of 2035, rising at a CAGR of approximately 14.4% during the forecast period from 2026 to 2035. In 2026, the industry size of the point of sale (POS) is evaluated at USD 33 billion.

The global point of sale (POS) marketplace is experiencing change at a breathtaking pace due to technological change and the concomitant shift in consumer expectations. The dominant trend driving this change is the widespread adoption of contactless and mobile payments. With Near Field Communication (NFC) capabilities in just about every POS system, the ability for consumers to pay without physically interacting with the POS is now prevailing. Even more, are the expanded uses of self-service kiosks in retail and quick-service restaurant environment, which effectively eliminates the wait time altogether, giving consumers a better experience!

Cloud-based POS platforms are becoming the de facto standard due to their scalable deployment, remote management, and efficiency at a competitive price. Artificial intelligence (AI) represents another significant disruptor in the POS marketplace. AI-based systems can provide more sophisticated capabilities. Retailers and quick-service chains are also using AI technology to enhance their inventory management functions by analyzing POS data with external drivers. On the hardware side, innovation also continues with portable devices that offer mobility and complete inventory tracking. SoftPOS technology is also starting to penetrate the market for its affordability and convenience.

Point of Sale Market - Growth Drivers and Challenges

Growth Drivers

- Rising adoption of contactless and mobile payments: According to the UK Finance Limited, in the UK, there were 2.15 million debit and credit card transactions in April, which was 4.6% more than in April 2024. The rise of contactless payments enabled by NFC technology and mobile wallets has significantly boosted the POS market. Customers are moving towards fast, hygienic, and convenient forms of payment. Businesses have begun utilizing point-of-sale (POS) systems that allow customers the ability to make contactless payments and shorten transaction times. Markets for contactless payment are expected to grow, and as regulators and banks encourage this adoption, the market for devices that can accept contactless payments is also growing around the world.

- Shift towards cloud-based POS Systems: The cloud-based revolution has disrupted the technology for POS systems by providing accessible, scalable, and cost-effective solutions. Cloud POS systems can minimize on-premises computational and storage technology requirements. When cloud POS systems can integrate and pair with CRM and inventory management software options, users can work seamlessly and have rigorous real-time data analytics capabilities. For example, in July 2025, SAP introduced SAP Customer Checkout that offers existing customers an elegant, efficient, and future-scalable POS experience. This innovation creates new pathways and is allowing businesses to remain strategic and competitive in an environment that is moving quickly as the entirety of the POS market along with the SAP product portfolio, moves to the cloud.

- Integration of AI and advanced analytics: Retailers today leverage the vastly superior transaction data analysis of AI to detect trends and better manage inventory levels, waste, and ultimately profitability. In addition, fraud prevention mechanisms contained within modern cloud-based POS software enhance security. These intelligent capabilities are now driving the rapid adoption of next-gen POS solutions. In July 2025, Razorpay POS launched AI-only self-healing devices to evaluate and rectify up to 60% of problems, preventing payment checkout disruptions in a seamless, stable manner for merchants who accept payments offline nationwide.

Challenges

- Non-tariff barriers & bureaucratic delays: These obstacles create friction in the supply chain, increase the cost of operations, and lead to longer time-to-market. Non-tariff barriers and bureaucratic inefficiencies raise the cost of entry into markets, delay product deliveries and terminal roll-outs, and restrict access to regions with high growth potential. For the POS space, non-tariff barriers and inefficiencies increase the time to innovation, deter international investment, and limit the development of POS systems in underserved markets.

- Infrastructure & cybersecurity readiness: Infrastructure and cybersecurity readiness will have a direct impact on how adoption activities occur with POS systems. In these environments, poor connectivity, high compliance costs, and limited professionally skilled support contribute to a higher total cost of ownership (TCO) for POS systems. This affects smaller players more. While POS systems are a huge IT service opportunity for retailers, restaurants, service providers, etc, many don't get to realize the full impact of these systems due to a lack of investment and increasing concerns around compliance and cybersecurity risks.

Point of Sale Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

14.4% |

|

Base Year Market Size (2025) |

USD 28.9 billion |

|

Forecast Year Market Size (2036) |

USD 111 billion |

|

Regional Scope |

|

Point of Sale Market Segmentation:

Type Segment Analysis

The fixed POS terminals segment is estimated to account for the largest share of 66% in the point of sale (POS) market over the discussed timeframe. Fixed POS systems are leading the market because of their dependability, complete functionality. Fixed POS can adequately and consistently manage large transaction volumes and offers a secure and stationary installation, as a requirement. Fixed point-of-sale (POS) terminals are payment systems that are usually located at checkout counters at retail shops, supermarkets, restaurants, and other hospitality venues. Fixed POS terminals are receiving increasingly advanced technology using cloud computing and AI-based analytics that enable better inventory management, promotional, and another consumer marketing.

Application Segment Analysis

The retail segment is poised to dominate the point of sale (POS) market with a share of 46% during the analyzed period. The retail sector leads POS revenue by organic growth through broad usage across supermarkets, department stores, and specialty shops around the world. Retailers adopt POS to simplify consumer checkout, integrate loyalty programs, offer an omnichannel experience, and consolidate inventory management. Industry experts report that omnichannel integration has sped up the use case for POS adoption in retail faster than any other industry.

Component Segment Analysis

Hardware continues to be the most significant category because of the needed devices such as terminals, scanners, printers, and cash drawers. These hardware components are necessary to capture transactions. Moreover, they have much higher upfront costs relative to software. In addition, market analysts mention that organizations continue to focus on strong, secure hardware to guarantee transaction performance and prevent fraud in carefully regulated markets.

Our in-depth analysis of the market includes the following segments:

|

Segments |

Subsegments |

|

Type |

|

|

Component |

|

|

Deployment Mode |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Point of Sale (POS) Market - Regional Analysis

North America Market Insights

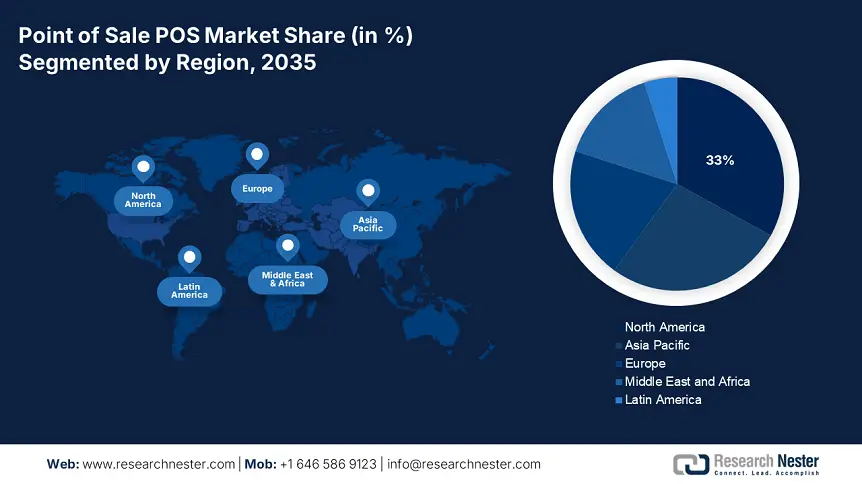

North America is anticipated to capture the highest share of 33% in the global point of sale (POS) market by the end of 2035. The growth is driven by the advanced state of its technological infrastructure, widespread adoption of digital payments, and developed retail ecosystem. According to a 2023 report by the Government of Canada, overall, 7 in 10 businesses in Canada accept cheques as a way to pay, and 6 in 10 businesses accept electronic funds transfer (EFT). Importantly, the Government has supported the growth of broadband connectivity through several initiatives, which are vital to cloud-based POS systems. The federal government also invests considerable amounts of money to support ICT development (Information and Communication Technology). This fosters innovation in payment security and digital transaction technologies.

The U.S. is at the forefront of the POS markets, owing to the presence of advanced technology infrastructure and the adoption of digital payments. The uptake of contactless payment and growth in e-commerce systems are driving the need for advanced POS systems. Initiatives to widen broadband access and expand network reliability have improved the execution of cloud-based POS systems. The U.S. is home to many of the major POS and fintech companies, which continuously develop emerging technologies to meet the changing needs of the payments industry.

The growth of Canada’s POS sector is driven by digital economy programming by the federal government and strong investments in ICT infrastructure. As per a 2023 report by the International Trade Administration, the technology sector in Canada is homegrown and very vibrant. There are over 43,200 firms in the Canadian ICT sector. Most of these firms are from the software and computer services industries. Also, the federal government supports small and medium-sized enterprises (SMEs) in the adoption of modern point-of-sale technology everywhere. The Canadian retail sector is a growing market for the adoption of cloud-based and mobile POS solutions as they streamline the business of service. These measures, amongst many others, are establishing Canada as a strong, growing player in the global POS marketplace.

APAC Market Insights

Asia Pacific is poised to exhibit a notable CAGR in the global point of sale (POS) market throughout the discussed period. The region leads global growth due to the rapid digital transformation of retail, along with expanding retail sectors. For instance, according to Invest India, India has experienced retail growth of 60% in the retail market, and the luxury retail market is valued at USD 30 billion. The region has one of the largest and expanding middle classes who increasingly disposable incomes. This is generating a strong demand for convenient payment solutions from merchants and consumers. Key APAC countries have governments focused on financial inclusion and the development of ICT infrastructure. Furthermore, countries like China and India have systematized large-scale financial inclusion programs, and the increase in digital wallets.

The POS market in India is growing rapidly, fueled by government initiatives as well as initiatives to promote cashless payments. In its 2024 report, the Federal Reserve Bank of Kansas City states that as of right now, Unified Payments Interface (UPI), a mobile-based instant payment system in India, boasts 340 million QR codes at merchant locations and 350 million active users. The Reserve Bank of India (RBI) and the Ministry of Electronics & IT have even further supported digital payment infrastructure with regulation and policy. Local fintech startups have also developed low-cost devices that meet local businesses' needs. The growth of e-commerce and organized retail has also accelerated the demand for complex (advanced POS) systems with omnichannel capabilities.

China is the leader in the POS market in the Asia Pacific due to rapid digital payment uptake from initiatives such as Alipay and WeChat Pay. While rapid urbanization, population increase, and a growing middle class, a variety of sectors such as retail and hospitality are clamouring for payment technologies that are easy to use and accept. The innovation from local device manufacturers and new fintech firms to create POS devices that are accessible, mobile, and cloud-enabled has answered the demand. Regulation in the country has contributed to more merchant trust in each transaction.

Europe Market Insights

The Europe point of sale (POS) market is at the forefront of the global economy, backed by improvements in technology, consumer demand for secure and reliable payment. The retail and hospitality industries, which have made significant investments in next-generation POS solutions, are well-developed in most economies of Europe. As per the De Nederlandsche Bank, in 2024, cash remained the most popular payment method at POS, despite the advent of digital payments in the euro region. In 2024, cash was used for more than half of all POS transactions. This percentage is much lower in the Netherlands, at about one in five. Furthermore, governments across major economies directly advocate for and invest in digital transformation as a strategy for enhancing ICT infrastructure.

France’s POS market is driven by demand from consumers for secure payment systems. Government initiatives support the increased use of digital payments on the grounds of both efficiency and financial inclusion. This has created new opportunities in the retail and hospitality sector in France to invest in next-generation POS solutions. Local and regional trends in France also show that consumers increasingly prefer transactions that are fast and contactless.

Germany's market enjoys the benefits of a tech-savvy retail landscape and a culture around secure data practices. Local manufacturers are most prevalent in the innovation of the hardware and software POS solutions to meet their strict adherence to regulations. The retail and hospitality sectors have also focused on upgrades to install new POS to enhance their customer experience and improve their operations. Innovative industry stakeholders and regulators continue to collaborate to promote best practices related to cybersecurity and build trust in the ecosystem. This engaging ecosystem affords Germany a critical role in Europe's burgeoning POS market.

Key Point of Sale (POS) Market Players

- Ingenico (Worldline)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Verifone Systems Inc.

- PAX Global Technology

- Newland Payment Technology

- NEXGO (Shenzhen Xinguodu Tech)

- Xiaomi (as proxy for POS OEMs)

- NCR Corporation

- Toshiba Corporation

- Panasonic Corporation

- Fujitsu Frontech Limited

- Pine Labs Pvt. Ltd.

- SumUp Payments Ltd.

- Square, Inc. (Block)

- Toast, Inc.

- Lightspeed Commerce Inc.

- Clover (Fiserv / First Data)

The global POS market is characterized by experienced hardware-centric players that guide the Smart POS with distinction and tremendous R&D. Emerging players from China are competing fiercely for share while offering lower prices and localization around their respective regions. The U.S. Older providers continue to persevere by offering valuable enterprise solutions. Pine Labs is gaining traction in nearby South Asia, offering Android systems and devices. As epitomized, the position is distinctively fragmented and evolving while valuing hardware excellence.

Recent Developments

- In June 2025, Global Payments released point-of-sale (POS) software, the Genius for Retail solution, meant for small and medium-sized retail businesses. Genius for Retail helps retailers accept credit cards, mobile wallets, gift cards, and other payment methods in-store and while on the go. It also provides a business management functionality with options such as inventory management, employee scheduling, tracking sales trends, and customer engagement capabilities.

- In February 2025, TRAY, a global leader in cloud-native enterprise-class POS systems, partnered with PrimePay. This partnership provides restaurant operators with a total, unified system of record, utilizing TRAY’s powerful point-of-sale (POS) software in combination with PrimePay’s HCM platform.

- Report ID: 264

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Point of Sale (POS) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert