Microgrid Market Outlook:

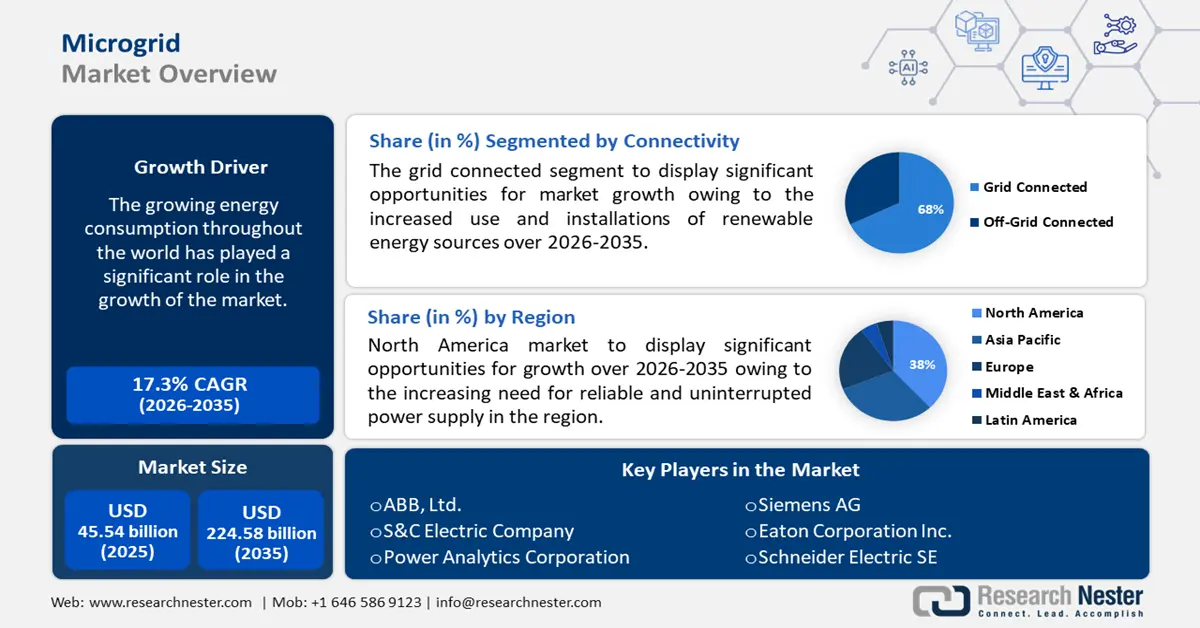

Microgrid Market size was over USD 45.54 billion in 2025 and is projected to reach USD 224.58 billion by 2035, witnessing around 17.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of microgrid is assessed at USD 52.63 billion.

The growing energy consumption across the world has played a significant role in the market growth. It was observed that there was an increase in energy consumption in 2021 in most countries, +1.3% in China, +4.7% in India, +4.7% in the United States, +9% in Russia, and +4.5% in the European Union. With the increasing demand for energy and the rising focus on renewable energy sources, microgrids are becoming an attractive solution for many businesses and organizations. They provide more reliable, affordable and sustainable energy, while reducing the environmental impact of energy production at the same time. In addition, microgrids are also seen as an efficient way to manage energy demand and storage, as well as providing ancillary services to the grid.

In addition, the market revenue is propelled by rising demand for backup power sources, the introduction of various technological advancements, and increasing investments in the development of microgrid solutions. Moreover, emergence of multiple microgrid companies and government initiatives to promote microgrid implementation, such as SPIDERS (Smart Power Infrastructure Demonstration for Energy Reliability and Security), is expected to impel the market size. These companies and programs are focused on providing reliable, secure, and cost-effective energy solutions. By leveraging new technologies and creating partnerships between government, industry, and academic institutions, they are creating a more sustainable energy landscape.

Key Microgrid Market Insights Summary:

Regional Highlights:

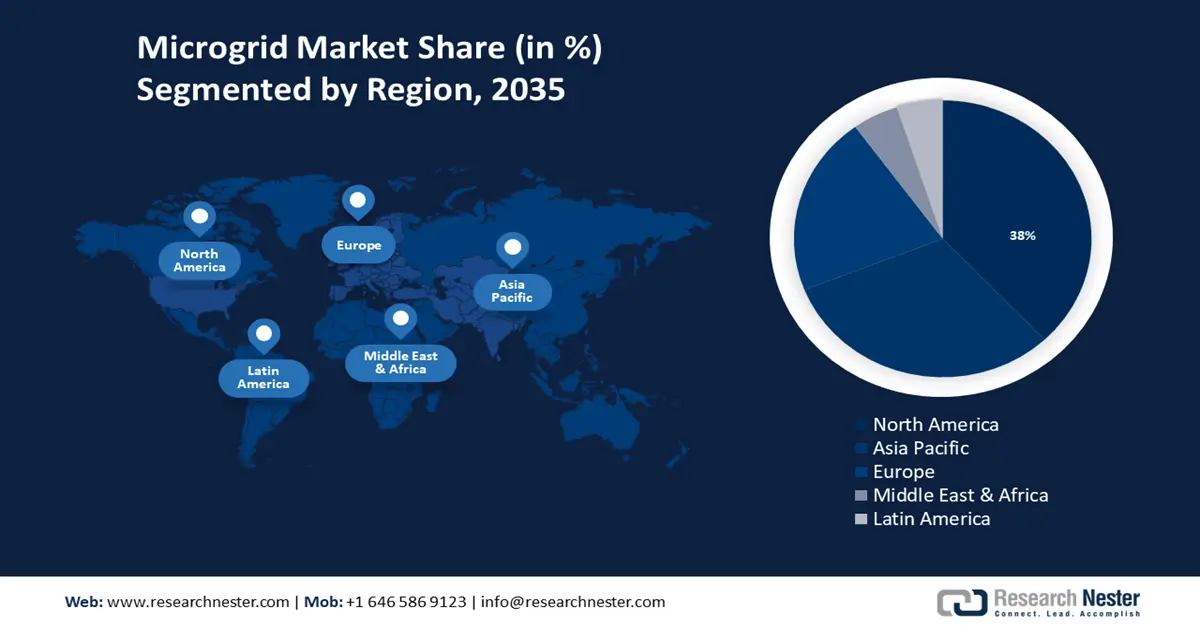

- North America microgrid market will hold around 38% share by 2035, driven by the increasing need for reliable and uninterrupted power supply and renewable energy adoption.

- Asia Pacific market will secure 30% share by 2035, driven by rapid electrification and infrastructure improvements in rural areas.

Segment Insights:

- The grid connected segment in the microgrid market is expected to achieve a 68% share by 2035, propelled by increased use and installation of renewable energy sources such as offshore wind.

- The hardware segment in the microgrid market is forecasted to secure a 59% share by 2035, fueled by increasing investment in renewable energy and the development of smart grids.

Key Growth Trends:

- Growing Number of Microgrid Projects and Installations

- Increasing Microgrid Installation for A Range of Purpose

Major Challenges:

- Challenges related to the integration of microgrids with existing electrical grids

- High installation costs

Key Players: General Electric Company, Siemens AG, Eaton Corporation Inc., Schneider Electric SE, Honeywell International Inc., ABB, Ltd., S&C Electric Company, Power Analytics Corporation, Exelon Corporation, HOMER Energy LLC.

Global Microgrid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 45.54 billion

- 2026 Market Size: USD 52.63 billion

- Projected Market Size: USD 224.58 billion by 2035

- Growth Forecasts: 17.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Singapore

Last updated on : 8 September, 2025

Microgrid Market Growth Drivers and Challenges:

Growth Drivers

- Growing Number of Microgrid Projects and Installations- A total of 4470 microgrid projects were installed during the second half of 2019, representing nearly 25GW of planned and installed capacity around the world. Globally, remote microgrids and commercial and industrial microgrids account for roughly 65-70% of all microgrid capacity. Microgrids are becoming increasingly popular as they provide a reliable and resilient source of energy and are more cost-effective when compared to traditional grid systems. The growing demand for renewable energy and the need to reduce carbon emissions are driving the growth of the microgrid market.

- Increasing Microgrid Installation for A Range of Purposes - For instance, a new microgrid project for electrifying electric vehicles was planned by the Los Angeles Transportation Department in November 2021. A microgrid powered by solar plus storage will serve as the fleet's charging station for electric buses. The power output is expected to be around 7.5 MW. The solar microgrid provides a reliable source of power for these buses, reducing the need for diesel fuel. It also reduces the amount of energy consumed from the electric grid, helping to lower energy costs.

- Government Initiative to Provide Efficient and Reliable Power Supply - Governments are recognizing the need to provide efficient and reliable power supply, especially in rural and remote areas, and are investing in microgrid systems. For instance, the US government has announced that it will provide more than USD20 million in financial assistance to 17 microgrid projects across the country to better meet the needs of remote and regional communities.

- Increasing Initiatives for Reducing Greenhouse Gas (GHG) Emissions- Microgrid systems can be used to limit the use of large-scale generators and reduce the amount of GHG emissions. With the launch of TP Renewable Microgrid, Tata Power and The Rockefeller Foundation aim to connect 5 million Indian households and reduce annual carbon emissions by one million tons.

- Growing Production Of Electricity - In accordance with the International Energy Agency in 2019, the world produced 617 EJ of electricity, an increase of 2% over 2018. As demand for electricity continues to grow, the need for a more reliable and efficient way to generate and distribute power is becoming more important. Microgrids are a cost-effective solution, as they are able to generate and distribute power independently from traditional power grids.

Challenges

- Challenges related to the integration of microgrids with existing electrical grids- The complexity of the integration of microgrids with existing grids, the cost of the integration process, and the lack of standardization in the microgrid market are all factors that contribute to the difficulty of integrating microgrids. This makes it more difficult for microgrid companies to enter the market, resulting in slower market growth.

- High installation costs

- Lack of awareness among end-users

Microgrid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

17.3% |

|

Base Year Market Size (2025) |

USD 45.54 billion |

|

Forecast Year Market Size (2035) |

USD 224.58 billion |

|

Regional Scope |

|

Microgrid Market Segmentation:

Connectivity Segment Analysis

The grid connected segment is predicted to account for 68% market share by 2035, led by increased use and isntallations of renewable energy sources such as offshore wind. It was observed that offshore wind installations worldwide in 2020 passed 6.1GW, making it the second biggest year since COVID was disrupted. Grid connected microgrids can help to distribute wind energy produced offshore more efficiently and reliably.

Additionally, the grid connected microgrids allow for better integration of renewable energy sources, as well as increased resilience against outages and disruptions. Furthermore, grid connected microgrids are able to provide backup power during outages and disruptions, which makes them highly desirable for businesses, governments, and other organizations.

Offering Segment Analysis

The hardware segment is estimated to dominate 59% market share by 2035. The segment growth can be attributed to increasing investment in renewable energy sources and development of smart grids, which require hardware components like inverters, energy storage, and power converters. Moreover, the segment is also expected to be driven by the increasing need for reliable and efficient energy storage solutions, as well as innovations in energy storage technologies, such as the development of advanced battery systems and other energy storage solutions. For instance, in April 2022, a Coimbatore-based startup, Cellex Battery Systems, has launched its cutting edge energy storage solutions for a variety of sectors in India, including renewable energy storage.

Our in-depth analysis of the global market includes the following segments:

|

By Connectivity |

|

|

By Offering |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Microgrid Market Regional Analysis:

North American Market Insights

The North America microgrid market share is anticipated to surpass 38% by 2035. The market growth is driven by increasing need for reliable and uninterrupted power supply, especially in remote and rural areas, and the increasing popularity of renewable energy sources such as solar and wind energy. Additionally, the government's supportive initiatives and incentives towards the development of smart grids in the region will impel the regional market revenue. It is estimated that approximately 9,000 electric generating units with a combined generating capacity of more than 1 million megawatts connect to more than 600,000 miles of transmission lines through the U.S. electric grid. Moreover, the increasing number of microgrid projects, and the growing emphasis of governments to build a clean future and support the natural resources sectors in the region will boos the market size.

APAC Market Insights

The Asia Pacific microgrid market is estimated to hold 30% revenue share by the end of 2035, propelled by rapid electrification of rural areas in several Asian countries, namely India, Malaysia, and the Philippines, and rising development activities to improve the electricity infrastructure. Further, high demand for power in rural areas is anticipated to drive the microgrid market in the region. An average of 39 kWh of electricity is consumed by rural households in India each month, according to a survey. Rural areas often lack access to reliable power grids, which makes them prime candidates for microgrid systems. Compared to centralized power grids, microgrids are more dependable, cost-efficient, and enable rural communities to generate and store their own energy.

Europe Market Insights

The microgrid market in the Europe will observe significant growth till 2035. The increasing focus of the governments of the European countries on the development of smart grids and the rising demand for power from both, the residential and commercial sectors are the primary factors that are fueling the market growth in the Europe. In November 2021, the United Kingdom earned a microgrid project to serve the people and businesses of Grove Park in Lewisham East, incorporating a 500kW renewable energy system and energy storage system, as well as smart grid management. Additionally, the high rates of energy losses experienced in the traditional power systems are encouraging the adoption of microgrids, as these systems can help reduce the energy losses and provide a more efficient power supply.

Microgrid Market Players:

- General Electric Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens AG

- Eaton Corporation Inc.

- Schneider Electric SE

- Honeywell International Inc.

- ABB, Ltd.

- S&C Electric Company

- Power Analytics Corporation

- Exelon Corporation

- HOMER Energy LLC

Recent Developments

-

Siemens AG created a grid software suite to manage the complexity of grid systems. An open, modular software suite has been developed by Siemens Smart Infrastructure. This suite includes a number of tools to simulate, analyze, monitor, and control the power grid. This makes it easier for utilities to optimize their systems, reduce costs, and increase reliability.

-

An innovative microgrid control Lab has been opened at the University of Central Florida (UCF) by Florida Power & Light Company (FPL) and GE Digital. This lab will serve as a research facility to explore new technologies and approaches to improving grid reliability and resiliency.

- Report ID: 3379

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Microgrid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.