Microturbine Market Outlook:

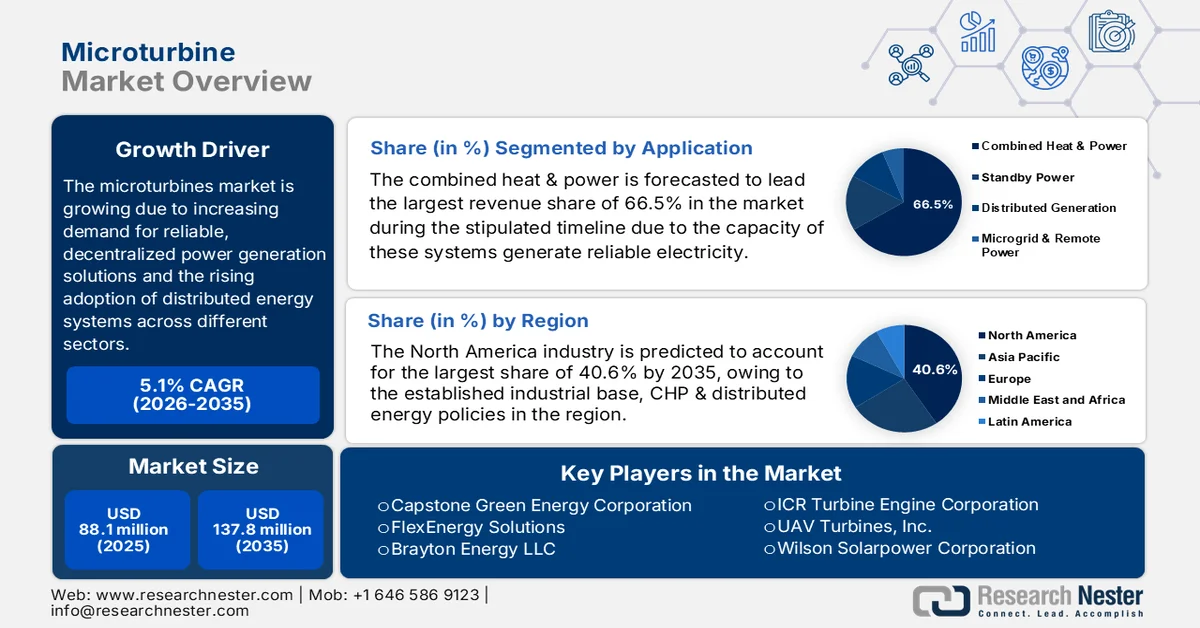

Microturbine Market size was valued at USD 88.1 million in 2025 and is projected to reach USD 137.8 million by the end of 2035, rising at a CAGR of 5.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of microturbine is evaluated at USD 92.5 million.

The market is gradually evolving with distinct driving factors such as increasing demand for reliable power generation solutions and the rising adoption of distributed energy systems across different sectors. The supportive government initiatives promoting decentralized energy generation contribute to the positive outlook for the market globally. In this context, as stated by Cordis Europa, the EU-funded Fit4Micro project, which is running from 2022 to 2026, aims to develop a hybrid micro-CHP system. Using a double-shaft micro gas turbine with humidification, it aims for high electrical efficiency that is more than 40% and flexible heat-to-power ratios. The project is funded with a total cost of €4,993,387.50 (USD 5,443,000 USD) fully covered by the European Commission contribution. Therefore, this particular instance denotes that there is significant government backing for microturbine-based solutions in line with climate and energy priorities.

EU-Funded Microturbine Projects: Fit4Micro Micro-CHP Participants and Contributions 2022-2026

|

Participant |

Country |

Net EU Contribution (€) |

Net EU Contribution (USD) |

|

MITIS |

Belgium |

1,476,643.26 |

1,608,740 |

|

OWI SCIENCE FOR FUELS GMBH |

Germany |

719,722.50 |

784,497 |

|

B.T.G. BIOMASS TECHNOLOGY GROUP BV |

Netherlands |

722,937.50 |

787,000 |

|

UNIVERSITE DE MONS |

Belgium |

610,000.00 |

664,900 |

|

ETA - ENERGIA, TRASPORTI, AGRICOLTURA SRL |

Italy |

196,875.00 |

214,594 |

|

FRAUNHOFER GESELLSCHAFT ZUR FORDERUNG DER ANGEWANDTEN FORSCHUNG E. V. |

Germany |

738,908.75 |

805,409 |

|

AALBORG UNIVERSITET |

Denmark |

215,762.50 |

235,182 |

|

THE EUROPEAN ASSOCIATION FOR THE PROMOTION OF COGENERATION VZW |

Belgium |

240,000.00 |

261,600 |

|

FAHRENHEIT GMBH |

Germany |

72,537.99 |

79,015 |

Source: Cordis. Europa

Furthermore, the aspects of improvements in carbon-neutral fuels, microgrid integration, and smart monitoring systems are creating new opportunities for players in the market. In this context, Ansaldo Energia in May 2024 officially reported that the ATS consortium, which was led by Ansaldo Green Tech with partners Maps Group, SIMCO, and SIGE, has secured funding from the Liguria Region through FESR cohesion funds to develop a new zero-impact microturbine. The project is mainly focused on enabling microturbine powered by CO₂-neutral e-fuels and hydrogen for use in energy communities and micro-grids. Therefore, such initiatives that are integrating carbon-neutral fuels and smart grid management denote that there is an increasing market momentum for microturbine as key enablers of decarbonized as well as resilient energy systems.

Key Microturbine Market Insights Summary:

Regional Highlights:

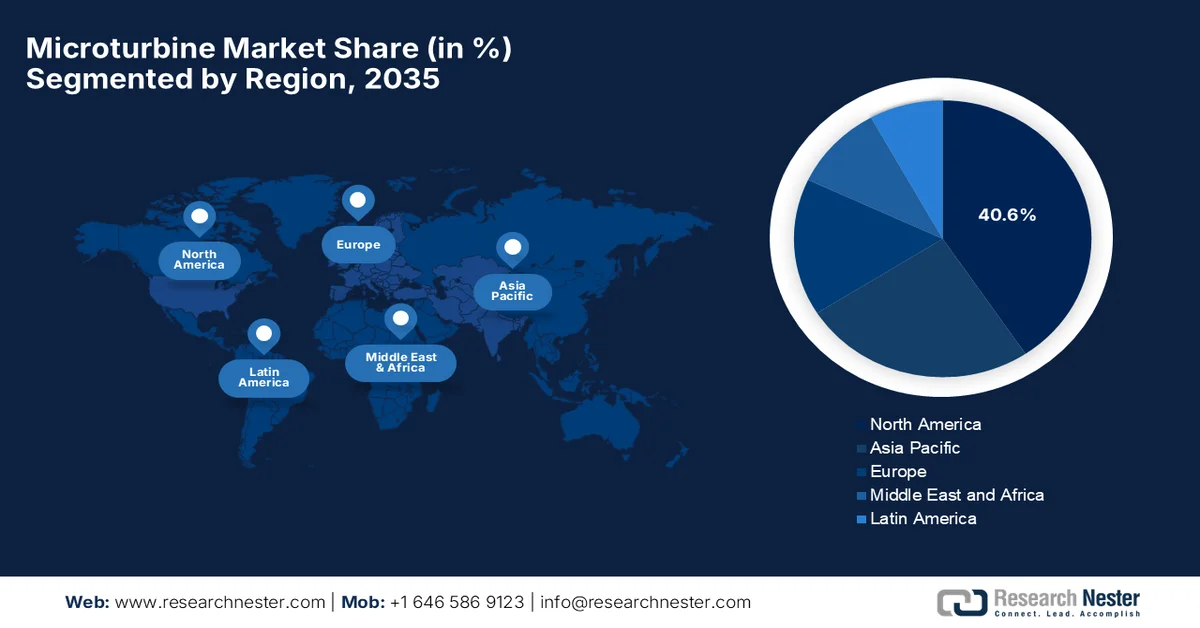

- North America is anticipated to dominate the microturbine market with a 40.6% revenue share by 2035, driven by its established industrial base, supportive CHP and distributed energy policies, and strong deployment across oil & gas and healthcare sectors.

- Asia Pacific is poised to register the fastest growth through 2035, fueled by rapid industrialization and substantial green innovation funding promoting distributed generation and microgrid development.

Segment Insights:

- The combined heat & power segment is projected to command a 66.5% revenue share by 2035 in the microturbine market, propelled by accelerating demand for decentralized and distributed energy solutions amid rising renewable capacity expansion.

- The 51–250 kW subtype is anticipated to secure a considerable revenue share by 2035, stimulated by its suitability for industrial and commercial CHP applications requiring balanced power output, cost efficiency, and fuel flexibility.

Key Growth Trends:

- Decentralized power generation

- Energy security and grid reliability

Major Challenges:

- Supply chain concerns

- Integration with renewable and variable energy sources

Key Players: Capstone Green Energy Corporation, FlexEnergy Solutions, Brayton Energy LLC, ICR Turbine Engine Corporation, UAV Turbines, Inc., Wilson Solarpower Corporation, Solar Turbines Incorporated, Calnetix Technologies LLC, Ansaldo Energia S.p.A., Bladon Micro Turbine, Aurelia Turbines Oy, Micro Turbine Technology B.V., Bowman Power Group Ltd., TurboTech Precision Engineering Pvt. Ltd., Toyota Turbine & Systems Inc., Hitachi Power Systems, Elliott Group, OPRA Turbines B.V., Mitsubishi Heavy Industries, Ltd., and Siemens Energy AG.

Global Microturbine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 88.1 million

- 2026 Market Size: USD 92.5 million

- Projected Market Size: USD 137.8 million by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: - United States, China, Japan, Germany, Canada

- Emerging Countries: - India, South Korea, United Kingdom, Italy, Australia

Last updated on : 17 February, 2026

Microturbine Market - Growth Drivers and Challenges

Growth Drivers

- Decentralized power generation: The market benefits from the rising demand for localized, reliable power in remote or off-grid areas, which is reducing dependence on centralized grids. The industrial, commercial, and institutional sectors are identified as the leading adopters for consistent energy supply. According to the official statistics published by IRENA in March 2025, the worldwide renewable power capacity reached 4,448 GW in 2024, wherein 585 GW was added, accounting for 92.5% of total capacity expansion and marking a 15.1% annual growth. It also mentioned that the global renewable capacity still needs to expand 16.6% on a yearly basis to meet the 2030 target. Therefore, this denotes that there is a continued need for accelerated deployment of decentralized and distributed energy solutions such as microturbine, hence there is a huge growth potential for the market.

- Energy security and grid reliability: The rising occurrences of natural disasters and grid disruptions are encouraging investment in terms of on-site and backup power solutions. In this context, microturbine offer proper power generation to maintain operations during outages, which is suitable for bolstering the microturbine market. The U.S. Department of Energy states that its Grid Resilience and Innovation Partnerships Program is allocating a total amount of USD 10.5 billion to enhance grid flexibility and resilience against extreme weather and disasters. It also notes that as of December 2024, through the first two funding rounds, USD 7.6 billion has been allocated to 105 projects across all 50 states and D.C., which includes more than USD 600 million in October 2024 to strengthen grids impacted by Hurricanes Helene and Milton. Therefore, these initiatives support localized and backup power solutions, such as microturbine, to maintain operations during outages and bolster energy security.

- Growth in IT and commercial sectors: The expansion of the digital economy, IT infrastructure, and telecom sectors increases demand for continuous, uninterruptible power, driving business in the market. According to the official statistics that are kept by the IEA organization, in 2024, global data centres consumed approximately 415 TWh, about 1.5% of total electricity, which has grown at 12% annually over the past five years. This is being influenced by AI and high-performance servers, whereas the electricity demand from data centres is projected to grow 15% per year, doubling to around 945 TWh by 2030, with accelerated servers contributing nearly half of the increase. In addition, the U.S., China, and Europe are identified as the largest consumers, highlighting the increasing need for continuous power solutions in commercial and IT infrastructures.

Challenges

- Supply chain concerns: This is the major bottleneck hampering the growth of the international market. Microturbine are mainly dependent on specialty materials such as high-temperature alloys, advanced bearings, and sensors. Therefore, volatility in terms of the supply chain results in delivery delays, cost volatility, and quality control risks. Simultaneously, the market participants have reported lead times for key subassemblies extending multiple months, which negatively impacts manufacturers’ ability to meet orders and lengthens customer project timelines. Furthermore, any disruptions in terms of sourcing impacted by geopolitical tensions, export controls, or raw material shortages also increase inventory costs, and production issues may slow market expansion.

- Integration with renewable and variable energy sources: Microturbines are mostly regarded as flexible generation assets within renewable-rich installations, yet integrating with intermittent energy sources causes control as well as stability challenges. The process of designing controls that enable load following and proper synchronization with solar, wind, or battery systems without any reliability issues is also proven to be complex. Meanwhile, any variations in output from renewables can drive frequent start or stop cycles or rapid load swings on microturbines, thereby increasing wear and maintenance costs. In addition to integration standards, grid codes, and interconnection requirements vary by jurisdiction, thereby complicating system design and permitting, hence causing hindrance to market expansion.

Microturbine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 88.1 million |

|

Forecast Year Market Size (2035) |

USD 137.8 million |

|

Regional Scope |

|

Microturbine Market Segmentation:

Application Segment Analysis

The combined heat & power is forecasted to lead the largest revenue share of 66.5% in the microturbine market during the stipulated timeline. The industrial, commercial, and institutional sectors are identified as the leading adopters for consistent energy supply. According to the official statistics published by IRENA in March 2025, the worldwide renewable power capacity reached 4,448 GW in 2024, wherein 585 GW was added, accounting for 92.5% of total capacity expansion and marking a 15.1% annual growth. It also mentioned that the global renewable capacity still needs to expand 16.6% on a yearly basis to meet the 2030 target. Therefore, this denotes that there is a continued need for accelerated deployment of decentralized and distributed energy solutions such as microturbines, hence there is a huge growth potential for the market.

Power Rating Segment Analysis

The 51-250 kW subtype is anticipated to grow with a considerable revenue share in the microturbine market by the end of 2035. The subtype is mainly suitable for industrial and commercial CHP systems and balances output with installation cost as well as footprint. Besides the 51-250kW also offers a proper balance between power output, installation complexity, and capital expenditure, making it extremely attractive for factories, office complexes, hospitals, and commercial facilities that require both electricity and thermal energy. In addition, these units can often operate on a variety of fuels such as natural gas and biogas, and integrate heat recovery systems with the main goal to maximize overall energy efficiency. Furthermore, this rating provides reliable, on-site generation, and it supports energy resiliency and cost savings, driving its consistent growth in the market over the upcoming years.

End user Segment Analysis

The industrial subtype, which is a part of the end user, is predicted to capture a significant revenue stake in the microturbine market over the forecasted years. The growth of the sub-segment is highly subject to the heightened demand for proper power solutions. The aspects such as burgeoning electricity costs, stricter emissions regulations, and the need for continuous operations in manufacturing, food processing, and pharmaceuticals are assets for the subtype’s growth and exposure. Microturbines offer a compelling solution by enabling on-site power generation with integrated heat recovery, reducing dependence on the central grid. In addition, the modular and scalable nature of microturbines allows industrial facilities to scale capacity to operational requirements, manage peak loads effectively, and maintain production continuity during grid disruptions, efficiently fueling adoption in this end user category.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Power Rating |

|

|

End user |

|

|

Technology Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Microturbine Market - Regional Analysis

North America Market Insights

The North America microturbine market is expected to lead, capturing the largest revenue share of 40.6% by 2035. The leadership of the region is mainly propelled by its established industrial base, CHP & distributed energy policies, and strong installation rates in oil & gas, and healthcare. The region also benefits from regulatory incentives, and the presence of large technology providers has helped it to maintain its leadership in both aspects of adoption and innovation. In January 2026, Capstone Green Energy reported that it had completed the installation of a 6.6 MW CHP microturbine system at a North Carolina renewable energy facility by converting swine waste via pyrolysis into 100% renewable electricity and supplying thermal energy for on-site operations. Also, this project demonstrates distributed generation and CHP in action, enhancing energy efficiency, supporting odor control, and generating carbon emission reduction credits, hence denoting an optimistic opportunity for market growth.

The extensive natural gas infrastructure and energy conservation policies that encourage reduced emissions and grid modernization are positioning the U.S. market as the most influential landscape in the region. The burgeoning power consumption from data centers in the country positions microturbines as key solutions for achieving efficiency objectives. According to the official statistics published by the U.S. DOE in December 2024, data center electricity use in the country reached 4.4% of total consumption and is projected to rise to 6.7% to 12% by 2028 due to AI, manufacturing, and electrification growth. Therefore, to meet this demand, DOE is advancing onsite generation, storage solutions, and grid-flexibility technologies. It is also supporting infrastructure reuse and innovative rate structures. Hence, these efforts demonstrate the lucrative opportunities for the market’s growth and exposure in the country.

The strong focus on clean energy grants and hybrid systems deployment, particularly in remote and off-grid communities, is rearranging the growth dynamics of microturbine market in Canada. The initiatives that expand distributed generation capabilities and support energy independence are also propelling the market’s growth in the country. Based on the government data from Canada, the Nemiah Valley Renewable Microgrid project, which is supported by Natural Resources Canada under the Clean Energy for Rural and Remote Communities Program, aims to reduce diesel use for heat and power in remote Indigenous communities. The project spans from January 2019 to March 2026, with a total grant of USD 2.48 million for innovative technologies to lower greenhouse gas emissions and improve energy independence. Therefore, such instances create applications for microturbines in distributed generation, driving market growth in Canada.

APAC Market Insights

The Asia Pacific market emerges as the strongest region during the discussed timeframe. The region’s leadership is mainly propelled by rapid industrialization and strategic investments by energy service companies to diversify energy portfolios with flexible microturbine systems. In addition, generous funds for renewable energy integration and microgrid projects across key economies also contribute to the market’s expansion in the region. As stated by NEDO, along with METI, it manages Japan’s green innovation fund that has been expanded with an additional amount of ¥456.4 billion (USD 3.3 billion) in the FY2023 initial budget, bringing total support to over ¥2.756 trillion (USD 19.9 billion) for long-term R&D, demonstration, and social implementation toward carbon neutrality by 2050. The fund is mainly focused on priority fields under the green growth strategy that require sustained investment in innovative energy technologies. Hence, with such effective funds, there will be a huge demand for distributed generation technologies across industrial and urban applications.

The accelerated deployment in industrial and utility settings, where solutions are sought for reliable power are responsible for uplifting China microturbine market. Government agencies in the country are promoting advanced distributed energy technologies to reduce emissions, and are encouraging innovation in small-scale turbines for industrial and community applications. In January 2026, the country’s government published a few guidelines to promote industrial green microgrids by integrating solar, wind, high-efficiency heat pumps, energy storage, and intelligent management to accelerate carbon reduction in key industries. The policy requires that at least 60% of electricity from new renewable projects at industrial sites be consumed locally. Hence, the country’s industrial green microgrid push is boosting encouraging opportunities for microturbine deployment in distributed energy systems.

The need for dependable power in both industrial and remote areas, constant efforts to reduce power outages, are the main drivers responsible for boosting the microturbine market in India. In addition, government incentives for cleaner energy and strict emission regulations are also encouraging widespread adoption in this field. Ministry of Power in October 2024 revealed that NTPC partnered with the country’s Army to establish a 200-kW solar hydrogen-based microgrid at Chushul, Ladakh, by providing complete power in off-grid, high-altitude locations. Besides, this particular system replaces diesel generators, integrates renewable energy with hydrogen storage, and ensures reliable power under extreme winter conditions. From a strategic perspective, such instances in the country denote that the country’s interest in off-grid clean energy will create lucrative growth potential for microturbines.

Europe Market Insights

Europe microturbine market is all set to witness significant expansion from 2026 to 2035. The market’s growth in this region is mainly propelled by a strong commitment to decarbonization, with applications in combined heat and power systems playing a pivotal role. Simultaneously, the regulatory landscape in the region has a priority towards renewable integration and emissions reduction, making microturbines attractive for industrial and commercial sectors as part of broader sustainability strategies. As stated by the European Commission in May 2024, it has approved a total of €3.2 billion (USD 3.4 billion) Czech scheme to support new and modernized high-efficiency CHP plants by promoting electricity and heat production from renewable and low-carbon gases. The program also aligns with the European Green Deal and Czechia’s National Energy and Climate Plan, aiming to reduce CO₂ emissions by around 9.3 million tonnes per year, hence positively impacting market growth.

The robust energy transition policies that prioritize cogeneration and distributed power solutions in manufacturing and industrial clusters are the main boosting factor for the microturbine market in Germany. According to the article published by the Federal Ministry of Economic Affairs and Energy in May 2023, Euro-K, in collaboration with TU Berlin, has begun developing a hydrogen-capable burner for micro gas turbines by enabling them to run on 100% hydrogen. The technology aims to provide clean, efficient electricity and heat for hospitals, administrative buildings, and hybrid commercial vehicles, thereby supporting decarbonization efforts. In addition, the country hosts significant pioneers, each growing through distinct growth strategies such as innovations, partnerships, and acquisitions, hence positioning Germany as the predominant leader in this field.

The energy security concerns coupled with sustainability goals are allowing an increased uptake in public infrastructure and commercial buildings, prompting a profitable business ecosystem for the UK microturbine market. There has been a structural shift towards net-zero targets and rising electricity costs, which are fueling demand for on-site power, reducing reliance on the national grid. The country’s biogas microgrid in a box project, which was launched in March 2023 by the Department for Science, Innovation and Technology and funded through Innovate UK, is developing a hybrid renewable energy hub for off-grid communities. This system integrates solar, wind, and biogas energy with battery storage and CHP waste heat recovery, managed through an intelligent energy platform. Furthermore, it offers low-emission, modular power for villages, schools, hospitals, and agricultural businesses, hence making it suitable for the microturbine industry’s development.

Key Microturbine Market Players:

- Capstone Green Energy Corporation (U.S.)

- FlexEnergy Solutions (U.S.)

- Brayton Energy LLC (U.S.)

- ICR Turbine Engine Corporation (U.S.)

- UAV Turbines, Inc. (U.S.)

- Wilson Solarpower Corporation (U.S.)

- Solar Turbines Incorporated (U.S.)

- Calnetix Technologies LLC (U.S.)

- Ansaldo Energia S.p.A. (Italy)

- Bladon Micro Turbine (UK)

- Aurelia Turbines Oy (Finland)

- Micro Turbine Technology B.V. (Netherlands)

- Bowman Power Group Ltd. (UK)

- TurboTech Precision Engineering Pvt. Ltd. (India)

- Toyota Turbine & Systems Inc. (Japan)

- Hitachi Power Systems (Japan)

- Elliott Group (U.S.)

- OPRA Turbines B.V. (Netherlands)

- Mitsubishi Heavy Industries, Ltd. (Japan)

- Siemens Energy AG (Germany)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Capstone Green Energy Corporation is a leading manufacturer of microturbine systems, which is well known for its C-Series microturbines that provide combined heat and power, renewable energy integration, and distributed energy solutions. The company is mainly focused on high-efficiency, low-emission systems for various applications.

- FlexEnergy Solutions is a specialist in terms of ultra-low-emission microturbines and integrated CHP systems. The firm mainly targets industrial and commercial end users by leveraging continued innovations to deliver high-efficiency on-site energy solutions, which positions it as a major player in this sector.

- Brayton Energy LLC is mainly focused on high-performance microturbine and small gas turbine systems, primarily for industrial power generation, renewable energy integration, and hybrid applications. The company benefits from thermodynamic designs and fuel flexibility, that are enabling efficient power production from biogas, natural gas, and other fuels.

- ICR Turbine Engine Corporation is a specialist in small-scale microturbines and turbine engines for commercial, industrial, and defense applications. The company is mainly known for precision engineering and reliability, and it focuses on customized turbine solutions that meet different operational requirements.

- UAV Turbines, Inc. develops compact microturbine solutions for industrial, remote, and unmanned power generation applications. Besides, the company’s microturbines are optimized for high efficiency, lightweight design, and continuous operation in any type of challenging environment.

Below is the list of some prominent players operating in the global microturbine market:

The global microturbine market is led by established pioneers such as Capstone Green Energy and Ansaldo Energia, which benefit from significant installed bases and extensive product portfolios. Innovation in terms of fuel flexibility, CHP integration, and hybrid energy solutions are certain factor of differentiation undertaken by the key players. Firms such as Toyota Turbine & Systems and Hitachi Power Systems leverage advanced manufacturing capabilities. In October 2024, Enterprise Group, Inc. announced that it entered into a five-year exclusive agreement with FlexEnergy Solutions by making its subsidiary Evolution Power Projects the sole provider of short-term turbine and microturbine solutions in Alberta and British Columbia. The partnership strengthens Enterprise’s market presence and enables EPP to deliver efficient power generation for commercial and industrial clients, hence positively impacting market growth.

Corporate Landscape of the Microturbine Market:

Recent Developments

- In August 2025, Capstone Green Energy announced that it had acquired its distributor, Cal Microturbine, LLC, bringing its sales, service, and aftermarket support in California, Hawaii, Nevada, Oregon, and Washington under its new Capstone West Territory to strengthen customer relationships and capture growth in distributed energy demand.

- In December 2025, FlexEnergy Solutions announced that its 330 kW GT333S flex turbine and integrated hot water cogeneration system had been recertified by the California Air Resources Board, marking ten consecutive years of emissions compliance.

- Report ID: 3733

- Published Date: Feb 17, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Microturbine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.